The US car market is bankrupting Americans — and it’s only going to get worse. Here’s how to save thousands of dollars if you want to buy a car soon

The U.S. car market faces a perfect storm that is rapidly engulfing ordinary car owners across the country. The clearest sign of this is the rising rate of auto loan borrowers who are falling behind on their monthly payments. As of January this year, 6.6% of subprime auto borrowers were at least 60 days past […]

I’m 59 years old, single and dreaming of retirement — but I’m still carrying an $81,000 mortgage balance. Do I have to wait to leave the workforce until it’s fully paid off?

Imagine this scenario: Brenda is 59, single, has no children and is eyeing retirement. The hitch? She still has $81,000 outstanding on her mortgage, so she’s wondering if it makes sense to remain in the workforce until it’s paid off. If she retires with a mortgage, she’d join a growing share of older Americans who’ve […]

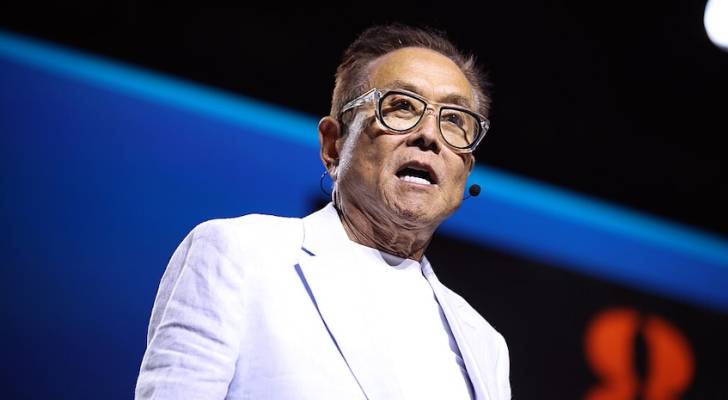

Robert Kiyosaki warns of ‘violent summer’ in the US — urges Americans to ditch ‘fake money’ and put it into ‘God’s money’ instead. Do you own any?

We adhere to strict standards of editorial integrity to help you make decisions with confidence. Some or all links contained within this article are paid links. Rich Dad, Poor Dad author Robert Kiyosaki has just issued a dire warning for Americans. “CIVIL WAR has begun. ICE raids in Los Angeles erupt into mass violence,” he […]

This Florida art collector says $17K in goods went missing after a local consignment store abruptly closed — and the owners seem to have vanished, too. How to spot shady resellers

Consignment shops can provide cheap finds for thrifty shoppers while serving as an alternative outlet for sellers. Rich Goren of St. Petersburg, Florida, sold art pieces at his local shop for years — only to one day arrive and find the shop empty, and his goods gone. Goren says two art pieces and two pairs […]

Many baby boomers are utterly unprepared for retirement — but here are 3 things the savviest of them do to basically guarantee themselves a life of comfort. Do you do any of them?

A significant portion of older Canadians are headed for retirement with insufficient savings. Spring Financial reports a median retirement savings of $809,100 for Canadians aged 55 to 64 as of 2025. Among those ages 65 to 74, the number decreases to $739,200. Considering Canadians think they need $1.54 million to retire, according to a study […]

California woman says she threatened a debt collector after taking this 1 golden nugget of advice from Dave Ramsey — and it worked. Here’s what The Ramsey Show hosts pushed her to do next

Mary from San Bernardino, California, is one month into following financial advice from The Ramsey Show, and although she’s already completed step one of Dave Ramsey’s baby steps, she finds herself facing pressure due to her debt. She shared with hosts Jade Warshaw and Ken Coleman that she has $9,000 in collections and $10,000 in […]

I’ve been studiously stashing away thousands in my daughter’s 529 plan for years — but suddenly she’s not even planning to go to college. What do I do with this fat fund now?

You’ve spent years saving diligently for your daughter’s education, only to learn she’s decided not to go away to college after all. If you have thousands stashed in a 529 plan, you might be wondering: What happens to that money now? At the end of 2024, roughly 17 million 529 plan accounts were open in […]

6 Florida deputies fired for allegedly ‘double dipping,’ filing false time sheets — robbing taxpayers of an estimated $14,000. Could you be risking your career through ‘overemployment’?

Five Florida deputies were arrested this month after an internal tip led the Nassau County Sheriff’s Office (NCSO) to investigate suspected cases of “double dipping.” Don’t miss I’m 49 years old and have nothing saved for retirement — what should I do? Don’t panic. Here are 6 of the easiest ways you can catch up […]

‘Mother Nature, she’ll claim it back’: Florida residents growing increasingly fed up with a vacant home on their street that’s been left to rot — here are the hidden costs of abandoned homes

In the southwest Florida coastal city of Cape Coral, residents of an idyllic neighborhood are fed up — and they say one vacant home is to blame. Don’t miss I’m 49 years old and have nothing saved for retirement — what should I do? Don’t panic. Here are 6 of the easiest ways you can […]

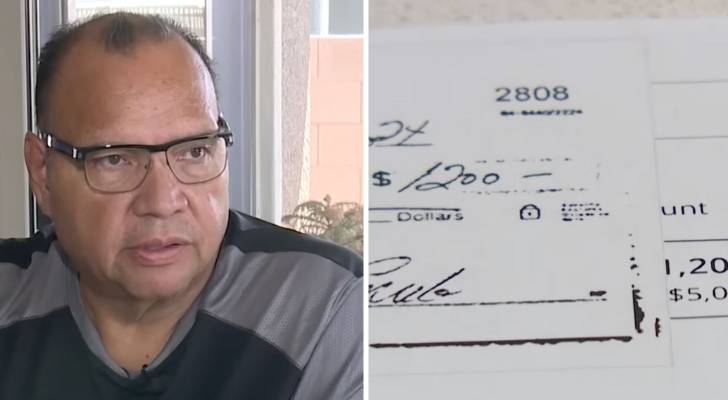

Las Vegas residents hit with ‘double whammy’ after losing thousands in alleged contractor scam — only for the state consumer protection agency to deny them reimbursement over a technicality

On June 10, the Nevada State Contractors Board issued a consumer alert about a company owner and associate who were arrested for fraudulent construction practices. The company in question was Patio Covers 4 Less. Ryan Vozzola, who was named as principal and Amy Rusch, who was named as de facto partner, were arrested and subsequently […]