About half of the country’s population has a bad credit score that keeps them from doing what they want. Luckily, the evolving industry has allowed consumers to borrow the money they need to get through one emergency or the next, even with bad credit. New companies are constantly launching to meet this need, though it comes with some caveats.

Anyone with bad credit must be careful about how they get their loans. There are predatory companies and overpriced agreements that could ultimately put someone in a worse position than they were before. By seeking out a loan from one of the lenders in this guide, consumers can bypass the need to filter through the scams of the market today. Instead, they’ll have positive relationships with fair and helpful lenders.

The Top Bad Credit Lenders of 2024

After countless hours of research, this guide ultimately settled on the top bad credit lenders. Those companies include:

- MoneyMutual

- BadCreditLoans

- PersonalLoans

- CashUSA

- Funds Joy Loans

- Upgrade Personal Loans

Read on below to learn more about how these companies help consumers who struggle with their credit:

MoneyMutual

- Loans offered: $100 to $5,000

None of the companies on this list have quite the popularity that MoneyMutual does. With the ability to get up to a $5,000 deposit within the next 24 hours, consumers with any score can take care of their financial obligations. Individuals with bad credit who need a lot of money immediately will see a solution in this company.

Taking out such a large sum can seem overwhelming, mainly when a circumstance arises that won’t cost anywhere close to $5,000. Consumers can request loans as small as $100, giving them the small but necessary funds they need.

As one of the longest-running financial services with bad credit options, this brand continues to support consumers everywhere from their homes in Las Vegas, Nevada. Since its launch, they’ve helped over two million customers to be happier with their financial concerns. It also holds membership as part of the Online Lenders Alliance (OLA) and CFEF.

BadCreditLoans

- Loans offered: $500 to $10,000

BadCreditLoans has one of the most straightforward application processes found in the industry. With the ability to get up to $10,000 in a single loan, this company offers one of the higher options available to cover the unexpected bills that can arise. Consumers could use this money to pay for other loans and compress everything into one.

This service is available for free, making it possible to search the rates of multiple lenders simultaneously with the same application. If the user sees a lender they want to borrow from, they can fill out additional questions to determine if it fits. The lenders will charge a separate fee, but all of these charges are clearly shown on the website before any agreement is complete.

The BadCreditLoans platform is available 24/7, allowing users to sign on at any time of day or night to look for their solutions. This website is transparent in what they offer, making them increasingly popular. With the ability to work with nearly any lender, consumers with almost any credit history or concern can get the loan they need.

PersonalLoans

- Loans offered: $1,000 to $35,000

PersonalLoans makes finding a loan more accessible, offering high limits for any credit history. This brand offers an incredible $35,000 maximum on loans, giving users what they need to fund emergency expenses or anything else. Like the other platforms on this list, this website helps consumers shop for the best option for their needs for free. It is entirely up to the customer to decide which of the many lenders they should choose.

To access these loans, consumers must enter their information and peruse the options offered. They’ll also have to complete an application for their chosen lender and be subjected to other fees and interest to consider. To ensure no confusion or dishonesty, the creators show all the charges to customers before committing to the loan.

This website is pretty easy to use and safe. The website protects user data by offering security and data encryption technology support.

