We adhere to strict standards of editorial integrity to help you make decisions with confidence. Some or all links contained within this article are paid links.

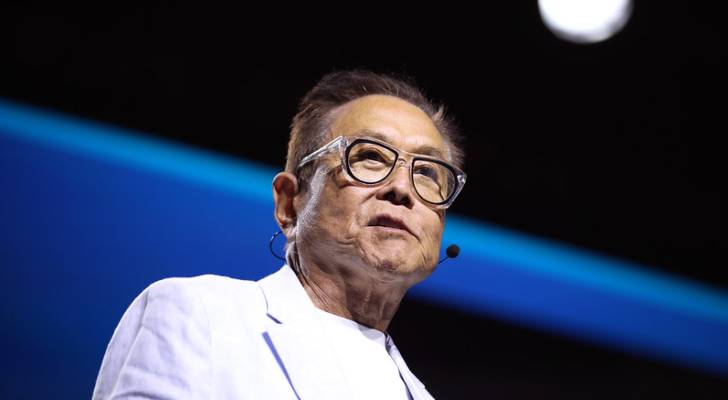

Since peaking at a 40-year high of 9.1% in June 2022, headline inflation in the U.S. has eased. But according to “Rich Dad Poor Dad” author Robert Kiyosaki, the worst may be yet to come.

“The end is here: what if you threw a party and no one showed up? That is what happened yesterday,” Kiyosaki wrote in a May 21 post on X. “The Fed held an auction for U.S. bonds and no one showed up. So the Fed quietly bought US$50 billion of its own fake money with fake money.”

He added, “The party is over. Hyperinflation is here. Millions, young and old, to be wiped out financially.”

Kiyosaki is no stranger to predictions of economic collapse, and the claims in his recent post couldn’t be independently verified. He didn’t cite a source for the US$50 billion “fake money” purchase or the fact that “no one showed up.”

However, the same day he made his post, the U.S. Treasury did see weak demand for a US$16 billion sale of 20-year bonds, as investors grew uneasy over the country’s mounting debt.

The auction followed Moody’s downgrade of the U.S. sovereign credit rating on May 16 — a move Kiyosaki warns could have dire consequences:

“A Moody’s downgrade will probably mean higher interest rates, which means a U.S. recession, which means the economy will slow, unemployment will climb, the bond market, housing market, and weak banks may fail … which may mean the 1929 Depression.” But amid the gloom, he also sees a silver lining — literally.

“Good news. Gold will go to US$25,000. Silver to US$70. Bitcoin to US$500k to US$1 million,” he wrote, before ending with a stark note: “May God have mercy on our souls.”

Let’s take a closer look at the assets he’s championing.

Precious metals

Kiyosaki’s endorsement of gold and silver is nothing new — he’s been advocating for precious metals for decades.

In October 2023, he wrote on X: “Gold will soon break through US$2,100 and then take off. You will wish you had bought gold below US$2,000. Next stop, gold US$3,700.”

Gold prices surged in 2024 and have continued to climb through 2025, surpassing US$3,400 per ounce in August. According to reporting from JP Morgan, gold could also strike as high as $4,000 per ounce by the second quarter of 2026 if current trends continue — blowing past Kiyosaki’s earlier predictions.

Gold has long been viewed as a potential safe-haven investment. It’s not tied to any one country, currency or economy. It can’t be printed out of thin air like fiat money, and investors tend to pile in during times of economic turmoil or geopolitical uncertainty — driving up its value.

Ray Dalio, the founder of Bridgewater Associates — the world’s largest hedge fund — told CNBC in February: “People don’t have, typically, an adequate amount of gold in their portfolio. When bad times come, gold is a very effective diversifier.”

Like Kiyosaki, Dalio has been championing gold for decades, once stating that “if you don’t own gold, you know neither history nor economics.”

Kiyosaki has also been purchasing gold and silver mines since 1985, and now he “literally owns tons of gold and silver.”

But investing in gold isn’t just for financial heavyweights like Kiyosaki and Dalio. With CIBC Investor’s Edge, you have the opportunity to tap into the world of precious metals without the worry of storing and protecting the actual gold bars.

CIBC Investor’s Edge offers these investments in the form of gold and silver e-certificates — no vaults, no mines — just a simple way to diversify your portfolio and grow your wealth.

Real estate — revisited

In light of his dire outlook, Kiyosaki suggested a few steps individuals could take to protect themselves — and highlighted the power of one income-generating asset.

“I have always recommended people become entrepreneurs, at least a side hustle, and not need job security.” He wrote on X. “Then invest in income-producing real estate in a crash, which provides steady cash flow.”

Real estate has long been a favoured asset for income-focused investors. While stock markets can fluctuate wildly in response to headlines, high-quality properties tend to continue generating stable rental income.

It can also be a powerful hedge against inflation. When inflation rises, property values are likely to increase as well, reflecting the higher costs of materials, labour and land. At the same time, rental income tends to go up, providing landlords with a revenue stream that adjusts for inflation. Perhaps that’s why Kiyosaki once disclosed he owns 15,000 houses — and strictly for investment purposes.

If you want to tap into the booming real estate market but avoid the hassles of being a landlord, investing in Real Estate Investment Trusts (REITs) can offer a hands-off approach for everyday investors.

You can buy and sell REITs on the stock market using a self-directed online trading platform like CIBC Investor’s Edge, where you’ll benefit from low trading commissions and little to no account maintenance fees, depending on your portfolio size.

Get 100 free online equity trades when you open a CIBC Investor’s Edge account using promo code EDGE100. Offer ends September 30, 2025.

Bitcoin

Bitcoin has been one of the top-performing assets of the past decade — and Kiyosaki is betting it still has room to run.

On Nov. 29, 2024, he predicted, “Bitcoin will soon break US$100,000.” On Dec. 4, the cryptocurrency surpassed that milestone, grabbing headlines worldwide. As of August 26, 2025, bitcoin has surged past US$110,000 per coin.

But in Kiyosaki’s view, this is just the beginning. He sees bitcoin climbing much higher — potentially reaching US$500,000 to US$1 million.

He’s not alone in that view. Twitter co-founder Jack Dorsey said in May 2024 that bitcoin could hit “at least” US$1 million by 2030 — and possibly go even higher.

If you’re looking to hop on the bitcoin bandwagon, you might want to check out Coinbase — a platform where you can buy, sell and manage your crypto investments.

You can make quick and easy top-ups with Interac e-Transfer and Electronic Funds Transfer (EFT) — for free. With access to over 200 cryptocurrencies, you can sell and cash out instantly to most banks.

Plus, staking with Coinbase lets you earn crypto rewards of up to 14% APY while supporting blockchain security. You still have full ownership of your crypto and can unstake it at any time.

Bottom line: Whether or not Kiyosaki’s warning comes true, his message is clear: In uncertain times, owning precious assets like gold, crypto and real estate could be your best defence against financial turmoil.

This article provides information only and should not be construed as advice. It is provided without warranty of any kind.