They say that what happens in Vegas stays in Vegas.

Yet, when it comes to Donald Trump’s “no tax on tips” law, what began as a Royal Flush of a campaign promise is turning out to be a bust, with ripple effects extending far beyond Sin City.

Must Read

- Thanks to Jeff Bezos, you can now become a landlord for as little as $100 — and no, you don’t have to deal with tenants or fix freezers. Here’s how

- Dave Ramsey warns nearly 50% of Americans are making 1 big Social Security mistake — here’s what it is and 3 simple steps to fix it ASAP

- I’m 49 years old and have nothing saved for retirement — what should I do? Don’t panic. Here are 6 of the easiest ways you can catch up (and fast)

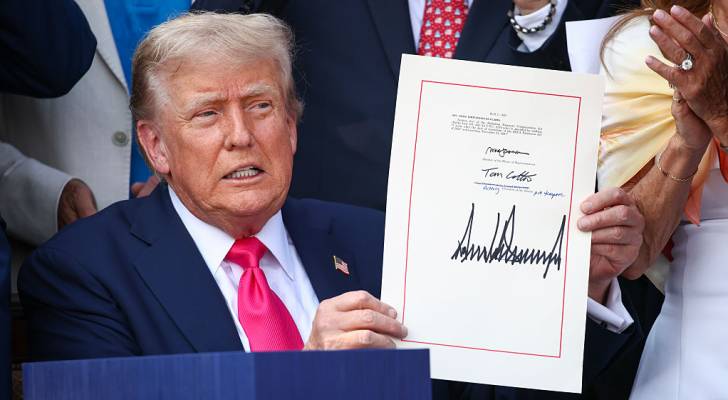

Trump famously made the “no tax on tips” promise on the 2024 campaign trail in Vegas [1] — arguably the center of the American hospitality industry — and added it to his One Big Beautiful Bill Act (OBBBA) that passed earlier this year. But now that the law is set to come into effect for the 2026 tax season, many in the Vegas hospitality industry, which is struggling in the midst of a tourism plunge that affects their tips, are discovering that it won’t quite deliver as promised.

That’s because, much like Trump’s “no tax on overtime” promise from the same OBBBA, the idea of “no tax on tips” sounds great on paper. It even received bipartisan support, but it saddles the nation’s roughly 4 million tipped workers with tax rules and qualifying technicalities to navigate, with a payout that’s not as generous as they’d hoped.

Local server and Culinary Workers Union member Debra Jeffries called it “quite a bait and switch from the campaign days” in an interview with a Las Vegas NBC affiliate [2]. Ted Pappageorge, the Culinary Workers Union’s Secretary-Treasurer, declared it “a slap in the face to workers.”

And University of Nevada law professor Francine Lipman added it was “a little bit misleading to say no tax on tips because there’s some conditions precedent to getting that deduction.”

What “no tax on tips” really gets you

The gist of the “no taxes on tips” law is that it allows a tax deduction — not tax-free tips — of up to $25,000 on tips while excluding, for example, gratuity such as that automatically added onto a restaurant bill.

Only people working in specific sectors qualify for the deduction, from various restaurant and hotel staff to home repair and wellness workers, among others. And despite this, their tips will still be subject to Social Security and Medicare taxes. The law begins to phase out, however, for individuals who make $150,000 per year, or couples that make a combined $300,000.

Still, Yale Budget Lab stats show that, as of 2023, 37% of tipped workers make so little that they pay no income tax at all and, thus, reap zero benefits from a tax law like this one [3].

That means only about 60% of tipped worker households would benefit from the law, resulting in an average annual tax deduction savings of around $1,800, according to the Tax Policy Center [6]. They added that lower-earning tipped households, making less than $33,000 annually, may only see savings of around $450 and possibly as low as $10.

In terms of the restaurant industry specifically, the non-profit One Fair Wage found that due to the low average income of tipped restaurant workers — almost half of whom make less than the annual federal income tax threshold to pay taxes — a whopping 66% would not benefit from the “not taxes on tips” law [4].

Though the “no tax on tips” plan was endorsed by organizations like the powerful National Restaurant Association — described by The New Yorker [5] as “an industry lobby that some labor advocates call ‘the other N.R.A.” Many others argue that the law doesn’t go far enough to address the needs of workers.

