Tech stocks are on an epic run — but chasing them could make investors miss the most proven path to wealth

If you already own Nvidia stock, you might be feeling pretty good about its recent performance — or a little worried about recent drops. If you don’t own it, you may have a little FOMO — but should you be worried about missing out? Nvidia is all over the news lately, but the company has […]

Here’s how many Americans actually have $1 million (or more) by the time they retire, and the 3 big moves they made to do it. Are you on track?

This article adheres to strict editorial standards. Some or all links may be monetized. These days, many people think they need over a million dollars to be able to retire comfortably. More specifically, most Americans think the magic number is $1.26 million, according to a 2025 Northwestern Mutual survey (1). Must Read Real Estate: Thanks […]

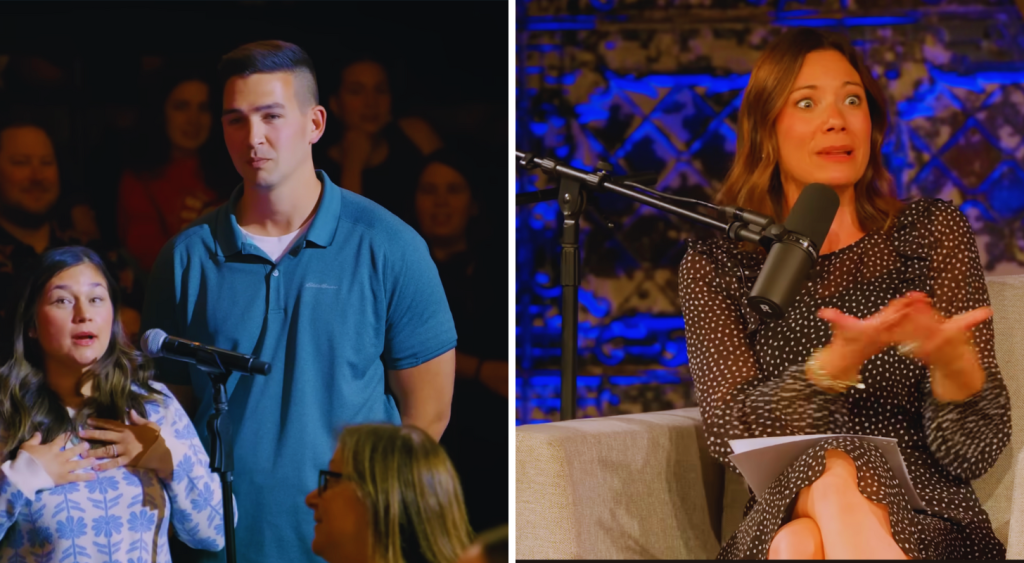

Debt-free Chicago dad earning $160K says his wife spends too much. Here’s why The Ramsey Show hosts say he’s the one with problem

Earning nearly $160,000 a year and living completely debt-free, a Chicago father might seem to have it all figured out financially. But when Jake and his wife Jenny spoke on The Ramsey Show recently, it wasn’t to share a success story — it was to air a familiar household conflict: how much spending is too […]

I’m 69 with $375K in savings but I’ve got a $250K reverse mortgage causing me serious stress. Should I just use most of my savings to pay it off ASAP and aim to survive on CPP?

This article adheres to strict editorial standards. Some or all links may be monetized. We adhere to strict standards of editorial integrity to help you make decisions with confidence. Some or all links contained within this article are paid links. Imagine this scenario: Samantha is retired at 69, but a few years back she took […]

A ‘generational divide’: Gen Z calls this old-school money habit ‘cringe,’ but older generations say it’s still paying off. Who’s right?

This article adheres to strict editorial standards. Some or all links may be monetized. Physical cash may not be the default payment method for most Americans, but the generational divide over whether to use it reveals fundamental differences in how we manage money in 2025. According to a recent Cash App survey of more than […]

Zillow and Redfin are being sued by 5 states, the FTC over an alleged rental advertising scheme — here’s how it could impact prices

With rent prices already going up in 2025, this news may not make Americans feel any better about the state of the rental market. Zillow and Redfin, two online real estate companies, are being sued by both state and federal government officials. According to USA Today, attorneys general from five states have filed a joint […]

My sister just died and left me as the trustee for my 12-year-old nephew’s $100,000 inheritance. It’s a lot of responsibility — what do I do first?

When an adult inherits money, there is often freedom in how they can use it, unless specified otherwise through a will or estate plan. However, when a minor inherits money, it must be managed through a trust account because they are deemed too young to manage it by themselves. While this is a common method […]

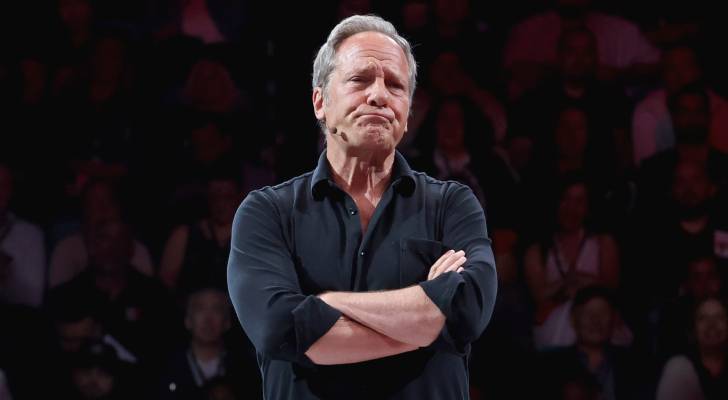

Mike Rowe warns the real crisis isn’t skills or AI but the ‘will to work.’ As more ‘able-bodied’ men exit the workforce, what does America lose?

As AI threatens to automate millions of white-collar roles, concerns about job-ready skills are louder than ever. But Mike Rowe, CEO of the mikeroweWORKS Foundation, warns that the real crisis isn’t technological, it’s human. “The skills gap is real, but the will gap is also real,” the 63-year-old former host of Dirty Jobs said in […]

Trump could put Fannie Mae and Freddie Mac on the market by the end of the year, housing chief says — here’s what it could mean for your mortgage

President Donald Trump is “opportunistically evaluating” taking Fannie Mae and Freddie Mac public as early as the end of the year, says Federal Housing Finance Agency (FHFA) chief William Pulte. “President Trump made the right decision not to take Freddie and Fannie public during his first term and is opportunistically evaluating an offering this time […]

Canadians are increasingly keeping more cash on hand as the world becomes more digitized — Is this a smart move?

“Cash is king." For millennials and generations before them, this phrase reminds them of a time before digital wallets, online payments and plastic payment methods. Now you might think the notion is obsolete given the technology in our pockets. But, according to a recent Bank of Canada (BoC) report surveying payment methods of Canadians, it […]