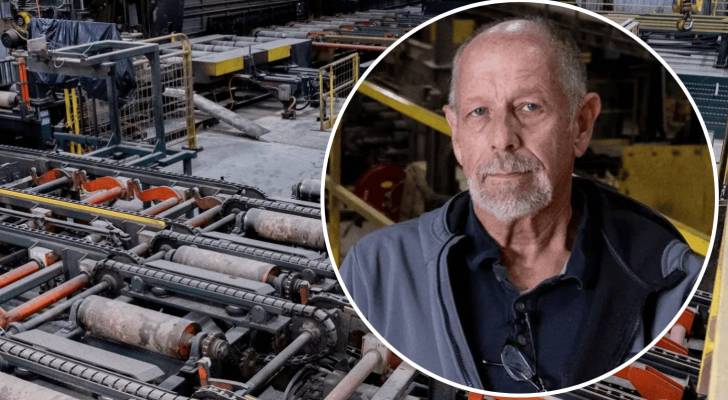

Wilson Jones stands in what used to be the heart of his family’s lumber empire — the Mackeys Ferry Sawmill in North Carolina.

But instead of the familiar roar of saws cutting through Southern pine, there’s only silence.

"I’ve grown all my life in the lumber business," the 60-something mill owner tells Bloomberg (1), his voice heavy with emotion. "And to hear nature at a sawmill, I think for any lumberman is not natural. I don’t wanna be overly dramatic, but in a way it’s as unnerving as watching a loved one take their final breath."

Jones is the fifth generation in his family to run a lumber business — and the first to close a mill. The culprit? President Donald Trump’s "Liberation Day" tariffs, announced April 2, 2025, which promised to bring manufacturing jobs roaring back to America.

"When I say Liberation Day, I cannot put enough snark and sarcasm in my voice because we weren’t liberated," Wilson says. "Liberation Day, it did, at the time, it had damn near liberated me from our business."

Must Read

- Real Estate: Thanks to Jeff Bezos, you can now become a landlord for as little as $100 — and no, you don’t have to deal with tenants or fix freezers. Here’s how

- Retirement: Dave Ramsey warns nearly 50% of Americans are making 1 big Social Security mistake — here’s what it is and 3 simple steps to fix it ASAP

- Investing: Warren Buffett used 8 solid, repeatable money rules to turn $9,800 into a $150B fortune. Start using them today to get rich (and stay rich)

A national manufacturing collapse fuelled by tariffs

The Jones family’s story isn’t unique. It’s playing out in factories, mills and plants across America. Since President Trump’s April tariff announcement, overall manufacturing employment has declined by 42,000, while job openings and hires have fallen by 76,000 and 18,000, respectively according to the Center for American Progress (2). Manufacturing hiring plunged in May to the weakest rate since 2016 under President Barack Obama (3).

The situation hasn’t improved in recent months. Manufacturing jobs are down by 78,000 since the start of 2025, with the sector losing another 3,000 jobs in October alone according to an ADP report (4). Despite job openings in the sector increasing to 462,000 in July — up from 393,000 in June — actual hiring has declined 5% year-over-year according to iCIMS data (5).

Time-to-fill has also increased from 40 to 42 days, suggesting employers are making slower, more cautious hiring decisions in an uncertain market.

Wilson Jones sees the pattern clearly: "If you put all these little communities together from Maine over to Michigan, down to Mississippi and Alabama, it’s having the same effect on these small little communities."

The human cost is racking up. Of the 50 workers laid off when Mackeys Ferry closed, only 10 accepted positions at the Jones brothers’ other mill an hour away. The rest? They’re looking for new careers, new lives, or just trying to figure out what comes next.

"From the guy that’s just stacking lumber to the guy that’s sawing — don’t even care about the guy that’s the mill owner — what about those guys?" Wilson asks.

Tariffs breaking promises

On "Liberation Day," President Trump said: "Jobs and factories will come roaring back into our country, and you see it happening already. We will supercharge our domestic industrial base." (6) But the numbers tell a different story.

According to the American Enterprise Institute, the cost to American purchasers per manufacturing job created by tariff protection will be at least $225,000 annually per job-year for an indefinite period, with more realistic calculations indicating a cost of $550,000 annually per job-year (7).

So what’s the fundemental problem? Tariffs raise costs for American manufacturers that rely on imported materials. For every job in steel production, there are another 80 jobs in U.S. industries that use steel (8). When steel prices go up — as they have, with some domestic producers raising prices 38.5% — those 80 downstream jobs suffer.

Wilson Jones doesn’t hold back about what he’d tell President Trump if he visited the shuttered mill: "President Trump, gee, I understand what you’re trying to do, but you’re on a fool’s mission. And you’re not helping out a few. You’re hurting a lot."

Entire industries crumbling under weight of tariffs

The tariff disruption spans multiple sectors:

Lumber: Tariffs on Canadian softwood lumber have reached 45%, devastating an industry where the U.S. relies on Canada for 30% of its supply. For Mackeys Ferry, a regular $500,000 shipment to China suddenly faced tariffs worth more than the wood itself.

Furniture: Trump announced a 30% tariff on upholstered furniture and will charge 50% on all kitchen cabinets and bathroom vanities. Prices for living room, kitchen and dining room furniture rose 9.5% from August 2024 to August 2025 (9).

Alex Shuford, CEO of Rock House Designer Brands in North Carolina, said this in a recent Marketplace interview (10): "We’re exactly the type of company that this is intended to benefit. And when we look across the longer arc of time, we see it as a net-negative."

