Your life can change in just a moment when an unexpected expense comes around. It might be a bill you forgot to pay, making the ends meet, not having enough money for rent, an urgent home repair, etc. For all of these situations and more, our recommended best payday loans UK with instant approval can help you.

Check out our ranking to select the ideal payday loan for you, and request it right now to receive the money you need as soon as possible.

Top 5 Best Payday Loans UK Quick Approval

- Response Loans: Best Payday Loans sourcing with Instant Approval in the UK

- Sunny Cash: Best for Payday Loans

- Fancy A Payday: Best for Short Term Loans

- THL Loans: Best For Fast Loans

- Monarch Loans: Quick Payments

- Lemon Loans: Best loans up to £5,000

Now that you know what the top brokers for payday loans with instant approval are in the UK in 2023, you can choose your favourite option and request your loan in just a couple of clicks.

If you want further help to choose the ideal broker for your needs, then keep reading. The following reviews will help you to make the best decision.

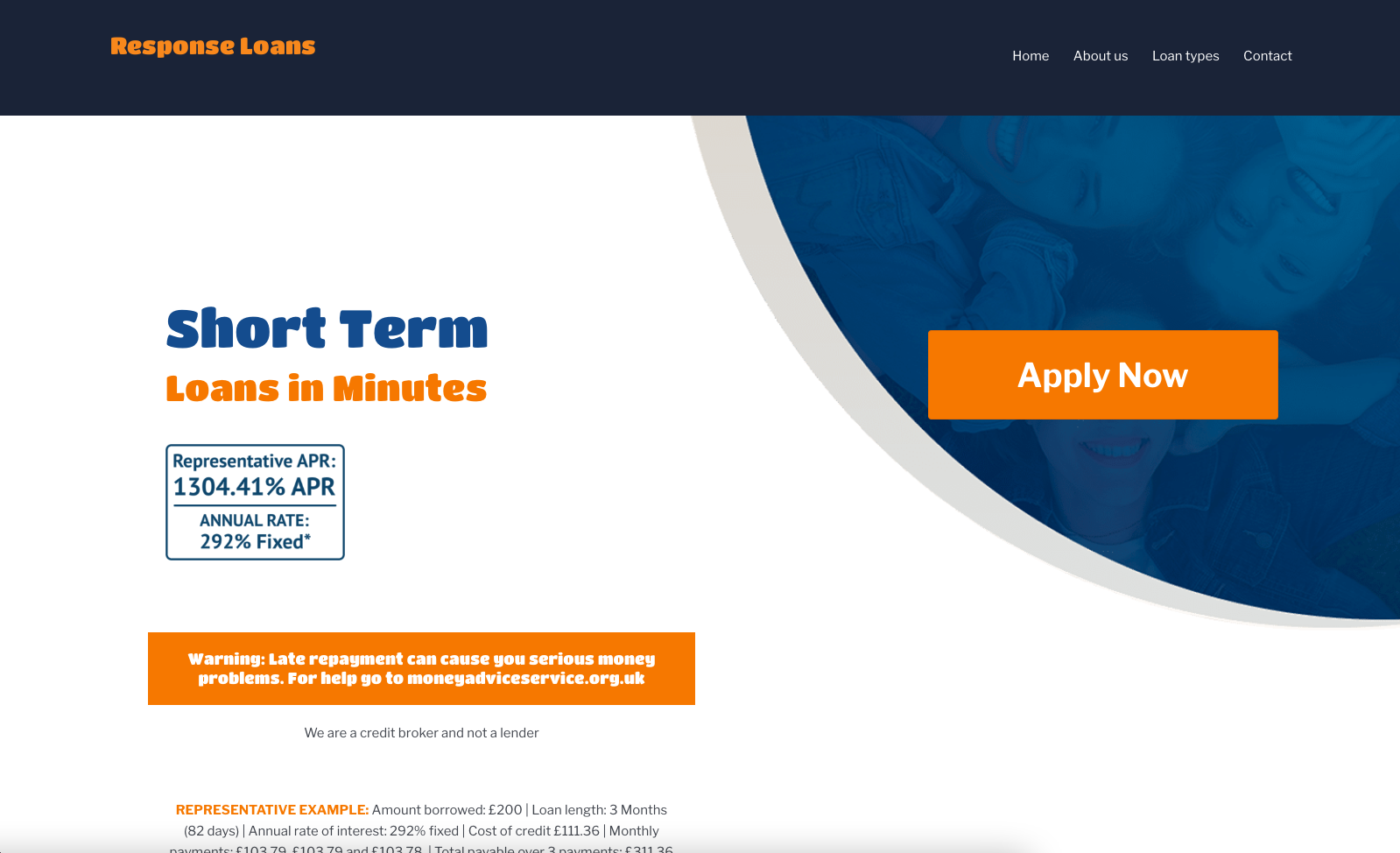

1. Response Loans: Best Overall Payday Loans Sourcing with Instant Approval in the UK

Responseloans.co.uk is our #1 pick because they can lend you up to £5,000, the interest rate on those loans is fair, the repayment terms are great, and the approval rate is amongst the highest from our list.

In short, Responseloans.co.uk will make finding a loan easy and hassle free. All you need to do is complete their simple application form and this will then allow them to find the best loan deal for you. You can then repay the loan with comfortable and affordable instalments, and most of their direct lenders bring you options for repaying early.

Furthermore, Response loans service free from brokerage fees, which makes it even more affordable to get a loan from Response Loans. Therefore, if you are looking for a broker that deals with direct lenders and that’s great in all the areas that matter, then Response Loans is precisely what you need.

