This article adheres to strict editorial standards. Some or all links may be monetized.

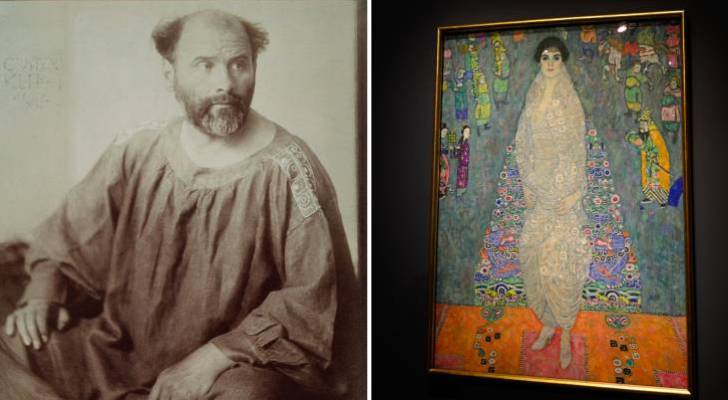

Art investing reached new heights recently, when a Gustav Klimt painting set a record as the second-most-expensive painting ever sold at auction.

The “Portrait of Elisabeth Lederer” sold in a Sotheby’s auction for $236.4 million (1), beaten only by Leonardo da Vinci’s “Salvator Mundi” — which sold for a staggering $450.3 million in 2017 (2).

Must Read

- Real Estate: Thanks to Jeff Bezos, you can now become a landlord for as little as $100 — and no, you don’t have to deal with tenants or fix freezers. Here’s how

- Retirement: Dave Ramsey warns nearly 50% of Americans are making 1 big Social Security mistake — here’s what it is and 3 simple steps to fix it ASAP

- Investing: Warren Buffett used 8 solid, repeatable money rules to turn $9,800 into a $150B fortune. Start using them today to get rich (and stay rich)

Klimt, born in Vienna in 1862, was a founding member of the Vienna Secession — a movement which looked to bring Western European modern art and design influences to Austria (1). Known for his Symbolist paintings and contributions to Art Nouveau, he was close with the Lederer family and other prominent families across Vienna.

The six-foot-tall portrait is one of many Klimt painted for the family before his death in 1918, portraying the young heiress draped in an intricate Chinese robe.

While you might not have a quarter of a billion to buy a Klimt, this massive sale proves just how valuable art investing can be, even for those investing in less famous works of art.

A tragic history

Art valuations are based on a wide variety of metrics — the reputation and skills of the artist, what condition the piece is in, how the work shaped and influenced artistic movements — but the history behind a piece of art can play a significant role in its asking price.

While every original is a one-of-a-kind, Klimt’s “Portrait of Elisabeth Lederer” stands in rarified air, having narrowly avoided the fiery end many of his early works suffered.

During World War II, the Nazis looted the Lederers’ vast art collection (3). After this, Klimt’s many works were showcased in a 1943 exhibition at the Immendorf Castle in Vienna, but the Lederer family portraits were left out due to their Jewish heritage. This saved their portraits from the fate of Klimt’s other works on display when the Nazis burned the castle down right before they lost the war.

Lederer died before the war ended, but the painting was returned to her brother Erich in 1948, who held onto it until late in his life.

In 1983, art dealer Serge Sabarsky acquired it, selling it two years later to Estée Lauder heir Leonard A. Lauder — who owned two other works by the Austrian painter.

The Lederer portrait was the jewel of his collection, Emily Braun, Lauder’s art adviser, told CNN:

“He ate lunch whenever he was at home, and lunch would be at a little round table right by the painting.”

Lauder died in June, and his massive art collection went on sale via Sotheby’s on Nov. 18.

Read more: Robert Kiyosaki says this 1 asset will surge 400% in a year — and he begs investors not to miss its ‘explosion’

A record-breaking sale

The painting was speculated to sell for around $150 million, according to CNN (3), but it blasted those predictions out of the water, selling for $86 million more than the market assumed.

This isn’t the only record-breaking sale Sotheby’s is celebrating.

On Nov. 20, Frida Kahlo’s self-portrait, “El sueño (La cama),” or “The Dream (The Bed)” sold for $54.7 million, smashing the auction record for paintings by a female artist (4).

Previously, the record was held by Georgia O’Keeffe, whose 1932 painting “Jimson Weed/White Flower No. 1” sold for $44.4 million.

These incredibly successful auctions have showcased the value of investing in modern art, increasing investor interest in the art world.

While the average retail investor doesn’t have the many millions Lauder had available to spend on his impressive art collection, there is a new way investors can own a piece of some of the greatest works ever committed to canvas that doesn’t require billionaire status.

Masterworks, a platform for investing in shares of blue-chip artwork allows you to invest in fractional shares of masterpieces by beloved artists like, Picasso, Basquiat and Banksy.

Masterworks is also easy to use, with their team of art experts handling everything from procurement and purchase to storage and sale. To date, Masterworks has had 25 successful exits, distributing $65+ million in total proceeds (including principal).

Simply browse their impressive portfolio of paintings and choose the number of shares you want to buy.

From here, Masterworks will handle all the details, making high-end art investing effortless and accessible.

Note that past performance is not indicative of future returns. Investing involves risk. See Reg A disclosures at masterworks.com/cd.

What to read next

- Approaching retirement with no savings? Don’t panic, you’re not alone. Here are 6 easy ways you can catch up (and fast)

- Dave Ramsey says this 7-step plan ‘works every single time’ to kill debt, get rich — and ‘anyone’ can do it

- Grant Gardone reveals the ‘real problem’ with US real estate (and what average Americans must actually do to get rich)

- 22 US states are already in a recession — protect your retirement savings with these 10 essential money moves ASAP

Join 200,000+ readers and get Moneywise’s best stories and exclusive interviews first — clear insights curated and delivered weekly. Subscribe now.

Article sources

We rely only on vetted sources and credible third-party reporting. For details, see our editorial ethics and guidelines.

The New York Times (1); The Guardian (2), (4); CNN (3)

This article provides information only and should not be construed as advice. It is provided without warranty of any kind.