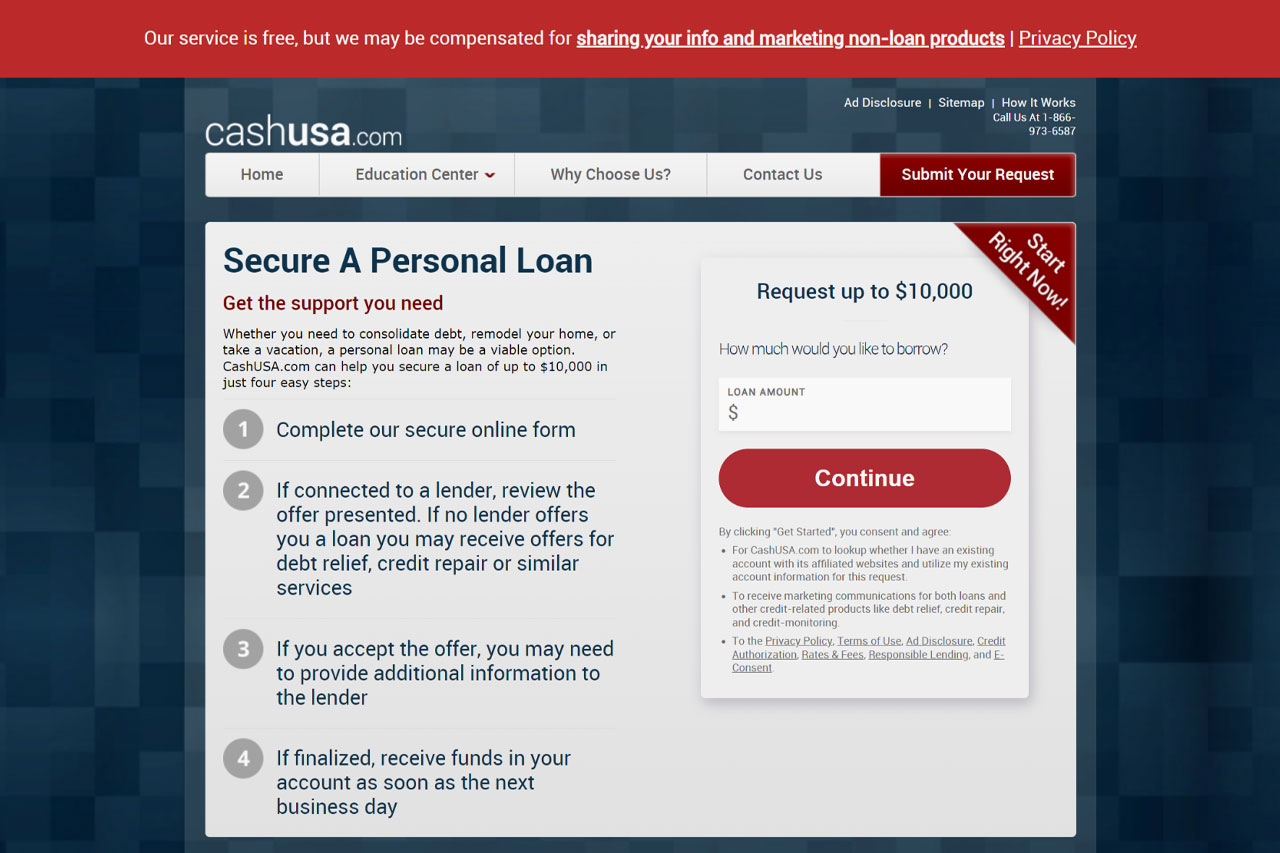

CashUSA

- Loans offered: $100 to $10,000

CashUSA was created to help consumers with Average, harmful, or no credit. This platform works for all credit scores, offering a competitive payment schedule as users fulfill their payback commitment. To get started, consumers will need to complete the form online and go over the offers that are available to them. They’ll choose from different interest rates and how long the user wants to spend to repay it.

Like other lenders, this platform has detailed and easy-to-understand requirements for borrowing. Only US citizens or permanent residents can apply. They also must have had a job for the last 90 days. Consumers will also need a routine and account number to deposit the money.

Funds Joy Loans

- Loans offered: $100 to $10,000

Fund Joy Loans might not be as well known as the other platforms on this list, but it still offers many benefits. It takes about 10 minutes to complete the online form, allowing users to get up to $5,000 with their loan. The advanced system offers a direct path for consumers to get a loan using a computer, tablet, or mobile phone.

This platform directly brings lenders to customers to ensure they get the best offer possible. They’ll explain the APR, terms, and details consumers need. Since all the fees are clearly outlined, consumers go into any loan with a complete understanding of the commitment.

