Have you ever considered diversifying your investment portfolio with precious metals? If so, you’re in the right place.

In this comprehensive Lear Capital review, we will take a look at one of the leading names in the precious metals industry, and help you determine if it’s the right choice for your investment needs.

From the benefits of precious metals investment to the ins and outs of setting up a precious metals IRA with Lear Capital, we’ve got you covered.

Lear Capital Lawsuit Update

AUGUST 2023 UPDATE: This review was written prior to a series of lawsuits in 2023 involving the company under review. Lear Capital, one of the popular gold IRA companies in the industry, has recently filed for bankruptcy amid legal scrutiny. We advise prospective investors to avoid this company as it has been implicated in overcharging investors and employing deceptive marketing tactics.

As part of the bankruptcy plan, Lear Capital will pay $5.5 million to be split among its investors. Those who had filed for bankruptcy claims will get refunds according to the terms of the plan, and those who hadn't filed will get a share of the remaining money. The settlement also mandates Lear Capital to enhance its sales practices and disclosures to ensure transparency and legality.

If you're thinking about opening a gold IRA, we recommend considering Augusta Precious Metals instead. This is one of America's most popular gold companies, offering reasonable prices, transparent fees, excellent customer support, and a great track record.

Download Augusta's free "Buyer Beware" kit to be informed about the gold IRA industry's gimmicks, deceptive marketing tactics, and more.

Augusta has been featured on Money magazine, Investopedia, and endorsed by Mark Levin, Joe Montana and other wealthy celebrities.

Overview of Lear Capital

As a highly-regarded precious metals firm with over 25 years of experience, Lear Capital offers a comprehensive selection of products and services, including gold, silver, platinum bullion, rare coins, and other precious metal coins as part of their precious metals IRAs. With a focus on customer education and support, Lear Capital is dedicated to helping investors make informed decisions when investing in precious metals.

Lear Capital’s team of experienced account representatives guide investors through the buying or selling process and provide tailored investment strategies, ensuring a smooth experience when opening and managing a Lear Capital account.

The company’s commitment to competitive rates, a 24-hour risk-free purchase assurance, and real-time metals pricing has led to many positive Lear Capital reviews from satisfied customers. For more information, visit Lear Capital’s website.

Benefits of Precious Metals Investment

Investing in precious metals provides a hedge against market risks and maintains value during economic downturns, making it an attractive option for diversifying your investment portfolio. By including physical gold, silver, and other precious metals in your IRA, you can reduce the potential impact of market fluctuations on your retirement savings.

Working with a reliable company like Lear Capital offers added assurance of secure storage for your metals and protection from potential fraudulent activities. With a variety of physical metal products to choose from, including gold, silver, and platinum bullion, you can tailor your investment to suit your long-term goals and risk tolerance.

Precious Metals IRA with Lear Capital

Lear Capital assists customers in setting up and managing ira precious metals accounts, providing guidance on eligible metals, storage options, and account maintenance. A precious metals IRA enables individuals to diversify their retirement portfolios by incorporating physical gold, silver, and other precious metals.

Upon receipt of funds in your account, you can choose from the assortment of metals provided by Lear Capital on its website. The company then executes your order and sends the metals to the Delaware Depository for secure storage.

Eligible Metals

For a precious metals IRA with Lear Capital, eligible metals include gold bullion with 99.5% purity, platinum bullion with 99.95% purity, and silver bullion with 99.9% purity. Investing in these high-purity precious metals ensures that your precious metal IRAs meet the required standards for tax benefits and long-term appreciation potential.

With Lear Capital, you can rest assured that your IRA is backed by the highest quality precious metals.

Storage Options

Lear Capital offers secure storage options for precious metals, including the Brinks Depository in Salt Lake City and the Delaware Depository, both insured by Lloyds of London. This ensures the safety and protection of your investment, giving you peace of mind as you diversify your retirement portfolio.

Investing in precious metals, including precious metal coins, is a great way to diversify your retirement portfolio and protect your assets through precious metal investments.

Fees and Charges

Lear Capital charges a variety of fees, including an annual account maintenance fee of $180, storage fees, and possible commissions on gold purchases, with a minimum investment requirement of $7,500. It’s essential to be aware of these fees and charges when investing in precious metals with Lear Capital, as they can impact your overall returns.

When comparing Lear Capital to alternatives, it’s crucial to consider these factors.

