This article adheres to strict editorial standards. Some or all links may be monetized.

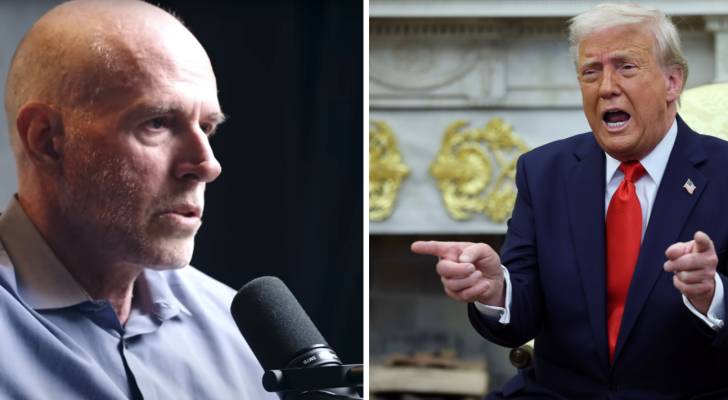

New York University marketing professor Scott Galloway delivered a fiery takedown of President Donald Trump’s sweeping tariffs, calling them a “blackout drunk” move that could derail the global economy.

“It would be hard to think of a more elegant way to reduce prosperity this fast,” Galloway said during an April 11 appearance on The View.

Taking aim at Trump’s economic nationalism, Galloway defended the logic behind outsourcing low-wage manufacturing jobs.

Must Read

- Thanks to Jeff Bezos, you can now become a landlord for as little as $100 — and no, you don’t have to deal with tenants or fix freezers. Here’s how

- I’m 49 years old and have nothing saved for retirement — what should I do? Don’t panic. Here are 6 of the easiest ways you can catch up (and fast)

- Dave Ramsey warns nearly 50% of Americans are making 1 big Social Security mistake — here’s what it is and 3 simple steps to fix it ASAP

“We want to wear Nikes. We don’t want to make them,” he said. “We have outsourced low-wage jobs overseas, such that we can create more profits, more investments and create higher-wage jobs.”

But it’s not just about labor. Galloway warned that Trump’s tariffs could dramatically increase prices for everyday Americans.

“If these tariffs hold, your iPhone is going to go from $1,000 to $2,300,” he said. “To make an iPhone in the U.S., it would cost $3,500.”

Galloway didn’t hold back on where he thinks the blame lies: “We finally need to acknowledge, we have someone at the wheel of the global economy that is blackout drunk right now.”

The Trump administration reignited reciprocal tariffs for many countries in early August, but on Aug. 11 announced through executive order that tariffs on China would be frozen for another 90 days until Nov. 10. As it stands, U.S. tariffs on Chinese imports will be locked in at 30% while China’s duties on U.S. imports will stay at 10%. However, any reduction in tariffs depends on continued good relations between the two superpowers.

Preparing for bad times

Galloway isn’t alone in his feelings — Trump’s tariffs have sparked serious warnings from some of the most powerful names in finance. Billionaire hedge fund manager Ray Dalio recently highlighted the role of one time-tested asset that could help investors brace for economic turbulence.

“People don’t have, typically, an adequate amount of gold in their portfolio,” he told CNBC in February. “When bad times come, gold is a very effective diversifier.”

Gold has long served as a hedge against inflation. It can’t be printed out of thin air like fiat money, and because it’s not tied to any single currency or economy, investors often flock to it during periods of economic turmoil or geopolitical uncertainty, driving up its value.

Over the past 12 months, gold prices have surged by more than 40%.

A gold IRA is one option for building up your retirement fund with an inflation-hedging asset.

Opening a gold IRA with the help of Goldco allows you to invest in gold and other precious metals in physical forms while also providing the significant tax advantages of an IRA.

With a minimum purchase of $10,000, Goldco offers free shipping and access to a library of retirement resources. Plus, the company will match up to 10% of qualified purchases in free silver.

If you’re curious whether this is the right investment to diversify your portfolio, you can download your free gold and silver information guide today.