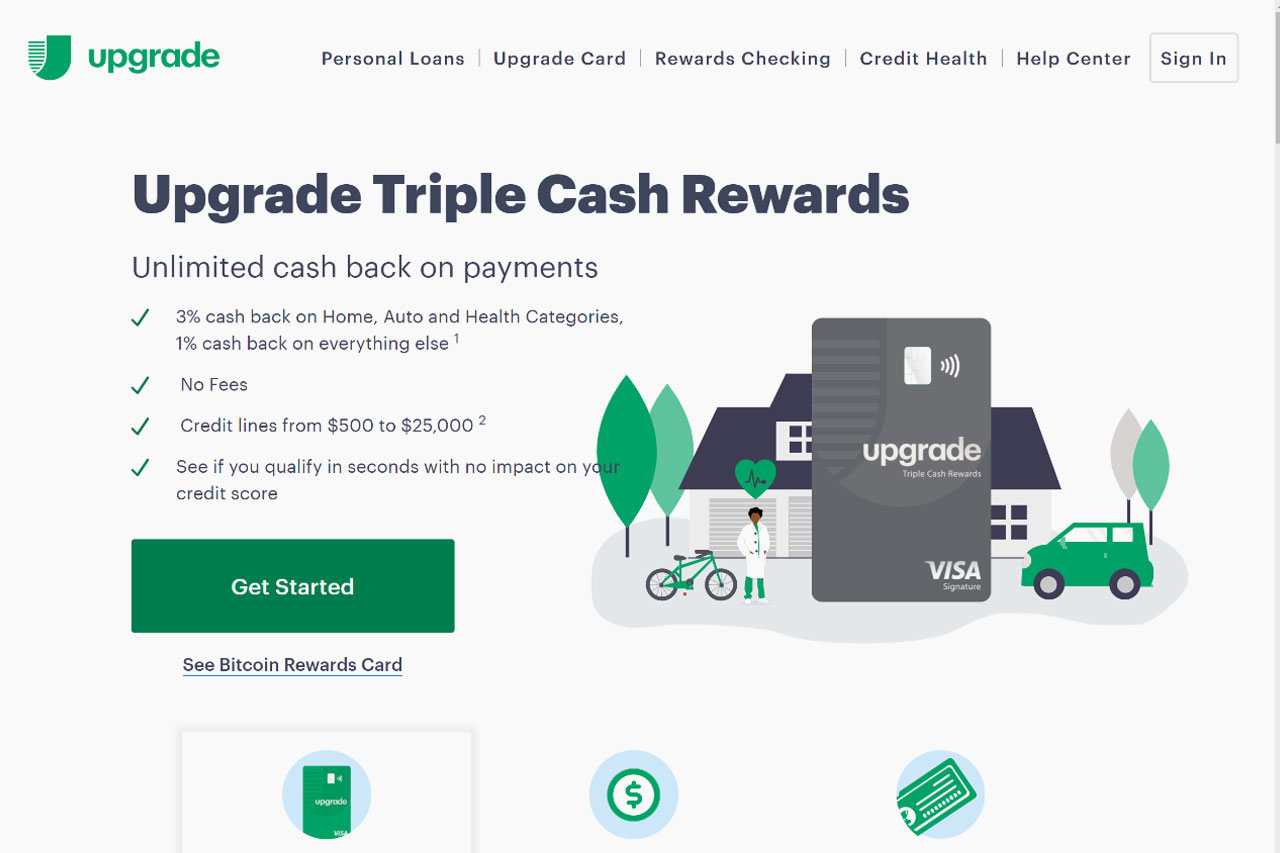

Upgrade Personal Loans

- Loans offered: $100 to $50,000

Upgrade Personal Loans is the final platform that supports bad credit loans. This financial services company directly interacts with customers to get fee-free checking accounts, affordable credit lines, and substantial personal loans. This opportunity makes it possible to borrow up to $50,000, allowing users to get one of the highest amounts on the list.

This platform helps consumers to build their financial future with complete and direct support. Personalized loans offer a great way to improve the user’s future, ensuring that anyone can get low fixed rates, no prepayment fee, and low monthly payments to fulfill the financial obligation. This company offers other financial services, including refinancing credit cards or simplifying checking accounts.

How We Chose The Best Bad Credit Lenders

The only way to ensure a bad credit lender is genuinely what they say they are is by carefully reviewing all the options offered to consumers. To create this guide, many factors were considered to ensure that users get exactly what they hope for.

Total Possible Loan Amount

Even with bad credit, consumers nowadays might be shocked to learn that they could potentially borrow thousands of dollars, getting them out of financial binds that they’ve previously been in. The top lenders for bad credit will typically offer up to $5,000 for a loan, but some of the options in this guide offer as much as $50,000.

Waiting Time for a Deposit

No one wants to wait forever to get funds when it is money that they’re counting on to get them through. Some lenders can access funds within a few hours, though others can take up to 7 business days. While lengthier deposit times might seem inconvenient, all waiting periods were considered.

Ease of Use

Some companies create anxiety and distrust among consumers because of their complicated application processes. Their websites aren’t very user-friendly, and they might even be outdated. These platforms had to work for consumers’ needs would be a necessity.

Rate of Approval for Bad/No Credit

The companies in this guide all accept applicants with no credit or poor credit. Some of these lenders also market to people with good credit, but the only way they were listed in this guide is if they also offered services to bad or no credit.

