Buffett’s latest $9.7B acquisition has the hallmarks of a Berkshire deal — why the legend might have a ‘surprise or two’ left before he steps down

Berkshire Hathaway, with Warren Buffett still at the helm, announced on Oct. 2 its acquisition of OxyChem, Occidental Petroleum’s chemical business, for $9.7 billion in cash. Throughout his lifetime, Buffett has stood by the tenets of value investing — seeking out companies with stock prices that are lower than the intrinsic value of the business. […]

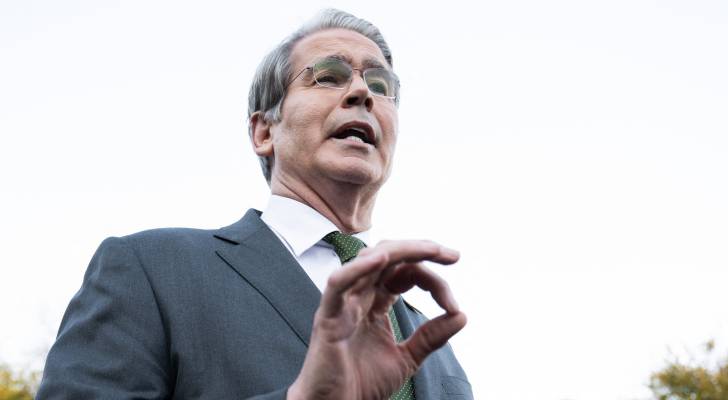

Scott Bessent claims ‘move from a blue state to a red state’ is No. 1 way to beat inflation. NBC anchor, critics stunned. But is it that ‘absurd’?

This article adheres to strict editorial standards. Some or all links may be monetized. Rising living costs have been a persistent strain for many Americans — and President Donald Trump’s sweeping tariffs have only intensified the pressure. It’s a concern Treasury Secretary Scott Bessent was pressed on during his latest appearance on MSNBC’s Meet the […]

This stressed out couple makes $167K but has $339K in debt. Ramit Sethi says fixing these 2 ‘toxic’ money habits could pull them out of ‘dire danger’

Christine, 47, and Thad, 57, make a combined annual income of $167,625. But despite their solid earnings, they’re buried in debt — to the tune of $339,000. Each carries a six-figure loan, “which creates a toxic mix of frustration and complacency and even hopelessness,” said Ramit Sethi on an episode of I Will Teach You […]

Think slowing your financial ‘burn rate’ can stand in for an emergency fund? Here’s why it might not keep you afloat for long

If you’re furloughed or lose your job, do you know how much money you’d need to bridge the gap until you’re getting a paycheque again? That gap is called your ‘burn rate’ — a term that was originally coined to describe how startup companies track cash before they become profitable. But it can also apply […]

Suze Orman is sounding the alarm over the ‘holiday money trap.’ Here’s her 4-step fix to curb your spending before it spirals out of control

The enticement of big sales come Black Friday. The shining lights of pre-December Christmas marketing. The nauseatingly dulcet tones of Mariah Carey. All that considered, every November, Americans fall into what Suze Orman calls the ‘holiday money trap’. Must Read Real Estate: Thanks to Jeff Bezos, you can now become a landlord for as little […]

Las Vegas workers who might benefit from Trump’s ‘no tax on tips’ policy are missing out as fewer non-Americans come to town — thanks in part to Trump

Tourism in Las Vegas is down since last year — and tip-dependent workers, like bartenders and dealers who rely heavily on tourist traffic, are especially vulnerable, even with Trump’s ‘no tax on tips’ policy. The Wall Street Journal reports that tip incomes in Las Vegas are shrinking across the board. While tip tax exemptions might […]

Dave Ramsey tells homeless, unemployed Ohio man with $14K debt that there’s no point declaring bankruptcy. Why his money problems are just symptoms

Toby called into The Ramsey Show from Ohio, laying his problems on the line. He’s homeless, unemployed and saddled with $14,000 in debt of which nearly half is a car loan. Even his car’s “broke.” He was charged with a DUI last year, and added that he had developed a mental block about working. Toby […]

Kyle Busch’s $8M loss is a warning to those with this 1 type of life insurance policy. Are you sure your ‘tax-free retirement plan’ isn’t a scam?

This article adheres to strict editorial standards. Some or all links may be monetized. NASCAR star Kyle Busch and his wife, Samantha, recently said they lost more than $8 million after buying a life insurance policy that they claim was pitched as a “tax-free retirement plan.” “I never thought something like this could happen to […]

Are you claiming Social Security at 62? Here’s 1 special little rule that US retirees often miss — and can cost you thousands of dollars

Whether it’s boredom or financial stress, many retirees go back to work after filing for Social Security. About 19% of Americans 65 and older were still working, according to the Pew Research Center [1]. Must Read Real Estate: Thanks to Jeff Bezos, you can now become a landlord for as little as $100 — and […]

Waiting until 65 to retire? These 4 surprising stats show why working longer may not make sense for everyone — here’s why you may want to reconsider

For years, working until 65 has been treated as the default — but that old benchmark may no longer make sense. With stress levels high, health declining earlier and the cost of living forcing people to rethink what they want from life, a growing number of Americans are reconsidering how long they want to stay […]