The state of household savings is grim in Canada. In fact, more than 50% of Canadians made a financial resolution to save more this year. Paying off debts is also on the to-do list of over 40% of Canadians. These statistics are according to Finder, a personal finance website.

These statistics clearly show that Canadians are scrambling to save money for emergency purposes. However, due to inflation, they are unable to save much as they would like.

Well, if you are in a fix and need some emergency funds fast, you can apply for a no refusal payday loan or a personal loan.

If you are looking for a personal loan to boost your credit score or for any sudden expense, you can check the reliable lenders on our list.

Top 5 No Refusal Payday Loan Providers in 2023: Select Your Best Lender!

If you are looking to apply for a no-refusal payday loan Canada for instant cash of $1000 or more, then check out our recommended list of lenders in Canada.

- Loan Connect- Good or bad credit? Get personal loans today.

- Viva Payday Loans - Best Payday Loan 24/7

- Loans Canada- Multiple personal loan options!

- Prets Quebec- Get the best personal loans FAST!

Free Credit Score Here

To know more about the lenders we have mentioned above, please click on the link to redirect yourself directly to their website to get detailed information about them. Simply fill out the application form and wait till it is reviewed and approved. Upon approval, your bank account will be credited with the loan amount within the next few hours.

Here in this article, we have compared all of the listed lenders from which you can pick one for your personal loan needs.