Transparency

Every consumer wants to know exactly what they agree to before they invest their time and commit to repayment of the loan. A suitable lender will show all the percentage rates and fees they charge before the user commits. By law, they can’t charge more than a certain amount of fees, and even a lender for bad credit will abide by the current regulations of the financial sector.

Competitive Pricing

Even though these companies focus on supporting bad or no credit, they must price competitively to attract customers. Some companies take advantage of their customer’s bad situations, using them to make a lot of money. Others want to be competitive, offering customers a rate to draw them in. The cost and value of every brand were considered in these rankings.

The Reputation of the Lender

With so many scams in the financial industry today, shady companies have settled themselves in their ways. That’s why this guide had to learn about these lenders’ reputations in the industry. The most reliable brands have been helping consumers to borrow much-needed money for the last few decades. Though the length of time that these lenders have been around wasn’t as big of a factor, the reputation they’ve earned was important.

Reviews from Customers

Each bad credit company listed had customer reviews to ensure this guide had a complete idea of its interactions. For instance, the top choice on this guide, MoneyMutual, has over two million reviews and still maintains a 5-star rating amongst users. The customer is the only person these companies should be concerned with, and their experience helped curate the guide.

Security, Certification, and Regulation

Most people know they shouldn’t invest overseas to maintain a safe and healthy financial portfolio. The laws regarding the security and management of these funds can vary, which is why many bad credit lenders have offshore roots. However, the most reliable options are already members of the OLA and CFEF, ensuring they can be encrypted with the same technology that federal banks and credit unions use.

Repayment Schedules

The top companies allow consumers to have various options when repaying them. Since most customers work around their paydays, the companies selected for this guide had to offer the chance to pay weekly, monthly, or any other schedule that would help the user.

Quality of Affiliated Lenders

Though some of the options on this list offer loans to customers directly, many are platforms connecting customers with a plethora of lenders at their service. These platforms share the customer’s data with a group of lenders they trust, helping users to shop around until they find the best rates for their needs. Without the ability to rate these platforms’ services (since they have none), this guide considered their performance by judging the lenders they work with.

How a Bad Credit Loan Works

The truth is bad credit is a problem that haunts millions of Americans. Everyone sometimes finds themselves in a bind that a loan could help them out of. Unfortunately, most people aren’t prepared. A report from the US Federal Reserve on the Well-Being of US Households found that 4 out of every 10 Americans wouldn’t be able to cover $400 in emergency expenses if faced with this issue. Plus, about half of Americans have a credit score that isn’t what they’d need for any other loan.

Companies that offer loans to people with bad credit can get cash from people who need it in exchange for interest fees. Anyone could borrow money today with the ability to pay it back over time with a small charge for using the service, working in the same way as a car loan or a mortgage.

When applying for a bad credit loan, the application online usually includes the following:

- Contact information.

- The total amount of loan requested.

- Potential borrowing period.

- Bank account details (routing and account number for direct deposit).

Once this information is entered, users then have to wait for an acceptance of the application. Acceptance usually means customers have their funds in the next 48 hours, but the lender upfront will disclose the total wait time.

Repayment will vary from one lender to the next, sometimes offering up to three years to pay it back—however, some lenders as for a lump sum to be paid by a specific date.

Customers should be aware that some websites for bad credit lenders require that users enter their social security numbers. This number allows them to check their credit score and history to determine the risk of loaning to them. Access to the user’s credit history is a soft inquiry, so it should not impact the user’s score. However, if the user’s credit score is also being checked, it is a hard inquiry, which could affect the user’s credit score if it repeatedly occurs.

Finding a compatible lender is possible regardless of the user’s credit score.

Bad Credit Loan Requirements

There are certain qualifications for bad credit loans. While the specific requirements could vary slightly, they generally state that:

- The borrower must be at least 18 years old.

- They must be either a United States citizen or a permanent resident.

- They must be currently employed for the last 90 days.

- Their income must meet specific amounts to determine the possible loan offered.

- They must include their phone numbers for work and home.

- They must provide their email address for electronic communications.

The income requirements will vary from one lender to the next. Some lenders require higher wages to counteract the user’s low credit. Others cater to low-income consumers, though the interest rates tend to be higher with sooner payback dates.

Regardless of the customer’s financial situation, meeting those requirements should be everything the individual has to do to get a loan for bad or no credit.

