My Toronto friends have their sights set on a Miami vacation, where the ocean breeze carries the promise of unforgettable memories. And as a Florida resident and a credit card expert, they asked me for help with finding the right new credit card to use to book the trip.

Challenges like this are my bread and butter. Or should I say, my Cuban sandwich and cafecito? And since planning the perfect family escape is an annual ritual for millions of Canadians, I figured, why not take you all along for the ride?

Whether you’re planning your own tropical getaway or just dreaming of one, stick around — you may just pick up some tips to make your next vacation as rewarding as it is relaxing!

The itinerary

Before we jump in, let’s note requirements of my friend and his family::

- Travelling in late June

- Direct flight from Toronto to Miami

- 3.5+-star hotel near Miami Beach

Aeroplan vs. WestJet: Which is right for you?

For this I’ve selected two of Canada’s premier travel programs: Aeroplan and WestJet Rewards. And, for the ultimate travel experience, I zeroed in on the premium versions of these cards. Yes, they come with annual fees ranging from $100 to $150, but the enhanced travel perks make it worth every penny.

Here are the cards:

Aeroplan

WestJet Rewards

To keep things simple, we’re avoiding anything too complex, such as points transfers. The good news? Both carriers offer direct flights to South Florida, ensuring a smooth journey to your sun-soaked destination.

While WestJet exclusively lands at Hollywood-Ft. Lauderdale International Airport, don’t let that dampen your spirits. This airport is a mere 30-minute drive north of Miami, offering pretty quick access to any Miami hotel.

Welcome bonuses help supercharge savings

Let’s kick things off with the welcome bonuses. After all, it’s those juicy sign-up offers that really turn heads and drive applications, right? Remember, welcome offers are as dynamic as the travel industry itself, so the figures you see here may not be accurate at time of reading.

Here are the current welcome offers (as of writing):

- TD Aeroplan Visa Infinite: Up to $1,300 in value† including up to 40,000 Aeroplan points† and no annual fee for the first year†

- CIBC Aeroplan Visa Infinite: Get a total of up to 40,000 Aeroplan points (up to $800 in travel value†)

- Amex Aeroplan: Earn up to 30,000 Welcome Bonus Aeroplan®* points

- WestJet Rewards World Elite Mastercard: Get up to $450 in WestJet dollars. Plus, you’ll get a round-trip companion voucher every year

WestJet Rewards Dollars are valued at $1 each, making the welcome bonus worth $450. In contrast, Aeroplan point values vary, averaging 1.5 cents per point. This valuation results in Aeroplan credit cards offering a welcome bonus valued at $600, $150 more than WestJet.

However, both the TD Aeroplan and CIBC Aeroplan Visa Infinite cards feature more intricate welcome bonuses, including annual bonuses and minimum spending requirements that far exceed what my friend had budgeted for his family vacation. These additional factors will impact the overall value for my friend in this scenario.

Airport perks to make travelling a breeze

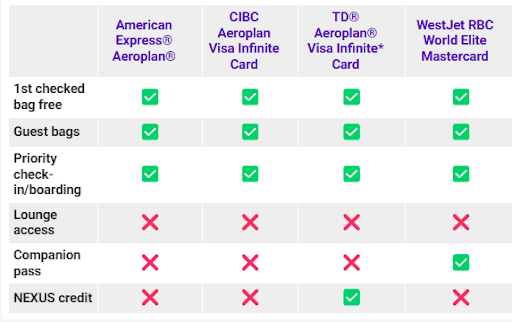

Before jumping into the costs and points, lets take a quick look at the benefits and perks each card offers:

All cards offer a first free bag for the cardholder and up to eight travellers on the same reservation, potentially saving around $140 in baggage fees. Additionally, they include priority check-in and boarding with their respective carriers.

The WestJet Rewards World Elite Mastercard does not provide complimentary lounge access directly. However, cardholders can trade their annual companion voucher for four lounge passes. This benefit, available on each account anniversary, may not be useful for new cardholders like my friend. Nevertheless, it’s a noteworthy feature to consider.

