Ark7 is a real estate investment app built to democratize real estate.

Available for iOS and Android, Ark7 lets you buy shares in curated properties for as little as $20 per share. The app is currently available in seven markets and plans to expand internationally.

Is Ark7 legit? How does Ark7 work? Can you invest in real estate through Ark7? Please keep reading to learn everything you need about the app today in our review.

What is Ark7?

Ark7 is a San Francisco-based startup company founded to make buying real estate as easy as buying stocks.

Using the Ark7 mobile app for iOS or Android, you can invest in real estate and earn passive income with no platform fees, management hassle, and minimum investment required.

Ark7 is currently available in seven markets across the United States. The company curates properties, then lets investors buy shares in those properties. You can get started for as little as $20 per share. Your share entitles you to a cash distribution on your investment (say, 4% to 5% each year). And you can sell your stake or buy more at any time.

As of 2024, Ark7 has 30,000 active investors, funded $15 million worth of property, and paid $1.5 million in cash distributions. Anyone can get started on the official website or mobile app stores.

Ark7 Benefits

Some of the benefits of Ark7 include:

- Buy shares in curated properties

- Invest in real estate for as little as $20 per share

- Earn passive income

- Buy or sell shares at any time

- It makes real estate investing as easy as stock trading

- Receive monthly distributions straight to your account

Ready to invest? Try Ark7 today!

How Does Ark7 Work?

Ark7 lets you download the app, browse available properties, and buy shares in those properties within five minutes.

Ark7 currently has curated properties available in seven states. You can buy shares of properties in the Phoenix, Atlanta, and Dallas metro areas, among other major cities. In the future, Ark7 plans to expand globally.

You can browse curated properties to find an investment opportunity you like. Suppose you want a piece of a multi-family new construction townhouse in Jonesboro, Georgia, for example. In that case, you can click to learn more about the opportunity, then invest for as little as $20 per share.

Ark7 curates properties using strict criteria. Instead of allowing any property developer to list properties on Ark7, the company handpicks properties it believes will be a good opportunity for investors.

After you buy property shares with Ark7, you earn cash distributions from those properties as rental income. You might earn 4% to 6% returns on your investment each month, for example, through rental income, giving you passive income on your investment.

As you hold the property, the value of the property could rise or fall. You can sell your shares or buy more based on how you want to diversify. You can continue to hold your shares for passive income. Or, you can sell your shares for a profit or loss as property values rise or fall.

You can even open an IRA with Ark7, buying real estate while enjoying all of the tax advantages of an IRA.

It’s free to download Ark7 and access the app. You pay no extra fees when buying or selling properties. However, Ark7 charges a fee for managing each property and handling the paperwork (8% to 15% of monthly rental income) and a one-time 3% fee for identifying and curating each property.

Ready to transform your finances? Try Ark7 today!

How Ark7 Buys & Manages Properties

Ark7’s portfolio consists of handpicked, curated properties.

The company’s website states they continuously strive to add new properties to their curated collection. The goal is to choose properties that drive optimal returns for investors, helping them diversify their portfolios, earn passive monthly income, and enjoy long-term appreciation.

Here are some of how Ark7 buys and manages properties:

- The Ark7 acquisition team “screens over 1,000 potential properties every month,” according to the official website, to find the best deals possible for investors.

- Ark7 specifically focuses on single-family and multi-family rental properties.

- Most Ark7 properties are in high-growth but not overly heated markets, as the company believes these markets provide the best returns.

- Before listing each property on the app, Ark7 purchases the property via a cash or financing strategy, depending on the market conditions. Then, the company passes this strategy to investors.

- Ark7 holds 1% to 10% shares of each property. The company does this intentionally, as they are held accountable for operational loss and profit of the property – just like other investors in the property.

- Ark7 manages each property itself or via its long-term strategic partners. With property management, Ark7 wants to ensure each property is well-maintained and reaches its maximum occupancy and rent price potential.

- Tenants of the Ark7 property communicate with managers through the Ark7 Renter App. All leasing, property management, accounting, and tax filing is automated or semi-automated via Ark7’s internal tools for improved accuracy and efficiency.

