If you are looking for speedy cash, here we have found the top loans that have speedy cash. We have found Fast Loans to be one of our top choices as it meets the criteria when looking for cash fast. Below in the table, we have gone through and listed the top loan lenders in the US for speedy cash.

| Brand | Summary | Score |

| Fast Loans | Speedy Cash | 10/10 |

| Fast Money Source | Fast approval process | 9/10 |

| HonestLoans | Great interest rates | 9/10 |

| CreditClock | Available 24/7 | 9/10 |

| Big Buck Loans | Good for poor Credit | 8/10 |

| Low Credit Finance | Flexible for low-income | 8/10 |

| Heart Paydays | Good Customer Support | 8/10 |

Have you found out that Speedy Cash is not as fast, affordable and reliable as advertised?

If this is your current situation, then we are here to help because we’re going to share with you the best loans like Speedy Cash that you can claim today to get money quickly and easily.

Be it a higher approval rate for bad credit borrowers, a faster disbursement, a lower interest rate or even better customer support service, our suggested alternatives will bring you what Speedy Cash simply can’t give you.

Come with us to check our ranked Speedy Cash alternatives to apply for your loan right now.

Ranking of the Best Loans Like Speedy Cash: Complete Overview

Here you have our ranking of the best Speedy Cash alternatives in 2024, so you can apply for your loan now:

- Fast Loans: Best Speedy Cash Alternative

- Fast Money Source: Faster Approval

- HonestLoans.net: Lower Interest Rate

- CreditClock: More Availability

- Big Buck Loans: Better for Bad Credit

- Low Credit Finance: Better for Low Income

- Heart Paydays: Better Customer Support

To apply for your loan now, just click on the name of your favorite lender to fill out the application form and receive the money today.

If you want to know more about why each one of these lenders is a better choice than Speedy Cash, then keep reading.

1. Fast Loans: Best Speedy Cash Alternative

Fast Loans is better, more affordable and more inclusive than Speedy Cash - because they have a higher approval rate for all types of customers including extremely bad credit. Their interest rate is consistently lower than Speedy Cash, and you can borrow up to $50,000 - whereas Speedy Cash limits it at just $1500.

2. Fast Money Source: Faster Approval

Speedy Cash is fast but Fast Money Source has managed to become even more “speedy” thanks to their super-simple application form, high-tech application review software and top-speed disbursement system. You can get approved instantly and receive the money in record time, something that Speedy Cash cannot do as of now.

3. HonestLoans.net: Lower Interest Rate

HonestLoans.net has proven to consistently offer a lower interest rate than Speedy Cash, and that includes high-risk borrowers. Therefore, if you are looking for a cheaper loan, then this alternative is a solid option. In addition, they approve loans fast and they are likely to bring you better repayment conditions.

4. CreditClock: More Availability

Simply put, if you need a loan outside of business hours, then CreditClock is the best alternative to Speedy Cash because they work 24/7. Be it during holidays or in the middle of the night (or both), you can get approved and receive the money in a fast fashion for up to $5,000 USD for any purpose, with a high approval rate for bad credit and unemployed customers.

5. Big Buck Loans: Better for Bad Credit

If you have extremely bad credit, so bad that Speedy Cash has already rejected your application, then you can forget about them and apply at Big Buck Loans instead. With the highest approval rate for bad credit customers, now you will stand a high chance at getting approved and getting the money you need.

6. Low Credit Finance: Better for Low Income

If your low income has already prevented you from getting a loan that you need urgently, then you should apply for it at Low Credit Finance. Thanks to their high approval rate for unemployed and low income customers, now you will stand a firm chance at getting approved and getting the money you need.

