Welcome to your 50s! This is your last decade of formal employment — and a time to finalize and fine-tune what retirement will look like. While this process can be exciting, it can also be daunting. That’s because it’s in your 50s when most Canadians start to play “catch-up” on retirement savings.

Take, for instance, the average savings for Canadians nearing retirement. According to a data report released by Money.ca, the average retirement savings for Canadians aged 55 to 64 is $833,696 — a significant increase compared to the $183,067 saved by those in the 45 to 54 age range. This sharp rise suggests that many Canadians focus heavily on increasing their retirement contributions in their 50s in an effort to close the gap before they retire.

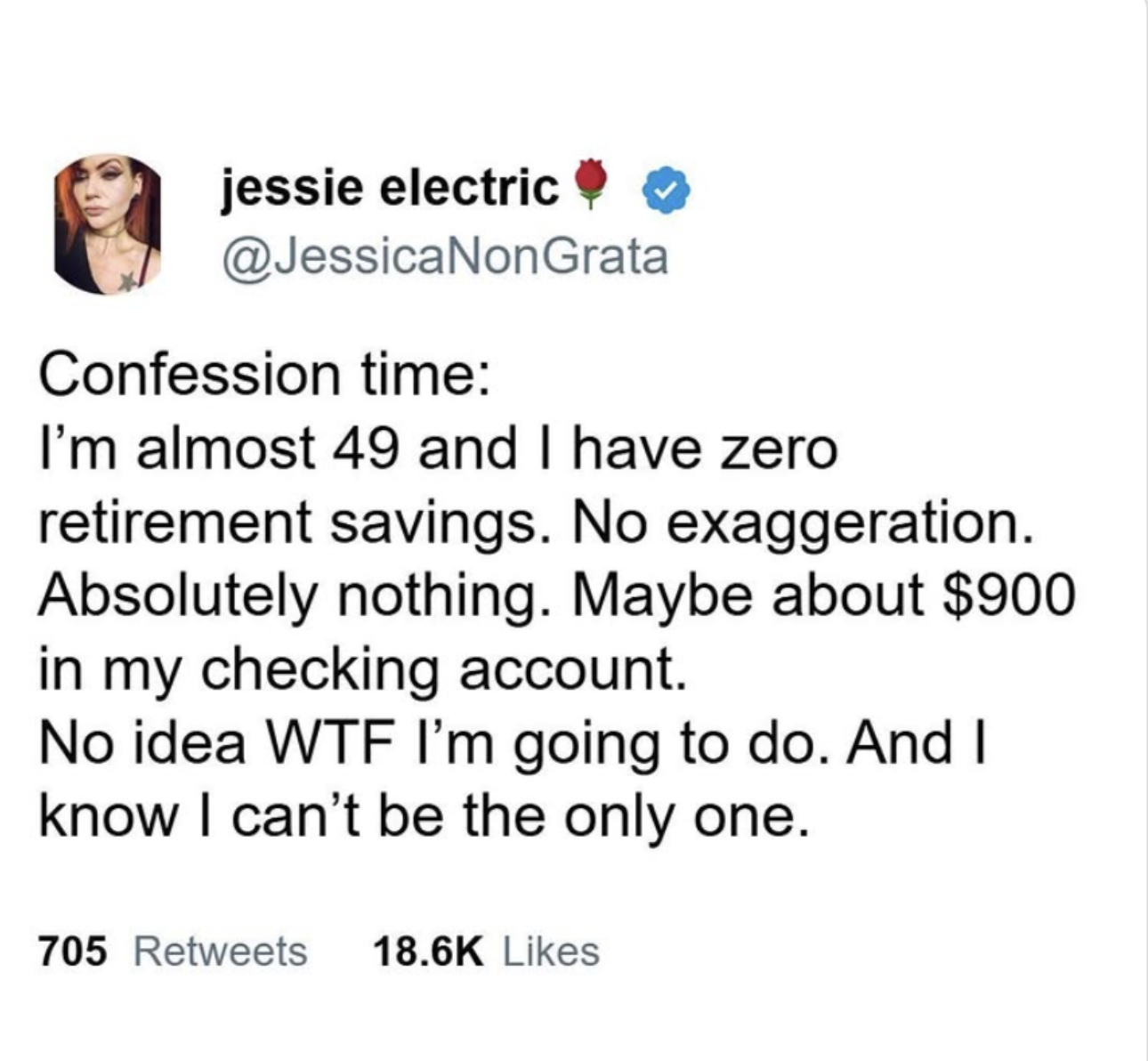

A stark reality check on retirement savings

A viral tweet recently shed light on a growing crisis: individuals approaching their 50s with little to no retirement savings.