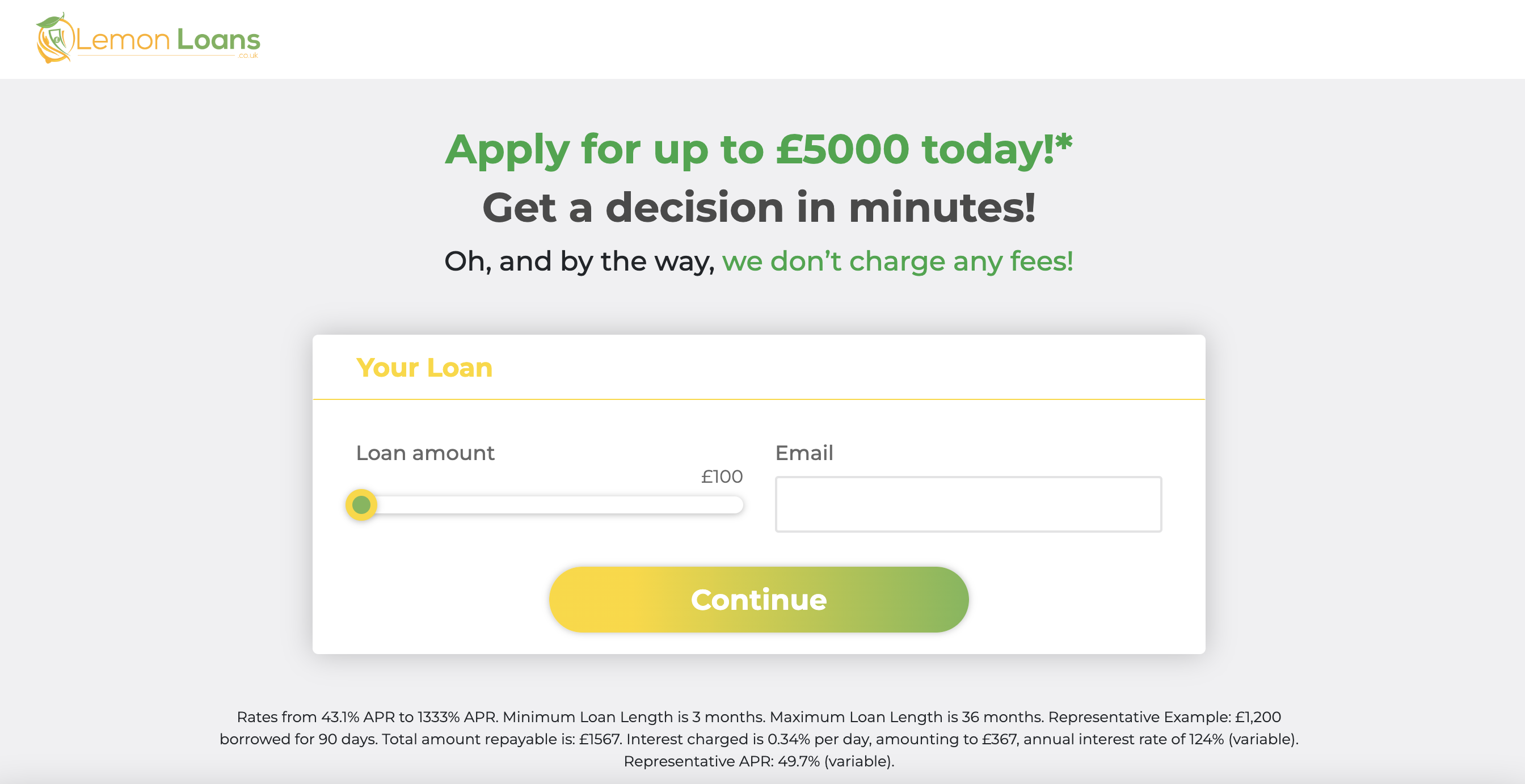

2. Lemon Loans - Best Loans up to £5000

If you need the money right now, then LemonLoans is exactly what you need. Even though all of our listed brokers release the fund quickly once you are approved, lemon Loans is the quickest from them all, because they can top up your bank account in as little as 90 seconds after you’re approved.

As a new customer, you can request up to £5,000. Since the APR is fair and competitive, you won’t have to deal with an excessive loan cost. They are also free from predatory fees.

Lemon Loans is the perfect solution when looking for the fastest payday loan, because it’s ideal for attending to last-minute emergencies.

3. THL Loans: Best for Bad Credit

If your current credit score rating is poor, then you don’t have to lose hope, because LoanCashNow is willing to bring you a payday loan with instant approval even with the worst credit score. It’s because they believe that everyone should have access to funding, and thanks to their payday loans, you can get the money you need without barriers.

LoanCashNow allows you to request up to £1,000 - making it ideal for solving a wide array of emergencies and situations. And since they do not charge application fees, you can drive down the cost of the loan.

The APR is competitive and fair, especially considering that they are willing to accept customers with bad credit. And since you have up to 6 months to repay the loan, you have more freedom for managing the payments.