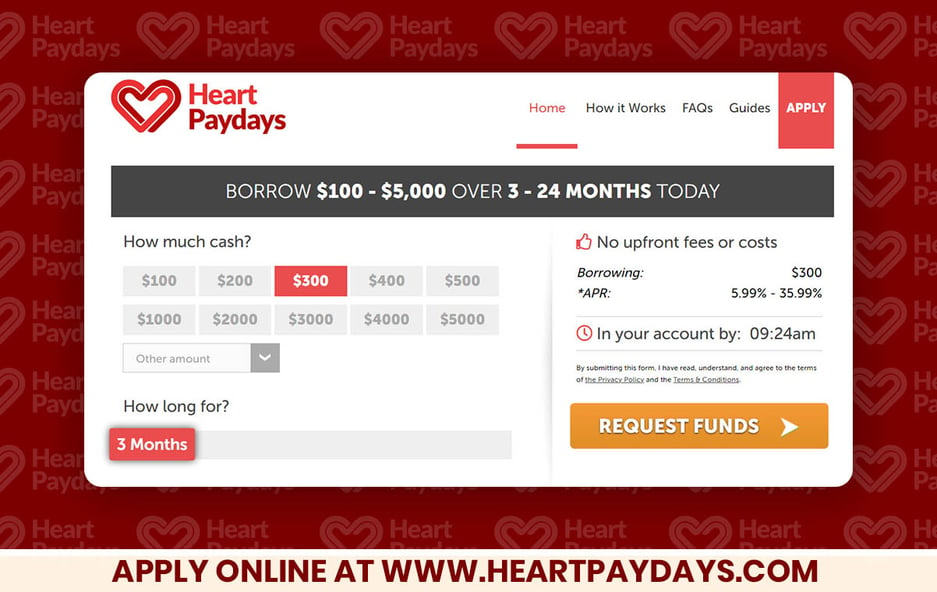

7. Heart Paydays: Better Customer Support

If customer support is the most important aspect of a lender for you, then Heart Payday is the best option hands down. It’s more efficient in this area, especially because they’re kind and understanding with people who are applying for a loan for the first time. And you can take advantage of their low interest rate and generous loan terms and conditions.

How to Apply for Loans like Speedy Cash

If you’ve already picked your preferred Speedy Cash alternative you don’t know how to apply, then here you have the instructions to follow:

- Select a Speedy Cash alternative from our ranking

- Apply for the loan on their website

- Submit the application form

- Wait for approval

- Get approved and receive the money.

As you can see, it’s very easy to apply for your loan at our recommended lenders, and it’s even easier to get approved. Don’t miss out more time and apply now to receive the money you need today.

Why You Should Consider Applying for Loans Like Speedy Cash

If you need to help to decide whether you should apply for a loan at Speedy Cash or at our recommended lenders, then check the following list of scenarios:

- Have you already been rejected by Speedy Cash? - Then it might be a result of a number of problems, but if that's the case, you're better off submitting an application to one of our suggested lenders because they have a higher approval rate for all kinds of borrowers.

- Aren’t you convinced by the payday loans that Speedy Cash offers? - Whatever the cause, we have better options like Viva Payday Loans that provide payday loans, such as their demanding repayment terms, harsh conditions, or exorbitant interest rates.

- Do you need an emergency loan? - In these circumstances, Speedy Cash won't be much assistance if you need money after hours, but fortunately, options like CreditClock operate around-the-clock and can instantly accept your application and deposit the money in your account within one to four hours.

- Are you currently unemployed? - Then Speedy Cash will struggle to approve your loan, but our suggested lenders, like Low Credit Finance, will have no problem providing you with the money you require.

- Do you have an alternative income source? - Lenders like Speedy Cash are not fond of such income streams, but our recommended alternatives will accept it without problems.

Based on these situations, now you can choose the lender that will better meet your needs and goals.

What Does Speedy Cash Need to Improve?

Although Speedy Cash is a respectable lender, there are still certain areas where they need to improve, which is why we offer a list of alternatives. What this company needs to do better is as follows:

- Approval rate for extremely bad credit borrowers

- Approval rate for unemployed customers

- Approval rate for low income clients

- Speed of approval and disbursement

- Flexibility of payment schedules

- Availability and reliability

- Customer support

Once they become more capable in these areas, we will revisit this page and see how well it compares against our recommended alternatives.

F.A.Q

Here you have the answers to the most frequently asked questions about loans like Speedy Cash, so you can know more about our suggested alternatives.

What company is similar to Speedy Cash but better?

ZippyLoan is the best company like Speedy Cash but better in all the areas that matter such as max loan amount ($15,000), lower interest rate, faster approval and disbursement, and higher approval rate for bad credit, low income, unemployed and limited credit history.

Are loans like Speedy Cash trustworthy?

Yes, we’ve only picked alternatives that are registered in the US states they do business in, that have a clean online reputation and that have been working responsibility since their foundation date. You can trust our recommendations without problems.

What company offers better payday loans than Speedy Cash?

Viva Payday Loans is a better payday loans issuer than Speedy Cash because they allow you to borrow more money (up to $5000), you can pay it back in a more flexible payment schedule, and the interest rate is likely to be lower - along with a faster approval and disbursement.

Other related posts about Personal Loans With No Credit Check