A credit card grace period is the amount of time between when the credit card company tallies your purchases each month and the date your payment is due.

If used responsibly, your credit cards are a valuable tool to build credit and earn rewards. But most cards have a lesser-known benefit that is a big help for large purchases.

The trick is taking control of your billing cycle. Most cards have what’s called a grace period. It’s not like the extra days some mortgage lenders offer to get your monthly payment in. It’s simply the amount of time your card issuer gives you to pay your balance after the company tallies your purchases each month.

If you understand this cycle, then you’ll have an advantage when you’re shopping for big-ticket items (a widescreen TV, new car tires) or making a large payment with your card (your child’s tuition, a car down payment).

And if you don’t master your card’s grace period, your new but super-necessary refrigerator can easily cost you punishing interest charges.

Looking for a new credit card? Check out the RBC® British Airways Visa Infinite, with a $1,176 first-year value. Compare more than 140 cards in just 5 seconds.

What is a grace period?

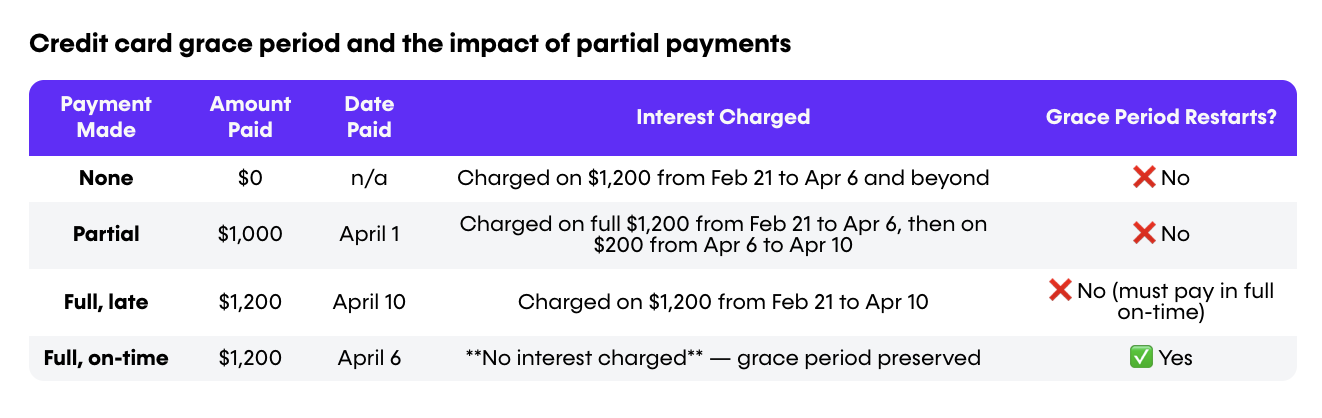

Most people assume that if they don’t pay their balance in full, they will only start to be charged interest after the payment due date… wrong! Others assume that if you make a partial payment of your balance by the payment due date, they will only be charged on the unpaid portion of the balance, from the time of their purchase… wrong again! In fact, if you don’t pay off your balance in full by the payment due date, you will be charged interest all the way back to the purchase transaction date for the entire balance – even if you make a partial payment! Let’s use an example:

- You buy a sofa for $1,200 on February 21 with your rewards credit card

- The billing cycle ends on March 16, and the payment due date is April 6

- You pay $1,000 April 1 and the balance of $200 on April 10

You’re thinking, fantastic, I’m only going to be charged interest on the $200 for the four days in which you carried a balance past the payment due date. Guess what? You’re in for a nasty surprise. Because you did not pay off you’re balance in full, you’re actually going to be charged interest on the full $1,200 for the 52 days from your date of purchase to the payment due date. Then, in addition to that, you’ll be charged interest for an additional four days on the $200 you paid off between the payment due date and the date you paid off your balance in full.

How a credit card grace period works

The grace period is a period of time where you will not be charged interest on your credit card balance as long as you pay the balance off in full by the payment due date. The grace period starts on the last day of your monthly billing period. Every Canadian credit card offers a minimum grace period of at least 21 days on new purchases if you pay our balance in full. This grace period is mandated by law and starts from the close of your billing period and ends when the next payment is due.

