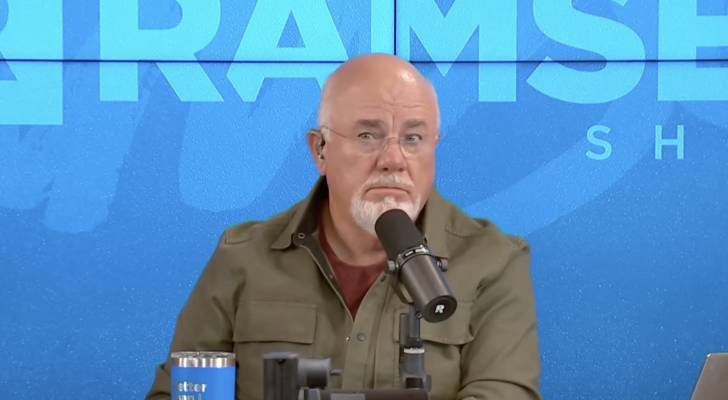

As the sun sets on the 30% federal tax credit for residential solar panels at the end of 2025, many homeowners are determining whether the cost eclipses the return on investment. One caller, Sid from Phoenix, Arizona, asked The Ramsey Show exactly that, prompting Dave Ramsey to issue a clear verdict: "Don’t do it."

The question is timely. Under the current Residential Clean Energy Credit, homeowners can deduct 30% of the cost of solar systems installed by December 31, 2025. But does that automatically make it a smart financial move?

Must Read

- Thanks to Jeff Bezos, you can now become a landlord for as little as $100 — and no, you don’t have to deal with tenants or fix freezers. Here’s how

- Dave Ramsey warns nearly 50% of Americans are making 1 big Social Security mistake — here’s what it is and 3 simple steps to fix it ASAP

- Robert Kiyosaki says this 1 asset will surge 400% in a year — and he begs investors not to miss its ‘explosion’

According to Ramsey, not unless you can break even in six years or less.

With the tax credit set to expire, the six-year rule of thumb becomes even more important. For many homeowners, the incentive has been the reason that made solar power seem affordable, trimming thousands off the upfront costs. Once it’s gone, it will leave some homeowners paying more out of pocket and waiting longer for the returns.

What determines if solar is worth it?

“Solar panels are excellent in some areas of the country,” Ramsey said. “It depends on two things: obviously sunshine, and high cost of electricity.”

Solar tends to make the most financial sense in places like California, Arizona and Hawaii, where both the cost of electricity and average sun exposure are high.

The U.S. Energy Information Administration (EIA) says the national average electricity rate is 17.47 cents per kilowatt-hour as of May 2025. In California, rates are more than 35 cents per kilowatt-hour, making the payback period much shorter.

In contrast, homeowners in states with lower electricity prices, such as Washington, Oklahoma or Idaho, may not see a strong return.

Read more: I’m almost 50 and have nothing saved for retirement — what now? Don’t panic. These 6 easy steps can help you turn things around

The break-even math

The caller was quoted $31,000 for a solar installation. After the 30% tax credit, his cost would be about $22,000. Based on his local utility rates, he estimated eight to nine years to recoup the cost through energy savings.

“Solar needs to have a break-even of six years or less,” Ramsey said.

Why the urgency? Because he says solar technology becomes obsolete quickly.

“Solar is technology. Eight years from now, it will be substantially different than it is right now.”

He compared it to buying a top-of-the-line plasma TV years ago for $8,000, only to see far better models now for under $300. With advances in panel efficiency and battery storage accelerating each year, he warned that committing now for nearly a decade may leave homeowners with outdated tech just as they break even.

Don’t go into debt for solar

Another Ramsey rule: Never go into debt to buy solar. Fortunately, this caller had $35,000 in cash beyond his emergency fund, a home worth $610,000 and no debt other than a $400,000 mortgage.

Still, Ramsey urged caution.

“You need to get your money back faster on something where the technology is becoming obsolete at breakneck speed,” he said.

What should homeowners do instead?

If you live in a high-sun, high-cost electricity region like Arizona, solar might still make sense — but only if the numbers work without debt. Otherwise, there are other ways to cut energy bills.

Sealing and insulating ducts can improve heating and cooling efficiency by as much as 20%. ENERGY STAR-certified smart thermostats can deliver cost savings, with typical households cutting $100 a year from heating and cooling costs.

The American Council for an Energy‑Efficient Economy reports that smart thermostats reduce HVAC energy consumption by about 8% for heating and 10% for cooling.

What to read next

- Are you richer than you think? 5 clear signs you’re punching way above the average American’s wealth

- Dave Ramsey says this 7-step plan ‘works every single time’ to kill debt, get rich — and ‘anyone’ can do it

- This tiny hot Costco item has skyrocketed 74% in price in under 2 years — but now the retail giant is restricting purchase. Here’s how to buy the coveted asset in bulk

- 22 US states are now in a recession or close to it — protect your savings with these 5 essential money moves ASAP

Join 200,000+ readers and get Moneywise’s best stories and exclusive interviews first — clear insights curated and delivered weekly. Subscribe now.

This article originally appeared on Moneywise.com under the title: ‘Don’t do it’: Dave Ramsey warns Phoenix homeowner considering a switch to solar — explains when the move is worth it

This article provides information only and should not be construed as advice. It is provided without warranty of any kind.