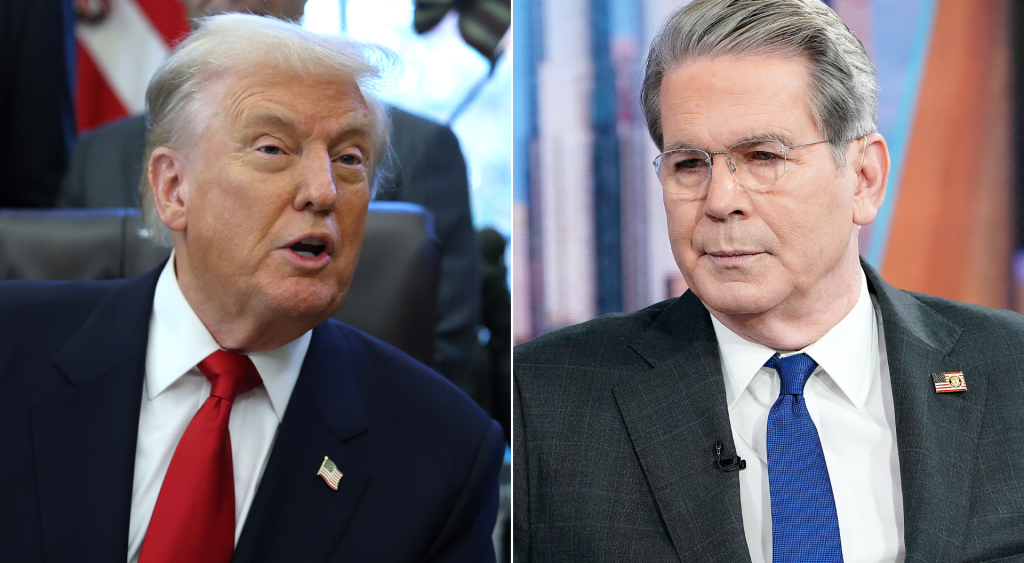

With President Trump appearing to be “committed” to the idea of giving most Americans a $2,000 dividend payment from tariff revenue, Treasury Secretary Scott Bessent shared some insight into who might be eligible for these payments.

This rebate plan was designed to give back to Americans after critics bashed Trump’s widespread tariff policy, which fueled a trade war and raised prices across the country.

Must Read

- Thanks to Jeff Bezos, you can now become a landlord for as little as $100 — and no, you don’t have to deal with tenants or fix freezers. Here’s how

- Dave Ramsey warns nearly 50% of Americans are making 1 big Social Security mistake — here’s what it is and 3 simple steps to fix it ASAP

- Warren Buffett used 8 solid, repeatable money rules to turn $9,800 into a $150B fortune. Start using them today to get rich (and stay rich)

A $2,000 payment could help a lot of Americans who are struggling with the rising cost of everyday necessities, but aside from revealing a timeline — Trump said he’s planning to issue tariff rebate payments in mid-to-late 2026 (1) — the White House has shared very few details on how these payments will be made or who will receive them.

"The president made it clear he wants to make it happen," said White House press secretary Karoline Leavitt, according to ABC News (2). "So his team of economic advisers are looking into it."

Bessent had signaled that the payouts could come “in lots of forms,” including tax reductions that are bundled into Trump’s One Big Beautiful Bill. But the treasury secretary’s recent comments on the matter gave us some more insight into who might qualify for these $2,000 dividend payments.

Do you qualify?

While the exact details have yet to be finalized, Bessent told Fox News that the payments will likely be given to those making "less than, say, $100,000," according to Newsweek (3).

In a post shared on Truth Social, Trump promised that a dividend payment of “at least $2,000 a person (not including high income people!) will be paid to everyone," offering a glimpse into who may be eligible for these payments (4). But Bessent’s comments provide an earnings cap that helps define what Trump may have meant when he mentioned “high income people.”

Kevin Thompson, CEO of 9i Capital Group, estimates that if this $100,000 income cap is implemented, roughly 120 million Americans would be set to receive a dividend payment (2). Thompson adds that it would require $240 billion to cover all of these payments.

For the many households that have been squeezed by higher prices for groceries and everyday essentials, a $2,000 rebate could provide some much needed relief. But some economists caution that there could be problems with the math behind Trump’s dividend payment plan.