-

Fees

-

Storage options

-

Customer reviews

-

Available products

Keep in mind that some fees may be negotiable, so it’s always worth discussing potential savings with a Lear Capital representative.

Lear Capital Reviews: Customer Experience and Testimonials

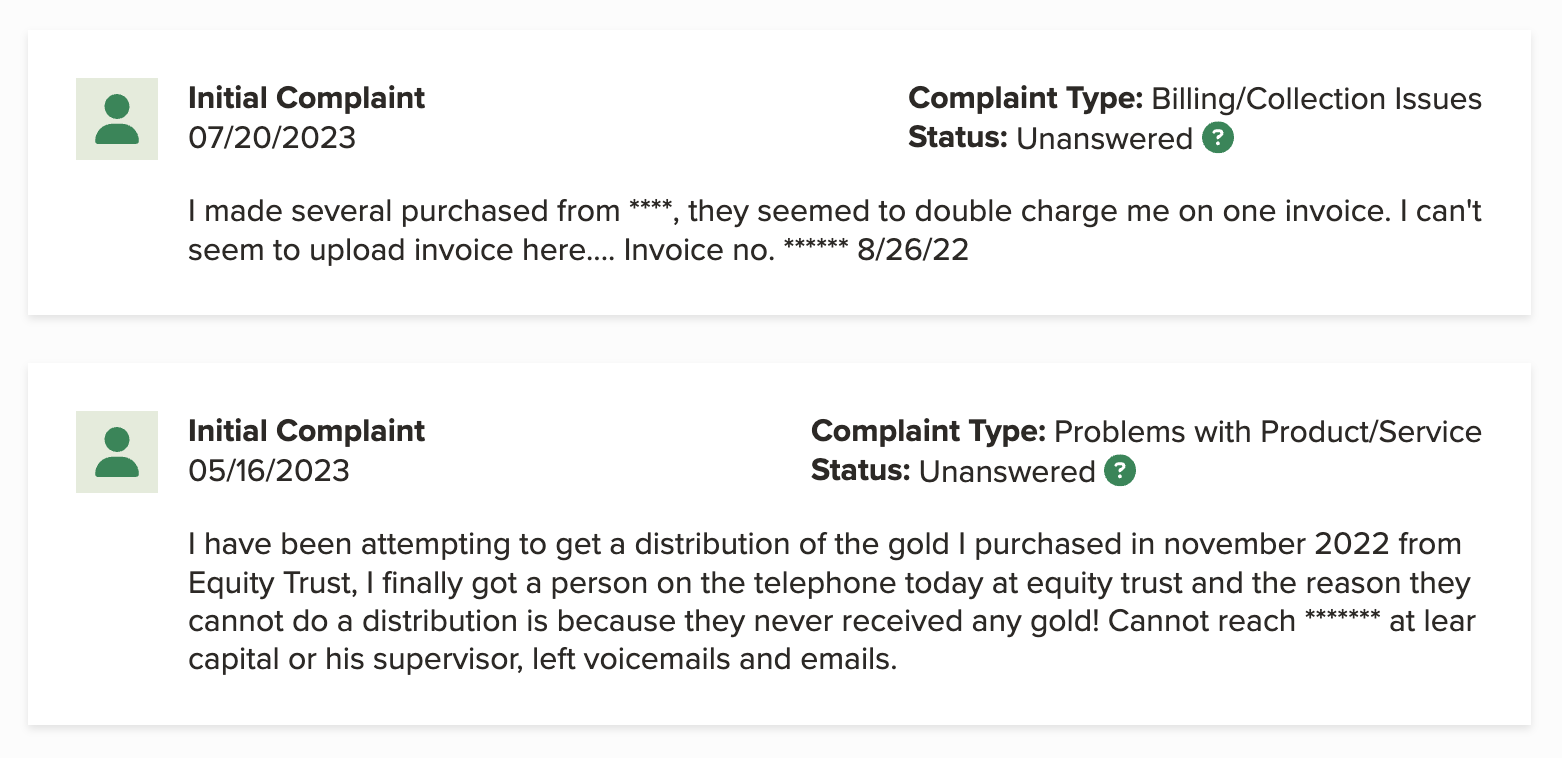

Customer reviews for Lear Capital are mixed, with many praising the company’s educational resources and customer service. These investors appreciate the guidance provided by knowledgeable account representatives, who help them navigate the investment process and make informed decisions.

