We adhere to strict standards of editorial integrity to help you make decisions with confidence. Some or all links contained within this article are paid links.

Sometimes, helping too much can actually hurt.

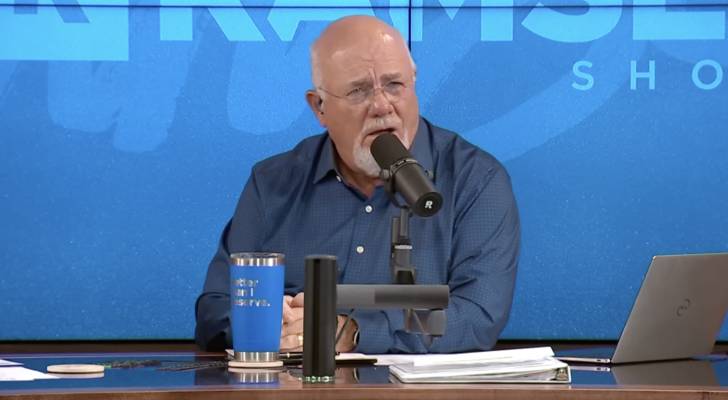

That’s the blunt advice that Dave Ramsey from The Ramsey Show [1] gave to a caller whose two adult sons are still living at home.

Julie from Cedar Rapids, Iowa, called in about a disagreement with her husband. They have four adult children (two are his, two are hers) and Julie’s husband wants the wills to stipulate that in the event of their passing, the house will be sold.

Trending Now

- Thanks to Jeff Bezos, you can now become a landlord for as little as $100 — and no, you don’t have to deal with tenants or fix freezers. Here’s how

- I’m 49 years old and have nothing saved for retirement — what should I do? Don’t panic. Here are 6 of the easiest ways you can catch up (and fast)

- Dave Ramsey warns nearly 50% of Americans are making 1 big Social Security mistake — here’s what it is and 3 simple steps to fix it ASAP

The issue? One of each of their sons, both 34, still live at home and can’t afford to move out on their own if the house is sold.

“You’re probably not gonna like the answer,” Ramsey said. “Tell them to leave, I’m serious as a heart attack.”

‘They’re in their 30s’ — and still living at home

Julie said that both sons work full-time, but in low-paying jobs: One makes $17 an hour, and the other makes $12 an hour.

Julie said they cannot afford to move out, but Ramsey pushed back: “You’re not in Manhattan!”

The average rent for a 2-bedroom apartment in Cedar Rapids was $982 per month in September, according to Zillow.

“My God, you can make $20 [an hour] at Target,” Ramsey said.

He says Julie needs to help her sons find career coaching and work-ethic coaching, so they can get out of the house and “establish a life of some kind.”

“They’re in their 30s. This is called ‘failure to launch’. You’re doing them no favors. You need to set some deadlines with some specific, stage-gated goals.”

He suggests a six-month timeline to get them better paying jobs and out of the house.

Read more: Here are 5 ‘must have’ items that Americans (almost) always overpay for — and very quickly regret. How many are hurting you?

How common is this situation?

Julie’s story may sound extreme, but she’s far from alone. According to a 2024 Pew Research Center report [2], approximately one-third of young adults aged 18 to 34 live with a parent. That includes:

- 57% of those aged 18 to 24

- 21% of those aged 25 to 29

- 11% of those aged 30 to 34

And it’s not just a roof over their heads. The same report found that 44% of young adults received financial support from parents last year.

Parents’ finances can become deeply intertwined with their adult children’s, and nearly half (49%) of lower-income parents said it did at least some financial harm — a risk that only compounds if the arrangement stretches on for years.

Help your adult children find their footing

If your adult child is still living at home and you want them to move out, Ramsey’s advice may feel harsh, but it comes from a place of encouraging independence and growth. Here are steps parents can take to help their children move out and move on.

1. Set a clear, realistic timeline

Start by agreeing on a move-out deadline. Give your child six months to find higher-paying work or secure affordable housing. Put it in writing, and make it a shared goal, not a threat.

