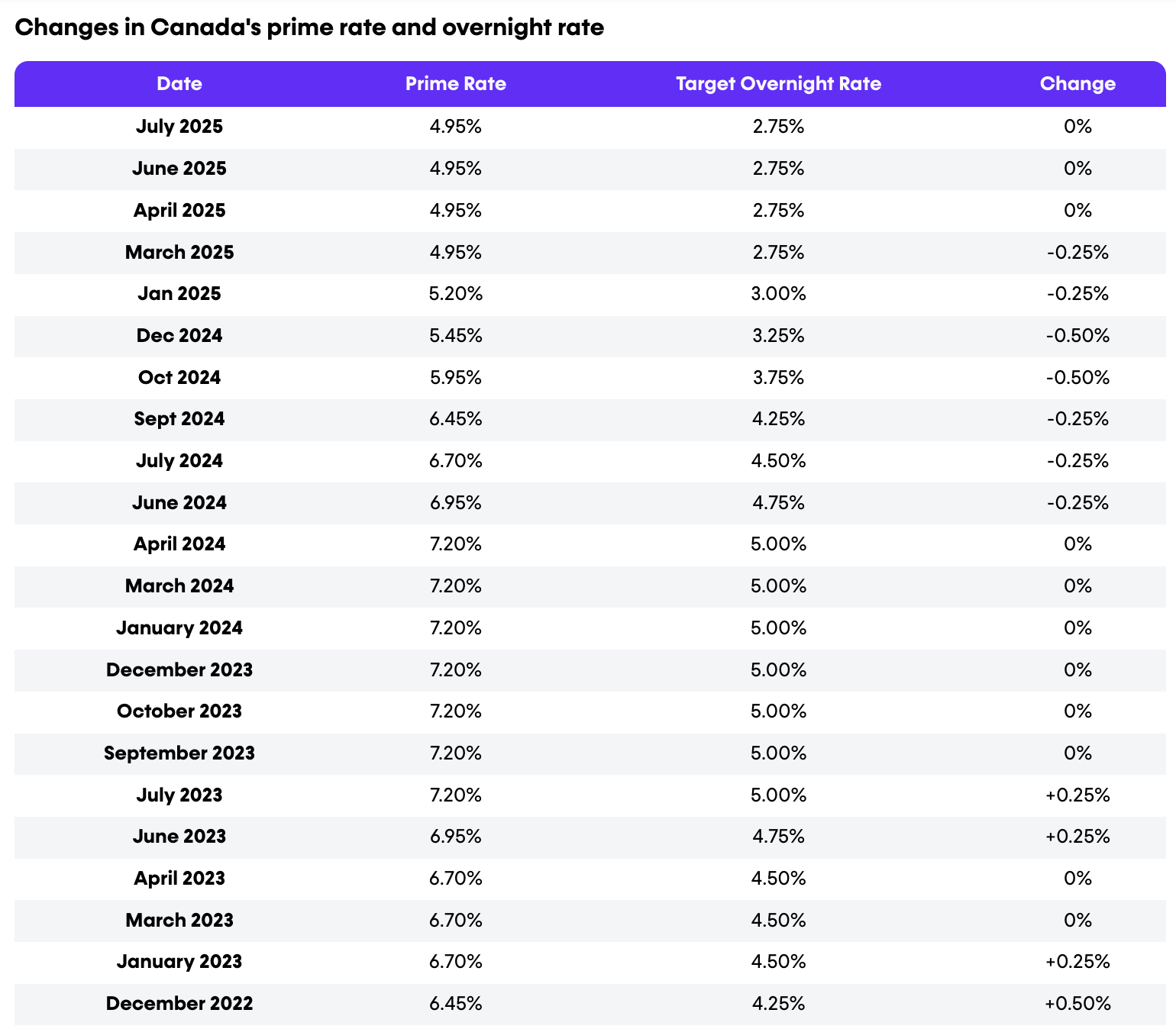

The Bank of Canada dropped its overnight lending rate by 0.25% on September 17, 2025, lowering its target rate from 2.75% to 2.50%. This latest rate drop breaks the BoC’s recent streak of three consecutive rate holds that began in March 2025.