How Much Do Bad Credit Loans Cost?

The cost of a bad credit loan depends on multiple factors, including the amount the user wants to borrow, their current credit score and history, and the repayment terms. With these details disclosed to customers upfront, many bad credit loans offer as small as a 5.99% interest rate.

With a 5.99% interest rate, a $1,000 loan could cost less than $60 for the fee to take an entire year to pay it off. An APR of 7.9% is another typical rate. Borrowing $1,500 with up to two years to pay off the loan would cost about $126.54 in fees.

Borrowers with bad or no credit might experience higher interest rates than those with a good score. Using one of the platforms to connect with multiple lenders allows borrowers to connect with various options that could serve them well.

If the loan defaults, these companies tend to charge additional fees that will add to the total cost of the loan. Users who can’t keep up with their payments or struggle to complete payments by the end of the term could experience detrimental penalties. Borrowing money should only be an option if the customer can maintain repayment.

Will a Bad Credit Loan Impact Your Credit Score?

When a potential borrower submits their information on a website to qualify for a small loan, the platform will launch a soft inquiry on their credit. A ‘soft’ query has little to no effect on the credit score, even if the user applies to qualify for dozens of loans with different lenders. This option often verifies the user’s identity and connects them with the application process.

Choosing a lender and submitting a loan application is a different story. This request is a direct application to form an agreement with the lender, considered a hard inquiry. While 1 or 2 hard inquiries shouldn’t influence the credit score much, applying for loans with multiple lenders could create a dip in the individual’s credit score.

To avoid the effect on the credit score, most financial experts say it is essential to use a platform to qualify for multiple lending websites rather than blindly applying to dozens of lenders. Soft inquiries like these will not put the user at risk of harming their credit score. However, they’ll be able to narrow down the options to one loan application, ensuring that a standalone hard inquiry won’t have a damaging effect.

In some cases, lenders will report the payments that users make to the credit bureaus, which is why it is so important to make consistent payments. This consistency tackles one of the most significant concerns on someone’s credit score – payment history. Establishing regular payments will be incredibly beneficial for anyone who wants to improve their bad credit.

Are Bad Credit Loan Websites Safe?

Bad credit loans have gotten a reputation for being a scam, but the ones on this list have been screened for safety. All the services have been verified for authenticity with the criteria provided in this guide.

Protecting against malicious loan websites online is paramount for anyone who borrows money. While these websites might claim that procuring the funds is easy and no credit check is required, consumers should always examine the terms of their contract to be safe. Looking for reviews of bad credit loan websites can provide helpful insight regarding the services offered.

With a suitable lender, all of the borrower’s information is protected by bank-grade encryption, preventing them from being hacked or having their identity stolen. The top websites for bad credit loans have thousands of customers, demonstrating the repeated trustworthiness of their brand.

Any lender must abide by strict regulations whether they support customers with bad or good credit. The service always charges a fee, but lenders have restrictions on how high they legally can raise these rates.

Secured Loans Vs. Unsecured Loans

Someone with bad credit has two options – a secured or unsecured loan. Credit score, the amount of the potential loan, current collateral, and income all play a role in determining the best choice for the borrower’s needs.

Secured Loans

A secured loan requires collateral, giving the company “security” that they will have their loan paid back or keep something equal in value from the borrower. Some examples of valuable items that might be used as collateral include cars, coins, and antiques. The user borrows money the same day, and the lender can keep the collateral if they default. Many consumers already have this type of loan because of their mortgage, which is secured by the house that the bank can repossess if payments aren’t made.

Someone with bad credit can benefit from a secured loan because of the motivation to keep their collateral when their payments are complete. Anyone with collateral can borrow up to the value of their chosen item.

Unsecured Loans

The majority of bad credit loan companies offer unsecured loans. No collateral is required in the exchange, but the loan is ultimately secured by the borrower’s credit score and the perceived ability to repay what’s loaned.

Since unsecured loans come with a higher risk for the lender, the interest rates tend to be high. While a secured loan might have a rate of 5.99%, an unsecured loan could be up to 35%. With this added fee, an unsecured loan costs more financially in the long run, but borrowers have the luxury of not putting anything valuable at risk during repayment.

How to Avoid Bad Credit Loan Scams

As many good lenders as the industry has, there are many more scammers. To avoid scams, here are a few tips that any new borrower should remember:

Check Reviews on Google

Understanding the experience of other customers will paint a clear picture of the reputation that the lender has garnished. The best companies tend to be at the top of the list with positive ratings.

