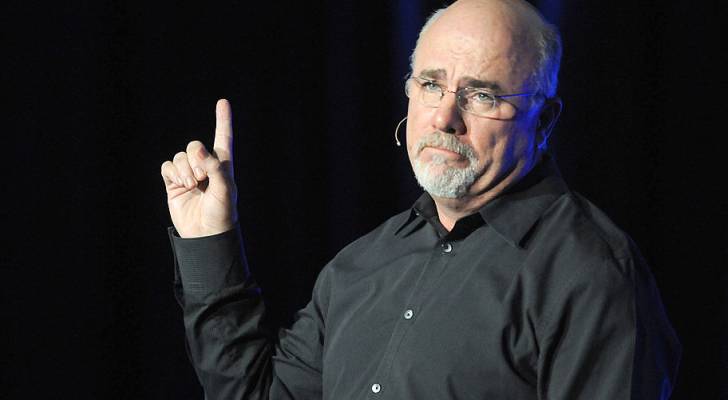

Personal finance guru Dave Ramsey is famous for his no-nonsense advice, and also for his insistence on avoiding debt.

The millionaire advisor started his finance journey at the bottom. He filed for bankruptcy at just 28 years of age, and since then, he’s built an empire advising everyday Americans on how they can ditch their debt and make their first million.

Don’t miss

- I’m 49 years old and have nothing saved for retirement — what should I do? Don’t panic. Here are 5 of the easiest ways you can catch up (and fast)

- Gain potential quarterly income through this $1B private real estate fund — even if you’re not a millionaire. Here’s how to get started with as little as $10

- Thanks to Jeff Bezos, you can now become a landlord for as little as $100 — and no, you don’t have to deal with tenants or fix freezers. Here’s how

Recently, he’s come down hard on 30-year mortgages, offering an in-depth look at how a longer mortgage term can see you paying thousands more in interest than if you choose a 20- or 15-year term. He warned readers of his blog strongly against taking a longer mortgage simply to make monthly payments smaller.

In his words, “Sure, the 30-year plan gives you a smaller monthly payment. But this longer, drawn-out repayment plan has more of your money going toward the interest each month — which also makes the principal balance go down much slower.”

How amortization works

A mortgage is an amortized loan, or one where you make a scheduled payment (typically each month) and this payment is applied to both the principal of the loan and the interest that accrues. The payment goes to the interest first, and anything remaining goes towards the principal. This can mean that a smaller monthly payment will see you paying mostly interest, rather than paying down your principal.

To demonstrate the difference between a 15-year mortgage and a 30-year, let’s take this example.

Say you have a $1,000,000 mortgage on your home and you’ve put 20% down, or $200,000. At a 7% mortgage rate, if you choose a 15-year term, you will pay $8,932.49 per month and your interest payments over the life of the loan will be $329,653.94.

By contrast, on a 30-year mortgage, your monthly payments will be $6,586.03 and you will pay $580,894.27 in interest. In other words, the extra 15 years will cost you an additional quarter of a million dollars — $251,240.33, to be exact. That’s a quarter of the value of your home, and a serious amount of cash that could be put towards your retirement savings, your child’s education or making improvements to your home.

Ramsey advised his readers to create their own amortization schedule to ensure they have a clear view of how a long mortgage could see them throwing money away.

Read more: Car insurance premiums could spike 8% by the end of 2025 — thanks to tariffs on car imports and auto parts from Canada and Mexico. But here’s how 2 minutes can save you hundreds of dollars right now

Ramsey’s tips for mortgages

Of course, affordability is a top issue for Americans, and 30-year mortgages are common precisely because it can be difficult to find the extra funds for a large mortgage payment each month.

In addition to recommending a shorter loan term, Ramsey offered a few more tips for getting the best mortgage for you. Here are his words of advice — plus a few more of our own.

1. Shop around

Doing your homework by comparing several different lenders could lead you to a better mortgage rate or amortization schedule for your loan. Don’t feel like you have to go with your existing bank or one that’s recommended to you. If you have time to explore your options, do so as much as you can.

2. Start early

If you’re shopping for a new home, preapproval for a mortgage can help you to move faster when closing on a home. This process can also be lengthy. It typically takes 45 to 60 days from starting the application to securing a mortgage, due to federal regulation in the industry.

3. Be prepared (and prepared to wait)

Your lender will review your credit history, income and current debts in the process of evaluating you for a mortgage. You may also be expected to foot the bill for appraisals, property inspections, survey fees, title searches and lender reviews.

Do your research ahead of time to understand what will be required, how much it will cost and the timeline for each step of the process. This can help you manage your stress while you shop for a new home.

4. Make additional payments

If you have an existing mortgage, or will have to sign for a 30-year term, do your best to budget for additional payments on your loan. If you can make an extra monthly payment, these typically go towards your loan principal, not the interest. Even a few thousand here and there can help you chip away at your balance, and pay off your mortgage faster.

5. Refinance your existing mortgage

Finally, Ramsey suggested that existing mortgage holders could look at refinancing their loans to reduce the term.

“This would change things like your interest rate, monthly payment amount and amortization period,” he wrote.

Again, this is a place to shop around and take your time. Look for a lower interest rate and a shorter amortization period, while keeping the monthly payment amounts realistic. If you’ve managed to increase your salary or reduce your debt or expenses since your initial loan agreement, a refinance is a smart move to get you even closer to total debt freedom.

What to read next

- Want an extra $1,300,000 when you retire? Dave Ramsey says this 7-step plan ‘works every single time’ to kill debt, get rich in America — and that ‘anyone’ can do it

- Here are 5 ‘must have’ items that Americans (almost) always overpay for — and very quickly regret. How many are hurting you?

- There’s a 60% chance of a recession hitting the American economy this year — protect your retirement savings with these essential money moves ASAP (most of which you can complete in just minutes)

This article provides information only and should not be construed as advice. It is provided without warranty of any kind.