Steel and aluminum: Despite tariffs meant to protect these industries, roughly 1,400 U.S. and Canadian steel and aluminum workers have lost their jobs due to tariffs (11). Aluminum giant Alcoa’s CEO warned that a 25% aluminum tariff could cost 100,000 American jobs (12).

Read more: Robert Kiyosaki says this 1 asset will surge 400% in a year — and he begs investors not to miss its ‘explosion’

Supply chain disruptions and confusion devastate rural America

The ripple effects reach far beyond individual factories. The Joint Economic Committee finds that continued tariff uncertainty could reduce U.S. manufacturing investments by more than 13% per year — more than $490 billion by 2029 U.S. (13).

In Washington County, North Carolina, where Mackeys Ferry operated, Economic Development Director Kelly Chesson calls the closure "a big blow."

"50 guys are going, men and women are gonna lose their jobs. Yeah, that is a blow," Chesson says, noting the county still hasn’t recovered from losing 200 jobs when a paper mill closed 20 years ago. "We still haven’t recovered from that."

The uncertainty paralyzes business planning. Companies need decades-long horizons to invest in new facilities, but tariff policies change by the day — sometimes by the hour. For rural communities already struggling with limited economic diversification, each facility closure promises to echo for generations.

What are economists saying?

Betsey Stevenson, professor of economics at the University of Michigan and former chief economist at the Department of Labor, puts it bluntly: "It’s a policy choice to sow this much uncertainty. And that uncertainty has a cost." (14)

The evidence is overwhelming. According to Al Jazeera, Trump’s April 2025 tariff announcements triggered the worst two-day loss in U.S. stock market history, wiping out approximately $6.6 trillion in value in just the first two days. Over the following week, global equity markets lost about $10 trillion — roughly 10% of global GDP (14). The markets have since recovered to all-time highs but experts are concerned that’s fueled by AI hype, since the view in manufacturing is very different.

The Federal Reserve Bank of Richmond’s May 2025 survey found that 88% of manufacturers in the Fifth District reported making changes to their business due to tariffs, with the Dallas Fed’s August 2025 survey showing more than 70% of Texas manufacturing firms reported negative impacts from tariffs (15, 16).

Standing by the vote

Wilson Jones voted for Trump — all three times.

"I voted for Trump all three times. Yep. I did," he admits. "But I literally was in the voting booth. And I rapped my knuckles and the Trump one hurt more, and that was the one that I voted for. Because it was just, it was so disgusting and, and I hate to say that, but that’s literally how I made that choice."

Even after losing his business to Trump’s policies, he stands by his vote: "Given the two people running, regardless of what they said on the campaign trail, I would’ve voted for President Trump again."

His brother Stephen agrees: "I don’t think I had a choice to vote any other direction."

What this means for your wallet, and what’s next

For consumers, the costs are mounting. The Tax Foundation reports the tariffs will result in an average tax increase of $1,200 per U.S. household in 2025 and $1,600 in 2026 (17). That’s showing up in furniture prices, building materials, cars — virtually everything made with steel, aluminum or imported components.

Food prices have been rising sharply due to tariffs, with grocery costs jumping 0.6% in August 2025 — the biggest month-over-month increase in three years. Coffee prices soared 20.9% year-over-year, beef steaks rose 16.6%, and items like bananas and apples saw significant increases as Trump’s tariffs hit imported foods. However, facing mounting political pressure over grocery prices, Trump announced on November 14, 2025 that he would scrap multiple tariffs on beef, coffee, tropical fruits, cocoa, tea, and other commodities — a dramatic reversal after months of insisting tariffs don’t raise consumer prices. Housing costs will likely continue climbing as lumber prices feed into construction expenses.

Consumers and rural manufacturers can only hope more tariff adjustments are coming.

As for Wilson Jones? He’s maintaining the Mackeys Ferry equipment, hoping someone might buy the mill. The last board rolled off the production line on September 29, 2025.

"There’ll be some [lumber] we’ll be able to sell here and there, but… we’re trying to get the biggest chunks out of it right now," he says.

His philosophy now? "Quit feeling sorry for yourself. Yep. Pull your head outta your rear and try to, you know, make a difference where you can make a difference."

But for the 50 families who lost their livelihoods, for the rural communities watching their economic anchors disappear, and for American consumers facing higher prices on everything from kitchen cabinets to cars, the question remains: Is this the "liberation" America was promised?

The silent sawmill in North Carolina suggests otherwise.

What to read next

- Approaching retirement with no savings? Don’t panic, you’re not alone. Here are 6 easy ways you can catch up (and fast)

- Dave Ramsey says this 7-step plan ‘works every single time’ to kill debt, get rich — and ‘anyone’ can do it

- Grant Gardone reveals the ‘real problem’ with US real estate (and what average Americans must actually do to get rich)

- 22 US states are already in a recession — protect your retirement savings with these 10 essential money moves ASAP

Join 200,000+ readers and get Moneywise’s best stories and exclusive interviews first — clear insights curated and delivered weekly. Subscribe now.

Article sources

Bloomberg (1); Center for American Progress (2) ; CNN (3), 12, 14); ADP (4); iCIMS (5); CNBC (6); American Enterprise Institute (7); Econofact (8); CBS News(9); Marketplace (10); Freightwaves (11); Joint Economic Committee (13); Al Jazeera (14); Federal Reserve Bank of Richmond (15); Federal Reserve Bank of Dallas (16); Tax Foundation (17)

This article provides information only and should not be construed as advice. It is provided without warranty of any kind.