Taking it a step further, some worry that employers will begin using the law as an excuse to offer lower wages to tipped workers.

“If there’s some level of ultimate take-home pay that workers know they will accept to take a job, or to stay in a job … the wages needed to meet that level will have just gone down,” Economic Policy Institute president Heidi Shierholz told PBS [6].

Read more: How much cash do you plan to keep on hand after you retire? Here are 3 of the biggest reasons you’ll need a substantial stash of savings in retirement

Further fallout of the OBBBA

A lesser-discussed hit facing tipped restaurant workers coming out of the OBBBA is a cut to Medicaid and SNAP (food stamp) benefits.

The Center for American Progress found that, for tipped workers, SNAP cuts could deliver a financial blow of “almost six times the impact of ‘no tax on tips’” in the next decade, while Medicaid and the Children’s Health Insurance Program (CHIP) cuts could equal an impact 28 times that of the tips benefits [7].

Using one example, they pointed to a hairdresser and single mother of a teenager who makes just under $17 an hour and around $10,000 in annual tips. Work is slow in the winter months and she can’t consistently maintain the 20-hour work week required by the OBBBA to receive SNAP benefits for her family. As a result, even though she can deduct her $10,000 in tips from her taxes, she’s still $600 in the hole because the $1,007 she saves on her taxes doesn’t make up for the $1,620 she loses in SNAP assistance.

Meanwhile, a report from One Fair Wage [8] earlier this year said that hospitality and tipped restaurant workers “are among the lowest-wage workers in America,” relying on Medicaid and SNAP benefits “at much higher rates than all other workers over the last several decades.”

Their research found that the OBBBA would strip Medicaid from 1.2 million tipped restaurant workers or restaurant positions by 2034 — totalling 45% of that workforce — adding, “this bill may lower taxes for 50,000 fewer workers than the number of workers who will lose their Medicaid benefits.”

For better or worse, the “no tax on tips” law, like Trump’s “no tax on overtime” law, is only on the books until 2028.

What to read next

- Want an extra $1,300,000 when you retire? Dave Ramsey says this 7-step plan ‘works every single time’ to kill debt, get rich in America — and that ‘anyone’ can do it

- ‘Rich Dad, Poor Dad’ author Robert Kiyosaki says this 1 asset will surge 400% in a year — and he begs investors not to miss its ‘explosion’

- There’s still a 35% chance of a recession hitting the American economy this year — protect your retirement savings with these 5 essential money moves ASAP

- This tiny hot Costco item has skyrocketed 74% in price in under 2 years — but now the retail giant is restricting purchase. Here’s how to buy the coveted asset in bulk

Join 200,000+ readers and get Moneywise’s best stories and exclusive interviews first — clear insights curated and delivered weekly. Subscribe now.

Article sources

At Moneywise, we consider it our responsibility to produce accurate and trustworthy content people can rely on to inform their financial decisions. We rely on vetted sources such as government data, financial records and expert interviews and highlight credible third-party reporting when appropriate.

We are committed to transparency and accountability, correcting errors openly and adhering to the best practices of the journalism industry. For more details, see our editorial ethics and guidelines.

[1]. AP News. “Trump complains about his teleprompters at a scorching Las Vegas rally”

[2]. 3 NewsLV. “Nevada tipped workers find ‘no tax on tips’ promise falls short under new legislation”

[3]. The Budget Lab. “The “no tax on tips act”: Background on tipped workers”

[4]. One Fair Wage. “Short changed: Ending income taxes on tips will not make subminimum wages livable”

[5]. The New Yorker. ““No tax on tips” is an industry plant”

[6]. PBS. “Killing taxes on tips sounds good, but experts say it doesn’t solve the real problem”

[7]. The Center for American Progress. “Despite ‘no tax on tips,’ Trump’s Big ‘Beautiful’ Bill is bad for tipped workers”

[8]. One Fair Wage. “Serving while sick: The effect of Trump Medicaid and benefits cuts on restaurant workers & public health”

This article provides information only and should not be construed as advice. It is provided without warranty of any kind.