Nvidia (NASDAQ: NVDA) has been one of the best-performing stocks of the last decade, benefiting from advancements in artificial intelligence (AI), cloud computing, and gaming. However, its high price and volatility make it a challenging stock for Canadian investors to buy.

One way to manage risk and build a long-term position in Nvidia (NASDAQ: NVDA) is through dollar-cost averaging (DCA ) — a strategy where investors buy a fixed dollar amount of stock at regular intervals instead of making a lump-sum purchase.

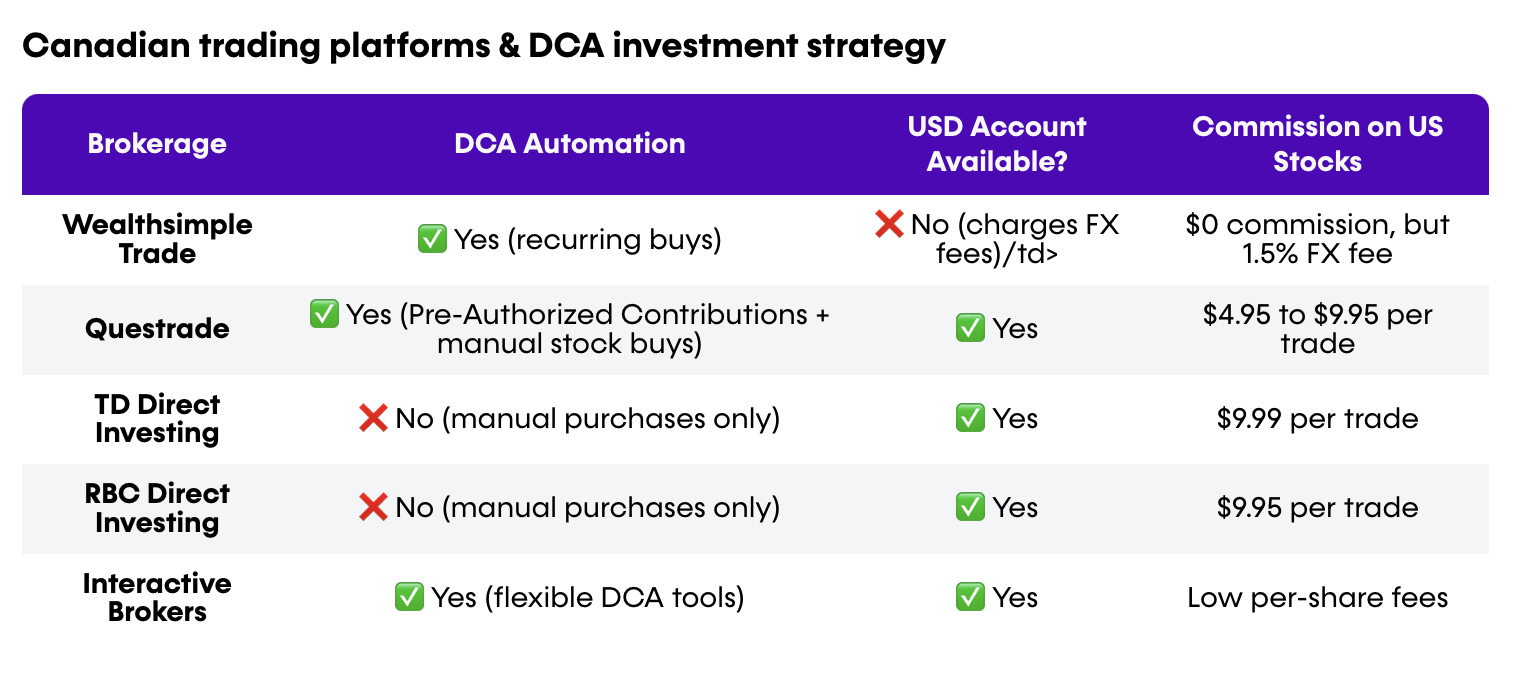

To use DCA effectively, Canadian investors need to learn which accounts to use (either TFSA, RRSP, or taxable), and which trading platforms to use, such as Wealthsimple, Questrade, TD Direct Investing, among others.

What is dollar-cost averaging (DCA)?

DCA is an investment strategy where you invest a fixed amount of money at regular intervals, regardless of the stock’s price. Over time, this smooths out the impact of market volatility and can reduce the risk of buying at a peak.

Example of DCA with Nvidia for a Canadian investor

- Instead of buying $12,000 worth of Nvidia (NASDAQ: NVDA) all at once, you decide to invest $1,000 per month for 12 months.

- Some months, Nvidia may be expensive; other months, it may be cheaper.

- This strategy reduces the impact of market swings and ensures you don’t buy at a short-term high.

Why DCA works well for Canadian investors buying Nvidia

1. Reduces Risk of Market Timing

- Nvidia (NASDAQ: NVDA) is highly volatile, and its price can swing 5 to 10% in a single day.

- By investing consistently, you avoid making emotional decisions based on short-term price movements.

2. Helps Manage Currency Risk for Canadians

- Nvidia (NASDAQ: NVDA) trades in USD, meaning Canadian investors face currency fluctuations when buying the stock.

- DCA helps average out currency exchange rates over time, reducing the risk of buying when the Canadian dollar is weak against the US dollar.

3. Easy to Automate with Canadian Brokerages

- Some platforms like Wealthsimple Trade and Questrade allow investors to set up recurring stock purchases, making DCA fully automated.

- Even if you use a brokerage that doesn’t offer automated DCA (like TD Direct Investing), you can still manually buy a fixed amount each month.

Which Canadian accounts are best for Nvidia DCA?

1. TFSA (Tax-Free Savings Account)

✅ Best for long-term growth because all gains are tax-free.

✅ No taxes on capital gains or dividends.

🚨 Downside: Nvidia doesn’t pay a dividend, so this is only useful for long-term capital gains.

2. RRSP (Registered Retirement Savings Plan)

✅ Contributions are tax-deductible, reducing taxable income.

✅ Great for Nvidia because there are no withholding taxes on US stocks inside an RRSP.

🚨 Downside: Withdrawals in retirement are taxed as income.

3. Taxable Account

✅ Good for flexibility (no withdrawal restrictions).

🚨 Downside: Capital gains are taxable at 50% in Canada.

🚨 Currency conversion fees may apply.

Which Canadian brokerages support DCA for Nvidia?

Best option for Canadian investors using DCA

- If you want zero commissions, Wealthsimple Trade is the easiest option, but you pay FX fees.

- If you want a USD account and more control, Questrade or Interactive Brokers is better for reducing currency conversion costs.

DCA vs. lump-sum investing: Which is better for Nvidia?

A common question is: “Should I just buy Nvidia all at once instead of using DCA?”

✅ Lump-sum investing is better if the market is in an uptrend, because historically, stocks tend to rise over time.

✅ DCA is better if you’re worried about short-term volatility and want to spread out your risk. Since Nvidia is highly volatile, DCA can be a smart way to manage risk while still building a position over time.

Final thoughts: Why DCA is a smart strategy for Canadians investing in Nvidia

Dollar-cost averaging is a great way for Canadian investors to buy Nvidia without worrying about short-term price swings or currency fluctuations. By investing consistently over time, you lower the risk of making poor timing decisions while benefiting from long-term market growth.

This article Dollar-cost averaging with Nvidia: A long-term strategy for Canadian investors

This article provides information only and should not be construed as advice. It is provided without warranty of any kind.