Overall, Ark7 aims to maintain a hassle-free and efficient property curation process. The goal is to consistently select properties that pose the most significant potential gains to investors while providing them passive income via rents.

Make your money work for you at Ark7!

How Ark7 Selects Properties

Real estate investing isn’t easy. How does Ark7 plan to beat the market and buy low and sell high consistently? How does Ark7 select properties with the best growth potential and passive income returns for investors?

According to the official website, these are some of the considerations Ark7 makes when purchasing properties:

Big Data, Local Expertise, and 100+ Indicators

To choose the right property location, Ark7 uses 100+ indicators – ranging from socio-economic factors to real estate market conditions to property-specific micro factors. These indicators help Ark7 determine if the area is poised for stable growth over time and how the location could change in the foreseeable future.

Supply and Demand-Related Factors

Ark7 evaluates the location of a property by assessing the balance between supply and demand. To consider supply and demand, the company checks factors like massive socio-economic development, population inflow, and friendly domestic policies. The company also analyzes the market explicitly: if there’s high growth in housing demand but not enough housing supply, then prices will rise until equilibrium is achieved.

Master City Development Plans

Many of Ark7’s hottest properties are near a city’s master development plans. The company recently listed three properties near Arizona’s “Silicon Desert” hub, for example, in the Mesa – Casa Grande area. The company also listed three properties near Philadelphia’s future Life Science Innovation Hub, near University City in downtown Philadelphia.

Communities Around the Property

In addition to analyzing the property itself, Ark7 considers the current state of the real estate market and the surrounding neighborhoods. Some of the factors involved in this part of the decision-making process include:

- Great accessibility

- A pleasing appearance

- High-rated public schools

- Parks

- Other living essentials

Explore the world of real estate investing with Ark7!

Real Estate Market Conditions

Ark7 also considers real estate market conditions. Is the property in a flourishing market with high demand and low supply? Have comparable properties sat on the market for weeks without being sold? Ark 7 considers factors like:

- How long have similar properties stayed on the market

- How much have similar properties sold for compared to their listed price

- How popular is the area compared to other local markets

Ability to Make a Profit

If Ark7 purchases the property, would it result in profitable returns for investors? Will investors earn a stable passive income via rent? Will the properties find it easy to find tenants? Or will houses deliver poor returns? After analyzing these factors, Ark7 can determine a property’s ability to make a positive and stable monthly income, then compare those numbers to its market value, measured by the CAP rate. To analyze these factors, Ark7 considers things like:

- Rental rates

- Rent-to-sale ratios

- Local policies on renting or zoning

- Natural factors that impact insurance and maintenance cost

- Property tax

- Rent sales tax

Property Uniqueness

Ark7 considers a property’s uniqueness compared to others in the same area. The company may buy a 10-bedroom duplex near a university campus for student housing (like its Philadelphia-D2 property currently listed on the app) or a kid-friendly family house in the Arizona suburbs for a young family working in tech.

Physical Property Factors & Inspection Results

Ark7 works with professional house inspectors to examine each property closely. Ark7 will consider listing the property on its app if everything looks good. The company believes things like:

- The appearance of the building, including the exterior, structure, and floor plan

- Conditions of the infrastructure based on local topography

- The results of professional home inspection reports

Ark7 describes its property section process as “art and science.” The company combines big data and local expertise while analyzing 100+ indicators to select the ideal properties.

When a property is listed on the Ark7 app, it has passed rigorous screening by its team. The team then translates all this information into information that investors can digest quickly.

Own a piece of American real estate with just $20!

Ark7 Property Selection: An Example

For an example of how Ark7 selects properties, consider two recent cases:

Ark7 Lists Three Properties in the Heart of Philadelphia

Three properties in the center of Philadelphia were recently listed on the Ark7 app. All three properties are near Philadelphia’s future Life Science Innovation Hub is growing within University City. Ark7 liked the area because it’s under a master city development plan built to attract large employers and creative startups. It should drive a highly skilled workforce and increased income to the area, creating a good situation for renters, young families, and owners.

