With grocery prices soaring 3.8% year-over-year – more than double Canada’s overall inflation rate of 1.7% – your weekly shop is eating up more of your budget than ever before.

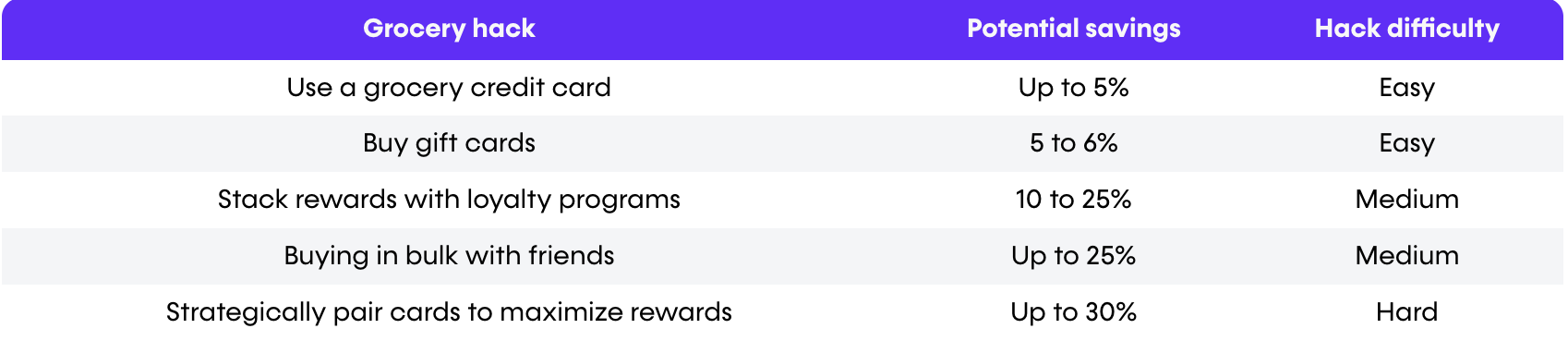

But following some smart credit card strategies could put an extra $1,465 back in your pocket annually, on groceries alone. Here are the most effective tactics to save money on your groceries that work right now.

1. Use a grocery rewards credit card

Cards such as American Express Cobalt (5% back) and Scotiabank Gold American Express (6% at Empire stores) deliver exceptional returns. For cash back, consider the BMO CashBack World Elite (5%) or Neo World Elite (up to 7% with Neo Everyday account and a $10,000 balance).

Check three things when choosing:

- Where you shop (not all stores qualify as “grocery”)

- Spending caps (BMO limits 5% bonus category to $500 monthly, for example)

- Whether annual fees justify the returns

2. Stack rewards with loyalty programs

Combine credit card rewards with store loyalty programs for double the benefits:

- PC Optimum and PC Financial Mastercard: Up to 45 points per dollar at Shoppers Drug Mart

- Scene+ and Scotiabank Gold Amex: Six points per dollar at Sobeys-owned stores

- Moi Rewards and RBC Moi Visa: Additional points on Metro purchases

Here’s a real-world example: A $222 grocery bill at Maxi could earn 42,800 PC Optimum points ($42.80) plus rewards from your credit card — a total return of 23%.

3. Use receipt-scanning apps

Apps such as Receipt Hog and Checkout 51 add another layer of rewards. Scan receipts within 14 days on the Fetch app for at least 25 points per receipt or use Checkout 51’s weekly offers for specific products. Combined with credit card rewards, savvy shoppers earn up to $400 annually across multiple apps.

Surprisingly, the day of the week matters significantly when using receipt apps:

- Thursday: Checkout 51 and Caddle refresh offers (shop Thursday afternoon for maximum overlap between expiring and new offers)

- Wednesday: Fetch often updates special brand promotions

- Weekends: Receipt Hog frequently runs bonus coin promotions

Even casual use of a single app can potentially generate $100+ annually in savings.

4. Buy gift cards at grocery stores

Purchase gift cards for other retailers at grocery stores to earn your card’s premium grocery reward rate on non-grocery spending.

- For example, instead of earning 1% at Home Depot, buy Home Depot gift cards at Sobeys with your Scotiabank Gold Amex for 6% back.