That means if your payment is due on the 10th of each month and you make a purchase on the 11th day, that purchase won’t start accumulating interest during the next few weeks — as long as you pay off your balance by the next payment due date.

Stretch your savings further — get cash back or travel perks with the right credit card, such as the the RBC® British Airways Visa Infinite, with a $1,176 first-year value! Find out by comparing more than 140 cards in just 5 seconds — your future self will thank you!

How to use credit card grace periods to your advantage

The best way to maximize your grace period is to use your credit card for large purchases at the very beginning of your billing cycle. So learn what day your bank counts up your charges and buy that fridge in the days right afterward.

Depending on the length of your grace period, you’ll have nearly the full billing cycle of about a month, plus the grace period of several weeks or more. That could give you close to two full months to pay off your balance without any interest, allowing a bit more financial flexibility when planning your budget.

During that window, you might have an additional payday or two before your bill is due, giving you time to build up cash to pay off that purchase. That extra time can come in handy if you face a surprise car repair bill when you need to pay for that new TV.

Remember: Any balance left over after your grace period will build interest.

The grace period perk is especially helpful when you have a new credit card and you’re trying to meet the requirements for a welcome offer. You maximize the value of your credit card bonus or rewards program when you aren’t offsetting it by paying interest.

- **Did you know that as of July 2025, credit card interest rates in Canada average between 19.99% and 24.99% on purchases. Find low-interest credit cards using the Money.ca credit card comparison tool

What about partial payments?

Many cardholders mistakenly believe that making a partial payment before the due date will limit the interest charged to just the unpaid portion. Unfortunately, that’s not how it works.

If you don’t pay your full balance by the due date, you lose the grace period entirely. That means:

- Interest is charged on the full purchase amount, from the original transaction date, not from the due date.

- You’ll continue to be charged interest on all new purchases, until the grace period is reinstated — which often requires two or more consecutive full payments.

To illustrate, let’s assume you bought a $1,200 sofa on February 21. Your billing cycle ends March 16, and the payment is due April 6.

When does the grace period restart?

If you lose your grace period (by carrying a balance), most credit card issuers will require:

- Two or more full payments (on-time) over consecutive billing cycles before the grace period is reinstated for new purchases.

This means that even if you pay in full next month, new purchases may still accrue interest immediately unless you’ve paid in full and on time over multiple cycles.

4 pro tips when it comes to the credit card grace period

To use the credit card interest-free period effectively, remember the following:

- Grace periods don’t apply to cash advances

- Partial payments don’t protect the grace period

- Paying off purchases made after the billing cycle starts doesn’t restore the grace period

- Check your cardholder agreement or contact your issuer to confirm your card’s specific grace period reset rules

Grace period offered by credit card issuers

To get the most out of credit card grace periods, be sure to know how long you’ve got before interest is charged. To help, here’s what some major credit card issuers offer for grace periods:

- TD: 21-day grace period

- RBC: 21-day grace period

- Scotiabank: 21-day grace period

- CIBC: 21-day grace period

- BMO: 21-day grace period

Pay your full balance to keep your payoff cushion

To keep the longer payoff window that a grace period provides and avoid interest on your purchases, you do need to pay the full balance. If you carry a balance and just pay the minimum, you may lose your grace period for new purchases. In fact, anytime you carry a balance, you lose your grace period — the days, weeks or months when new purchases do not accrue interest charges.

This means you’re not only charged interest sooner for purchases, but you’re also charged interest on the unpaid balance. To restore your interest-free grace period, you must pay your bill in full and on time for several consecutive billing cycles, depending on the card issuer rules (read the fine print to find out).

3 prot tips to maximize the credit card grace period

- Plan to make big purchases right after your billing cycle starts.

- Always pay your credit card balance in full, each month — even one dollar unpaid cancels the grace period.

- Know your statement closing date and set payment reminders.

This article provides information only and should not be construed as advice. It is provided without warranty of any kind.