Ark7 Lists Three More Properties in Phoenix’s Rising Tech Hub, Silicon Desert

Ark7 recently listed three additional properties on its app in the Phoenix metro area – precisely, in the Mesa – Casa Grande area. The site is under a master city development plan to attract large employers. Some see it as the “Silicon Desert.” Like Philadelphia Life Science Innovation Hub, Silicon Desert is expected to attract a skilled workforce and increased incomes.

As a testament to their smart property selection, Ark7 cites that year-over-year median home value in Casa Grande is up 34.1% since the announcement of a major semiconductor manufacturer and its suppliers moving to the area.

Similarly, the 5-year compound annual growth rate (CAGR) has reached 13.39% and is expected to continue growing.

Ark7 considers both YoY median home value changes and CAGR, forecasting the past ten years, to make smart short-term and long-term investment decisions.

Unlock the power of investing with Ark7!

Sample Ark7 Properties

Ark7 is available in seven markets across the United States and plans to expand internationally.

Ark7’s app features curated properties researched by their team. That team considers hundreds of factors before listing each property on the app.

Some of the Ark7 properties available include:

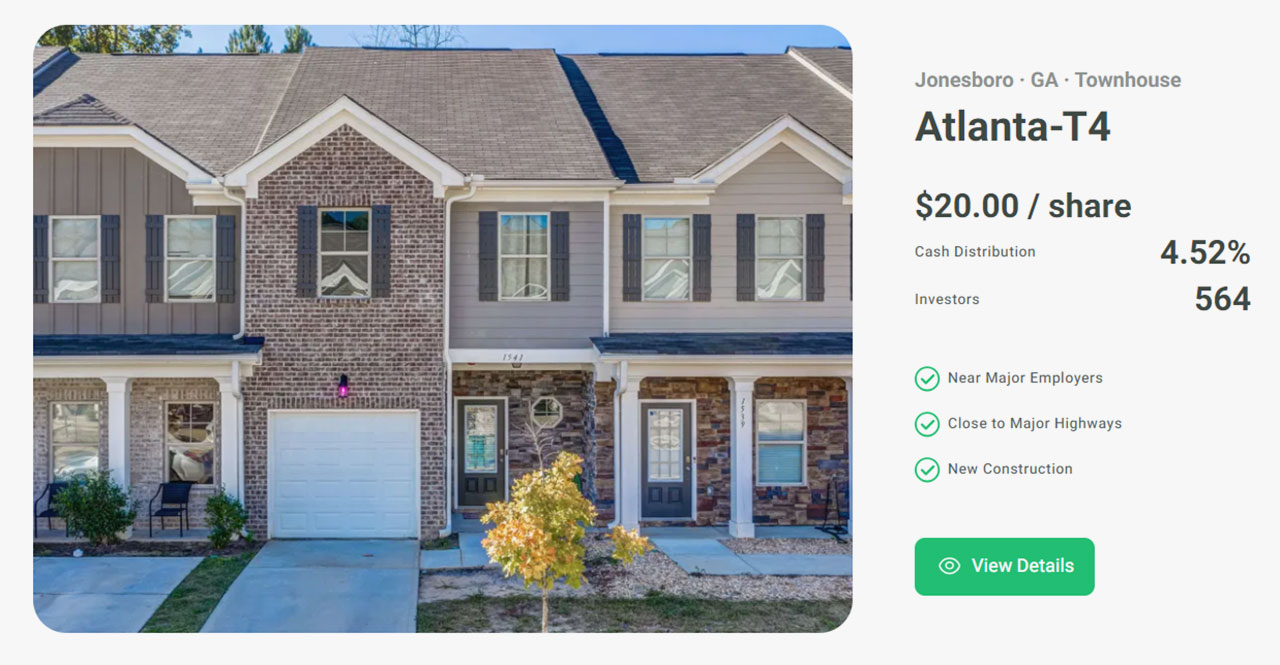

Atlanta-T4

Priced starting at $20 per share, this townhouse is in Jonesboro, Georgia, close to major employers and highways. It’s a new construction. Ark7 expects a cash distribution of 4.52% and has 500+ investors.

