As fears about inflation, rising defaults and soaring personal debt persist, an increasing number of Canadians are turning to their banks for financial advice — that’s the verdict of JD Power’s 2025 Canada Retail Banking Advice Satisfaction Study.

The latest edition of the annual study names RBC as the top in customer satisfaction when it comes to banking and financial advice, but also warns of a deteriorating consumer optimism as the cost-of-living crisis continues to worsen for Canadians.

JD Power Retail Banking Study highlights growing consumer fears

The 2025 Canada Retail Banking Advice Satisfaction Study, which examines Canadian banking habits and preferences, reveals that more than 44% of Canadian bank customers are now considered financially vulnerable, a significant increase from 36% five years ago.

This deterioration in financial health comes as no surprise, with 71% of customers expressing concern about the rising cost of living and 36% reporting struggles with housing costs, such as mortgages and utilities.

The banking satisfaction study surveyed 2,582 Canadian retail bank customers who reported receiving advice from their bank in the past year. Customer satisfaction was measured across five dimensions: clarity of advice, concern for customer needs, relevancy, quality and frequency of advice.

RBC tops in customer satisfaction for 5th straight year

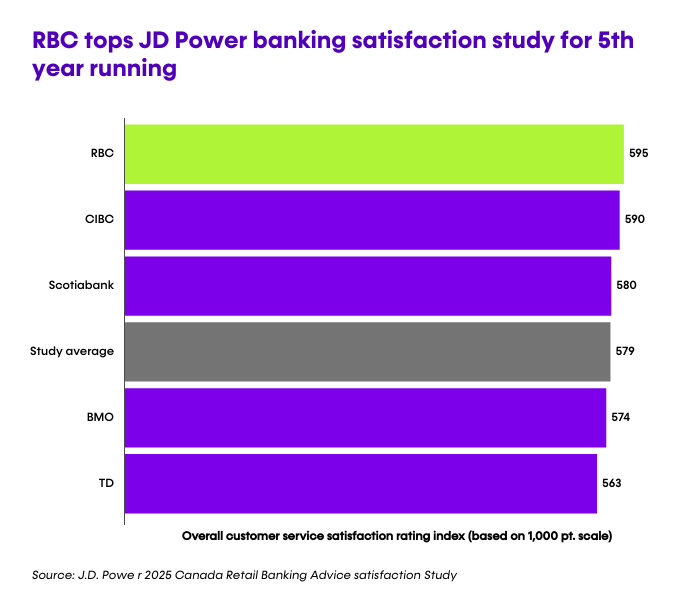

In terms of customer satisfaction among the Big 5, RBC ranks highest for the fifth consecutive year, scoring 595. CIBC follows in second place with 590, and Scotiabank takes third with 580.

The study also includes a financial health support index that measures how banks and credit card issuers assist customers in making informed financial decisions and achieving their financial goals. CIBC and RBC are the top performers among banks in this index.

Other study findings

Other study findings include:

- Appetite for bank advice is growing: Customer interest in bank guidance jumped to 26% from 19% in 2021, with the highest demand among new immigrants (47%), affluent customers (32%), and young affluent Canadians (31%)

- Shift in advice focus: While investment and retirement advice remain top priorities, interest in immediate needs like bill payment guidance increased 4 points and credit advice rose 2 points. Meanwhile, demand for investment and retirement advice dropped by 7 and 4 points, respectively

- Rising satisfaction with advice: Overall satisfaction reached **579 **(1,000-point scale), up 13 points from 2024. Improvement drivers include better frequency, quality, relevancy and demonstrated concern for customer needs

- Advice recall stalls: Though 49% of customers feel their bank creates memorable interactions, this metric has plateaued. Research shows customers prefer marketing that reassures them of on-demand support when needed

“A golden opportunity for retail banks”

Jennifer White, senior director for banking and payments intelligence at JD Power, says the latest study highlights a growing consumer push towards their banks when it comes to financial advice in Canada:

“The eroding financial health of customers and their fear that economic conditions may worsen are driving customers — especially younger ones with growing deposits — to seek financial advice from their retail bank at an accelerated pace,” she said in a release accompanying the 2025 study.

“This combination presents a golden opportunity for retail banks to rise to the challenge and offer services and advice that go beyond the transactional,” she added. “Customers are shifting their focus from longer-term goals such as investment and retirement planning to more immediate concerns like paying bills, reducing debt, and sticking to a budget. Banks that are attuned to their customers’ pain points and can provide relevant and frequent financial advice will be positioned to benefit from a loyal customer base.”

Read more: 7 smart ways to fight inflation, cut debt, and save big in 2025 — even on a tight budget

What does this mean for you?

As more Canadians feel the financial pinch, now is the perfect time to take advantage of the financial advice services your bank has to offer. Banks are increasingly focused on providing guidance for immediate financial concerns rather than just long-term planning.

This shift presents an opportunity for Canadians to seek advice on day-to-day money management, from setting up automated savings and bill payments to exploring balance transfer credit cards for existing debt. The banks that scored highest in this study, namely RBC and CIBC, offer robust financial health support resources that many Canadians aren’t currently fully making use of.

Learn more about the JD Power Canada Retail Banking Advice Satisfaction Study.

About JD Power

JD Power is a global leader in consumer insights, advisory services, and data and analytics. A pioneer in the use of big data, artificial intelligence (AI) and algorithmic modeling capabilities to understand consumer behaviour, JD Power has been delivering incisive industry intelligence on customer interactions with brands and products for more than 55 years.

This article provides information only and should not be construed as advice. It is provided without warranty of any kind.