Smarter spending: How Canadians can use buy now, pay later without paying more

As Black Friday deals flood flyers and forums, Canadians are gearing up for holiday shopping with one goal — stretching every dollar. Now, there’s a new way to make that easier: PayPal (NASDAQ:PYPL) has launched its Buy Now, Pay Later (BNPL) service in Canada, allowing shoppers to split purchases into smaller, interest-free payments (1). The […]

Amazon fined $20K after B.C. shopper’s package vanished — here’s who really pays when orders go missing

Have you ever had a package go missing but still had to pay for it? Have you ever disagreed with a retailer if they should give you a refund? Well, a new ruling from the Consumer Protection B.C. (CPBC) is shedding light on who exactly is responsible in these sorts of scenarios. After a B.C. […]

Relief at last: What the Bank of Canada’s new outlook means for your wallet — and how to take back control

The Bank of Canada’s latest Quarterly Financial Report, released mid-November, doesn’t grab headlines the way a rate announcement does, but it offers something just as important: a clear look at how the Bank sees the Canadian economy, the risks it’s watching, and what that means for your mortgage, your savings, and your financial stability heading […]

Prime Day? Pass. Canadians can still score real holiday deals without Amazon

Every fall, Canadians are bombarded with countdown clocks, “lightning deals,” and inboxes full of urgent reminders that Amazon Prime Day — or the biggest and best Black Friday deals — are here. But as flashy banners return, a growing number of shoppers are asking: Are Amazon’s deals really that good? And is this really where […]

The high price of play: What parents need to know about competitive sports costs in Canada

The buzz of a new school year mixes with the sound of skates hitting the ice and dance shoes tapping across studio floors. For parents whose children are eyeing competitive extracirricular activities, this season often comes with more than just excitement. It brings a financial reckoning many don’t anticipate until the first invoice lands. Whether […]

Understanding the biggest sales events of the year: Amazon Prime Day vs Black Friday vs Cyber Monday vs Boxing Day

In today’s retail landscape, specific sale events dominate the shopping calendar. In Canada, the biggest sale days are Boxing Day, Black Friday (and its sister Cyber Monday), along with Amazon Prime Day. Each sales event offers unique opportunities to save on everything from electronics to everyday essentials. For savvy shoppers, understanding the differences between each […]

50% of Canadian pet parents avoid taking their pets to a veterinarian: study reveals

Half of Canadian pet parents say they’ve skipped or declined vet care for their pets, according to a PetSmart Charities of Canada-Gallup study (1). The biggest reason? Cost. But travel distance matters, too — the farther a clinic is, the more likely pet parents are to put off a visit. The research offers a first-ever […]

Hidden in plain sight: The Habsburg 137-carat Florentine Diamond that proves Canada’s banks are built on trust

A diamond that once glittered in the crowns of emperors resurfaced — and not in Vienna or Paris, but inside a secure Canadian bank vault. According to The New York Times (1), the 137-carat Florentine Diamond — a jewel of the Habsburg dynasty thought lost, stolen or recut more than a century ago — “has […]

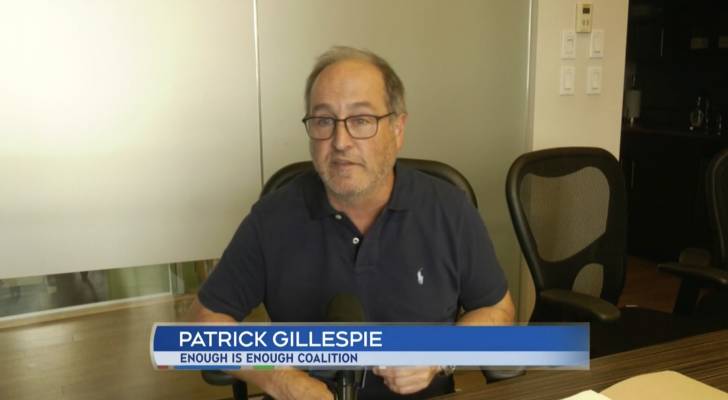

Moncton businesses say crime is hitting their bottom line

Downtown Moncton’s business community is speaking out against what it calls an alarming rise in crime — and the growing financial fallout that’s coming with it. The newly formed Enough is Enough Coalition, made up of business owners, landlords and property managers, is demanding action from all levels of government. In a statement last week, […]

Canadian snowbird retirees are being forced to sell their Florida homes amid skyrocketing insurance costs, plunging loonie — is this temporary or long-term exodus from the Sunshine State?

For years, Ontario retiree Cesidia Cedrone and her husband escaped Canada’s brutal winters by retreating to their cozy Florida condo. But this year, instead of packing their bags for the sunshine, they packed up their belongings in Florida — for good. “Things changed so drastically. The Canadian dollar is not at par with the U.S. […]