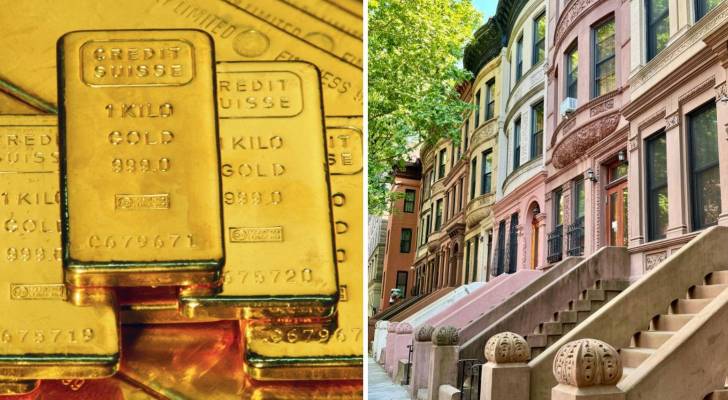

Goldman Sachs has compared gold to another rare and sought-after asset: Manhattan real estate.

“You can’t pump gold — but you can bid it out of someone’s hands. Gold doesn’t get used — it changes hands and gets repriced,” Goldman Sachs’ analysts wrote in a recent Sunday note.

Don’t Miss

- Want to retire with an extra $1.3M? See how Dave Ramsey’s viral 7-step plan helps millions kill debt and build wealth — and how you can too

- The Canadian economy shrank in Q2 2025 — protect your wallet with these 6 essential money moves (most of which you can complete in just minutes)

- Boomers are out of luck: Robert Kiyosaki warns that the ‘biggest crash in history is coming’ — here’s his strategy to get rich before things get worse

And this year, gold’s price has been skyrocketing, recently passing a record high of US$3,700 (C$5,200).

Like Manhattan real estate, the supply of gold is limited

Manhattan real estate is known for its limited supply, which is why it’s so expensive. More people want to live there than there are available homes to live in, making it a costly market to break into. As of July 2025, RentCafe notes that the average rent in Manhattan is US$5,620 (C$7,865) for a 695-square-foot apartment. The average price of homes listed for sale is US$1.4 million (C$2 million), according to Realtor.com.

Gold is similarly limited in supply. Almost all the gold ever mined still exists, hidden away in vaults, jewelry boxes and central bank reserves. And since only 1% of new gold is added to the existing 220,000 metric ton supply each year — its power lies not in its consumption, like oil and gas — but in its accumulation, like Manhattan real estate.

“Its market clears through changes in ownership, not production-versus-use balances,” Goldman’s analysts wrote. “The gold price reflects who’s more willing to hold it and who’s willing to let go.”

Supply and demand metrics — like how raising the price of gas could lead to people taking fewer road trips, thus slowing demand — don’t apply to gold, since the supply will always be limited.

Read more: Are you drowning in debt? Here are 3 simple strategies to help crush your balance to $0 in no time

Conviction vs. opportunistic buyers

The Goldman report also identified two groups of gold buyers — “conviction buyers” like central banks, spectators and ETFs, and “opportunistic buyers,” meaning households in emerging markets.

Since opportunistic buyers only step in when the price is right, they provide a floor under the price of gold during sell-offs, but conviction buyers set the trend.

The Manhattan real estate market shares these two groups of buyers.

“The total number of apartments is largely fixed, and the small amount of new construction each year is not what drives prices,” their analysts wrote. “What matters is the identity of the marginal buyer."

Manhattan conviction buyers are those with deep pockets who want to live there regardless of cost. Manhattan opportunistic buyers are those who will buy only if the price is right — if they can’t find a reasonable deal, they will live in Brooklyn or New Jersey instead.

A good time to invest in gold?

The unique comparison suggests that the current hype around gold isn’t going away anytime soon. Gold is attractive to investors because it has a solid reputation and is considered a safe-haven asset during economic uncertainty. Gold also helps to hedge against inflation and currency risk.

One way to dip into the gold market in Canada is to buy gold stocks or ETFs.

Gold stocks

Canadian gold stocks provide various ways to gain exposure to gold. For example, gold mining companies search for new gold deposits and development businesses that focus on turning gold deposits into mining production. Also, there are royalty and streaming companies that provide funding to gold mining companies, with the agreement that they will receive royalties based on future gold production.

When you choose a single company, its performance can offer potential growth and dividends. If the company faces operational, management or budgetary problems, they could impact its performance. So, gold stocks are best suited for active investors comfortable evaluating gold stocks and following industry trends.

Gold ETFs

Investors looking to gain exposure to the pure gold price could look into Canadian gold ETFs as a convenient and lower-risk option, as they avoid the volatility of investing in a single company. However, it does bring about commodity risk as its returns are directly tied to the value of the commodity.

Furthermore, gold doesn’t generate any income, nor does it yield any dividends. As a result, gold ETFs are most suitable for passive investors who want to protect themselves against economic turmoil but don’t want to spend time evaluating individual gold companies.

What To Read Next

- Here are 5 expenses that Canadians (almost) always overpay for — and very quickly regret. How many are hurting you?

- Ray Dalio just raised a red flag for Americans who ‘care’ about their money — here’s why Canadians should limit their exposure to U.S. investments

- I’m almost 50 and don’t have enough retirement savings. What should I do? Don’t panic. Here are 6 solid ways you can catch up

- Here are the top 7 habits of ‘quietly wealthy’ Canadians. How many do you follow?

This article originally appeared on Money.ca under the title: Gold isn’t like oil, it’s like real estate: Goldman Sachs on what Canadians should know about this asset

This article provides information only and should not be construed as advice. It is provided without warranty of any kind.