Ryan from Wisconsin called in to The Ramsey Show because instead of making money, his $4.4-million real-estate portfolio is losing it.

He earns $5,000 to $19,000 a month in rent from his tenants, which is not enough to service his mortgage debt. He’s now $1.8 million in the hole. Much of it is commercial real estate.

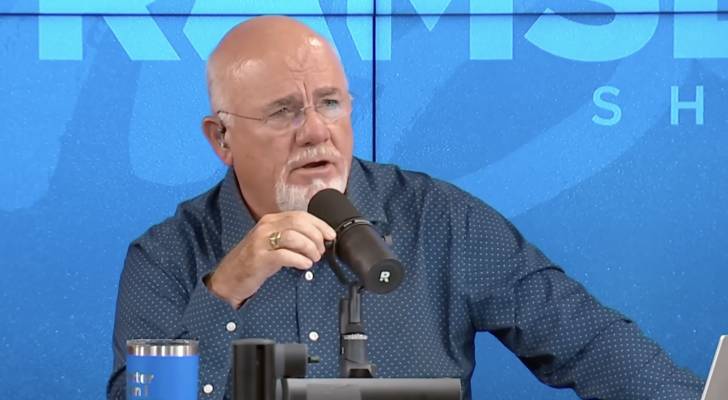

“Your rate of return on that portfolio sucks,” Dave Ramsey said, noting that a commercial real estate portfolio should deliver at least 10%. (1)

Must Read

- Thanks to Jeff Bezos, you can now become a landlord for as little as $100 — and no, you don’t have to deal with tenants or fix freezers. Here’s how

- Dave Ramsey warns nearly 50% of Americans are making 1 big Social Security mistake — here’s what it is and 3 simple steps to fix it ASAP

- Robert Kiyosaki says this 1 asset will surge 400% in a year — and he begs investors not to miss its ‘explosion’

Ryan explained that he got excited about commercial real estate after buying a building for $426,000 and then selling it for $1.6 million.

He continued to amass more commercial properties, but they aren’t making him money anymore.

“You’re still the guy that hit the slot machine once, and so you keep puttin’ quarters in the stupid thing,” Ramsey said.

One thing that has added to Ryan’s woes is the ongoing impact of the pandemic, which caused vacancies to soar in commercial buildings.

What kind of ROI you should expect on real estate

Ramsey told Ryan to sell off unprofitable properties over the next three years and use the profits to erase his debt.

To determine which properties are worth holding on to and which he should ditch, Ramsey recommended calculating the cash-on-cash return he makes from each one.

Read more: I’m almost 50 and have nothing saved for retirement — what now? Don’t panic. These 6 easy steps can help you turn things around

If you’re a property owner, you can calculate cash-on-cash return by dividing your annual pre-tax cash flow (rent) by the total cash you spend on maintaining the property. (2)

Ramsey said residential real-estate investors should aim for an 8 to 10% cash-on-cash return from their rental properties. Meanwhile, commercial property investors should expect a 10 to 14% cash-on-cash return.

Ramsey said he’s earning a cash-on-cash return “up in the 20s” on his own commercial real estate investments.

He added that properties tend to gain value. If you add property appreciation into your calculation (along with and any tax deductions you might enjoy if the property depreciates in value), you should see an internal rate of return (IRR) of 15 and 20%.

“Ours does that,” Ramsey said, “And it’s not rocket surgery to do it.”

However, Ryan suggested that Ryan appears not to have done the math before buying bricks and mortar.

“You’ve just been buying crap, man,” he said. “And you didn’t think anything about the debt aspect, and so the debt on some of these [properties] is eating your lunch.”

Ramsey stressed that not all real estate is a good investment. Here’s how to determine the difference between winning properties and losing propositions.

How to identify a solid real-estate investment

Although real estate is often touted as a low-risk investment, there is risk involved. It’s not a “set it and forget it” endeavor.

Whether you manage your properties yourself or pay a property manager, there will be constant expense, upkeep and management of tenant issues.

The old adage location, location, location applies here. Not all neighborhoods lend themselves to profitable real-estate investments.

While you could earn more if you purchase a property in an up-and-coming area, it’s not guaranteed. Be sure to investigate the property values in the surrounding area. (3)

These are some other calculations to do to determine whether a property is worth your while before buying it:

Internal rate of return (as outlined by Ramsey, the annual rate of growth you expect the property to generate) Capitalization rate (expected rate of return, calculated by dividing net operating income by the current market value) Sales comparison approach (what have other similar properties recently sold for?) Value per gross rent multiplier (a valuation determined by dividing property value by gross rental income). (4)

You could compare a number of properties using these metrics to determine which is best for you.

Even with the best preparation, sometimes the unexpected happens — like a global pandemic that roils the commercial real estate market — and you will have to manage accordingly.

Like Ryan, remember you may have to do ongoing calculations to ensure that your portfolio is earning its keep and jettison those properties that are not generating revenue.

Article sources

We rely only on vetted sources and credible third-party reporting. For details, see our editorial ethics and guidelines.

The Ramsey Show (1); Rocket Mortgage (2); Harvard Division of Continuing Education (3); University of San Diego Continuing Education (4)

What to read next

- Are you richer than you think? 5 clear signs you’re punching way above the average American’s wealth

- Dave Ramsey says this 7-step plan ‘works every single time’ to kill debt, get rich — and ‘anyone’ can do it

- This tiny hot Costco item has skyrocketed 74% in price in under 2 years — but now the retail giant is restricting purchase. Here’s how to buy the coveted asset in bulk

- 22 US states are now in a recession or close to it — protect your savings with these 5 essential money moves ASAP

Join 200,000+ readers and get Moneywise’s best stories and exclusive interviews first — clear insights curated and delivered weekly. Subscribe now.

This article originally appeared on Moneywise.com under the title: Wisconsin man $1.8M in debt with a rental portfolio worth $4.4M — Dave Ramsey says his real estate strategy ‘sucks’

This article provides information only and should not be construed as advice. It is provided without warranty of any kind.