We adhere to strict standards of editorial integrity to help you make decisions with confidence. Some or all links contained within this article are paid links.

What does it really mean to be wealthy? At what point — specifically, at what income level — does one cross into “rich” territory?

According to Bloomberg, an annual income of $175,000 a year places you in the top 10% of tax filers, signifying you’re statistically wealthy.

Don’t miss

- Thanks to Jeff Bezos, you can now become a landlord for as little as $100 — and no, you don’t have to deal with tenants or fix freezers. Here’s how

- I’m 49 years old and have nothing saved for retirement — what should I do? Don’t panic. Here are 6 of the easiest ways you can catch up (and fast)

- Robert Kiyosaki warns of a ‘Greater Depression’ coming to the US — with millions of Americans going poor. But he says these 2 ‘easy-money’ assets will bring in ‘great wealth’. How to get in now

But in their 2023 survey, 25% of those earning that much or more described themselves as “very poor”, “poor”, or “getting by, but things are tight.” Half said they’re just “comfortable”, at best.

It’s true that everything from cars to condos are costlier than ever before. But even with those costs accounted for, the question remains: Are Americans underestimating their real net worth

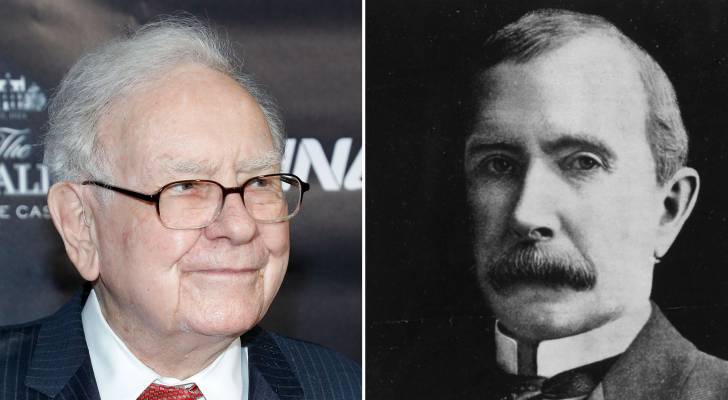

Warren Buffett thinks so. In a 2022 interview with Charlie Rose, the Berkshire billionaire tried to put things in perspective for modern Americans.

“You live in a new environment where the bottom 2% in terms of income in the United States, the bottom 5% … The top 1% all live better than John D Rockefeller was living when I was six years old. … And today, you can get better medicine, better education, better entertainment, and better transportation.”

And Rockefeller was at one point the richest man in the world. Here are a few key things to remember as you work toward your wealth goals.

Stable investments over riskier bets

According to a recent survey from Bank of America, individuals aged 21 to 43 with at least $3 million in assets only have 25% of their portfolio invested in stocks.

It is worth noting that 93% of these rich, young Americans say they plan to allocate more of their portfolio to alternatives in the next few years, according to the survey.

So, what alternative investments are capturing the interest of these young millionaires?

The Bank of America survey revealed that among wealthy young investors, 45% own gold as a physical asset, and another 45% are interested in holding it.

Investing in gold is often considered the go-to inflation-fighting move. It can’t be printed out of thin air like fiat money, and its value is largely unaffected by economic events around the world.

And because of the precious metal’s safe-haven status, investors often rush toward it in times of crisis, making it a potentially effective hedge.

One way to invest in gold that also provides significant tax advantages is to open a gold IRA with the help of Priority Gold.

Gold IRAs allow investors to hold physical gold or gold-related assets within a retirement account, which combines the tax advantages of an IRA with the protective benefits of investing in gold, making it an attractive option for those looking to potentially hedge their retirement funds against economic uncertainties.

To learn more, you can get a free information guide that includes details on how to get up to $10,000 in free silver on qualifying purchases.

Comparison: the greatest thief of joy

It’s not surprising that so many Americans struggle to understand what their financial standing really is. A 2025 study conducted by web data collection firm Soax found that 73% of Americans use some form of social media.

Why is that important?

Aside from an array of finance influencers who all have varying opinions on the best way to create wealth, social media also inherently lends itself to comparisons. but remember: Nobody’s showingtheir mortgages or debts on Facebook and Instagram. Instead, they’re just sharing five-star vacations and ritzy nights out.

This is why professional financial advisors play a crucial role in helping you understand your actual financial position and plans for the future. With the help of a qualified professional, like those you can find through Advisor.com, you can find out where you really stand.

Advisor.com is a free service that helps you find a financial advisor who can co-create a plan to reach your financial goals by matching you with a small list of the best options for you to choose from. From their database of thousands, you get a pre-screened financial advisor you can trust. You can then set up a free, no-obligation consultation to see if they’re the right fit for you.

Read more: Want an extra $1,300,000 when you retire? Dave Ramsey says this 7-step plan ‘works every single time’ to kill debt, get rich in America — and that ‘anyone’ can do it

Social media and the FOMO factor

Social media also fuels FOMO (fear of missing out), especially as more people boast about their investment returns or sudden financial “wins.” Watching influencers and celebrities claim they’ve doubled or tripled their money overnight can easily lead to unrealistic expectations.

But getting investment information from reliable, expert sources (not from social media) is crucial.

When asked what he did to learn about the stock market, Buffett told Berkshire shareholders last year that he did a lot of reading.

“The answer would be, in my particular case, it would be going through the 20,000 pages [of Moody’s Manual],” Buffett said.

Moody’s Manual was a series of publications by financial services company Moody’s on publicly traded stocks. These texts provided detailed information on various industries, companies and securities.

Resist the urge to constantly check

Americans who are constantly checking up on their wealth or investment portfolio might also be incorrectly believing they’re worse off than they are.

Buffett has always preached about investing for the long-term and exercising patience.

“If you worry about corrections, you shouldn’t own stocks,” Buffett once said in an interview with The Street.

Market ups and downs are natural, but fixating on them daily can make you feel like you’re losing ground, leading to potentially short-sighted decisions as well.

With Wealthfront’s automated investing platform, the power of compound interest works for you. Their sophisticated "set it and forget it" approach means your money is professionally managed and automatically rebalanced, allowing your wealth to grow steadily over time.

Start investing for the long term with globally diversified portfolios or go for a higher yield than a traditional savings account with an automated bond portfolio.

Open your account today and receive a $50 bonus to jumpstart your investment journey. Whether you’re saving for retirement, a home, or building generational wealth, Wealthfront’s low-cost, automated investment strategy can help you achieve your financial goals.

What to read next

- You don’t have to be a millionaire to gain access to this $1B private real estate fund. In fact, you can get started with as little as $10 — here’s how

- Here are 5 ‘must have’ items that Americans (almost) always overpay for — and very quickly regret. How many are hurting you?

- Accredited investors can now buy into this $22 trillion asset class once reserved for elites – and become the landlord of Walmart, Whole Foods or Kroger without lifting a finger. Here’s how

- Rich, young Americans are ditching the stormy stock market — here are the alternative assets they’re banking on instead

Stay in the know. Join 200,000+ readers and get the best of Moneywise sent straight to your inbox every week for free. Subscribe now.

This article provides information only and should not be construed as advice. It is provided without warranty of any kind.