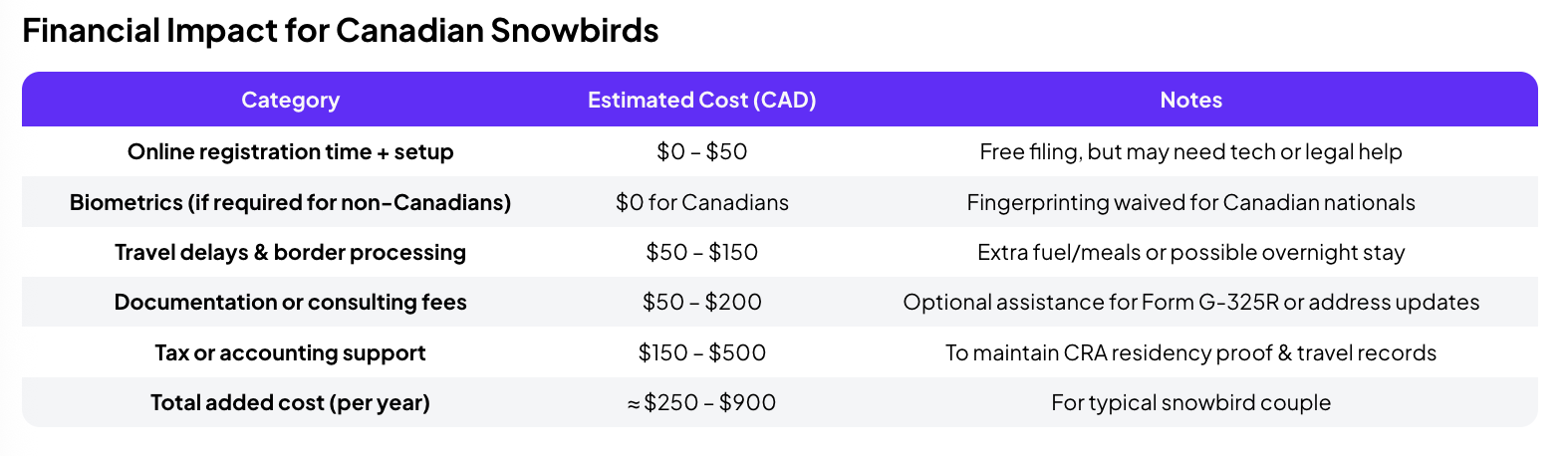

For a typical Canadian couple, new U.S. border rules could add $250 to $900 a year in extra costs — covering document preparation, travel delays and cross-border tax advice — before they even unpack their bags in Florida or Arizona.

The new U.S. rule was announced in March and went into effect on April 11, 2025. As of this date Canadians who spend 30 days or more in the United States must register with the U.S. Department of Homeland Security (DHS) through an online Alien Registration Form (G-325R). The move is part of a renewed effort by the current President Trump and his administration to track non-citizens staying in the country for extended periods — but it’s reach will affect many of Canada’s winter travellers and retirees, commonly known as snowbirds.

Don’t Miss

- Want an extra $1,300,000 when you retire? Dave Ramsey says this 7-step plan ‘works every single time’ to kill debt, get rich — and ‘anyone’ can do it

- The Canadian economy is showing signs of softening amid Trump’s tariffs — protect your wallet with these 6 essential money moves (most of which you can complete in just minutes)

- Boomers are out of luck: Robert Kiyosaki warns that the ‘biggest crash in history is coming’ — here’s his strategy to get rich before things get worse

Does it cost to register under the new rule?

Although registration itself is free, the new rule adds layers of red tape — and this adds costs to those who plan to continue their snowbird life.

Canadians entering the U.S. by land who plan to stay more than a month must now register online with U.S. Citizenship and Immigration Services (USCIS) within 30 days of arrival.

Those flying south for the winter are already covered, as air travellers automatically receive an electronic I-94 record, which counts as proof of registration.

Children under 14 must be registered by a parent or guardian, and those who turn 14 while in the U.S. must register within 30 days. Dual citizens and American Indians born in Canada with at least 50% Indigenous heritage remain exempt.

Snowbirds should expect more paperwork, more time

Canadians who must register will need to create an online USCIS account, complete Form G-325R and keep a printed copy of their “Proof of Registration.” While Canadians are exempt from fingerprinting, those from other countries may have to attend biometric appointments at local Application Support Centers.

There’s also an ongoing requirement to notify U.S. authorities within 10 days of any change of address, using the USCIS online portal or a mailed Form AR-11.

Read more: What is the best credit card in Canada? It might be the RBC® British Airways Visa Infinite, with a $1,176 first-year value. Compare it with over 140 more in 5 seconds

How this new U.S. rule will cost Canadian snowbirds

While the DHS insists there’s no fee for filing required forms or submitting biometrics, snowbirds should expect to pay indirect costs.

