This article adheres to strict editorial standards. Some or all links may be monetized.

American baby boomers are expected to pass on an astronomical $84 trillion in inheritances to their heirs over the next 20 years in what’s being dubbed “the great wealth transfer.”

However, offering monetary gifts to adult kids can be tricky. On the one hand, many parents likely want to do everything they can to provide their kids an advantage in this inhospitable economy. On the flip side, some may worry whether their kids are ready for such a sudden influx of wealth.

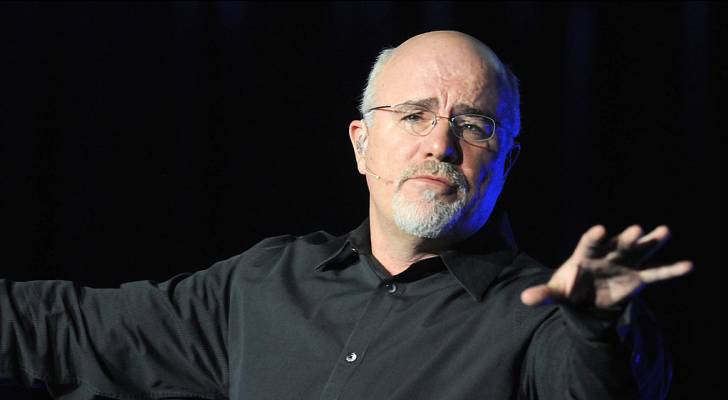

A caller on The Ramsey Show was grappling with this exact dilemma. He told personal finance guru Dave Ramsey that he wanted to “gift” his childhood home to his 18-year-old son — but he wasn’t sure if it was a “bad idea.” Ramsey was surprisingly open to the idea, albeit with a few caveats.

Must Read

- Thanks to Jeff Bezos, you can now become a landlord for as little as $100 — and no, you don’t have to deal with tenants or fix freezers. Here’s how

- I’m 49 years old and have nothing saved for retirement — what should I do? Don’t panic. Here are 6 of the easiest ways you can catch up (and fast)

- Dave Ramsey warns nearly 50% of Americans are making 1 big Social Security mistake — here’s what it is and 3 simple steps to fix it ASAP

Preparing your adult kids for the great wealth transfer

“Yeah I’d give it to him,” Ramsey confirmed after listening to the caller speak highly of his son. “But I’d put some terms on it,” he added, suggesting that the caller’s son should have solid plans for his life beyond owning a home.

In the U.S., 65% of parents admitted to providing some sort of financial assistance to their adult kids between the ages of 22 and 40, according to a USA Today study.

The great wealth transfer is a situation that experts say could reset a historic divide when it comes to personal finance and homeownership for younger generations. Those who receive an early inheritance passed down by their parents during their lifetime — like the caller’s son — are some of the first beneficiaries of this transfer. It’s expected to make millennials the richest generation in American history.

If you are among the lucky inheritors of generational wealth in the form of a gifted home, Ramsey recommends that you consider any maintenance or renovations the property may need in the future — and to set aside money for that.

Like the sound of high-yield account rates?

Then you might also be interested in exploring certificates of deposit (CDs). A CD is a low-risk savings option that can yield interest comparable to, or even higher than, the top savings accounts. The trade-off for this higher rate is that your money stays locked in the account for a set period.

With MyBankTracker, you can shop and compare top certificates of deposit rates from various banks nationwide.

Their extensive database shows the most competitive rates, with daily rate updates and personalized recommendations based on your risk preferences and time horizon so you can find the right CD to meet your retirement savings goals.

Read more: How much cash do you plan to keep on hand after you retire? Here are 3 of the biggest reasons you’ll need a substantial stash of savings in retirement

FinancialAdvisor.net is a free online service that helps you find a financial advisor who can help you create a plan to reach your financial goals. Just answer a few questions and their extensive online database will match you with a few vetted advisors based on your answers.

You can view advisor profiles, read past client reviews, and schedule an initial consultation for free with no obligation to hire.

If you’re not expecting to inherit a home, there are other ways to take advantage of the hot real estate market without having to buy a house or make an enormous down payment.

If you’re not an accredited investor, crowdfunding platforms like Arrived allow you to enter the real estate market for as little as $100. Arrived offers you access to shares of SEC-qualified investments in rental homes and vacation rentals, curated and vetted for their appreciation and income potential.

Backed by world-class investors like Jeff Bezos, Arrived makes it easy to fit these properties into your investment portfolio regardless of your income level. Their flexible investment amounts and simplified process allows accredited and non-accredited investors to take advantage of this inflation-hedging asset class without any extra work on your part.

While some platforms have democratized real estate investing by lowering entry barriers, those seeking larger-scale, institutional-quality commercial property investments often require a different approach.

For accredited investors with a higher risk tolerance and investment horizon, there are ways you can tap into the potentially higher returns of commercial real estate.

First National Realty Partners (FNRP) focuses on properties leased by industry-leading tenants such as Whole Foods, CVS, Kroger, and Walmart.

FNRP offers investors the opportunity to own a piece of essential retail infrastructure, with an experienced team that oversees every facet of the investment process, from property acquisition to leasing and property management.

Leveraging proprietary technology and a deep understanding of the market, FNRP has the potential to deliver exceptional returns while maintaining the highest standards of investment performance.

What to read next

- Warren Buffett says you can’t buy time — but landlords are finding a way. Here’s how savvy real estate investors are avoiding 12 hours a month in tedious admin (for free)

- There’s still a 35% chance of a recession hitting the American economy this year — protect your retirement savings with these 5 essential money moves ASAP

- This tiny hot Costco item has skyrocketed 74% in price in under 2 years — but now the retail giant is restricting purchase. Here’s how to buy the coveted asset in bulk

- Want an extra $1,300,000 when you retire? Dave Ramsey says this 7-step plan ‘works every single time’ to kill debt, get rich in America — and that ‘anyone’ can do it

Join 200,000+ readers and get Moneywise’s best stories and exclusive interviews first — clear insights curated and delivered weekly. Subscribe now.

This article provides information only and should not be construed as advice. It is provided without warranty of any kind.