Dallas-S9

Ark7 has a single-family home in Mesquite, Texas, with shares starting at $20. The house is near major employers, close to major highways, and has value-added upgrades. It currently has a cash distribution of 4.55% and 1,100+ investors.

Dallas-S8

Ark7 has another single-family home in Mesquite, Texas, starting at $20 per share. Like Dallas-S9, Dallas-S8 is close to major employers, is close to major highways, and has value-added upgrades. It pays a cash distribution of 4.81% per share and has 1,050+ investors.

Philadelphia-D2

Ark7’s Philadelphia-D2 is a multi-family property in Philadelphia, Pennsylvania, within walking distance of Temple University’s campus. It’s also close to public transportation and has value-added upgrades. You can buy a share of Philadelphia-D2 for $96.70 per share and earn a cash distribution of 6.40%. A total of 200+ investors have purchased shares to date.

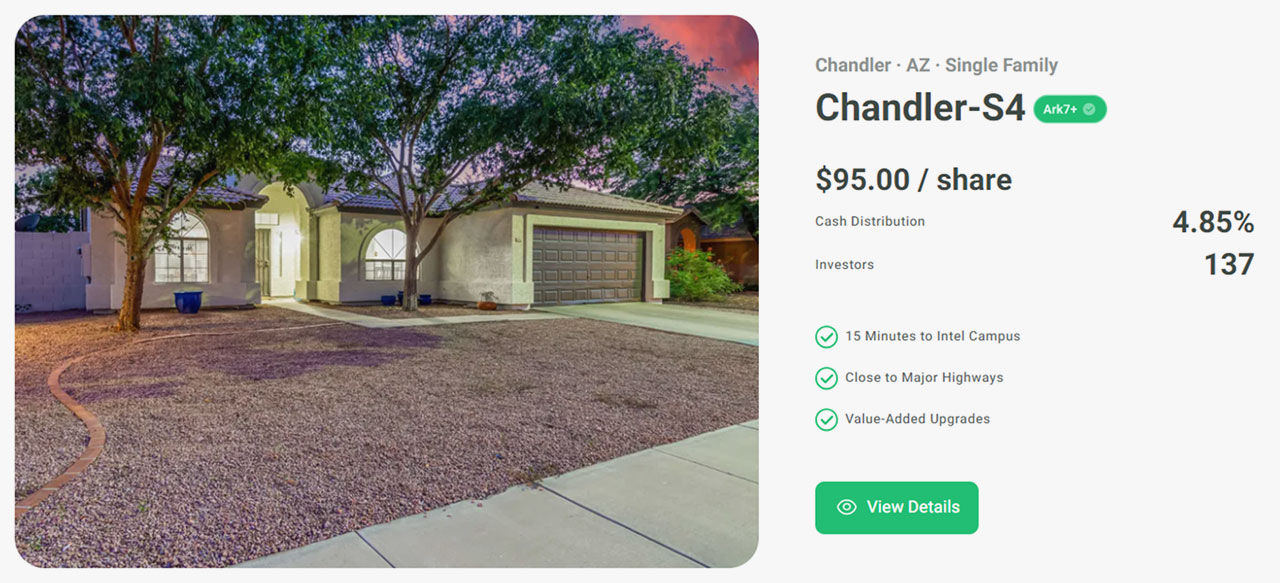

Chandler-S4

Ark7’s Chandler-S4 property is priced at $95 per share and pays a cash distribution of 4.85%. A total of 130+ investors have purchased shares. The single-family home is 15 minutes from Intel’s campus, close to major highways, and has value-added upgrades.

Join Ark7 today and turn your financial dreams into reality!

How the Ark7 App Works

Ark7 has designed its app to be the most intuitive real estate investment. Available for iOS and Android, the app has average scores of 4.1 stars to 4.4 stars out of 5 across the app stores, with most users satisfied with Ark7’s mobile apps and how they work.

You can learn about properties, invest, and explore opportunities through the Ark7 app.