Check Ratings for the Lender With the Better Business Bureau (BBB)

While some lenders might have bad ratings for the experiences of some users, others show consistency in how well they treat their customers.

Check Requirements for Procuring and Paying Back the Loan

By law, all lenders have to be transparent in their lending terms. Any company that claims to offer free money without showing the fees associated with the agreement could be a scam.

Avoid Lenders Without Credit Checks

Every lender with an online application process will require the user’s social security number or the last four digits. This step is how lenders determine that the customer can repay the loan. Ignoring credit history could be a sign of a scam as well.

Compare Lender Names With Similar Names for Credit Cards and Financial Institutions

One of the techniques of today’s bad credit loan scams is that these lenders will have names familiar with longstanding institutions. They piggyback on the company’s reputation, which the user might be more familiar with, to form a false sense of trust.

Avoid Lenders That Don’t Document the Loan

Every lender records their customers, loans, and other critical financial data because their business is based on it. However, some companies might urge customers to only interact over the phone without requiring some or any paperwork. In the United States, it is illegal for loans or credit cards to be provided over the phone without this documentation.

Check for State Registration

Lenders must be registered to do business in the state they offer loans. Financial regulations of a particular state will allow new customers to check bad credit lender’s authenticity.

Don’t Pay the Fees Before Receiving the Loan

When a company scams customers, they might request that the user send them money for approval. More often than not, these are scams and should be avoided. Never send any lending company money upfront. Many legitimate companies require no hidden fees, deducting any fee from the loan the user procures.

Determining Your Credit Score Classification

A credit score is calculated based on the payment histories and habits of the individual. A good credit score unlocks many opportunities because it shows that the borrower consistently pays off their loans and maintains minor damage to their financial history. With a bad credit score, those doors close and require more collateral from the average customer.

Here is how a lender typically ranks credit scores:

- Exceptional Credit: 800+

- Very Good Credit: 740 to 799

- Good Credit: 670 to 739

- Fair Credit: 580 to 669

- Poor Credit: 580 or below

Top 7 Types of Bad Credit Loans

Even when someone has a lackluster credit score, that doesn’t mean all opportunities are gone. There are many lending opportunities to help them get back on track.

Even though a bad credit score can interrupt the path to a new car or home, there are plenty of options when money is needed.

Online Bad Credit Loans

These loans are the easiest way for the average consumer to get funds fast. Much like a payday loan or cash advance, a website requires users to prove their income to determine what they qualify to borrow.

Bank Agreement or Line of Credit

Even someone with bad credit might have a history with their bank that shows their consistent income and spending habits. Banks sometimes allow customers to open a line of credit or a short-term loan to support their emergency needs.

Home Equity Loan or Home Equity Line of Credit

Home equity loans allow consumers to use their homes as collateral in a secured loan. They work like credit cards, allowing users to borrow up to their home’s value.

Peer-to-Peer Loans

A peer-to-peer loan means the customer has an agreement with a specific person. A perfect example of an informal peer-to-peer loan is one in which an individual borrows from a friend. However, some websites allow peer-to-peer lending, including checking a credit score.

Secured Personal Loan

A secured personal loan lets someone take out collateral on a valuable item. Pawn shops and title loan companies are commonly known for using this technique. As soon as the loan is repaid, the lien on their item is lifted with no risk of losing it. However, with these loans, defaulting could mean losing the valuable item used as collateral initially.

Student Loan

Someone with bad credit can still get a student loan from the federal or state governments. They are even offered privately. With a student loan, the requirement is only for the individual to be enrolled in school part-time or full-time, but their credit is not as big of a concern.

Car Title Loan

Anyone with a paid-in-full vehicle can get a secured loan with their car as collateral. Customers get their cash now, and anyone who defaults puts their vehicle at risk of repossession.

Frequently Asked Questions About Bad Credit Loans

Q: How much money can consumers borrow with bad credit loans?

A: The total amount will vary, though most websites offer between $100 and $50,000 with poor credit. Some lenders want to learn more about the user’s source of income rather than zeroing in on their evolving credit score. Someone with a high income can borrow more than someone with a limited income. Still, even fixed income can get a significant loan.

Q: Will a bad credit loan positively impact the user’s credit score?

A: Possibly. The key to improving any credit score starts with making payments when they are due, so consumers who keep up with the payment schedule should be able to see their scores improve. However, late or missing payments could have the opposite effect.