In the tweet, a 49-year-old confesses to having zero retirement funds and only $900 in their bank account, sparking widespread discussion about financial preparedness.

Now, if you’ve fallen behind on your retirement savings, don’t panic — there’s still time to make meaningful progress towards this goal.

Cutting expenses and reducing debt

Reducing your financial obligations now can significantly impact your retirement readiness. Focus on:

- Paying Off High-Interest Debt: Credit card balances and personal loans should be prioritized to free up more income for savings.

- Downsizing or Simplifying Living Arrangements: Consider moving to a smaller home or reducing discretionary spending to redirect funds toward your retirement.

And, if you find it difficult to manage these tasks, consider using a money management app like Monarch Money to help keep you on track. Monarch Money allows you to track your spending, investments, and account balances all in one place. The financial transparency it provides can also make it easier to notice expenses you should cut or balances that have been too high for too long.

Sign up for Monarch Money today and get 50% OFF your first year with code NEWYEAR2025.

Understanding the importance of catch-up contributions

Your 50s are prime earning years for most Canadians, which means you can boost your savings significantly. In fact, the Canada Revenue Agency (CRA) allows individuals over 50 to make higher contributions to tax-advantaged accounts such as Registered Retirement Savings Plans (RRSPs) and Tax-Free Savings Accounts (TFSAs). These “catch-up” contributions can help accelerate the growth of your retirement fund.

Automate your savings

Consistency is key. Automate contributions to your RRSP, TFSA or other savings accounts to ensure that you’re putting aside money regularly. Payroll deductions or pre-authorized transfers make it easier to stay disciplined.

Maximizing investment returns

Investments play a crucial role in catching up on retirement savings. Meet with a financial advisor to:

- Ensure your portfolio is appropriately balanced between high- and low-risk assets.

- Take advantage of investment opportunities within your RRSP or TFSA to grow your savings tax-efficiently.

- Consider dividend-paying stocks, mutual funds, or bonds that align with your risk tolerance and retirement timeline.

If you find yourself in need of some guidance along the way as you ensure your investments are working for you, using a tool like Moby can simplify the process with curated stock picks and investing advice.

Moby is a stock market research platform that provides personalized financial insights based on your unique goals, real time market updates and investment research formatted in easy to understand reports so you can make informed decisions about your portfolio without being an investing wiz. Get started with a free trial of Moby today.

Exploring additional income streams

If your current savings are insufficient, look into ways to boost your income:

- Take on Freelance Work or a Side Hustle: Earning additional income can be a fast track to saving more.

- Sell Unneeded Assets: Downsizing and selling unused property or assets can provide a financial boost.

- Consider Working Longer: Delaying retirement by even a few years can significantly increase your savings and reduce the number of years you need to draw on them.

- Diversify your portfolio with alternative assets: Fine art has long been touted as a solid investment choice due to its inflation-hedging properties, making it a steady option to build your wealth. With Masterworks’ investment platform you can buy and sell shares of fine art pieces the same way you’d trade stocks and enjoy. Starting with as little as $20 you can dip your paintbrush into this income stream.

Reevaluating your financial plan

By your 50s, you likely have a clearer picture of your retirement timeline and financial needs. This is the perfect time to:

- Assess Retirement Goals: Determine your target retirement age and desired lifestyle. Will you travel? Downsize your home? Understanding your goals will help you estimate how much you need to save.

- Review Retirement Income Sources: Look at your projected income from sources such as Old Age Security (OAS), the Canada Pension Plan (CPP), workplace pensions and personal savings. This will help you identify potential shortfalls.

- Plan for the inevitable with life insurance: While it’s certainly not an easy thing to think about, planning for the finances of what happens when you’re gone can be a life saver for your loved ones and ease your mind in the present. With PolicyMe finding the best, most affordable life insurance policy for you is simple. All you need to do is fill in some information about yourself, and they will provide you with a free quote in minutes.

Delay benefits for bigger payouts

For Canadians nearing retirement, delaying government benefits such as CPP or OAS can lead to increased monthly payouts. For example:

- Delaying CPP past age 65 can increase payments by 8.4% per year (up to age 70).

- Waiting to take OAS benefits can result in a 0.6% increase per month (or 7.2% per year).

Bottom line

Catching up on retirement savings in your 50s is not just possible — it’s achievable with a well-thought-out plan. By taking advantage of tax-advantaged accounts, reducing debt, optimizing investments and boosting income where possible, you can bridge the gap and retire comfortably. Remember, the best time to start was yesterday, but the next best time is today.

This article rom $183K to $833K: How Canadians in their 50s bridge the retirement savings gap originally appeared on Money.ca

This article provides information only and should not be construed as advice. It is provided without warranty of any kind.