Erica York, vice president of federal tax policy at the Tax Foundation, shared some numbers that seem to contradict Thompson’s estimates. In a post shared on X, York revealed that the $100,000 income cap would mean 150 million Americans would qualify for a dividend payment, and that it would take $300 billion to cover the payments (5). But these numbers aren’t what concerns York the most.

“Only problem, new tariffs have raised $120 billion so far,” York stated in her post. “The math gets worse accounting for the full budgetary impact of tariffs: a dollar of tariff revenue offsets about 24 cents of income and payroll tax revenue. Adjusting for that, tariffs have raised $90 billion of net revenues compared to Trump’s proposed $300 billion rebate.”

Meanwhile, Thompson also told Newsweek that he believes potential dividend payments are more likely to be symbolic, or restructured as tax savings, versus literal checks mailed to homes. Bessent initially suggested this when he said the dividend payments could come "in lots of forms."

"It could be just the tax decreases that we are seeing on the president’s agenda,” said Bessent before revealing the $100,000 income cap on Fox News. “No tax on tips, no tax on overtime, no tax on Social Security, deductibility on auto loans. Those are substantial deductions that are being financed in the tax bill.”

However, Trump’s dividend payments — in whatever form they may take — still have some hurdles to clear. Congress may need to pass legislation on this plan, as previous stimulus payments required congressional approval. Meanwhile, the Supreme Court is still weighing the legality of some of Trump’s tariff policies.

Read more: Robert Kiyosaki says this 1 asset will surge 400% in a year — and he begs investors not to miss its ‘explosion’

How to use the money if you qualify

If you’re in the group that may be eligible for a dividend payment — which means you earn less than $100,000 a year — a $2,000 boost could go a long way toward paying bills or supporting your financial goals. Here are a few things to consider while you wait for your dividend payment to be delivered.

Prioritize debt

If rising prices have strained your family budget and forced you to carry a balance on your credit cards, the dividend payment could offer a chance to pay down high-interest debt. It’s very hard to meet financial goals when high-interest debt is hindering your progress, so if a $2,000 windfall from the government falls on your lap, using the money to pay off outstanding debts is a solid strategy.

Groceries and other essentials

For many families, $2,000 can cover groceries for up to three-to-four months. According to Ramsey Solutions, the average American household spends roughly $504 per month on groceries (6), which means a $2,000 dividend payment could keep the fridge stocked up for you and your family for several months.

A $2,000 payment could also offer relief with rent or mortgage payments, giving some breathing room to those who have struggled with paying their landlord or their mortgage lender.

Emergency fund

If you’re debt-free and not worried about the cost of everyday essentials, putting your $2,000 dividend payment into an emergency fund is a great idea.

An emergency fund is a great way to prepare for whatever life may throw at you. Whether you find yourself staring at a $1,000 emergency mechanic bill or have just lost your job, an emergency fund can keep you afloat while preventing you from racking up debt on a credit card or dipping into your savings.

Experts recommend saving at least three-to-six months’s worth of expenses in an emergency fund, but any amount that you can comfortably save can be beneficial the next time a sudden expense hits your wallet. For those who don’t have an emergency fund, a $2,000 dividend payment could be a great way to start one.

Long-term investments

If you qualify for a dividend payment and are managing the rising costs of everyday essentials well, you may want to put your $2,000 payment into your investments. Used strategically, a $2,000 payment could give a boost to your future finances, since even a modest investment can benefit from compounding interest.

Here are a few investment moves that you may want to consider:

- Invest your $2,000 dividend payment into an IRA or Roth IRA

- Put your dividend payment into a high-yield savings account

- Invest in a diversified ETF

What to read next

- Approaching retirement with no savings? Don’t panic, you’re not alone. Here are 6 easy ways you can catch up (and fast)

- Dave Ramsey says this 7-step plan ‘works every single time’ to kill debt, get rich — and ‘anyone’ can do it

- Grant Gardone reveals the ‘real problem’ with US real estate (and what average Americans must actually do to get rich)

- 22 US states are already in a recession — protect your savings with these 10 essential money moves ASAP

Join 200,000+ readers and get Moneywise’s best stories and exclusive interviews first — clear insights curated and delivered weekly. Subscribe now.

Article sources

We rely only on vetted sources and credible third-party reporting. For details, see our editorial ethics and guidelines.

Fox 12 (1); ABC News (2); Newsweek (3); Truth Social (4); X (5); Ramsey Solutions (6)

This article provides information only and should not be construed as advice. It is provided without warranty of any kind.