Canadians owe a staggering $2.5 trillion in household debt — here’s how to chip away and finally breathe free

Debt: Almost all Canadians have it. In fact, Canada’s Market Pulse Consumer Credit Trends and Insights Report found that consumer debt levels rose to $2.5 trillion at the end of hte first quarter of 2025 — a 4% year-over-year increase (1). TransUnion estimate that consumer debt, across all credit products, hit a record $2.5 trillion […]

Making Christmas count: Canadians cut back as groceries, gas and gifts get pricier

More Canadians are entering the holiday season feeling financially squeezed this year, with consumers favouring more intentional spending as a result. A recent survey from Money Mart (1) found that 78% of Canadians say inflation will affect their holiday spending in 2025, and 37% expect to spend less than they have in the past. Among […]

Understanding the biggest sales events of the year: Amazon Prime Day vs Black Friday vs Cyber Monday vs Boxing Day

In today’s retail landscape, specific sale events dominate the shopping calendar. In Canada, the biggest sale days are Boxing Day, Black Friday (and its sister Cyber Monday), along with Amazon Prime Day. Each sales event offers unique opportunities to save on everything from electronics to everyday essentials. For savvy shoppers, understanding the differences between each […]

Relief at last: What the Bank of Canada’s new outlook means for your wallet — and how to take back control

The Bank of Canada’s latest Quarterly Financial Report, released mid-November, doesn’t grab headlines the way a rate announcement does, but it offers something just as important: a clear look at how the Bank sees the Canadian economy, the risks it’s watching, and what that means for your mortgage, your savings, and your financial stability heading […]

Health-care costs for Canadian families climb to $19,000 in 2025, Fraser Institute warns

A Canadian family of four will pay an estimated $19,060 in public health-care costs this year, according to a new report from the Fraser Institute. The think tank says the figure reflects the real burden households shoulder through taxes, even if Canadian health care services are ‘free’ at the point of use. The report, released […]

Canadian home sales edge higher in October as affordability pressures persist

Canadian home sales rose again in October, offering another sign of a slow recovery heading into 2026. New data from the Canadian Real Estate Association (CREA) shows national sales increased 0.9% month-over-month, marking six gains in the past seven months. But activity remains subdued compared with last year. Actual — not seasonally adjusted — sales […]

The hidden shock of retirement: How losing your health benefits can cost thousands a year

When Mary and Robert Chen retired last year, they thought carefully about how much they had saved in their RRSPs and other retirement accounts. They planned their income streams, considered their tax brackets and even ran projections for a comfortable lifestyle. One thing they did not fully anticipate was how losing their workplace health benefits […]

Canadians plan leaner holidays as Gen Z cuts back 35%: PwC

Canadians are heading into the 2025 holiday season planning to spend an average of $1,675 on gifts, travel and entertainment, according to PwC Canada’s annual Holiday Outlook. That figure represents a 10% drop from last year, as rising prices and economic uncertainty push consumers to stretch their dollars further. Despite the overall pullback, PwC says […]

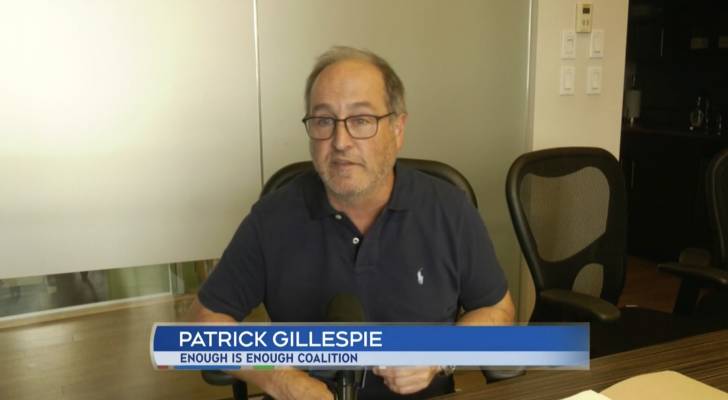

Moncton businesses say crime is hitting their bottom line

Downtown Moncton’s business community is speaking out against what it calls an alarming rise in crime — and the growing financial fallout that’s coming with it. The newly formed Enough is Enough Coalition, made up of business owners, landlords and property managers, is demanding action from all levels of government. In a statement last week, […]

Canadian grandparents feel rising costs as financial support cuts into retirement

Canadian seniors are feeling the squeeze of higher living costs and many are balancing the financial needs of their children and grandchildren with their own shrinking retirement security, a new report shows. The 2025 Aging and Affordability Insights Benchmark Report by Bloom Finance, released October 1st, compares survey data from last year and highlights how […]