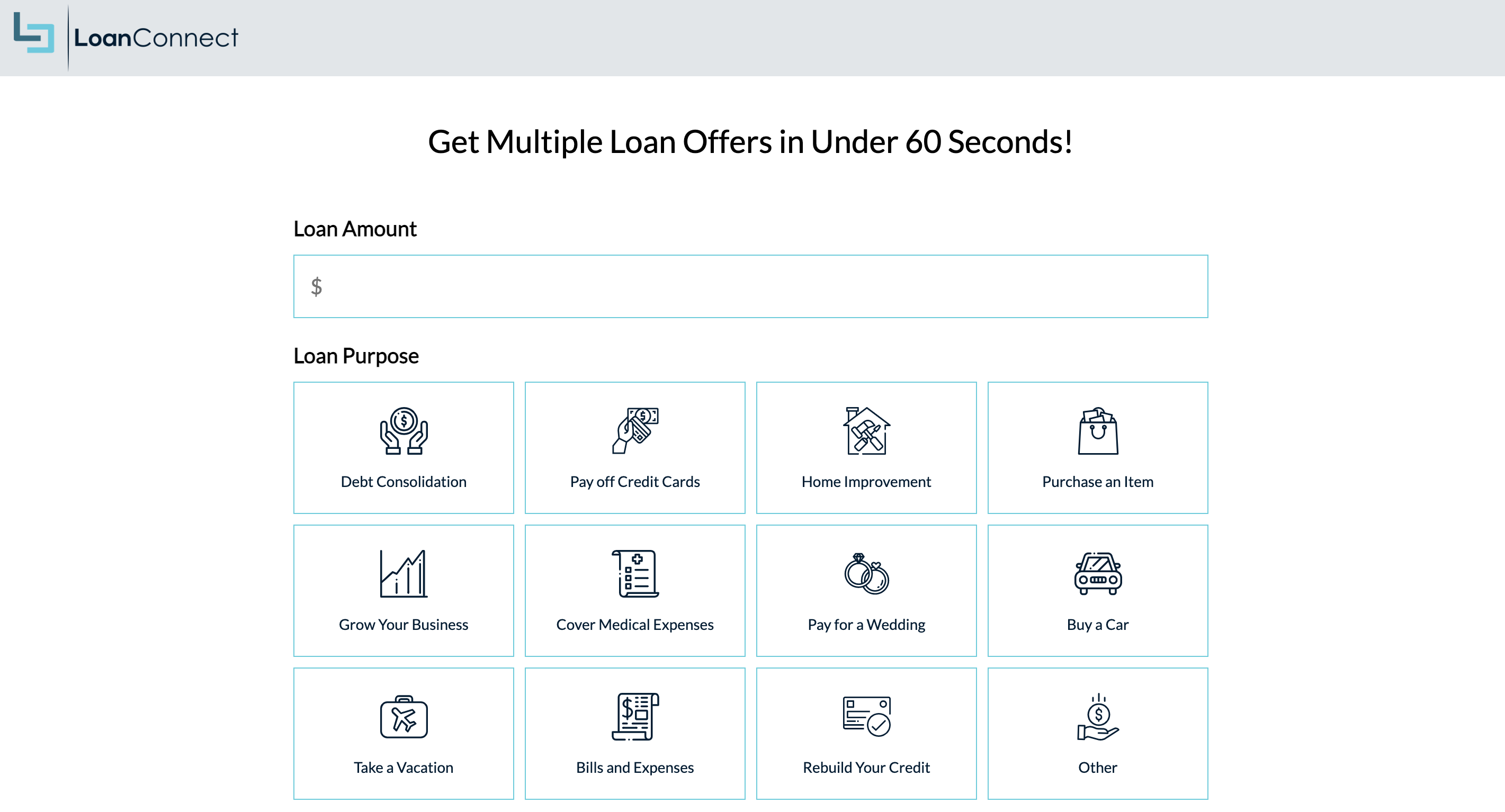

1. Loan Connect - Great if you have bad credit.

Suppose your main focus is to find a personal loan lender who doesn't charge an exorbitant interest rate. In that case, you would be glad to know that Loan Connect's sole objective is to offer no-hassle personal loans at the best rates. A few more benefits of choosing Loan Connect are summarized in the points below.

- Borrowing limit is $500-$50,000

- Loan repayment period from 6-60 months

- Rates as low as 6.99%* APR!

- Fast approval rate

- Low-interest rates and additional fees

Loan Connect is Canada’s leading search engine to find trusted and fast lenders. They have amazing loan rates you can take advantage of and repay any previous loan you have taken at a higher interest rate.