Prior to the March pause, the BoC had steadily lowered rates over seven consecutive announcements, beginning in July 2024, as a way to tame inflationary pressures.

Why the September 17 BoC rate cut matters

The Bank’s 25 basis point drop is a move that signals a shift back toward easing after months of caution. While inflation edged up slightly in August to 1.9% from 1.7% in July, it remains below economists’ forecasts and well under the inflationary highs of recent years.

It’s also a signal that the bigger story is Canada’s weakening economy — weighed down by global tariffs, slowing trade, and a softer labour market.

By lowering its policy rate, the Bank of Canada is aiming to reduce borrowing costs, stimulate spending, and give households and businesses a measure of relief. While this rate drop was expected, some economic analysts warn that core inflation remains sticky and that upcoming federal fiscal stimulus could put upward pressure on prices later this year.

Impact of the latest BoC rate cut on Canadians

By resuming its strategy to ease rates, the BoC is signalling a renewed commitment to supporting households and businesses through lower borrowing costs — a move that will directly push Canada’s prime rate down from 4.95% to 4.70% and, hopefully, help stimulate an ongoing sluggish Canadian economy.

This recent cut to the overnight rate helps as it pressures lenders to lower Canada’s prime lending rate, which major banks use to set borrowing costs. That means Canadians can anticipate interest rate cuts on:

- Mortgages: Variable-rate mortgage holders will see their payments fall slightly. New fixed-rate borrowers could also benefit from lower advertised rates.

- HELOCs: Home equity line of credit holders, who typically pay “prime plus” pricing, will see interest rates fall by 0.25 percentage points.

- Loans and credit cards: Variable-rate car loans and some credit cards tied to prime will drop, though timing depends on the lender.

For indebted households, even a modest cut can ease monthly payment pressures. For the broader economy, it marks a fresh attempt to balance inflation management with the need to keep growth on track.

What’s next

Canada’s central bank held rates steady through the spring and summer, waiting to gauge the full impact of previous cuts. But inflation has cooled further, and economic growth has shown signs of weakness. Finally, with ongoing global trade uncertainty and slower business investment, which helped push national unemployment numbers up, the BoC now sees a strong case for economic easing.

Despite the pause over the summer and this recent rate drop, the Bank of Canada has left the door open for more moves depending on how inflation, consumer spending, and the job market evolve. For now, Canadians can expect slightly lower borrowing costs — and a signal that the central bank is prepared to provide more support if the economy weakens further.

How the BOC’s target rate affects the prime rate in Canada?

When the Bank of Canada changes its target rate — or chooses to hold it steady — this sends a signal to banks and lenders across Canada about where borrowing costs might head next. That’s because Canada’s prime rate — the benchmark rate banks use to set borrowing costs — is directly influenced by the BoC’s policy rate. When the BoC lowers the overnight rate, banks generally cut their prime rates by the same amount. The result: Borrowing becomes cheaper across a wide range of financial products and this helps stimulate consumers to spend and businesses to borrow and invest.

On the other hand, raising the rate makes borrowing more expensive and can slow economic activity. By holding the rate steady, the Bank indicates a wait-and-see approach, often reflecting uncertainty or a desire to assess the impact of previous rate moves before making further changes.

What does this mean for Canadian borrowers? It means Canadians with variable-rate mortgages, home equity lines of credit (HELOCs), variable auto loans, and certain credit cards will soon see interest charges fall by 0.25%. For example, a HELOC priced at “prime + 1%” will now cost 5.70%, down from 5.95%.

Who sets the Canadian prime rate?