2. Help them boost their earning power

To find new opportunities, you could support your kids to work with a career coach or point them towards a local employment center.

There are also small ways to start saving more every day, with platforms like Acorns, which automatically rounds up the price to the nearest dollar and places the excess into a smart investment portfolio. This can be a shared learning experience that could illustrate how saving a little each day can add up over time.

Let’s say they buy a coffee for $2.30. Acorns will round the purchase to $3.00 and invest the 70-cent difference for them. Here’s the math: $2.50 worth of daily round-ups adds up to just over $900 per year — and that’s not including the return they could earn from putting those savings into the stock market. That’s close to a month’s rent for that 2-bedroom apartment in Cedar Rapids.

Plus, you can get a $20 bonus investment when you sign up with a recurring monthly contribution.

Your kids could even start taking advantage of investing opportunities in real estate, without needing to buy their own home. For instance, you can tap into the real estate market by investing in shares of vacation homes or rental properties through Arrived.

Backed by world-class investors, including Jeff Bezos, Arrived allows you to invest in shares of vacation and rental properties, earning a passive income stream without the extra work that comes with being a landlord of your own rental property.

To get started, simply browse through their selection of vetted properties, each picked for their potential appreciation and income generation. Once you choose a property, you can start investing with as little as $100, potentially earning quarterly dividends.

3. Teach them to manage their money

Make sure they understand how to create and stick to a budget before they move out. If they can do so while putting their savings to work in the background, they will be able to achieve their goals faster.

To get started, a high-yield account, such as a Wealthfront Cash account, can be a great place to grow your emergency savings, offering both competitive interest rates and easy access when you need funds.

With a Wealthfront Cash account, you could earn up to 4.50% APY on your uninvested cash for your first three months (0.50% APY boost on top of the 4.00% base variable APY) provided by program banks. That’s over ten times the national deposit savings rate, according to the FDIC’s September report.

With no minimum balances or account fees, as well as 24/7 withdrawals and free domestic wire transfers, you can ensure your funds remain accessible at all times. Plus, Wealthfront Cash account balances of up to $8 million are insured by the FDIC.

4. Don’t confuse love with rescue

It’s hard not to want to step in and help your child when they are struggling, but teaching them to stand on their own will help more in the long run.

As Ramsey told Julie, “The most beautiful part of the whole conversation is that these young men [will] come into themselves rather than sitting in the basement … that’s an act of love.”

What to read next

- Robert Kiyosaki warns of a ‘Greater Depression’ coming to the US — with millions of Americans going poor. But he says these 2 ‘easy-money’ assets will bring in ‘great wealth’. How to get in now

- The ultrarich monopoly on prime US real estate is over — use these 5 golden keys to unlock passive rental income now (with as little as $10)

- This tiny hot Costco item has skyrocketed 74% in price in under 2 years — but now the retail giant is restricting purchase. Here’s how to buy the coveted asset in bulk

- Want an extra $1,300,000 when you retire? Dave Ramsey says this 7-step plan ‘works every single time’ to kill debt, get rich in America — and that ‘anyone’ can do it

Stay in the know. Join 200,000+ readers and get the best of Moneywise sent straight to your inbox every week for free. Subscribe now.

Article sources

At Moneywise, we consider it our responsibility to produce accurate and trustworthy content people can rely on to inform their financial decisions. We rely on vetted sources such as government data, financial records and expert interviews and highlight credible third-party reporting when appropriate.

We are committed to transparency and accountability, correcting errors openly and adhering to the best practices of the journalism industry. For more details, see our editorial ethics and guidelines.

[1]. The Ramsey Show. “My 34-Year-Old Sons Still Live At Home (They Can’t Afford Rent)”

[2]. Pew Research Center. “Parents, Young Adult Children and the Transition to Adulthood”

This article provides information only and should not be construed as advice. It is provided without warranty of any kind.