Emily, a 30-year-old from Jacksonville, Florida, reached out to The Ramsey Show looking for advice on an unusual situation. Her boyfriend, 32, views 401(k)s as a "scam," and his views are causing tension in their relationship.

She’s been dating the “lovely young man” for about nine months, and during a casual chat about retirement savings, she was shocked by his take on them.

“I’m a big saver,” she explained. “So I’m really into it, I have a 401(k) and a Roth IRA. And his response was that all that matters is working and making money now, and that 401(k)s are a scam.”

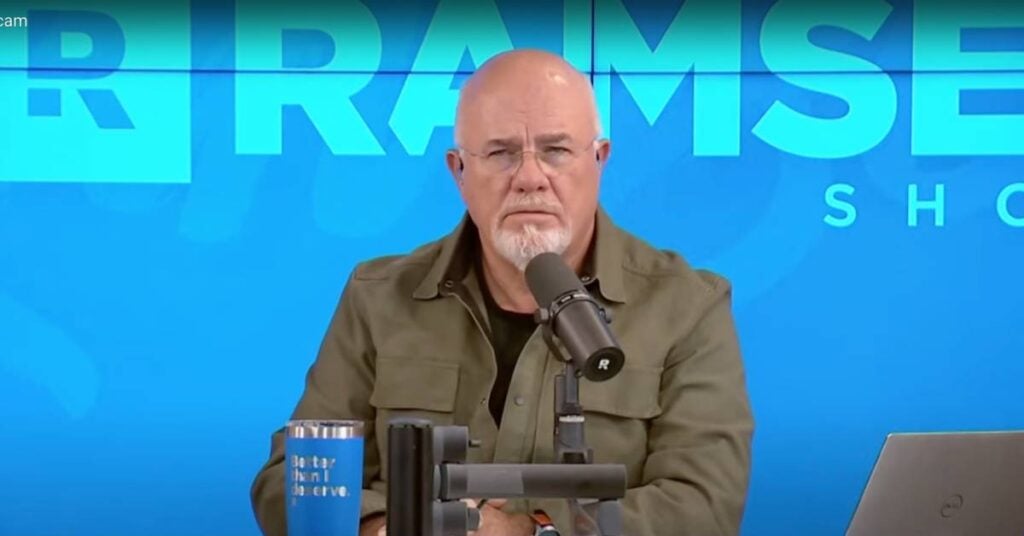

She called the show to ask financial educator Dave Ramsey for advice on how to approach the conversation and help her boyfriend understand why saving for retirement is important.

Ramsey weighed in with context and caution, and didn’t mince his words.

Don’t miss

- I’m 49 years old and have nothing saved for retirement — what should I do? Don’t panic. Here are 5 of the easiest ways you can catch up (and fast)

- Gain potential quarterly income through this $1B private real estate fund — even if you’re not a millionaire. Here’s how to get started with as little as $10

- Robert Kiyosaki warns of a ‘Greater Depression’ coming to the US — with millions of Americans going poor. But he says these 2 ‘easy-money’ assets will bring in ‘great wealth’. How to get in now

Like teaching someone how to ride a bike

“Without knowing why he thinks 401(k)s are a scam, what he’s really saying is, ‘I came from an area where we’re living hand-to-mouth, and thinking about the future isn’t something I want to do. I just want to enjoy the moment.’ That may be rooted in the instability he grew up with, political, economic, or safety-related, but,” Ramsey warned, “it’s still a broken and immature viewpoint.”

Ramsey didn’t hold back, saying, “That’s a problem for you. Because you get to live with someone who’s going to do no planning for the future, which guarantees your future sucks.”

“Did you ask him why he thinks they’re a scam?” co-host Ken Coleman asked. “Was there any kind of follow-up on that particular classification of it?”

She admitted, not really. Her boyfriend, originally from Albania, moved to the U.S. six years ago and just became a citizen this year. He’s 32 and she’s 30.

Coleman offered an empathetic approach, saying that fear might be at the core of her boyfriend’s beliefs.

“If he is truly scared of this product, 401(k), because he doesn’t understand it … then you can deal with fear,” Coleman said. “It’s like teaching someone to ride a bike. You start with training wheels. This is going to be a gradual teaching process.”

Ramsey also notes it may be a mistrust of banks, in general, based on experiences of banking in his country of origin, where there may not be the same safety net to prevent people losing their money. He calls out Latin America in reference to this, but notes this may be a root cause of Emily’s boyfriend’s mistrust too.

Whether it’s money-related insecurity or basic immaturity, Ramsey was clear: “You’ve got to work through this with him, or don’t marry him. Ain’t worth it.”

The caller appreciated the candid advice, and both hosts offered practical next steps.

“Take him to see a SmartVestor Pro,” Coleman recommended. “If he’s afraid, honor his fear. Don’t dismiss his questions.”

Read more: Want an extra $1,300,000 when you retire? Dave Ramsey says this 7-step plan ‘works every single time’ to kill debt, get rich in America — and that ‘anyone’ can do it

SmartVestor Pro is a free service offered by Ramsey Solutions, the organization founded by Dave Ramsey, and meant to connect individuals with legit financial professionals who share Ramsey’s investment philosophy.

Ramsey added, “Actual fear is of something that is logical. If you’re standing in the middle of an interstate and an 18-wheeler is coming at you at 100 miles an hour, you should move. That’s right. That’s actual fear. You’re going to die. That’s a lot different, though. And so this is false evidence appearing real, or it’s immaturity. I don’t know which.”

Money disagreements are a common issue with couples

Emily’s situation reflects a broader issue in the United States: many couples disagree about money matters or think about their partner’s finances — and this can even be a deal-breaker.

A 2019 Pew Research Center study found that:

44% of adults who live together claim financial stability as a prerequisite to getting married.

29% of cohabiting adults say their partner’s not being ready financially is a major reason for not marrying (while 24% claim it as a minor reason).

When it comes to not planning for retirement, Emily’s boyfriend isn’t the only one. According to the U.S. Census Bureau’s Survey of Income and Program Participation, among working-age individuals (ages 15 to 64), only 34.6% owned 401(k)-style accounts in 2020. This means that the remaining portion of the workforce does not have access to or participates in 401(k) plans.

With Northwest Mutual’s 2025 Planning & Progress Study defining the new “magic number” for a comfortable retirement as being $1.26 million, investing in your golden years doesn’t make you a mark; it makes you a thoughtful planner.

Still, “It’s tempting to roll your eyes at something that sounds stupid,” Ramsey admitted. “But you can’t. You’ve got to honor it and dig down to the root of it. Because when you’re not aligned on reality, you have a problem.”

Emily’s tricky situation highlights how important financial compatibility is. Facing differing financial philosophies head-on, through open communication and professional advice, can help couples navigate conflicts and work towards shared financial goals.

Agreeing about money is critical in a long-term relationship. When couples aren’t on the same page about joint budgets or even basic financial principles like saving and planning for the future, it’s not just about money, it’s about values, maturity, and security.

What to read next

- JPMorgan sees gold soaring to $6,000/ounce — use this 1 simple IRA trick to lock in those potential shiny gains (before it’s too late)

- This is how American car dealers use the ‘4-square method’ to make big profits off you — and how you can ensure you pay a fair price for all your vehicle costs

- Here are 5 ‘must have’ items that Americans (almost) always overpay for — and very quickly regret. How many are hurting you?

Like what you read? Join 200,000+ readers and get the best of Moneywise straight to your inbox every week. Subscribe for free.

This article provides information only and should not be construed as advice. It is provided without warranty of any kind.