While each bank sets its own prime rate, the big five banks — Bank of Montreal (BMO), Bank of Nova Scotia (Scotiabank), Canadian Imperial Bank of Commerce (CIBC), Royal Bank of Canada (RBC) and Toronto-Dominion Bank (TD) — usually have the same number.

That’s because the prime rate is heavily influenced by the BoC’s “policy interest rate.” It’s also known as the “target for the overnight rate,” because that’s what major banks charge each other for one-day loans.

When the BoC raises the overnight rate, it becomes more expensive for banks to borrow money. So they raise their respective prime rates to cover the added costs by pulling in higher interest from you.

When the BoC drops the overnight rate, banks usually lower their prime rates by the same amount — but there are some notable exceptions, as in 2015.

Canada prime rate history

Why does the prime rate go up and down?

The BoC is the nation’s central bank, and its mandate is to “promote the economic and financial welfare of Canada.” To do so, it modifies its targets for the overnight rate in line with the economy’s performance and inflation forecasts.

If the economy is booming, the BoC might raise the target for its benchmark interest rate to pull back on people’s spending and keep prices from inflating to astronomical heights. The top banks will likely raise their prime lending rate in the weeks that follow.

When the economy is weakening or inflation dribbles to undesirable lows, the BoC will lower its overnight rate. Exceptional circumstances like the coronavirus pandemic can lead to emergency rate cuts, too.

"The spread of COVID-19 is having serious consequences for Canadians and for the economy, as is the abrupt decline in world oil prices. The pandemic-driven contraction has prompted decisive [action] to minimize any permanent damage to the structure of the economy," the Bank of Canada said in a news release in March 2020.

That was when it slashed the overnight rate to an all-time low of 0.25%, a level last reached during the 2008 financial crisis.

In January 2022, Bank of Canada Governor, Tiff Macklem, announced to reporters that "interest rates will need to increase to control inflation. Canadians should expect a rising path for interest rates."

And they did. The central bank raised interest rates eight times in 12 months, only pausing the hike in March 2023. Rates went up twice more since then but were paused for months, until July of last year, when rates dropped 25 basis points. The July announcement is the third announcement in a row the Bank has held rates, suggesting that, while inflation has cooled, market uncertainty remains.

How the Canadian prime rate impacts you

Home equity lines of credit

If you have access to a HELOC, you’ll feel the movements in the prime rate most closely.

Rates on those products change in sync with the prime. The adjustable rate on a HELOC might be advertised as "prime plus 1%" or "prime plus one," for example.

The rate on this hypothetical HELOC would have decreased from 6.20% to 5.95%, a few days to a few weeks after the BoC target rate dropped to 2.75%. Based on June’s announcement, your payments should remain the same.

Credit cards

Similar to HELOCs, some lower-interest or variable APR credit cards might have an interest rate described as “prime plus 4.50% to 12.75%” or “prime plus 9.99%.”

Auto loans

Variable-rate auto loans shift in line with the prime, and the rate you’ll get on a new fixed-rate loan will change, too.

How much depends on the institution, so it’s important to check with your lender when you hear about a prime rate hike or cut.

Mortgages

The two most common types of mortgages in Canada, fixed-rate mortgages and variable-rate mortgages, interact with the prime in different ways.

An active fixed-rate mortgage won’t be affected — that’s what makes them fixed — but the rates for new borrowers usually go higher or lower in step with the prime.

By contrast, the interest rate you pay with variable-rate mortgages tangos directly with the prime rate over the course of the loan. With a five-year variable mortgage, you could be quoted for a rate that looks like "prime -0.45%" — the equivalent of 4.50% (with prime at 4.95% minus 0.45%).

With interest rates this low, Canadians could be motivated to lock-in lower debt costs — finding mortgages, auto loans and other debt products with lower borrowing costs, and help reduce the strain on monthly budgets.

This article provides information only and should not be construed as advice. It is provided without warranty of any kind.