We adhere to strict standards of editorial integrity to help you make decisions with confidence. Some or all links contained within this article are paid links.

Despite earning an estimated combined income of $500,000 to $600,000 a year, Bill from San Diego admits he and his wife struggle to save any money — and it’s easy to see why.

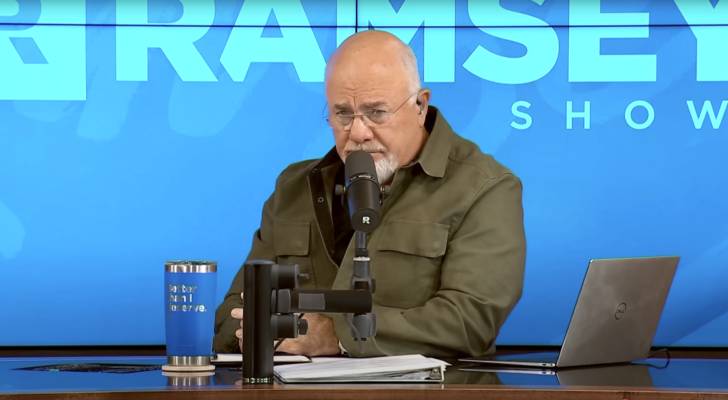

“Our monthly expenses are about $30,000, and then add taxes to that, so we pretty much even out every year,” Bill told Dave Ramsey on an episode of “The Ramsey Show” in a clip posted Jan. 13.

Don’t miss

- I’m 49 years old and have nothing saved for retirement — what should I do? Don’t panic. Here are 6 of the easiest ways you can catch up (and fast)

- Robert Kiyosaki warns of a ‘Greater Depression’ coming to the US — with millions of Americans going poor. But he says these 2 ‘easy-money’ assets will bring in ‘great wealth’. How to get in now

- You don’t have to be a millionaire to gain access to this $1B private real estate fund. In fact, you can get started with as little as $10 — here’s how

An exploration of the San Diego, California, couple’s finances and spending habits reveals how even high-earning households can struggle and end up living paycheck to paycheck.

Spending problem

A 2023 Empower survey found that 71% of U.S. adults believe earning more money would solve most of their problems, a mindset Ramsey once shared. However, he learned that higher earnings can’t fix poor organization and lack of detail.

Bill’s case shows that increasing income isn’t enough. He and his wife spend $12,000 a month on mortgages, $8,000 to $10,000 on charity, and $750 on a leased vehicle.

Ramsey considered their spending excessive, comparing it to “throwing a bale of dollars over the fence and coming back to see what’s left.” He advised them to create a detailed budget that tracks every dollar in and out.

Budgeting and tracking can help you understand where your money is going, so you can make every dollar work for you.

With YNAB, you can track spending and saving all in one place. Link your accounts so you can see a big-picture look of your expenses and net worth growth. You can prioritize saving for short or long term goals — like a vacation or a down payment for a house — with the app’s goal tracking feature.

If you want to pay debts faster, you can create personalized paydown plans to calculate how much interest you’d save if you topped up your monthly payments with a little extra.

The easy-to-use platform allows you to simplify spending decisions and clarify your financial priorities. Plus, you don’t need to add your credit card information to start your free trial today.

Read more: Want an extra $1,300,000 when you retire? Dave Ramsey says this 7-step plan ‘works every single time’ to kill debt, get rich in America — and that ‘anyone’ can do it

Easy targets

Data from Bank of America shows that 20% of households earning over $150,000 lived paycheck to paycheck in 2024, often due to expensive homes and high mortgage payments.

However, Bill and his wife seem to be spending just as much on their mortgages as they are on easily avoidable expenses. For example, they lease a vehicle, which Ramsey believes is unnecessary given their income. He suggested buying the car outright instead.

Additionally, nearly a third of their monthly expenses go to charity. While Ramsey supports generosity, he advised the couple to adjust their donations temporarily, especially since they aren’t investing.

Even high-income earners can struggle to save and invest, often facing lifestyle inflation and increased spending. You can significantly increase your savings by automatically investing your spare change with Acorns.

The app automatically rounds up your everyday purchases to the nearest dollar and invests the difference into a diversified portfolio. This means that while you’re still earning an income, every transaction — from your morning coffee to grocery shopping — contributes to building your wealth.

For example, when you spend $3.50 on coffee, Acorns will automatically invest the 50-cent difference. These small amounts add up over time.

Plus, with an Acorns Gold plan, you get a 3% IRA match on new contributions and the ability to customize your portfolio by selecting your own stocks.

Get help from a professional advisor

Seeking professional help from a financial advisor can be a game-changer when it comes to managing your money. According to Vanguard’s research, people who work with financial advisors see a 3% increase in net returns. This difference can be substantial over time. For example, if you’re starting with a $50,000 portfolio, you could potentially retire with an extra $1.3 million after 30 years of professional guidance.

If you’re unsure which path to take amid today’s market uncertainty, it might be a good time to connect with a financial advisor through Advisor.com.

This online platform connects you with vetted financial advisors best suited to help you develop a plan for your new wealth.

Just answer a few quick questions about yourself and your finances and the platform will match you with an experienced financial professional. You can view their profile, read past client reviews, and schedule an initial consultation for free with no obligation to hire.

You can view advisor profiles, read past client reviews, and schedule an initial consultation for free with no obligation to hire.

What to read next

- Financial aid only funds about 27% of US college expenses — but savvy parents are using this 3-minute move to cover 100% of those costs

- Here are 5 ‘must have’ items that Americans (almost) always overpay for — and very quickly regret. How many are hurting you?

- How much cash do you plan to keep on hand after you retire? Here are 3 of the biggest reasons you’ll need a substantial stash of savings in retirement

- This is how American car dealers use the ‘4-square method’ to make big profits off you — and how you can ensure you pay a fair price for all your vehicle costs

Stay in the know. Join 200,000+ readers and get the best of Moneywise sent straight to your inbox every week for free. Subscribe now.

This article provides information only and should not be construed as advice. It is provided without warranty of any kind.