Despite high hopes for relief, 72% of Canadians say they won’t shift financial strategy when Bank of Canada lowers rates.

As the Bank of Canada eyes another potential rate cut at its July 30 announcement, a new Money.ca reader poll suggests that the majority of Canadians don’t plan to change their financial habits — even if borrowing costs ease.

New survey shows Canadians can’t or won’t adapt even to more rate cuts

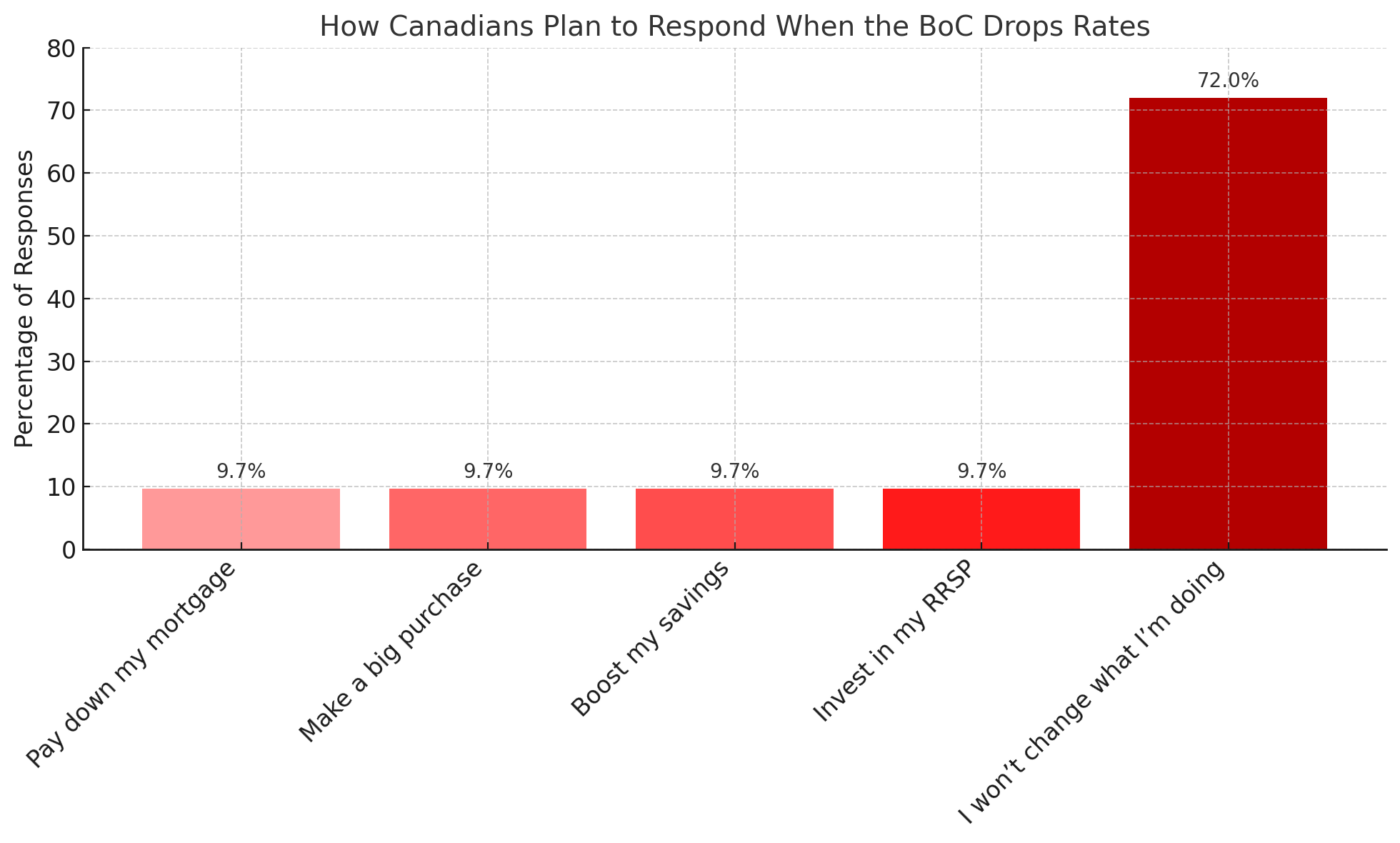

The Money.ca survey asked respondents: “When the Bank of Canada finally drops interest rates, how will you respond?” Turns out, almost 3 out of 4 respondents (72%) said they wouldn’t change what they’re doing — a signal that Canadians don’t feel the impact of rising prices or, more likely, there are now relatively few options when it comes to cutting expenses.

Of the remaining respondents, the remaining 28% were split on how they’d respond to a BoC rate cut:

- 9.7% would pay down their mortgage

- 9.7% would boost their savings

- 5.4% would make a big purchase

- 3.2% would invest in their RRSP

BoC rate cut in July is a possibility

The Bank of Canada held its policy interest rate at 2.75% on June 4, 2025, marking a continued pause as it awaits more clarity on global trade tensions and inflation dynamics. In the last few years inflation has cooled from a peak of 8.1% in 2022 to just under 3% in June 2025 — but many households are still struggling with the high cost of groceries, shelter, and credit repayments.

Affordability crisis still top of mind

While some economists are forecasting another quarter-point cut in July — or at least by September — the real issue for Canadians is affordability.

A June 2025 Leger poll found that 64% of Canadians feel they are “falling behind financially.” And despite slowing inflation, mortgage renewal rates remain above 5%, rent has hit record highs in major cities, and grocery prices — although rising slower — are still higher than they were two years ago.

Financial habits shaped by long-term uncertainty

The Money.ca survey results show that Canadians may be adapting to this new high-cost reality with prudence, not excitement. The fact that nearly three-quarters of respondents said they won’t make changes suggests that a single rate cut won’t be a tipping point. At this point, it’s not about one rate cut as it appears that people are waiting for a trend, not a blip.

For those few Canadians who are ready to act, most are leaning toward practical, stability-focused moves like reducing debt or increasing savings — not big purchases or investing sprees.

What to watch for next

The Bank of Canada’s next move will depend on inflation, GDP growth, and consumer spending data, all of which have cooled in recent months. A second consecutive rate cut in July or September could reinforce the shift to a lower-rate environment — but as this poll shows, Canadians are wary.

Until they see sustained improvements in affordability, employment security, and household budgets, most will stay the course — no matter what the central bank decides.

Survey methodology

The Money.ca newsletter survey was conducted through email in October 2024. Approximately 4,735 email newsletter subscribers, over the age of 18, were surveyed resulting in 93 responses. The estimated margin of error is +/- 8.5%, 19 times out of 20.

About Money.ca

Money.ca is a leading financial platform committed to providing individuals with comprehensive financial education and resources. As part of Wise Publishing, Money.ca is a trusted source of reliable financial news, expert advice, comparison tools and practical tips. Canadians get insight on a variety of personal financial topics, including investing, retirement planning, real estate, insurance, debt management and business finance.

Sources

1. Leger: Economic Confidence: Canada 2025

This article provides information only and should not be construed as advice. It is provided without warranty of any kind.