However, some customers express concerns about fees and transparency, feeling misled by the company. As with any investment decision, it’s essential to do your due diligence and research multiple gold IRA companies before choosing the one that best aligns with your investment goals and preferences.

The company has a low C+ rating on Better Business Bureau, so prospective investors should be extra careful and read some customer complaints prior to entrusting Lear Capital with their retirement funds.

Buyback Policy and Liquidation

Lear Capital does not guarantee a buyback of coins, but may offer a market price if they choose to buy back. When considering liquidating your precious metals IRA, it’s essential to be aware of potential costs and restrictions, such as fees for selling or transferring metals, storage fees, and applicable taxes.

If you decide to liquidate your precious metals IRA with Lear Capital, they can facilitate the sale of the metals and provide cash or deliver the metals directly to you. Remember that liquidating a precious metal IRA may have tax implications, so it’s advised to consult a Lear Capital representative for further information.

Credentials and Industry Affiliations

Lear Capital’s industry affiliations include memberships in various coin grading and consumer watchdog organizations, such as:

-

Professional Coin Grading Service

-

Business Consumer Alliance

-

Industrial Council for Tangible Assets

-

Numismatic Guarantee Corporation

-

Trust Link

These memberships demonstrate Lear Capital’s commitment to ethical business practices and customer satisfaction, further solidifying their reputation as a trusted precious metals firm.

By joining these organizations, Lear Capital is able to provide customers with the highest quality products.

Monitoring Your Investment Performance

Investors can track their precious metals IRA performance through Lear Capital’s online portal, which provides access to quarterly statements and real-time pricing information. By keeping a close eye on your investment and staying informed about market trends, you can make more strategic decisions about your precious metals portfolio.

With the right information and guidance, you can maximize the potential of your precious metals IRA.

Comparing Lear Capital to Alternatives

When considering alternatives to Lear Capital, investors should compare the following factors to find the best fit for their investment needs:

-

Fees

-

Storage options

-

Customer reviews

-

Available products

While Lear Capital offers competitive rates and a solid reputation in the industry, it’s essential to evaluate multiple gold IRA companies before making a final decision.

Some factors to consider when evaluating alternatives include:

-

Investment options

-

Reputation

-

Fees and pricing

-

IRA services

-

Additional services

By carefully choosing Lear Capital and comparing it to other Lear Capital alternatives and other precious metals firms, you can make a more informed decision and ensure that your investment aligns with your long-term goals and risk tolerance.

Tips for Investing in Precious Metals

To make informed decisions when investing in precious metals, consider factors such as market trends, long-term goals, and diversification strategies. By staying informed about market fluctuations and adjusting your investment strategy accordingly, you can maximize returns and minimize risks.

Additionally, seeking guidance from a trusted financial advisor can help you make more strategic decisions about your precious metals investments. By combining expert advice with thorough research and due diligence, you can ensure that your precious metals portfolio aligns with your overall investment strategy and long-term financial goals.

Frequently Asked Questions

Is Lear Capital a reputable company?

Based on ratings from the Business Consumer Alliance and positive reviews on Consumer Affairs, Lear Capital appears to be a reputable company.

What is the minimum investment for Lear Capital?

To invest in Lear Capital, a minimum of $25,000 is required as the initial investment. This amount includes taxes and fees, and may have been revised since being listed on their website.

What happened Lear Capital?

Lear Capital filed for bankruptcy in August of 2023 after reaching settlements with the Los Angeles City Attorney’s Office and New York Attorney General for $8.75 million due to breaching state consumer-protection laws.

The Secretary of State’s Securities Division was also investigating Lear for deceptive securities and commodities activities and misleading marketing at the time of bankruptcy.

What is the Lear Capital lawsuit?

Lear Capital is facing a lawsuit alleging that it deceived customers about its transaction fees, with the fee actually equaling 33% of the customer’s total purchase price.

The lawsuit claims that Lear Capital failed to disclose the true cost of the transaction to customers, leading to customers paying more than they expected.

What types of precious metals does Lear Capital offer for investment?

Lear Capital offers a variety of precious metals, including gold, silver, platinum bullion and rare coins, for investment.

Summary

In conclusion, Lear Capital is a reputable precious metals firm offering a range of products and services, including gold, silver, and platinum bullion, rare coins, and precious metals IRAs. With a focus on customer education and support, Lear Capital can help you diversify your investment portfolio and navigate the world of precious metals investing. By considering factors such as fees, storage options, customer reviews, and available products, you can make a more informed decision and find the best fit for your investment needs.