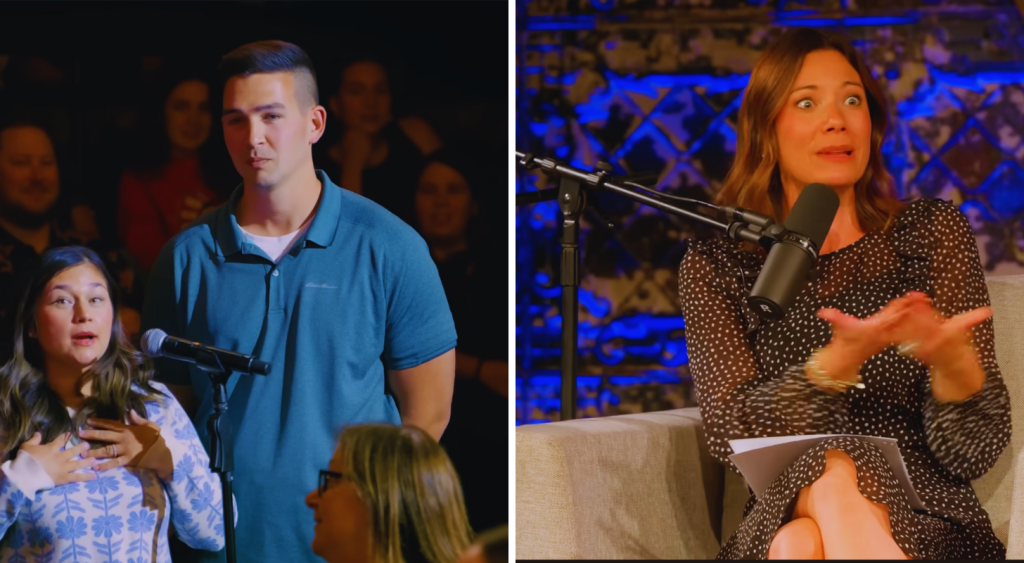

Earning nearly $160,000 a year and living completely debt-free, a Chicago father might seem to have it all figured out financially. But when Jake and his wife Jenny spoke on The Ramsey Show recently, it wasn’t to share a success story — it was to air a familiar household conflict: how much spending is too much when you’re already doing everything right? (1)

“We have the age-old debate,” Jenny told hosts Ken Coleman, Rachel Cruze and George Kamel. “I’m a spender. He’s a saver. He thinks I should spend less. I think he should relax and let me spend — and also, he needs to start spending a little bit, maybe too.”

Must Read

- Thanks to Jeff Bezos, you can now become a landlord for as little as $100 — and no, you don’t have to deal with tenants or fix freezers. Here’s how

- Robert Kiyosaki says this 1 asset will surge 400% in a year — and he begs investors not to miss its ‘explosion’

- Dave Ramsey warns nearly 50% of Americans are making 1 big Social Security mistake — here’s what it is and 3 simple steps to fix it ASAP

Jake works full time while Jenny stays home raising their four kids (ages 7, 5, 3 and 6 months) and managing the household finances. She admits she spends about $400 a month on “fun” purchases: clothes, Amazon finds and the occasional family outing or vacation.

The couple is debt-free, every dollar is budgeted, and she manages all their finances through a budgeting app. But Jake doesn’t look at the budget, doesn’t spend on himself and bristles whenever he sees a delivery box arrive.

That tension led to one question at the heart of their debate: When you’re living on a high income, debt-free and saving aggressively, how much spending is too much? Here’s what Ramsey’s team told them, and how Jenny might actually be saving the family big in the long run.

Fear disguised as discipline

Jake’s reluctance to spend stems from something deeper than thrift. As he told the hosts, he grew up in a family that “had what we needed, but nothing more.”

That scarcity mindset stuck with him even after his financial situation improved. Ramsey host Ken Colman pointed it out: “I’m looking at a young man who’s been terrified his whole adult life because of what he grew up with, money. You’ve stayed out of the budget, so the trust is there to a degree, but the side eye and the bad attitude about the packages and all the things are a manifestation of the fact that you don’t like the way that she spends.”