In contrast, the TD Aeroplan Visa Infinite grants complimentary same-day access to Maple Leaf Lounges for flights on the same day with Air Canada or Star Alliance. With this card, my friend’s family could enjoy a comfortable stay at Pearson before their departure.

Similarly, the CIBC Aeroplan Visa infinite offers complimentary lounge passes through Visa Airport Companion, so his family could visit one of nine lounges at Pearson — not bad!

Booking the trip and maximizing rewards

Now that we’ve taken a look at what kind of perks the card can provide, let’s examine the rewards. After all, it’s those rewards that are going to help offset the cost of the vacation, right?

Here’s how the card earn rates compare:

WestJet Vacations offers a variety of travel options including flights, hotels, cruises, car rentals and all-inclusive packages. For instance, a Toronto to Miami package, which includes a return direct flight from YYZ-FLL for four people and a five night stay in a 3.5-star hotel around Miami Beach, typically costs around $4,000 for a family of four. If we add in expenses like activities, excursions, incidentals and souvenirs, that total rises to around a $5,000 total cost for the trip.

In contrast, Aeroplan doesn’t offer a similar sign-up bonus. However, Aeroplan does provide travel packages, meaning my friend could consolidate their itinerary bookings in one place, saving them time, money and headaches.

Opting for Aeroplan also means the benefit of a direct flight to Miami, something not offered by WestJet. By applying the same booking criteria used with WestJet and factoring in expenses like excursions and activities for the kids, the total travel cost for the trip is estimated to be around $4,000 for the whole trip.

How much could they earn?

So just how many points would my friends earn with each card? Here’s the breakdown:

- Amex Aeroplan: $70 in Aeroplan points

- CIBC Aeroplan Visa Infinite: $65 in Aeroplan points

- TD Aeroplan Visa Infinite: $65 in Aeroplan points

- WestJet World Elite Mastercard: $90 in WestJet Dollars

However, these don’t take into account the annual fees, some of which are waived. For instance, both the TD Canada Trust and CIBC cards offer an annual fee rebate, while the Amex and RBC cards do not.

Insurance coverage just in case

Perks and points are the focus of this article, but travel insurance is another consideration worth examining. These often-underappreciated perks could be the superhero cape your friend didn’t know he needed!

But just how bulletproof is this coverage?

While all four cards offer comprehensive insurance, it’s the TD Aeroplan Visa Infinite cards that offers the best protection. That’s because the TD Canada Trust-version of the Aeroplan Visa Infinite provides significantly higher coverage amounts than the other options, including the similarly equipped CIBC Visa Infinite:

- Example: The TD Aeroplan Visa Infinite Card provides $5,000 in trip interruption coverage vs. $2,000 with the CIBC Aeroplan Visa Infinite

The CIBC and TD options also provide mobile device insurance of up to $1,000 in coverage should my friend or his wife lose their covered phone or tablet (that is, if they use their new card to purchase the phone and plan). Neither the Amex nor the RBC WestJet cards provide phone insurance.

What’s the verdict?

So, what’s the verdict? I’ll tell you the same thing I told my friend:

“It’s the TD Aeroplan Visa Infinite Card.”

Here’s why:

Beyond the welcome bonus and earn rates, the Aeroplan Visa Infinite from TD offers plenty of goodies to make travelling a breeze. Things like NEXUS credits, Maple Leaf Lounge access and free bags on Air Canada flights add plenty of oomph to an already strong rewards card.

Then there’s the comprehensive insurance which includes everything you need from emergency medical coverage to protection should Air Canada lose your bags or the flight gets delayed. Heck, they’re even covered in the event their hotel gets broken into.

But it’s the total package that helps push the TD Aerpoplan Visa Infinite Card to the top of the pile. The points are comparable with the others, but those premium perks, comprehensive travel insurance and an annual fee waiver make the TD card a simple choice.

This article Four travel cards compared: Which can get you to the beach faster?originally appeared on Money.ca

This article provides information only and should not be construed as advice. It is provided without warranty of any kind.