Here are some Ark7 app features and how it works:

Step 1) Explore Available Properties

Use the Ark7 app to browse the currently available properties. The front page of the app features a list of curated, income-generating properties in top markets across the United States. You get at-a-glance information about each property, including its cash distribution percentage, the number of investors, the number of available shares, and the cost of each.

Step 2) Learn More About a Property

If you are interested in a property, you can learn more about it using the Ark7 application. For example, you can discover location information, financial data, disclosures, documents, and other paperwork about the property. You can easily see why Ark7 invested in the property due to its proximity to major employers and highways.

Step 3) Buy Shares

If you want to invest with Ark7, select the desired number of shares for a property and place an order. You can connect your checking account to the platform to access your funds.

Step 4) Manage & Enjoy

You can open your Ark7 app to check your shares and see how they’ve risen or fallen in value over time. You can also see any dividends you’ve earned. Ark7 takes care of all of the accounting paperwork behind-the-scenes, making it easy for you to get reliable payouts and an at-a-glance look at the equity you have in the platform. You can sell your shares at any time.

Overall, Ark7 lets you invest in real estate in under five minutes with the ease of any investing app. It’s as easy as buying or selling shares – you can do everything without leaving your mobile device.

Find your path to wealth with Ark7’s real estate investments >>>

How Ark7 IRA Accounts Work

Ark7 has also launched individual retirement accounts for real estate, allowing you to hold real estate with all the tax advantages of an IRA.

You can open a traditional IRA or Roth IRA via Ark7, contributing up to your annual IRA contribution limit.

Here’s how Ark7’s IRA accounts work:

- Step 1) Create an IRA account on Ark7

- Step 2) Fund your Ark7 IRA account by transferring funds from an existing IRA or making a contribution from a bank account

- Step 3) Buy property shares through Ark7 just as you usually would, using your IRA funds while enjoying all of the tax advantages of an IRA.

Yes, you can use your IRA to buy real estate. By buying real estate using your Ark7 IRA, you own tangible property that may appreciate over time while enjoying the tax benefits of an IRA.

Although Ark7 does not charge a fee to open an IRA, you pay a $100 per year per property custodial fee to Ark7’s IRA custodian provider, Millennium Trust Company. The cost is capped at a maximum of $400 per year. And if your account balance is over $100,000, your annual fee is waived.

Ark7 Pricing: How Does Ark7 Make Money?

The Ark7 platform and app are available at no cost to users. However, the company charges a one-time sourcing fee and monthly asset management fees for each property, which is how Ark7 makes money.

Here’s how Ark7’s pricing works:

- Sourcing Fee: Ark7 charges a one-time sourcing fee of 3% of the property market cap. Ark7 charges this fee in exchange for sourcing, acquiring the property, and listing it on the Ark7 platform as sellable shares.

- Asset Management Fee: Ark7 charges a monthly fee of 8 to 15% of rental income from the property. Ark7 charges this fee in exchange for maintaining the property and managing tenants.

As an investor, you pay these fees automatically when investing in a property. However, there are no fees when buying properties, investing through Ark7, or selling shares.

Maximize your investment with Ark7’s affordable real estate options. Act now!

Other Ark7 Features & Benefits

Other Ark7 features and benefits include:

- Money is Secured: Ark7 lets you link your bank account to the platform safely and efficiently. The company uses Plaid and Dwolla to make transactions secure.

- Affordable Investing: You can invest in real estate with just one share and $20 through Ark7. Whether you’re looking to invest $100 or $100,000, you can quickly get started with Ark7.

- Diversify Your Portfolio: You may have stocks and bonds in your investment accounts, but Ark7 makes it easy to diversify into real estate. You can also diversify your real estate portfolio nationwide. If you own a house in California but want to invest in Arizona’s growing market, you can do so with Ark7 without actually buying in Arizona.

- Real Monthly Income: Ark7 pays you real monthly income through cash dividends. You can view your expected cash dividend before you invest, and you get paid based on actual market conditions and real rental income.

- Ark7 Manages Property & Paperwork: Ark7 manages the property and all paperwork while charging a fee of 8 to 15% of rental income each month – similar to how a property manager works. As a fractional property owner, you don’t need to do anything to manage the property.

