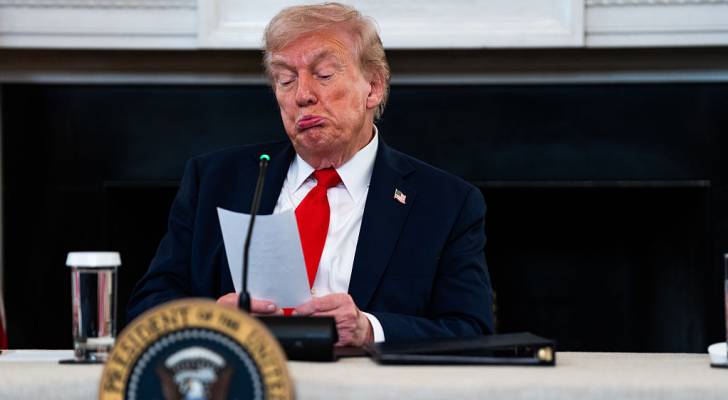

President Donald Trump’s new tax bill cuts the income tax liability for many Americans.

Altogether, roughly 40% of U.S. households could pay $0 in federal income tax in 2025, according to the Tax Policy Center (1). That’s in line with the 40% of households that had a $0 federal tax bill in 2022, under the Biden administration. However, Trump’s tax cuts favor specific groups, which means you could see a $0 tax bill for the first time if you meet certain conditions (2).

Must Read

- Thanks to Jeff Bezos, you can now become a landlord for as little as $100 — and no, you don’t have to deal with tenants or fix freezers. Here’s how

- Dave Ramsey warns nearly 50% of Americans are making 1 big Social Security mistake — here’s what it is and 3 simple steps to fix it ASAP

- I’m 49 years old and have nothing saved for retirement — what should I do? Don’t panic. Here are 6 of the easiest ways you can catch up (and fast)

Here’s a closer look at who will come out ahead.

Who can eliminate their tax bill?

Trump’s One Big Beautiful Bill Act (OBBBA) specifically favors seniors, employees who earn tips and overtime and those with children.

Here’s an example: Casey and Riley earn a combined income of $100,000 and have two children both under the age of 13. Their usual deductions allow them to lower their taxable income considerably, with $31,500 in standard deductions, $6,800 in 401(k) contributions, $6,800 for health insurance premiums, $1,260 for a Health Flexible Spending Account (FSA) and $3,000 for dependent care FSA.

But the new bill adds another deduction to this list: overtime pay. Together Casey and Riley can deduct an additional $10,000 because of this.

Altogether, their taxable income is slashed to $40,640 after all subtractions and deductions, which leaves them with a tax liability of $4,400. However, Casey and Riley also receive the maximum child tax credit of $2,200 per child, which is up from $2,000 last year. The combined tax credit of $4,400 offset the amount they owe in taxes and leaves them effectively with a $0 bill.

Similarly, a retired couple who are both 66 and earn a combined adjusted gross income of $96,700 could reduce their taxable income by $34,700 under the existing standard deduction. However, the OBBBA introduces a new seniors deduction worth $6,000 each or $12,000 together, which pushes their combined taxable income to just $50,000 (3).

Read more: How much cash do you plan to keep on hand after you retire? Here are 3 of the biggest reasons you’ll need a substantial stash of savings in retirement

Because this $50,000 is derived from capital gains and qualified dividends, it is subject to the 0% tax rate for such income (4). The senior couple could pay $0 in federal income taxes.

These are just some examples of how some families can eliminate their total liability by taking advantage of all the deductions and tax credits available to them. However, federal taxes are only part of the story.

Caveats to keep in mind

Although many Americans are expected to benefit from the new tax rules, there are several caveats to consider.

For instance, a $0 federal tax bill doesn’t necessarily mean your tax liability is nil. You could still face federal payroll taxes and state and local income, sales and property taxes, some of which could rise to offset these cuts. According to the National Association of Counties, the OBBBA shifts the cost burden from the federal level to state and local levels, which means counties may have to either cut services or raise local taxes to offset the downstream impact (5).

It should also be noted that the Trump administration has cut income taxes while raising import taxes (tariffs). Tariffs announced through Oct. 3 could cost each taxpayer an additional $2,800 in 2026, according to calculations by the Tax Policy Center (6).

Bottom line: The national tax code has been significantly overhauled, and a professional financial expert could help you estimate the total tax burden you and your family face this year — it’s likely to be different from what you’re used to.

What to read next

- Want an extra $1,300,000 when you retire? Dave Ramsey says this 7-step plan ‘works every single time’ to kill debt, get rich in America — and that ‘anyone’ can do it

- ‘Rich Dad, Poor Dad’ author Robert Kiyosaki says this 1 asset will surge 400% in a year — and he begs investors not to miss its ‘explosion’

- There’s still a 35% chance of a recession hitting the American economy this year — protect your retirement savings with these 5 essential money moves ASAP

- This tiny hot Costco item has skyrocketed 74% in price in under 2 years — but now the retail giant is restricting purchase. Here’s how to buy the coveted asset in bulk

Join 200,000+ readers and get Moneywise’s best stories and exclusive interviews first — clear insights curated and delivered weekly. Subscribe now.

Article Sources

We rely only on vetted sources and credible third-party reporting. For details, see our editorial ethics and guidelines.

Tax Policy Center (1); Tax Policy Center (2); Wall Street Journal (3); U.S. Internal Revenue Service (4); National Association of Counties (5); Tax Policy Center (6)

This article provides information only and should not be construed as advice. It is provided without warranty of any kind.