Ohio police warn drivers about new cellphone scam after Cleveland woman reports scary overnight incident — but the scenario’s drawing serious skepticism online. What you need to know

As technology continues to evolve, so too do the techniques that scammers and criminals use to prey on innocent victims. Take what happened to this woman in Cleveland, for example. The woman, who was not identified for her own protection, was recently driving when she noticed something had struck her vehicle. Don’t miss Thanks to […]

Here are 5 things that will likely get more expensive in 2025 — no matter what Trump does in the White House

We adhere to strict standards of editorial integrity to help you make decisions with confidence. Some or all links contained within this article are paid links. Imported household appliances that are made with steel parts — like washing machines, refrigerators and stoves — will be subject to President Trump’s expanded tariffs starting June 23, according […]

Canadians refuse to quit saving — despite market chaos and cost-of-living fears

Despite the ever-changing and volatile market that 2025 has wrought so far, many Canadians are staying diligent in saving for retirement. This, according to a new Sun Life report. For example, the report notes that positive trends in member savings behaviours are continuing with average contributions reaching over $9,500, a 6% increase from 2022. "The […]

Paul Simon’s daughter says she still hates Richard Gere for breaking his promise — flipping her family’s Connecticut home to developers for millions before absconding to Spain

Lulu Simon, the daughter of music icons Paul Simon and Edie Brickell, took to Instagram to share her story of property-related heartbreak involving Hollywood legend Richard Gere. She says that the Pretty Woman star assured her parents that he would “take care of the land” when he purchased the family’s six-bedroom Connecticut mansion in 2022. […]

Young Canadians squeezed by housing costs and shaky job market

They did everything right. They got the degrees, took the entry-level jobs, moved back home to save, and still, many young Canadians can’t get ahead. For a generation raised with the promise that hard work leads to stability, that promise is slipping further out of reach. Nearly half of Canadians aged 18 to 34 now […]

Americans could see price hikes across the country thanks to Trump’s trade war — so don’t get caught napping. Here are 5 ‘everyday items’ to load up on before they become more expensive

American consumers can expect to see higher prices for goods made in China — and maybe even empty shelves. After President Donald Trump’s “reciprocal” tariffs were announced on April 2, markets took a nosedive. A 145% tariff on Chinese goods effectively blocked trade and resulted in a slowdown at ports. The CEOs of major retailers, […]

Dave Ramsey gets frank with Seattle woman $100K underwater on Florida second home — why he says there’s only 1 way for her to defuse this ‘ticking time bomb’

When Sarah from Seattle recently called into The Ramsey Show, Dave Ramsey described her situation as “a ticking time bomb." She owns a condo in Seattle with a $2,300 monthly mortgage plus homeowners association (HOA) fees, and purchased a second property in Florida last year at the top of her budget. Don’t miss Thanks to […]

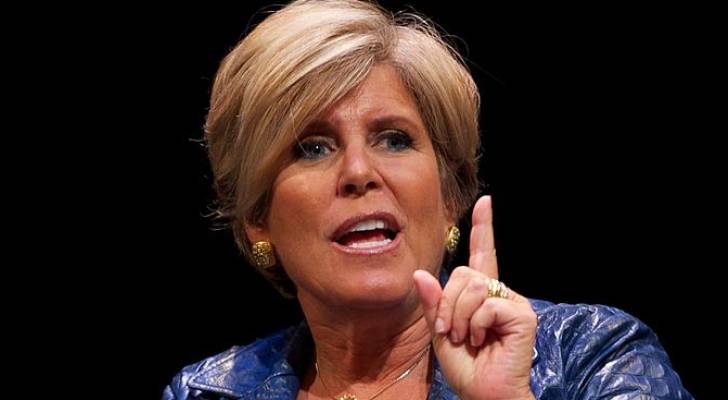

A California woman asked Suze Orman if she’d be responsible for her husband’s credit card debt if something happened to him — here’s what you need to know

We adhere to strict standards of editorial integrity to help you make decisions with confidence. Some or all links contained within this article are paid links. In an episode of Suze Orman’s Women & Money podcast, Jane from California wrote into the show to pick Orman’s brain about her husband’s credit card debt. Her question […]

‘We’re not robots’: As recession looms, Americans may be unsure about what to do with their 401(k) — here’s what experts recommend

We adhere to strict standards of editorial integrity to help you make decisions with confidence. Some or all links contained within this article are paid links. Since 1950, the US has weathered 11 recessions, proving time and again that downturns aren’t a question of if, but when. After a strong performance from the S&P 500 […]

Colorado man fights back after ‘intentionally complex’ hospital billing system leaves him with $104K bill for emergency surgery — how to ensure your hospital doesn’t try to overcharge you

Blake Pfeifer of Colorado Springs is calling on hospitals to uphold their legal requirements for transparent pricing. Pfeifer underwent emergency stomach surgery at the University of Colorado Health Memorial Hospital Central in 2022 and was surprised when bills for his week-long stay just kept coming. Don’t miss Thanks to Jeff Bezos, you can now become […]