- Modern Interface: Ark7’s apps and websites have solid scores for their interface. You can install the app and buy your first fractional real estate share within 5 minutes.

- High Liquidity: Want to sell your fractional shares? Thanks to the high liquidity on Ark7’s secondary market, you can easily do that. Whether you want to cash out or buy a different property with Ark7, you can avoid being locked in because of the liquidity of Ark7’s platform.

Discover affordable real estate investment opportunities with Ark7!

Ark7 Reviews: What Do Customers Say?

Ark7 is a unique new concept. Usually, you can’t buy fractionated real estate as quickly as you would buy stocks, but Ark7 flips that concept on its head.

So what do users say about Ark7? Can you earn 4% to 6% returns on investment by buying shares in properties across the United States?

Here are some of the reviews shared by users, major media, and others about Ark7:

Benzinga describes Ark7 as “a pioneer in the real estate industry,” praising the company for helping thousands of retail investors enter the market.

USA Today likes how Ark7 is “democratizing real estate investing” while making it easy for first-time investors to diversify their portfolios and expand into real estate.

Nasdaq wrote how Ark7 has “revolutionized the real estate industry” by making it accessible to investors – regardless of the accreditation or financial capabilities of those investors. You don’t need $100,00 to invest in real estate, nor do you need to be an accredited investor.

Ark7 has an A+ rating on the Better Business Bureau (BBB) website. The company also has 0 customer complaints.

Ark7 has a 4.2-star rating out of 5 on Trustpilot with 80+ reviews. Most customers (70%) have given the company a 5-star rating, praising its accessibility, good UI, easy-to-understand investing process, and overall smooth investing experience. The few negative reviews on Trustpilot do not appear to be legitimate complaints about Ark7’s service, quality, or reputability, and most investors have had a smooth investment experience.

The Ark7 iOS app store page has an average rating of 4.4 stars and 100+ reviews. Customers like the app, praising it for its usability, easy-to-understand UI, and smooth transaction process.

Ark7 has a 4.1-star rating on the Google Play Store with 30+ reviews. Reviewers have left positive reviews for Ark7 based on its easy interface, hassle-free investing process, and transparent reporting.

Ark7 reviewers have minor complaints about customer service issues, including difficulty reaching customer service personnel with concerns or complaints.

Across all review websites, Ark7 appears to do an excellent job of responding to customer concerns and complaints. Most Trustpilot reviews – good and bad – have responses from the official Ark7 account.

About Ark7

Ark7 is based in San Francisco, California. The company was founded by Andy Zhao (founder and CEO) and Lynn Yang (co-founder).

You can contact customer service via the following:

- Phone: (415) 275-0701

- Mailing Address: 535 Mission St Fl 14, San Francisco, CA 94105-3253

Final Word on Ark7

Ark7 is an app and platform that simplifies investing in real estate by providing a curated selection of properties throughout the United States.

For as little as $20, you can invest in real estate markets, diversify your portfolio, and earn passive income on your money.

To learn more about Ark7 and how it works or to start investing in real estate today, visit the official website.

For product review questions or feedback, please contact healthnewsflashreviews@gmail.com

Affiliate Disclosure:

The links contained in this product review may result in a small commission if you opt to purchase the product recommended at no additional cost to you. This goes towards supporting our research and editorial team. Please know we only recommend high-quality products.

Disclaimer:

Please understand that any advice or guidelines revealed here are not even remotely substitutes for sound medical or financial advice from a licensed healthcare provider or certified financial advisor. Make sure to consult with a professional physician or financial consultant before making any purchasing decision if you use medications or have concerns following the review details shared above. Individual results may vary and are not guaranteed as the statements regarding these products have not been evaluated by the Food and Drug Administration or Health Canada. The efficacy of these products has not been confirmed by FDA, or Health Canada approved research. These products are not intended to diagnose, treat, cure or prevent any disease and do not provide any kind of get-rich money scheme. Reviewer is not responsible for pricing inaccuracies. Check product sales page for final prices.