Read more: This is how much US drivers saved on car insurance when they switched providers, according to a new Consumer Reports survey of 140,000 policyholders

Retirement investing isn’t one-size-fits-all. For experienced investors ready to take greater control, a self-directed retirement account from IRA Financial unlocks a wider range of opportunities — allowing you to diversify your retirement portfolio.

A self-directed retirement account is a tax-advantaged individual retirement account (IRA) that lets investors allocate funds to a significantly broader range of alternative assets than typical IRAs offered by banks or brokerage firms.

While traditional IRAs limit options to stocks, bonds and mutual funds, a self-directed account allows you to invest in real estate, cryptocurrency, private businesses, precious metals and private lending.

IRA Financial offers an easy-to-use platform and app where you can manage your investments. You can also choose to work with their experienced retirement specialists and in-house tax team.

How It works

- Prequalify – Answer a few quick questions in 90 seconds.

- Fund your account – Transfer or contribute funds easily from an existing IRA or retirement plan.

- Choose your plan – Pick from Self‑Directed IRA, Solo 401(k), Checkbook IRA, or Crypto IRA.

- Start investing – Invest tax-free in real estate, crypto, and more.

With over $5 billion in retirement assets under custody, guaranteed IRA audit protection, 25,000+ clients nationwide and a 97% client retention rate, IRA Financial can help you grow your retirement fund with alternative assets.

Earn passive income in retirement

Real estate offers a compelling alternative for hedging against inflation — with the added benefit of generating passive income.

As the cost of materials, labor and land rises, property values often increase as well. At the same time, rental income tends to climb, giving landlords a revenue stream that can keep pace with inflation.

That’s why real estate is a favorite among retirement investors and those planning for long-term financial stability.

However, owning a rental property isn’t exactly as passive as it sounds. Between finding tenants, collecting rent, covering repairs, and saving for a down payment, being a landlord takes time — and money.

New investing platforms are making it easier than ever to tap into the real estate market.

For accredited investors, Homeshares gives access to the $36 trillion U.S. home equity market, which has historically been the exclusive playground of institutional investors.

With a minimum investment of $25,000, investors can gain direct exposure to hundreds of owner-occupied homes in top U.S. cities through their U.S. Home Equity Fund — without the headaches of buying, owning or managing property.

With risk-adjusted internal returns ranging from 12% to 18%, this approach provides an effective, hands-off way to invest in owner-occupied residential properties across regional markets.

If you’re not an accredited investor, crowdfunding platforms like Arrived allows you to enter the real estate market for as little as $100.

Arrived offers you access to shares of SEC-qualified investments in rental homes and vacation rentals, curated and vetted for their appreciation and income potential.

Backed by world-class investors like Jeff Bezos, Arrived makes it easy to fit these properties into your investment portfolio regardless of your income level. Their flexible investment amounts and simplified process allows accredited and non-accredited investors to take advantage of this inflation-hedging asset class without any extra work on your part.

Another option is First National Realty Partners (FNRP), which allows accredited investors to diversify their portfolio through grocery-anchored commercial properties without taking on the responsibilities of being a landlord.

With a minimum investment of $50,000, investors can own a share of properties leased by national brands like Whole Foods, Kroger and Walmart, which provide essential goods to their communities. Thanks to Triple Net (NNN) leases, accredited investors are able to invest in these properties without worrying about tenant costs cutting into their potential returns.

Simply answer a few questions — including how much you would like to invest — to start browsing their full list of available properties.

What to read next

- How much cash do you plan to keep on hand after you retire? Here are 3 of the biggest reasons you’ll need a substantial stash of savings in retirement

- There’s still a 35% chance of a recession hitting the American economy this year — protect your retirement savings with these 5 essential money moves ASAP

- This tiny hot Costco item has skyrocketed 74% in price in under 2 years — but now the retail giant is restricting purchase. Here’s how to buy the coveted asset in bulk

- Want an extra $1,300,000 when you retire? Dave Ramsey says this 7-step plan ‘works every single time’ to kill debt, get rich in America — and that ‘anyone’ can do it

Join 200,000+ readers and get Moneywise’s best stories and exclusive interviews first — clear insights curated and delivered weekly. Subscribe now.

This article provides information only and should not be construed as advice. It is provided without warranty of any kind.