Canada just lost its top spot with the U.S. — and your wallet will feel the shift

Canada has lost its nearly 30-year position as the United States’ largest buyer of American goods. New U.S. Census data shows Mexico imported slightly more U.S. products than Canada between January and August 2025 — US$226.4 billion (C$319 billion) versus Canada’s US$225.6 billion (C$317.9 billion) (1). This shift is part of a longer trend. In […]

The ‘Godfather of AI’ says the rapidly developing technology will spike unemployment- should you be concerned?

Geoffrey Hinton, called the ‘godfather of AI’ because of his pioneering computer science work earning him a Nobel Prize in 2024, is predicting a major spike in unemployment because of the technology. In an interview with Financial Times, (1) Hinton explained his concerns with AI and how he predicts that the capitalist system is going […]

Canadians are increasingly keeping more cash on hand as the world becomes more digitized — Is this a smart move?

“Cash is king." For millennials and generations before them, this phrase reminds them of a time before digital wallets, online payments and plastic payment methods. Now you might think the notion is obsolete given the technology in our pockets. But, according to a recent Bank of Canada (BoC) report surveying payment methods of Canadians, it […]

Elderly woman shocked to see one unpaid bill tanked her credit score — How to recover before it’s too late

A Canadian woman had a startling wake up call on the importance of having a good credit score after hers hit rock bottom. Speaking with CTV News, Gloria — a pseudonym given to hide her true identity — said she received a credit card bill in February for $389, which she believes she paid. Her […]

My sister’s a freelancer and somehow never has enough cash when her rent is due. But I feel like I’m becoming a crutch, should I stop bailing her out?

If you’ve helped out a loved one when they’ve been short on cash, you’re in the majority. A LendingTree survey found that 51% of respondents had loaned money to a friend or family member in the previous five years, and 27% of the time it was to a sibling (1). Now, imagine you’re 36-year-old Mia: […]

Rising mortgage costs put Canadian homeowners at risk

A growing number of Canadians could face difficulties making mortgage payments when they renew their loans this year and next, according to the Canada Mortgage and Housing Corp. (CMHC). The housing agency says it is monitoring the situation closely as higher interest rates push monthly payments higher. “My overall expectation is that delinquencies and arrears […]

From windfall to wipeout: BC tenant’s $57K victory against landlord overturned by judge — here’s why

On September 29, 2023, BC tenant Saeed Mohammadi was awarded $57,700 in compensation costs thanks to a decision from a BC Residential Tenancy Branch (RTB) arbitrator against his landlord Siavash Dehpour. Mohammadi won his case even though he hadn’t paid rent for months. However, nearly two years later, a judicial review of the decision, a […]

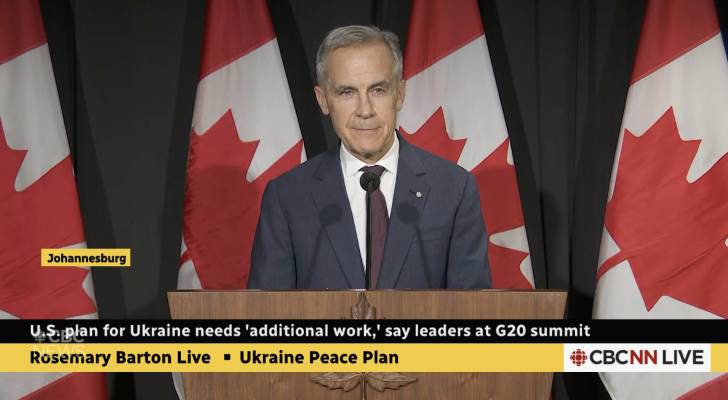

Mark Carney’s “Who cares?” has become a mood: But should you care?

Prime Minister Mark Carney’s off-hand “Who cares?” was delivered with a shrug, but it travelled farther than the Johannesburg press scrum where he said it. Asked when he last spoke to Donald Trump about stalled tariff talks, Carney brushed it off. “Who cares? I mean, it’s a detail. I spoke to him. I’ll speak to […]

Prime Day? Pass. Canadians can still score real holiday deals without Amazon

Every fall, Canadians are bombarded with countdown clocks, “lightning deals,” and inboxes full of urgent reminders that Amazon Prime Day — or the biggest and best Black Friday deals — are here. But as flashy banners return, a growing number of shoppers are asking: Are Amazon’s deals really that good? And is this really where […]

My work is offering a 4% RRSP match and I’m torn. Should I shrink my paycheques?

When your employer offers to put extra money toward your retirement through a group RRSP match, it can feel like a rare workplace win. A guaranteed contribution of up to 4% of your salary is essentially free money, a perk many Canadians never see on their paycheques. Still, saying yes means choosing how much you […]