This tip is best for planned major purchases, but use it in moderation — excessive gift card purchases might trigger reviews from your bank (banks hate people “gaming” the rewards system, even though they aren’t really).

5. Time shopping with promotions

Shop during promotional periods to multiply rewards. Several Canadian credit cards offer a lucrative 10% cash back for new accounts, including:

- CIBC Dividend Visa Infinite Card

- SimplyCash Preferred by American Express

- Scotia Momentum Visa Infinite

- Tangerine World Mastercard

These bonuses typically run for around three months from your opening of an account and can be worth up to $200 cash back.

6. Use multiple cards strategically

Rotate cards to maximize benefits and work around spending caps:

- PC Financial World Elite at Loblaws stores and the BMO CashBack Mastercard elsewhere

- Scotiabank Gold Amex at Empire stores and the Tangerine World Mastercard elsewhere

- BMO Eclipse for 5x points until monthly cap, then switch to CIBC Dividend Visa

This technique generates 20 to 30% more rewards than using a single card according to research.

Read more: What’s the second best credit card (and how to choose it)

7. Don’t overlook price protection

If you’re not using price protection features on eligible credit cards, you’re leaving money on the table. This little-known benefit can be a game-changer for grocery savings.

Price protection is essentially your credit card’s promise to refund the difference if an item you purchase drops in price within a specific timeframe (typically 30 to 90 days after purchase).

This means that if you buy something at a regular price, you can potentially claim additional savings if prices drop further during clearance events.

Read more: Which credit cards offer the best extended warranty and purchase protection?

8. Shop through credit card portals

Access online grocery stores through your card’s shopping portal for additional rewards. For Canadians, PC Optimum offers bonus points when shopping through their portal for Loblaws, No Frills and other Loblaws family of brands stores. CIBC Aventura and Scene+ both feature grocery delivery services where you’ll earn extra points. AIR MILES collectors can shop through airmilesshops.ca to earn Cash or Dream Miles on grocery delivery from partners like Metro and Sobeys. RBC and TD also offer enhanced rewards when accessing eligible grocery delivery services through their respective portals.

9. Buy in bulk and split with friends

Pooling resources with friends or family for bulk purchases at Canadian warehouse stores such as Costco, Real Canadian Superstore or Wholesale Club can save you 27% on average compared to regular grocery prices according to a recent study by the Path to Purchase Institute.

Pool resources among your friends or family for bulk purchases to save 27% on average. Assign one person to buy using their rewards card, then split costs afterward using apps such as Splitwise, KOHO or e-transfers. This strategy turns an individual expense into a group savings opportunity. Plus, the apps keep everything transparent while ensuring the card-holding buyer earns all the rewards.

10. Redeem points for grocery gift cards

Convert credit card points directly into grocery gift cards. TD Rewards offers excellent conversion rates at approximately 200-250 points per dollar. You should always try to avoid generic gift cards, which often provide less value per point.

11. Track spending with credit card apps**

Your credit card’s native app categorizes spending automatically. Schedule weekly reviews to catch miscategorizations and identify savings opportunities. For deeper insights, specialized apps like YNAB ($20.89/month) or free options such as Spergel’s grocery budget tracker can break down spending further.

12. Use category bonuses creatively

Card issuers classify purchases by merchant category, not individual items. Because of this you need to be careful about where you shop.

Walmart Supercentres typically code as "discount stores" not "grocery stores," so unless you have the Walmart Rewards Mastercard, your grocery bonus won’t apply. Costco registers as a "wholesale club" and only accepts Mastercard. Shoppers Drug Mart codes as a pharmacy despite selling groceries.

Buy household supplies at grocery stores instead of big-box retailers, and make test purchases at different stores to discover how they’re categorized.

Conclusion

With the average Canadian household spending about $13,530 annually on groceries, using even half these strategies could potentially save you over $1,400 each year. That’s real money that you can then put back into your household budget.

Remember the golden rule: Credit card rewards only benefit you when used responsibly. Paying your balance in full each month is the foundation of any successful rewards strategy.

Sources

1. Receipt Hog

2. Checkout 51

3. Path to Purchase Institute: Costco Is Canada’s Top Grocer, According to Dunnhumby

4. YNAB

5. Spergel

This article provides information only and should not be construed as advice. It is provided without warranty of any kind.