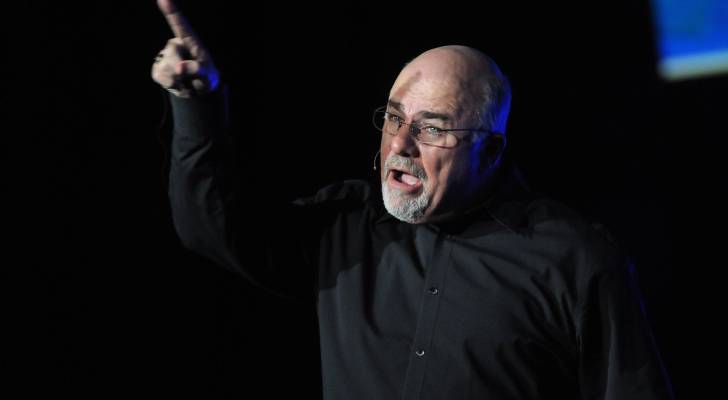

Across 32 years of giving people financial advice on the airwaves, Dave Ramsey has probably seen it all. But on an episode of The Ramsey Show earlier this year, he called out financial mistakes callers frequently make as being “Dumb! Really dumb!”

He added: “These things baffle me, that’s why I’m hitting them,” he said. “Because they’re just illogical.”

However, some argue that economic and social trends may have made some of these mistakes unavoidable. Here’s a closer look at three of Ramsey’s top “dumb” money mistakes and why they’re so common.

1. Co-buying property

Ramsey despises the prospect of buying property with anyone besides a spouse. He advises against this even in long-term relationships.

This advice is rooted in the fact that separating assets between an unmarried couple can be complicated. They do not always share the same property rights as married couples.

However, the housing crisis has pushed more people to consider co-ownership of property. A report by CoBuy, a platform that helps multiple buyers share a property, says 26.7% of home purchases in 2023 were co-purchases, while 30% of those co-purchases were completed by unmarried couples.

If you’re not in a position to purchase a home — whether on your own or with a spouse — you can still take advantage of real estate’s income-generating potential.

2. Wasteful spending on education

Investing in your education, Ramsey believes, should yield higher earnings. Otherwise it’s a wasted pursuit.

"Don’t spend $250,000 getting a master’s degree in sociology so you can be a caseworker for the state making $38,000," he said.

He believes students should realistically consider their career prospects and future earnings before going into debt for college.

You can also minimize the impact of paying for education by saving up for it ahead of time — whether for yourself or for your children — by using a high interest savings vehicle such as a guaranteed investment certificate (GIC) or a high-interest savings account.

A GIC pays a fixed interest rate on money held for a set period of time. GIC rates are usually higher than other savings accounts, but if you withdraw your GIC funds early, you’ll be charged a penalty fee.

But since this is a long-term savings play for your or your kid’s education, they are a strong option you’ll be less tempted to dip into.

If you’re looking for safe, high-return options, GICs are a great choice, investments without the stress.

3. Upgrading cars

Ramsey says a totaled car is not a reason to upgrade.

“You were driving a $6,000 car,” he said. “Your car gets totaled, you get a check for $6,000 and, suddenly, $6,000 cars aren’t good enough for you. That’s dumb!”

However, the high cost of vehicles could make this financial error difficult to avoid. The average cost of a new car in Canada as of July 2024 was $66,087, while the average used-car listing was $36,342 according to <a href="#AutoTrader"AutoTrader.

Sources

1. CoBuy: Co-buying & Co-owning a Home 2023 Report

2. AutoTrader Price Index June 2024

This article Dave Ramsey ranted about 3 ‘illogical’ money mistakes North Americans make that ‘baffle’ him — here’s how you can avoid these common financial errorsoriginally appeared on Money.ca

This article provides information only and should not be construed as advice. It is provided without warranty of any kind.