As the Bank of Canada prepares for its next rate announcement on July 30, Canadian sentiment is heating up — and so is the debate over whether it’s time for another rate cut.

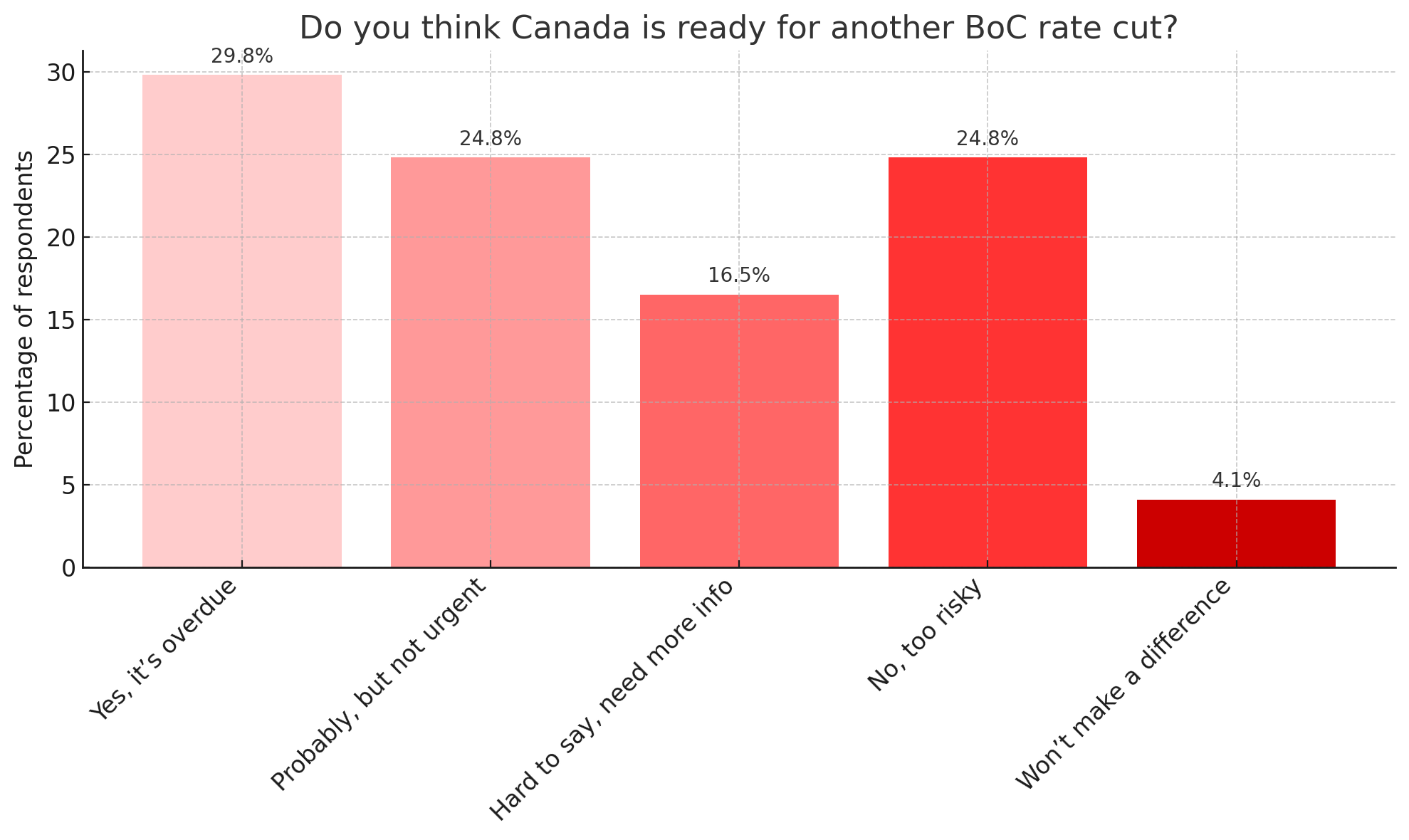

According to a new poll conducted by Money.ca, nearly one-third of respondents (29.8%) say a cut is overdue. But almost as many respondents (24.8%) say a cut is too risky right now, or that it’s not an urgent priority. Another 16.5% admit they need more information to decide.

This divide in opinion reflects broader economic uncertainty as Canadians continue to feel the sting of rising costs and economic strain.

Strained wallets and rising delinquencies

Inflation has cooled from its 2022 peak, but the cost of essentials — including food, housing, and transportation — remains high. For many households, the relief of lower interest rates in June hasn’t yet materialized in monthly budgets.

Meanwhile, financial stress is growing. According to the Bank of Canada’s June Monetary Policy Report, household credit card delinquencies and personal loan defaults are rising, particularly among younger borrowers. Mortgage holders with upcoming renewals also face the daunting prospect of locking in at higher rates than they’re used to, even with a cut or two.

“It won’t make a difference”

Interestingly, a small but notable portion of respondents (4.1%) said another rate cut “won’t make a difference either way,” reflecting growing skepticism that Banks of Canada (BoC) decisions are filtering down to household finances fast enough to matter.

Still, nearly one in four (24.8%) believe a cut is “probably” warranted — just not urgent. This group seems to acknowledge that economic conditions are softening, but believe caution is still warranted.

Overall poll results

One week before the July 30, 2025, BoC rate announcement, Money.ca asked newsletter readers to weigh in on one question: Do you think Canada is ready for another BoC rate cut?

The answers show a deepening divide on how national economic analysts can help with the economic strain felt by residents across Canada.

Here’s how respondents answered:

- Yes, it’s overdue – 29.8%

- Probably, but it’s not urgent – 24.8%

- Hard to say, I need more info – 16.5%

- No, too risky – 24.8%

- Won’t make a difference either way – 4.1%

Experts expect a hold

Despite public pressure, most economists believe the Bank of Canada will hold rates steady at 2.75% on July 30, 2025. Wage growth has plateaued, consumer spending is slowing, and business investment is down — all signals the BoC is closely watching. But inflation remains slightly above the 2% target, making a premature cut possible, but risky.

A difficult balance

These recent poll results make one thing clear: Canadians are far from united in how the BoC should respond to current conditions. This ongoing, national divide is likely to keep BoC Governor Tiff Macklem and his team walking a tightrope — balancing the risk of renewed inflation with the economic pain already felt in households and businesses across the country.

Survey methodology

The Money.ca newsletter survey was conducted through email between July 23 to 25, 2025. Approximately 5,130 email newsletter subsribers, over the age of 18, were surveyed resulting in 121 responses. The estimated margin of error is +/- 6.5%, 17 times out of 20.

About Money.ca

Money.ca is a leading financial platform committed to providing individuals with comprehensive financial education and resources. As part of Wise Publishing, Money.ca is a trusted source of reliable financial news, expert advice, comparison tools and practical tips. Canadians get insight on a variety of personal financial topics, including investing, retirement planning, real estate, insurance, debt management and business finance.

This article provides information only and should not be construed as advice. It is provided without warranty of any kind.