We adhere to strict standards of editorial integrity to help you make decisions with confidence. Some or all links contained within this article are paid links.

Tipping has become ubiquitous, but many Americans are burning out.

According to a recent survey by WalletHub, nearly nine in 10 believe tipping culture has “gotten out of control,” and 83% think automatic service charges should be banned.

Must Read

- Thanks to Jeff Bezos, you can now become a landlord for as little as $100 — and no, you don’t have to deal with tenants or fix freezers. Here’s how

- I’m 49 years old and have nothing saved for retirement — what should I do? Don’t panic. Here are 6 of the easiest ways you can catch up (and fast)

- Dave Ramsey warns nearly 50% of Americans are making 1 big Social Security mistake — here’s what it is and 3 simple steps to fix it ASAP

Nearly 3 in 5 Americans think businesses are replacing employee salaries with customer tips.

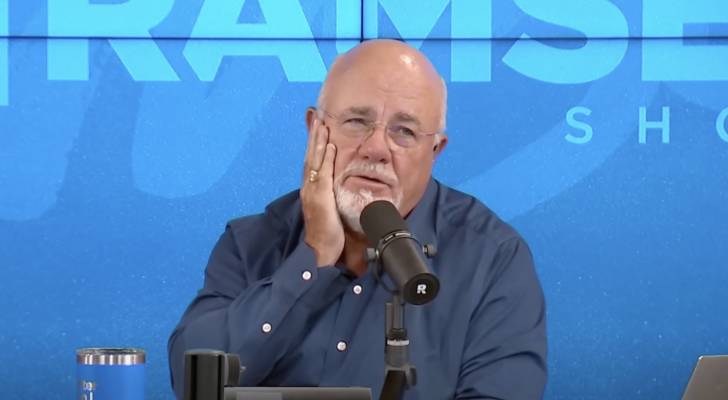

On a recent episode of The Ramsey Show, hosts Dave Ramsey and Jade Warshaw attempted to answer the question: When is it actually appropriate to leave a tip?

When should you tip?

Warshaw and Ramsey agree tipping is essential, especially in restaurants, where Warshaw says to tip 18-20%. “If you can’t afford to leave a nice tip, you can’t go,” she added.

Ramsey echoed this, noting many service workers rely on tips due to low wages.

For services like haircuts or nails, Warshaw suggests tipping around 15%. She tips more in situations where extra effort is involved, like deliveries in bad weather.

Ramsey also tips generously — even leaving $20 a day for hotel maids — but refuses to tip at counters with digital prompts, calling it “manipulation” and refusing to participate.

Both emphasize generosity and empathy for service workers, even if those values aren’t universally shared.

Tipping fatigue

Rising prices, inflation, and growing pressure to tip in more settings are leaving consumers increasingly overwhelmed and frustrated. Nearly 60% of Americans believe businesses use tips to replace wages, and many tip less when prompted by suggestion screens.

About 40% support replacing tipping with employee rating systems to determine pay.

Many people feel confused and overwhelmed by the growing number of tipping situations, such as in fast food and rideshares. A third of U.S. adults say tipping expectations have increased in the past five years, according to a Morning Consult survey.

Despite mixed consumer attitudes, the service industry still relies heavily on tipping, as many workers depend on tips for their livelihood and will continue to do so unless wages rise.

Read more: Robert Kiyosaki warns of a ‘Greater Depression’ coming to the US — with millions of Americans going poor. But he says these 2 ‘easy-money’ assets will bring in ‘great wealth’. How to get in now

Tips without budget stress

Want to show gratitude without breaking the bank? Consider these budget-friendly ideas:

- Cash-only tip jar: Keep a small bill, like $1 or $2, for cash-only gratuities at coffee shops or convenience stores.

- Daily tracking: Add a “tips” category to your monthly budget, so you can splurge or skip deliberately.

- Service-based tipping: Only tip at sit-down restaurants, delivery orders, valet and services like nail or hair — no need at counters.

- Modest weekly tip budget: For frequent routine services (e.g. your daily barista) to cap your spending.

- Evaluate, prioritize and trade off: For example, you might prefer splurging on a nice dinner out with friends each month to your convenient, weekly quick-service lunch.

Offset your spending

Americans spent a record-breaking $1.5 trillion on food away from home in 2023, making up 58.5% of total food spending, according to the US Department of Agriculture’s Economic Research Service.

But dining out isn’t the only major expense outside the home. Americans also shelled out over $535 billion on gasoline that year, exceeding the GDP of countries like Sweden and Thailand.

The good news is you can offset your spending by investing your spare change as you spend.

Micro investing app Acorns automatically rounds up your purchases to the nearest dollar and allocates your spare change into either a dedicated savings account or a diversified portfolio of ETFs.

For example: Spend $18.45 at a restaurant, and it rounds up to $19.00, investing the extra $0.55. Fill up your gas tank for $42.10, and it rounds up to $43.00, putting $0.90 toward your savings. Over time, those small amounts can add up to meaningful investments with the power of compound interest.

Acorns is also offering an extra $20 for those who sign up with a recurring deposit.

Bottom line: With these smart saving tips, tipping won’t feel so painful — and you can show appreciation without the stress.

What to read next

- The ‘Oracle of Wall Street’ who predicted 2008 crash sees trouble in US housing — and says boomers aren’t as rich as many think. Why that’s a problem

- There’s still a 35% chance of a recession hitting the American economy this year — protect your retirement savings with these 5 essential money moves ASAP

- This tiny hot Costco item has skyrocketed 74% in price in under 2 years — but now the retail giant is restricting purchase. Here’s how to buy the coveted asset in bulk

- Want an extra $1,300,000 when you retire? Dave Ramsey says this 7-step plan ‘works every single time’ to kill debt, get rich in America — and that ‘anyone’ can do it

Join 200,000+ readers and get Moneywise’s best stories and exclusive interviews first — clear insights curated and delivered weekly. Subscribe now.

This article provides information only and should not be construed as advice. It is provided without warranty of any kind.