Q: How can consumers raise their credit scores?

A: To raise a credit score, consumers must invest their time and money in paying account balances, maintaining on-time payments, and opening new credit accounts for more available credit. Consumers can also reduce how much of their available credit is used.

Q: How does a bad credit loan work?

A: A bad credit loan requires that users complete an online application with their personal information and direct deposit details. The possible lenders then verify the information and send funds to users. The loan is often repaid monthly or bimonthly, working similarly to a payday loan or any other short-term loan.

Q: What is considered a bad credit score?

A: A credit score under 580 is poor. However, not all lenders factor in this score when offering a loan.

Q: What’s a good credit score?

A: To be considered good, the FICO cred sore should exceed 670. However, exceptional credit is anything over 800.

Q: How do consumers know if their credit is bad?

A: People who default on a loan have damaged their credit score. Consumers can also lower their scores when they miss credit card or loan payments.

Q: How can someone check their credit score?

A: If the individual wants to check their scores with all primary credit monitoring platforms, they can check for free at AnnualCreditReport.com. By law, every person can get a free copy of their credit report once a year from each bureau. Many platforms offer free credit checks or memberships for continued tracking.

Q: How is a credit score calculated?

A: A credit score is usually determined first by payment history (35%). Then, they consider how much of the available credit is being used (30%), how far back their credit history goes (15%), the different types of credit that users have (10%), and any new hard or soft inquiries recently (10%).

Q: How can someone get a loan when they already have bad credit?

A: Bad credit lenders and other sources offer loans for even the worst credit scores. Even if the individual has a low score, many options with higher interest rates or payments are available.

Q: What will users need to have ready to apply online for a bad credit loan?

A: Most lenders for bad credit will require that the applicant is a current US resident over age 18. The borrower must have maintained a steady job for the last three months and have a valid checking account and social security number.

Q: How long will consumers have to wait to get their money?

A: Lenders often deliver funds within 1-2 business days when using direct deposit. Some deposits happen faster.

Q: What do users have to do to pay back their loans?

A: The repayment depends on the loan, but most lenders require that the user makes payments on a schedule. Schedules are available for weekly to monthly installments.

Q: What happens if the user can’t pay back the loan?

A: There are always penalties for defaulting on a loan. Each contract outlines the consequences of not following through with the repayment schedule.

Q: Are bad credit loans real?

A: These types of loans are legitimate. They have been around for years and are a regulated service industry. It also must be registered in the state where the user gets their loan.

Q: What is the top bad credit loan company?

A: The best companies to get bad credit loans from include MoneyMutual, BadCreditLoans, and PersonalLoans, according to the ranking criteria for this guide.

Q: How does a loan without a credit check work?

A: Many bad credit loans don’t consider the user’s credit when establishing a loan. Instead, this guide focuses on the user’s income, basing their qualifications on how much money they make. However, without a credit check, consumers might have to deal with higher fees or interest rates.

Q: What’s an origination fee?

A: An origination fee is a charge from a lender and can be 1% to 10% of the total loan amount. It is charged to the loan, meaning consumers will receive that much less of the balance. For instance, if the user is imposed a 1% origination fee of $1,000, they would receive $990.

The Top Bad Credit Lenders of 2024 Final Thoughts

Bad credit loans have been around for a long time, and getting one is easier than ever right now. Consumers can shop around for different rates and rules with many comparison websites. Users can choose from a broad range of prices, allowing them to find the best lender for their needs. Choose one of these top-rated bad credit lenders for the best match possible.

Affiliate Disclosure:

The links contained in this product review may result in a small commission if you opt to purchase the product recommended at no additional cost to you. This goes towards supporting our research and editorial team. Please know we only recommend high-quality products.

Disclaimer:

Please understand that any advice or guidelines revealed here are not even remotely substitutes for sound medical or financial advice from a licensed healthcare provider or certified financial advisor. Make sure to consult with a professional physician or financial consultant before making any purchasing decision if you use medications or have concerns following the review details shared above. Individual results may vary and are not guaranteed as the statements regarding these products have not been evaluated by the Food and Drug Administration or Health Canada. The efficacy of these products has not been confirmed by FDA, or Health Canada approved research. These products are not intended to diagnose, treat, cure or prevent any disease and do not provide any kind of get-rich money scheme. Reviewer is not responsible for pricing inaccuracies. Check product sales page for final prices.