As the cost of living continues to take a larger bite out of most people’s budgets, many Canadians are being forced to make tough choices at the grocery store checkout.

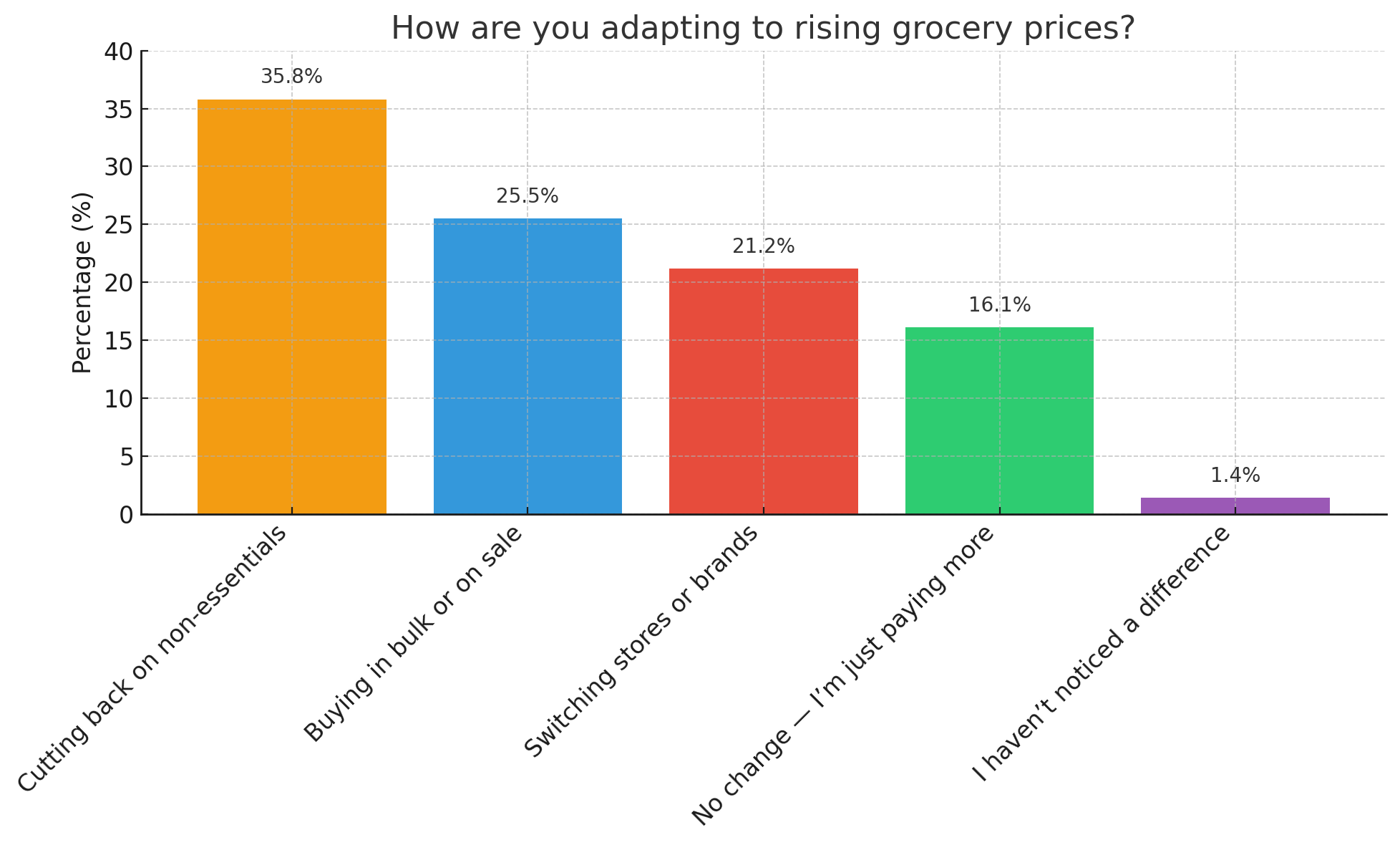

In a recent Money.ca reader poll, more than a third of respondents (35.8%) said they’re cutting back on non-essentials in an effort at dealing with the higher cost of groceries. Another 25.5% said they’re buying in bulk or only when items are on sale, while 21.2% have switched stores or brands in order to stretch their grocery dollars.

Only 16.1% reported making no changes — simply absorbing the cost increase, and just a sliver (under 2%) claimed they haven’t noticed a difference when it comes to food costs and the impact on their budget.

Households under pressure

For many Canadians, grocery bills now consume a larger share of disposable income. This comes at a time when mortgage rates are significantly higher and debt payments are taking up a larger proportion of household budgets. As a result, households are increasingly forced to choose between food quality, quantity, and affordability.

The result? More shoppers are adjusting their shopping habits in order to match needs with funds. According to the results of the Money.ca reader survey, the biggest change is for households to cut back on household essentials (35.8%), while 1 in 4 (25.5%) opted to buy in bulk or only when items were on sale. To cut costs 1 in 5 respondants (21.2%) opted to switch grocery stores or change product brands — in an effort to reduce the overall cost of food.

Global inflation hits home

The rising cost of groceries in Canada isn’t happening in a vacuum. Global factors, from climate-driven crop failures to geopolitical instability, continue to disrupt supply chains and drive up food prices. Droughts in key agricultural regions, coupled with the lingering effects of the pandemic on logistics and labour, have made everything from lettuce to lentils more expensive.

And while inflation has cooled overall, food prices remain stubbornly high. According to Statistics Canada, grocery prices rose 3.4% year-over-year as of June 2025— outpacing the overall inflation rate of 2.6%.

Long-term impact?

What started as a short-term adjustment may now be a long-term behavioural shift. Canadians are learning to live with less — and doing so creatively. Community-supported agriculture (CSA) boxes, backyard gardens, and food-sharing apps are seeing a surge in interest. But the emotional toll is mounting. Food insecurity is on the rise, and the anxiety over affording basic groceries is reshaping how Canadians view their financial future.

As global events continue to affect supply chains and economies, the cost of living — and eating — is unlikely to ease anytime soon. For now, Canadians are adapting. But not without sacrifice.

Survey methodology

The Money.ca survey was conducted through email between May 21 to 28, 2025. Approximately 5,970 email newsletter subscribers, over the age of 18, were surveyed with 137 responses. The estimated margin of error is +/- 6%, 17 times out of 20.

About Money.ca

Money.ca is a leading financial platform committed to providing individuals with comprehensive financial education and resources. As part of Wise Publishing, Money.ca is a trusted source of reliable financial news, expert advice, comparison tools and practical tips. Canadians get insight on a variety of personal financial topics, including investing, retirement planning, real estate, insurance, debt management and business finance.

Sources

1. Statistics Canada: Inflation slowed in 2024, but Canadians continued to shift their grocery shopping habits (June 10, 2025)

This article provides information only and should not be construed as advice. It is provided without warranty of any kind.