Nick’s sitting on a classic money dilemma: take the US$150,000 his wife has in a stock portfolio from her old job and knock down their mortgage, or stash it away as a safety net. The Boston couple is torn between peace of mind and the satisfaction of wiping out debt.

As a result, Nick called into The Ramsey Show for advice. He explained that they have an 18-month-old, another baby on the way and a budget that feels “very tight right now.” That’s why they’re debating whether to keep the money as backup.

Don’t Miss

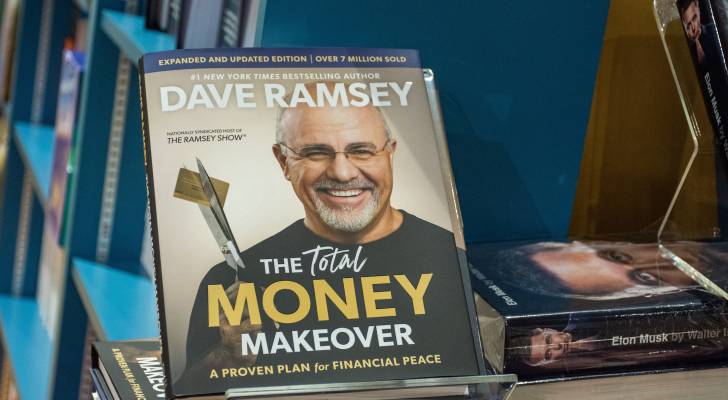

- Want to retire with an extra $1.3M? See how Dave Ramsey’s viral 7-step plan helps millions kill debt and build wealth — and how you can too

- A new nationwide survey of financial leaders warns Canada may face a recession in six months — protect your wallet with these 6 smart money moves ASAP

- Boomers are out of luck: Robert Kiyosaki warns that the ‘biggest crash in history is coming’ — here’s his strategy to get rich before things get worse

At the same time, he’d like to get a jumpstart on their mortgage. They owe about US$329,000 at a 2.875% rate. They’re already saving for retirement, have US$30,000 in an emergency fund and another US$100,000 in a high-yield money market account (the American equivalent of a high-interest savings account).

Here’s what Dave Ramsey told Nick to do — and why it may not make sense for everyone.

Should you pay down your mortgage sooner?

Nick and his wife are in a unique spot: they already have US$130,000 in liquid savings. Adding the US$150,000 stock portfolio would give them US$280,000 more to set aside.

“How much backup do you need?” Ramsey asked. “This is insanity. If I woke up in your shoes, I would put $250,000 down on that house and have a $30,000 emergency fund.”

You generally have two options if you’re in a similar situation: either invest your extra cash and aim for returns that outpace your mortgage interest, or pay off your mortgage early to save thousands in interest and free up more income for other goals.

Ramsey’s seven baby steps to building wealth include paying off your home early at step six. Additionally, a 2024 Ramsey Solutions study found that the average millionaire pays off their house in just over 10 years.

That advice makes sense if you’ve covered the basics: you already have an emergency fund, you’re already saving for retirement (or maxed out your RRSPs) and don’t have any outstanding high-interest debt.

On the other hand, if you don’t have a lot of savings but your mortgage is still manageable, then it may make more sense to save or invest those funds within a reasonable limit.

However, be mindful of other, more pressing financial matters that may act as a stopgap to paying off your mortgage or keeping that money invested.

"High-interest debts, such as credit card balances or certain loans, can collect large amounts of interest over time. The average interest rate on credit cards in Canada recently was between 19.99% and 25.99%,” according to the Canadian Investment Regulatory Organization (1). By paying off these debts, you are effectively getting a return of 19.99% or more. “Few investments can match that rate of return.” This is why finfluencers, like Dave Ramsey, consistently advise people to pay off high-interest debt, first.

Emergency savings also matter. Since home equity isn’t liquid, financial experts suggest saving three to six months of living expenses before using funds to pay down less-expensive debt, such as your mortgage.

Read more: Here are 5 expenses that Canadians (almost) always overpay for — and very quickly regret. How many are hurting you?

How to pay off your mortgage faster

However, if you are fortunate enough to be in a position with surplus funds and you’ve paid off high-interest debt and built up an emergency fund, then prioritizing your mortgage loan repayments is a smart money strategy.

The good news is there are plenty of ways to speed up paying off your mortgage, whether you have a lumpsum — like the $150,000 investment portfolio — or just a little extra in your budget. To help you strategize consider these options:

- Windfall: Make a lump-sum payment using a tax refund, bonus or inheritance.

- Systematic: Increase your regular mortgage payments if you earn more either because you got a raise or your earning through a side gig.

- Speed it up: Switch to biweekly payments. That adds up to 13 monthly payments a year instead of 12, and extra money towards the principal debt reduces interest costs and speeds up repayment.

- Target the end: Refinance into a shorter-term loan or lower rate, if it makes sense.

No matter what strategy you pick, just be sure you watch out for prepayment penalties.

With an open mortgage, you can pay off what you owe in full without any penalties. With a closed mortgage, you can typically prepay between 10% and 20% of the principal mortgage loan, each year. But these general rules are dependent on your original loan agreement with the lender. If you exceed that limit — even by accident — you’ll typically have to pay a penalty, unless your contract specifies otherwise. (Even with an open mortgage, there are administration fees, just be sure to confirm if there are restrictions or penalties if you pay off the mortgage within a specified period.)

Finally, take an honest look at whether you can afford your home. You’re typically considered ‘house poor’ if you spend more than 30% of your household income on housing costs, according to the Canada Mortgage and Housing Corporation (CMHC) (2). And many Canadians are already house poor. A survey by Zoocasa of Canadian homeowners across all income levels found that one in four (24.3%) are spending more than 30% of their household income on housing costs, whether they own or rent a home (3).

If your mortgage payments eat up too much of your budget, downsizing might free up the cash you need for savings and investments.

It could be worth setting up a conversation with your financial advisor to discuss your specific situation and see if it makes sense to pay off your mortgage sooner or focus on other financial goals instead.

What To Read Next

- Ray Dalio just raised a red flag for Americans who ‘care’ about their money — here’s why Canadians should limit their exposure to U.S. investments

- The ultra-rich are pulling back on volatile stocks right now, warns investing legend — here are the 4 assets they’re using to help shield their millions

- I’m almost 50 and don’t have enough retirement savings. What should I do? Don’t panic. Here are 6 solid ways you can catch up

- Here are the top 7 habits of ‘quietly wealthy’ Canadians. How many do you follow?

Article sources

We rely only on vetted sources and credible third-party reporting. For details, see our editorial ethics and guidelines.

Ramsey Solutions (1); Canadian Investment Regulatory Organization (2); Canada Mortgage and Housing Corporation (3); Zoocasa (4)

This article provides information only and should not be construed as advice. It is provided without warranty of any kind.