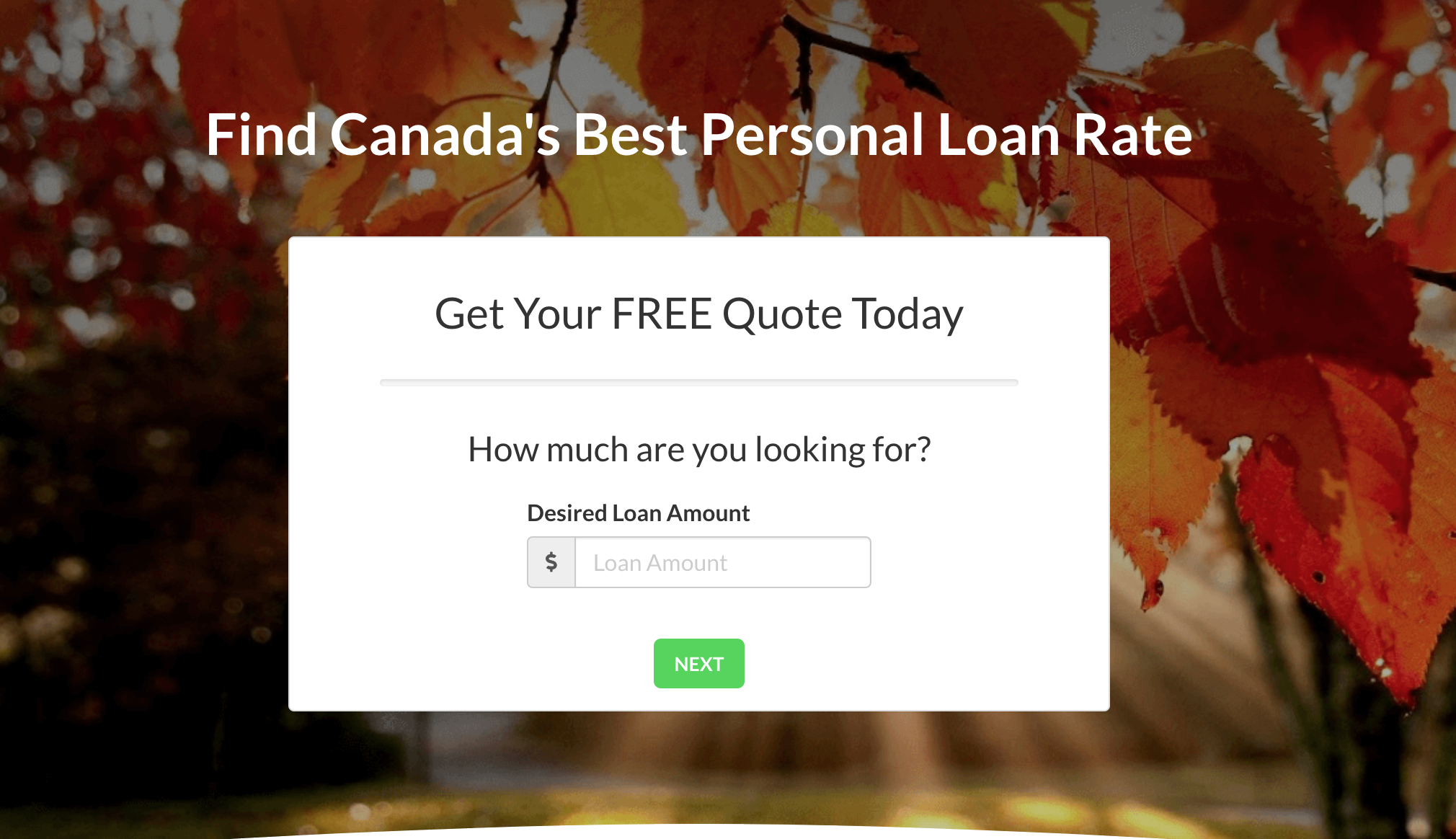

2. Compare Hub - Get personal loans at the best rates!

When it comes to personal loans of $1000 or more for emergencies, you can trust Compare Hub. At Compare Hub, you will get connected to some of the best personal loan companies that supply payday loans in Canada. It allows you to complete a free credit check and many more benefits as listed below.

- Register and compare rates of lenders

- Check your credit score for FREE

- Quick reimbursement of personal loans

- Expert guidance on personal loans

- High loan approval rate

Apart from personal loans, at Compare Hub you also get access to business loans, auto loans, and debt relief loans. Our lenders help you get loans fast, speak to them today to know their loan process and loan rates!

3. Loans Canada - Multiple personal loan options!

People often get confused regarding which type of loan and payment schedule will be best for them. Well, Loans Canada provides multiple options to their potential borrowers as it is the largest lender network in Canada. Know more reasons for selecting Loans Canada for your quick money needs.

People often get confused regarding which type of loan and payment schedule will be best for them. Well, Loans Canada provides multiple options to their potential borrowers as it is the largest lender network in Canada. Know more reasons for selecting Loans Canada for your quick money needs.

- Fast rate of approval

- Get a loan up to $50,000

- Fill application without any additional charges

- Boost your credit score

- Research and compare lenders

At Loans Canada, you also get to save time as they don't take too long to approve loans. Moreover, you get multiple offers, expert advice as well as free service. Here the loan application procedure is simplified.

4. Prets Quebec - Get the best personal loans FAST!

Prets Quebec has the same parent company as Loans Canada, so it offers the same benefits as Loan Canada. You can get both commercial and personal loans through them. Take a look at the benefits they offer and decide for yourself if you want to apply for a loan with them.

- High approval rating

- Easy 3-step personal loans

- Loans Up to $50,000

- Amazing personalized offers

- Loan experts to guide you

- No extra fees

Financial emergencies come unplanned, and this is when you need to go for a personal loan fast. Every Canadian no refusal payday loan company mentioned on our list is trustworthy and aims to offer loans fast and conveniently.

How to Apply for a 24/7 Payday Loans Fast?

Now you know about various personal loan lending companies in Canada to contact when you need cash fast. Next, pick one as per your preference so that the money gets instantly transferred to your bank account. All you need to do is follow a few quick steps.

- Step 1: Select a personal lender from the above list.

- Step 2: Visit their official website and apply online.

- Step 3: Wait for your application to gets approved.

- Step 4: Submit the required original documents.

- Step 5: Get your personal loan approval.

- Step 6: Get the loan amount transferred to your bank.

If you haven’t applied for a personal or payday loan before and are worried about how to complete the application, don’t worry. Filling out the loan application form is as easy as 1-2-3. You can easily complete it within 5 minutes or less.

What is a Payday Loan?

A payday loan is money you choose to borrow from a bank or lender in return for a fixed rate of interest. Sometimes people take personal loans not to solve their monetary issues, but to have a positive impact on their credit score. Lenders may or may not provide a personal loan to people with bad credit history.

However, certain lenders specialize in no refusal payday loans in Canada. A payday loan has a shorter term as compared to a personal loan.

In that case, you need not worry about having a lower or zero credit score because it is often easy to get this type of loan approved instantly due to its lower amount. Anyone with a personal bank account and documents can apply for a $1000 or less personal loan from lenders of their choice. Moreover, the application process does not take much time and can be completed in a few minutes.

How Do Payday Loans Work?

More or less, a personal loan works similar to regular loans with only a few changes. Regarding a $1000 personal loan, you will have to pay a significant amount of interest within a limited period, as per the terms of the loan.

Because these loans fall under the high-risk category and do not involve any collateral, most lenders check credit score and income along with a few other factors before loan approval.

When you apply for a personal loan, you will have to wait for application review and approval. On getting approved, ensure you read the contract correctly to know all the important terms and conditions of repayment. If somehow, you miss paying the installments on time, a penalty would be enforced upon you.

You will need to make monthly payments that will include both principal and interest. The interest rate varies based on the rates and policies of the loan company as well as your creditworthiness.

How Do I Know If I Qualify for a $1,000 Payday Loan?

Not everyone qualifies for a $1000 personal loan, as there are specific criteria for that. To know if you are eligible for a personal loan or not, read the pointers below.