For instance, getting help with online setup and documentation costs between $50 to $200, while and longer border crossings can mean higher fuel or lodging expenses.

However, the largest expense will be felt by those who need to hire a cross-border accountant — in order to maintain proper Canadian tax residency — an expense that can add another $150 to $500 per year.

Strictly speaking, the new U.S. alien registration rule does not a visiting Canadian to hire any professional, including a cross-border accountant. That’s because Form G-325R (and the registration process) are immigration-related, not tax-related. This means that all Canadians, including snowbords, can complete the online form on their own at no cost.

However, in practice, many snowbirds already walk a fine line between U.S. immigration rules and US/Canada tax rules, and the new registration system could expose the loopholes and cracks in these agreements — leaving Canadian snowbirds exposed. For Canadians that spend close to six months south of the border, hiring a cross-border accountant may become helpful (or even a necessity) not just to be compliant with the new registration rules, but to protect tax residency and their reporting status. Specialists, like cross-border accountants, can help in a variety of ways, including:

Record keeping, residency and tax-filing risk

The new registration confirms how long a person is physically in America. If a Canadian spends too many days in the U.S. — even unintentionally — they could trigger U.S. tax-residency thresholds under the “Substantial Presence Test.” Accountants help reconcile those day counts and keep proof that may be required by the Canada Revenue Agency (CRA) and the Internal Revenue Service (IRS).

Once registered in a U.S. immigration database, longer-stay patterns become easier for U.S. authorities to track. That data can be cross-referenced against IRS rules. A cross-border accountant helps ensure Canadians don’t inadvertently create a U.S. tax-filing obligation or lose their Canadian tax residency.

Avoiding double taxation and document alignment

If someone crosses residency lines, accountants can file the proper elections (like the Closer Connection Exception under IRS Form 8840) or claim treaty benefits to avoid being taxed by both countries.

Plus, many snowbirds rely on accountants to coordinate travel logs, property ownership documents, and investment records, so if the IRS or CRA ever questions residency, they have consistent evidence.

While the DHS registration form doesn’t itself demand professional help, it tightens the paper trail showing how long Canadians stay in the U.S. — which can, in turn, raise tax-residency and reporting issues.

That’s why many financial planners and tax advisers are suggesting that snowbirds speak to a cross-border accountant at least once to make sure their immigration records, travel history, and tax filings stay aligned.

Costs add up as DHS cracks down

Although USCIS states there is no government filing fee, several indirect costs can affect Canadians. Many snowbird couples can expect to budget between C$250 to C$900 in additional annual costs, depending on how often they travel, their method of entry, and whether they need professional assistance.

Failure to register could result in fines of up to US$5,000 or even six months in jail in extreme cases. Not carrying proof of registration is a misdemeanor punishable by a fine of up to US$100 or 30 days in jail.

To help, here’s a breakdown of potential costs due to this new U.S. regulation:

No exemption for visiting family

The rule doesn’t distinguish between retirees, seasonal renters, or those visiting family. If a Canadian stays 30 days or more, they must register. Those visiting for less than a month remain exempt.

Legal experts, including EY Law and Dentons, note that Canadians flying south for extended stays — particularly to Florida, Arizona and California — are likely already registered through their I-94 travel record. The concern lies mainly with Canadians who drive into the U.S., as land-border travellers are not automatically issued I-94 records unless they request them.

To avoid unnecessary paperwork, Canadians can ask U.S. border officers to issue an electronic I-94 at entry or ensure their passport is stamped — both serve as proof of registration.

What snowbirds should do now

Canadians planning to spend time in the U.S. should check their I-94 record at the official DHS site. If no record appears for their trip, they’ll need to complete the G-325R form within 30 days of entry.

Experts also recommend to:

- Print and carry proof of registration while travelling.

- Keep records of travel dates to avoid crossing the 182-day tax threshold that can affect Canadian residency status.

- Budget extra time at the border this winter as the new system rolls out.

While the new system is not expected to stop retirees from seeking southern sunshine in the United States, it is a reminder how a no-cost redtape can often end up costing hundreds of dollars — and a fair bit of time — for Canadians heading south each year.

What To Read Next

- Here are 5 expenses that Canadians (almost) always overpay for — and very quickly regret. How many are hurting you?

- Robert Kiyosaki warns of ‘massive unemployment’ due to the ‘biggest change’ in history — and says this 1 group of ‘smart’ people will get hit extra hard. Are you one of them?

- I’m almost 50 and don’t have enough retirement savings. What should I do? Don’t panic. Here are 6 solid ways you can catch up

- Here are the top 7 habits of ‘quietly wealthy’ Canadians. How many do you follow?

This article provides information only and should not be construed as advice. It is provided without warranty of any kind.