The hosts explained that this kind of fear-based money management can quietly sabotage even the most financially sound households. It creates guilt around normal spending and fosters resentment when one partner feels judged for enjoying what they’ve earned.

Ramsey co-host George Kamel reminded Jake that there’s a difference between intensity and intentionality.

“Once you’re through getting out of debt and you got the emergency fund, we move from intensity to intentionality — which means we can let our foot off the gas a little bit,” Kamel explained.

A $400 “fun budget” versus $4,000 childcare

While Jake worried about his wife’s $400-a-month spending, the hosts pointed out a hidden cost she’s saving the family on: childcare. Because Jenny stays home full time, the couple pays nothing for daycare. This is a major financial break for a family with four children.

In the U.S., estimates for full-time care for one child range from $550 to $1,500 per month, depending on age and location. (2) At the national average, daycare for one child costs about $1,039 per month or $12,472 per year. That means if all four kids were in care, Jake and Jenny could be facing more than $4,000 a month, or roughly $50,000 a year, which is nearly a third of Jake’s income. (3)

In other words, Jenny’s unpaid labor at home saves the family far more than her discretionary spending costs. And with a debt-free household and a clear plan to pay off their mortgage within five years, the family has room to enjoy life a little without derailing their goals.

Read more: I’m almost 50 and have nothing saved for retirement — what now? Don’t panic. These 6 easy steps can help you turn things around

Fixing the balance with trust and participation

The hosts ultimately sided with Jenny.

“Jake must look at the budget and must find a hobby,” Kamel decreed. “He must force a line item in the budget to spend money.”

That advice points to a broader truth for couples like Jake and Jenny: financial balance requires emotional balance, too. It’s not just about tracking dollars, it’s about sharing responsibility and trust.

Here are a few practical steps to take for couples looking to align their finances:

- Joint budget reviews: Both partners review the household budget monthly, which covers debts, savings, expenses, income and investments.

- Two fun funds: Have a ‘fun money’ allowance for couples to maintain a level of autonomy within a shared budget. When both partners have discretionary budgets — and both participate in financial decisions — spending guilt and resentment drop sharply

- Have monthly check-ins: Try setting aside 30 minutes each month for a relaxed “money date” to review your budget, celebrate wins, address frustrations and dream together about your financial goals.

- Mindset reframing: Recognize that being responsible doesn’t mean saying “no” to joy and spending money.

“If you’re not careful, you’re going to be fearful for your entire kids’ lives, and they’re going to adopt that same view. You’re not promised tomorrow — you better have some fun and make some freaking memories with Jenny and those babies.” Rachel advised.

Jake’s real challenge wasn’t about budgeting — it was about trust, participation and fear. When one partner holds all the financial anxiety, it can distort even the healthiest budget into a burden.

By sharing responsibility and loosening up just enough to enjoy the fruits of their labor, couples like Jake and Jenny can turn money management from a point of tension into a partnership built on mutual respect, shared goals and a little more grace for that occasional splurge.

What to read next

- Dave Ramsey says this 7-step plan ‘works every single time’ to kill debt, get rich — and ‘anyone’ can do it

- Are you richer than you think? 5 clear signs you’re punching way above the average American’s wealth

- Warren Buffett used 8 simple money rules to turn $9,800 into a stunning $150B — start using them today to get rich (and then stay rich)

- This tiny hot Costco item has skyrocketed 74% in price in under 2 years — but now the retail giant is restricting purchase. Here’s how to buy the coveted asset in bulk

Join 200,000+ readers and get Moneywise’s best stories and exclusive interviews first — clear insights curated and delivered weekly. Subscribe now.

Article sources

We rely only on vetted sources and credible third-party reporting. For details, see our editorial ethics and guidelines.

The Ramsey Show Highlights (I); Trusted Care (2); Visual Capitalist (3)

This article originally appeared on Moneywise.com under the title: Chicago dad earning $160K says his wife spends too much — but The Ramsey Show hosts say he’s the one with the problem

This article provides information only and should not be construed as advice. It is provided without warranty of any kind.