We adhere to strict standards of editorial integrity to help you make decisions with confidence. Some or all links contained within this article are paid links.

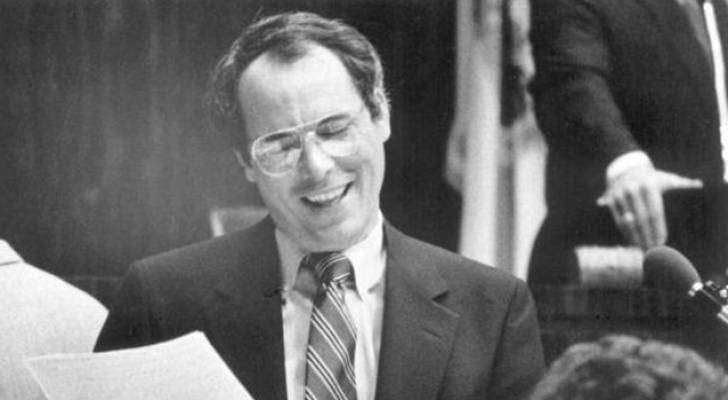

In America, stocks and bonds are often considered the go-to investments — but Pat Neal, whose net worth is estimated at $1.2 billion, doesn’t own a single one.

Why? “I like controlling my own future,” Neal told Forbes.

Trending Now

- Thanks to Jeff Bezos, you can now become a landlord for as little as $100 — and no, you don’t have to deal with tenants or fix freezers. Here’s how

- I’m 49 years old and have nothing saved for retirement — what should I do? Don’t panic. Here are 6 of the easiest ways you can catch up (and fast)

- Dave Ramsey warns nearly 50% of Americans are making 1 big Social Security mistake — here’s what it is and 3 simple steps to fix it ASAP

Instead, he reinvests in his own company: Neal Communities, the land development and homebuilding business he founded in 1970. Since then, the company has built 25,000 homes across Florida.

Neal did dabble in stocks early on. In the mid-1960s, around age 16, he bought 100 shares of Iowa Beef Packers and doubled his money. But that success didn’t last.

In the early 1970s, his first stockbroker urged him to buy 100 shares of Florida-based Delta Corporation at $28. After briefly rising, the stock tanked on bad earnings — and kept falling. The broker encouraged Neal to double down and he did.

“He asked me to buy an average down at $14. I bought that and I rode it down to $0,” he recalled. That broker later left the business to become a butcher.

After faring “just as well” with his next broker, Neal walked away from the stock market entirely — and focused on his real estate business instead. That’s where the real money started rolling in.

‘Buy land ahead of growth’

Neal’s investment strategy is simple but effective: spot opportunities before the crowd. He and his sons would spend their days scouting properties, calling contacts, reading obituaries and staying plugged into local developments — all in the name of making smart land purchases.

“My investment strategy is to buy land ahead of growth,” he said.

And that’s exactly what he did.

In the late 1980s, Neal bought 1,087 acres at the LeBamby Hunting Preserve in Sarasota County for about 10 cents per square foot.

Read more: Here are 5 ‘must have’ items that Americans (almost) always overpay for — and very quickly regret. How many are hurting you?

“They didn’t know the interstate was coming,” he recalled. “And when the adjoining roads got through, I was able to sell some of the property at $57 a square foot.”

More recently, in 2014, he and his son John purchased foreclosed land from the City National Bank of Florida at just $6,000 an acre. After developing the property, they sold portions in 2024 for $250,000 an acre.

His comment? “They didn’t know the value of their property.”

Of course, not everyone has the time, expertise or capital to buy large parcels of land before they boom. But today, getting into real estate is easier than ever — no matter how big or small your starting budget.

Becoming a real estate mogul — starting with $250

Mogul is a real estate investment platform offering fractional ownership in blue-chip rental properties, which gives investors monthly rental income, real-time appreciation and tax benefits — without the need for a hefty down payment or 3 A.M. tenant calls.

Founded by former Goldman Sachs real estate investors, the team hand-picks the top 1% of single-family rental homes nationwide, guided by proprietary underwriting and market analytics typically used by large institutions.

Each property undergoes a vetting process, requiring a minimum 12% return even in downside scenarios. Across the board, the platform features an average annual IRR of 18.8%. Their cash-on-cash yields, meanwhile, average between 10 to 12% annually.

Every investment is secured by real assets, not dependent on the platform’s viability. Each property is held in a standalone Propco LLC, so investors own the property — not the platform. Blockchain-based fractionalization adds a layer of safety, ensuring a permanent, verifiable record of each stake.

Getting started is a quick and easy process. With a minimum investment of $250, you can sign up for an account and then browse available properties. Once you verify your information with their team, you can invest in the properties of your choice in as little as 30 seconds.

Be the landlord of Walmart

If you’ve ever been a landlord, you know how important it is to have reliable tenants.

How do grocery stores sound?

That’s where First National Realty Partners (FNRP) comes in. The platform allows accredited investors to diversify their portfolio through grocery-anchored commercial properties without taking on the responsibilities of being a landlord.

With a minimum investment of $50,000, investors can own a share of properties leased by national brands like Whole Foods, Kroger and Walmart, which provide essential goods to their communities. Thanks to Triple Net (NNN) leases, accredited investors are able to invest in these properties without worrying about tenant costs cutting into their potential returns.

Simply answer a few questions — including how much you would like to invest — to start browsing their full list of available properties.

Expand your real estate empire

If you’re aiming to build a real estate portfolio like Pat Neal’s — without relying solely on instinct and spare time — a modern, all-in-one wealth management platform like Range can help you take a smarter, more strategic approach.

Designed for high-earning households (typically $200,000+), Range brings together investment management, tax planning, estate planning, retirement guidance and insurance optimization — all in one integrated platform.

Real estate investors will find Range especially useful. Whether you’re acquiring new properties or optimizing existing ones, Range helps you:

- Choose the right structure for each deal (e.g., 1031 exchanges)

- Forecast how property decisions affect cash flow and liquidity

- Plan long-term strategies around lending, refinancing and ownership

- Minimize tax exposure

You’ll also get access to a team of experienced financial planners who understand real estate and can help craft an investment strategy tailored to your goals.

With these options offering varying points of entry into the real estate game, investing in this market is no longer limited to moguls like Neal.

What to read next

- Robert Kiyosaki warns of a ‘Greater Depression’ coming to the US — with millions of Americans going poor. But he says these 2 ‘easy-money’ assets will bring in ‘great wealth’. How to get in now

- The ultrarich monopoly on prime US real estate is over — use these 5 golden keys to unlock passive rental income now (with as little as $10)

- This tiny hot Costco item has skyrocketed 74% in price in under 2 years — but now the retail giant is restricting purchase. Here’s how to buy the coveted asset in bulk

- Want an extra $1,300,000 when you retire? Dave Ramsey says this 7-step plan ‘works every single time’ to kill debt, get rich in America — and that ‘anyone’ can do it

Stay in the know. Join 200,000+ readers and get the best of Moneywise sent straight to your inbox every week for free. Subscribe now.

This article provides information only and should not be construed as advice. It is provided without warranty of any kind.