Ignoring your credit card debt is like letting a ticking time bomb go off — at 19.99% interest, a $3,000 balance can grow to over $6,900 in just five years if only minimum payments are made. According to the Financial Consumer Agency of Canada, making only minimum payments on a typical credit card at 20% interest can take more than 10 years to pay off and cost thousands in interest.

Understanding your statement’s different payment options isn’t just helpful — it’s essential for protecting your financial future.

Here’s how to decode your credit card statement, avoid the minimum payment trap, and finally break free from the debt cycle that keeps thousands of Canadians financially stressed.

What is the minimum payment on a credit card, compared to a statement vs. current balance?

The first step is understanding the difference between the various balances displayed on your bank’s website or statement:

Minimum balance

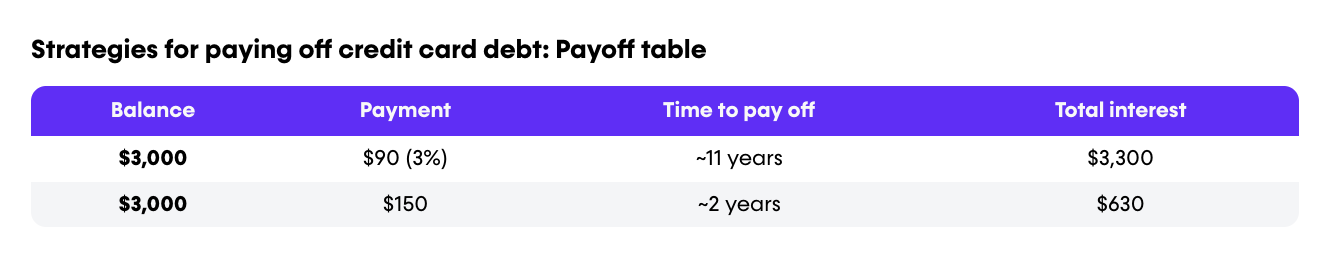

In Canada, the minimum payment is usually 2% to 5% of your balance or a fixed amount like $10, whichever is greater. For example, a $3,000 balance might have a minimum payment of $60 to $150. Paying only this minimum keeps your account current — but lets interest charges pile up fast and this will lengthen the amount of time it takes to pay off your credit card.

Statement balance

This balance is what your credit card closed at the billing cycle. Every credit card has a close date, and the statement balance includes all unpaid transactions as of the monthly date. To avoid paying any interest, you must pay the entire statement balance. This ensures that you are using the credit card interest-free and can maximize your earning potential with rewards.

Current balance

This amount includes all unpaid transactions on your account today. It does not include pending transactions that have not been posted to your account. This will be higher than the statement balance as the amount includes transactions that will be posted to your next statement. However, some choose to proactively pay the current balance monthly. This strategy goes above and beyond paying the statement balance and also maintains your credit card interest-free.

Could the best credit card in Canada be the RBC® British Airways Visa Infinite, with a $1,176 first-year value? Find out by comparing more than 140 cards in just 5 seconds — your future self will thank you!

How much should you pay on your credit card bill?

To stay debt-free, always aim to pay your statement balance in full by the due date. Say your statement balance is $1,200. If you pay it off in full, you avoid all interest. But if you pay only the minimum, it could take over 10 years to clear the debt, costing more than $1,500 in interest.

Why should I pay the minimum payment on my credit card?

At the very least, a minimum balance should be paid for the statement to not be sent to credit agencies as missed or late, though the posted interest rate will apply to the balance. Missing even one minimum payment can drop your credit score by 50 to 150 points and stay on your record for up to six years. If you can’t pay in full, always cover at least the minimum to avoid penalties and credit damage. An easy way to do this is to set up preauthorized payments from your chequing account so you avoid missing any payments.

What happens if I don’t pay the minimum payment on my credit card?

Credit issuers report statement balances and status to agencies like TransUnion and Equifax monthly. If you don’t pay the minimum payment on a credit, statements are reported as missed and late, impacting your credit score significantly. You also risk an increase in your interest rate, being disqualified for promotional offers and rates, having your account closed and being ineligible for future attractive credit cards and offers.

What happens if I miss my credit card payment?

Missing your credit card payment will result in an eventual late repayment. This balance will incur interest, which will differ from the type of transaction. Purchases will have a lower interest rate than a cash advance, and the credit card issuer’s terms will determine how minimum payments will be applied to your total balance.

Strategies to reduce your credit card debt

Credit card consolidation can help reduce your credit card payments. Many financial institutions offer this service, which involves taking out a new loan, usually at a lower rate. If qualified, this is seen in the form of a personal line of credit or home equity line of credit, and the rate is lower than a hefty credit card interest rate. The terms of the new loan agreement apply, but you pay a lesser interest rate to the lender.

Stop losing money to outdated credit cards. Compare credit cards to find the best fit — your future self will thank you.

The other strategy is to use a balance transfer credit card with a lower or promotional interest rate. Balance transfer cards offer intro rates as low as 0% for up to 12 months, which can give you a break from interest and help crush your debt faster. But watch out: Many charge a balance transfer fee of 1% to 3%, and the rate can jump to over 20% after the promo ends.

It’s worth noting that cancelling your older credit card can affect your average credit card age, which is a factor in determining your credit score. On the other hand, transferring a balance often comes with a transfer fee, which should be taken into account when deciding whether to proceed with a balance transfer.

Bottom line

You’re not alone if you’re struggling with credit card debt — but you do have options. Whether it’s paying more than the minimum, using a balance transfer, or consolidating debt, small steps can lead to big results. Take control now — your future self will thank you.

This article provides information only and should not be construed as advice. It is provided without warranty of any kind.