On paper, Jackson’s debt-free status and $200,000 annual salary might look like an easy ticket to financial freedom.

But in reality, the 25-year-old heavy-duty mechanic from Canada admits he’s often staring at a bank account that doesn’t reflect his hard work or financial progress.

Don’t miss

- I’m 49 years old and have nothing saved for retirement — what should I do? Don’t panic. Here are 5 of the easiest ways you can catch up (and fast)

- Thanks to Jeff Bezos, you can now become a landlord for as little as $100 — and no, you don’t have to deal with tenants or fix freezers. Here’s how

- Gain potential quarterly income through this $1B private real estate fund — even if you’re not a millionaire. Here’s how to get started with as little as $10

“I get my paychecks and I pay my bills with it and then I don’t look at my account all that much,” he said on a recent episode of The Ramsey Show. “I just kind of know there’s always a good chunk of change in there and it usually fluctuates between $15,000 and 25,000.

“But it’s not really going ahead from there because I’m kind of just living, you know?”

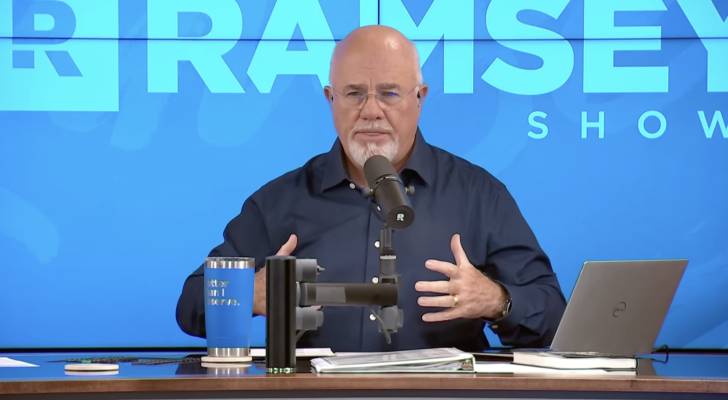

Jackson’s situation isn’t unusual, but celebrity finance personality Dave Ramsey believes his “healthy disgust” with his lack of progress at such a young age certainly is. Here’s why many high-income people struggle to accumulate meaningful wealth.

Biggest mistake rich people make

Jackson’s difficulty holding onto his high income isn’t unique. Roughly 36% of Americans earning more than $200,000 a year say they live paycheck to paycheck, according to a 2024 study by PYMNTs.

Among those in this income bracket, 22.8% cited family expenses as the top reason they can’t save money. Another 17% pointed to poor saving and financial habits as the main reason they live paycheck to paycheck.

Lifestyle creep and untamed budgets appear to drive many people to spend as much — or even more — than they earn. According to Ramsey, the biggest mistake high earners make is a lack of intentionality with their money.

Jackson, however, is determined to avoid that mistake.

“I feel like I make too much money to not have some sort of a plan and I don’t want to feel like a fool who squanders a fortune,” he tells Ramsey, who responds with a compliment: “Just asking the question puts you in the top 5%, dude.”

Ramsey’s advice? Start with a robust budget.

Read more: Want an extra $1,300,000 when you retire? Dave Ramsey says this 7-step plan ‘works every single time’ to kill debt, get rich in America — and that ‘anyone’ can do it

Give every dollar a job

According to Ramsey, the only way to be intentional with your money is to set up a spending plan before the income arrives.

“We’re going to write it down — before the month begins — where every dollar is going to go,” he told Jackson. “Give every dollar an assignment. Contract with yourself. If you have a spouse, do it with your spouse.”

A tight monthly budget should help Jackson earmark cash for necessary expenses, discretionary spending, taxes and emergencies — and ideally leave extra for savings and investments. Working with a financial planner would also be ideal.

Unfortunately, only 27% of Americans use professional help for investment advice and services, according to a 2024 YouGov survey.

Most aren’t doing this work independently either. Just two in five Americans said they have a monthly budget or closely monitor their spending, according to the National Foundation for Credit Counseling.

In other words, a robust, professional budget is rare, which helps explain why living paycheck to paycheck is so common. You can avoid the same pitfalls by hiring a professional or setting up a solid budget of your own.

What to read next

- Don’t have the cash to pay Uncle Sam in 2025? You may already be eligible for a ‘streamlined’ handshake with the IRS — here’s how it works and how it can potentially save you thousands

- Here are 5 ‘must have’ items that Americans (almost) always overpay for — and very quickly regret. How many are hurting you?

- Robert Kiyosaki warns of a ‘Greater Depression’ coming to the US — with millions of Americans going poor. But he says these 2 ‘easy-money’ assets will bring in great wealth. How to get in now

This article provides information only and should not be construed as advice. It is provided without warranty of any kind.