- Need to attain the age of 18 years

- Must be a permanent citizen of Canada

- Should have a registered personal bank account

- Should have a working phone number and email address

- Must have a verified source of income

Anyone who has been a true citizen of Canada for a long time will be able to meet all the criteria efficiently. However, even if you face some problems with your qualification for a $1000 personal loan, the no refusal payday loan Canada lenders recommended in this article would be able to sort out your issues effectively. As these companies deal with customers of this category only, it makes you a crucial asset for them.

Can Timely Repayment of Payday Loans Improve My Credit Score?

Yes, payday loan repayment on time does help to improve your credit score. If you are looking for a higher amount personal loan, banks do check your credit score to determine if you can repay the money in time. Therefore, having a low credit score can dent your chances of finding a lender willing to offer personal loans.

Many citizens of Canada are constantly worried about their credit score, hampering their chance to avail of a $1000 personal loan for emergency requirements. Luckily, there are some lenders that specialize in low amount, no credit check personal loans at a high rate of interest.

Some citizens in Canada with bad credit scores go for personal loans and pay them back on time to improve their credit scores. So, timely payment is a must to improve your credit score no matter what the loan amount is.

Can You Get a $1000 Payday Loan in All the Canadian States?

Yes, you can get a personal loan in most Canadian states; however, the terms and conditions and rate of interest can be different for different states. Also, some loan companies don't lend below their minimum loan amount. Also, the regulations for personal loans are different in different states. Having a good credit history is vital for personal loans.

Pros and Cons of $1,000 Personal Loans

There is always a good side and a bad side to everything that needs to be appropriately analyzed before anyone makes a final decision. And, in the case of $1000 personal loans, you should check out the pros and cons below.

|

Pros |

Cons |

|

· Fast turnaround time |

· High rate of interest |

|

· Help build a credit history |

· May lead to penalties if payment is delayed or missed |

|

· Available in most Canadian states |

· Collateral might be needed if the credit score is not good

|

|

· Loan repayment within 3-60 months |

|

|

· Flexible terms and conditions |

|

With so many pros and just a few cons, it would be a good choice to go for a personal loan like a if you are facing a financial crunch situation. Do compare the lenders we have listed before making a selection.

Alternatives to $1,000 Personal Loans

After going through the personal loan details and repayment structure, if you think they are not for you and want to know your other options, you can explore the below-given alternatives.

Car Title Loan

If you have a bad credit score, getting an unsecured personal loan might be difficult for you. In this case, you can opt for a car title loan. It is a secured loan where your car title is kept as collateral.

Payday Loan

Another good option for you is payday loans. These loans have a high rate of interest and are given for a short duration. Small amount payday loans up to $500 are ideal to pay small emergency expenses. However, you can also go for a big amount payday loan of $5000 and above. You might need to show proof of income to get this loan.

Family And Friends

If you are in a tight situation, first borrow money from your friends and family. It is a great alternative as you won’t need to pay any interest and it won’t affect your credit score either. However, try your best to return the money as soon as possible.

FAQs

How long does it take to get a $1,000 personal loan?

If you choose the lenders, we have recommended in this article like Viva Payday Loans, Compare Hub, and Loans Canada, you will be able to get your personal loan the same day after it gets approved by the lender.

Are $1,000 personal loans available in all states of Canada?

Yes, you can get a $1000 personal loan in most states of Canada. If you meet the terms and conditions, getting this loan is as easy as 1-2-3.

What happens if you don't pay back a payday loan?

If you don't repay your personal loan within the time specified by the lender, your credit score will get low even further. If that happens, you will not be able to take any more loans in the future.

Are $1,000 personal loans expensive?

Yes, the $1000 personal loans could get pretty expensive due to the high-interest amount charged by some lenders. Not every lender is willing to give out such high-risk personal loans. Do check the interest rates of the lenders we have recommended like Loans Canada and Viva Payday Loans and others. Some have comparatively low interest rates.

How much does it cost to get a $1,000 personal loan?

Even though online registration for a personal loan is usually free of cost, some lenders do charge a loan origination fee. Other charges that add to the loan cost vary as per the lender. These are the interest rate, loan terms, prepayment penalties, or late payment fees.

Can you get a $1,000 personal loan with bad credit?

You may or may not get a personal loan with a bad credit score. You need to check the terms and conditions of the lender. Some specific lenders do provide loans to high-risk customers too.

Can you get approved if you have a low income?

Yes, you can get a personal loan even if your income is low. However, it can be difficult as the lender will check various things like your credit score, income, debt-to-income ratio, and employment history. Having a low income does not mean that you cannot get a personal loan, it’s just that you may face difficulties in loan approval and will need to check with various lenders.