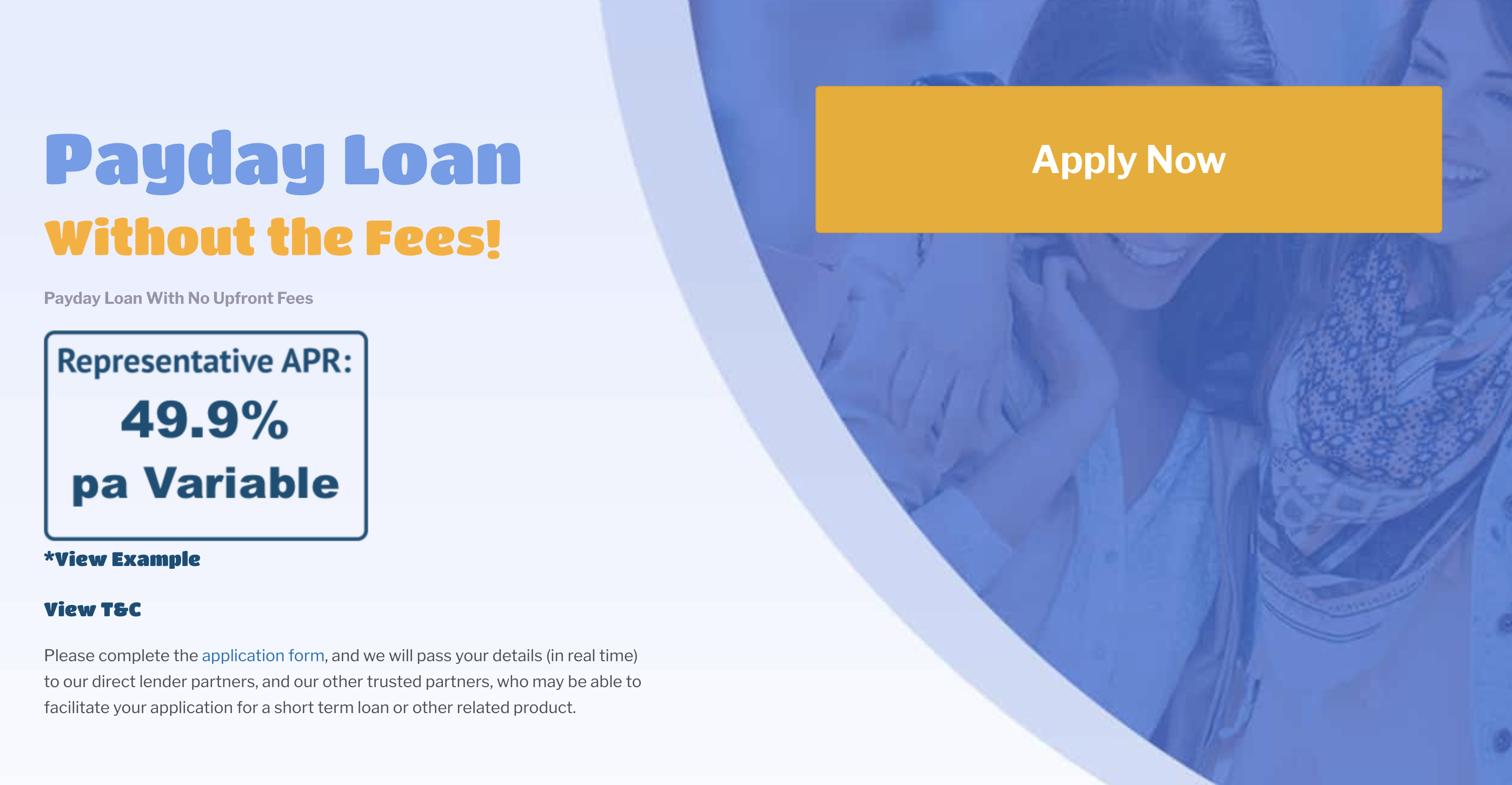

4. Fancy a Payday?: Best for Short-Term Payday Loans

If you intend to repay the loan as soon as possible, or at least on the scheduled repayment dates, then FancyaPayday.co.uk is an ideal solution. Their application process records your financial needs and helps to find the right solution for you. Therefore, if you only need the money for the short term, and you are comfortable with paying in fewer instalments, then FancyaPayday.co.uk is the ideal choice.

Fancy a Payday allows you to request unsecured loans of up to £5,000. The loans are short-term finance loans, so if you are 100% sure that you can repay the loan on your repayment days, then Fancy a Payday might be the ideal choice for you.

5. iCashLoans: Best for Early Repayment

Repaying the payday loan early is an excellent way to drastically reduce the cost of the loan. However, many lenders will apply “penalty” fees that will drive up the cost of the loan, but this is not the case for iCashLoans because they accept early repayments without abusive fees or penalties.

You can repay without any sort of penalty, there are no hidden costs or fees, and they are amongst the fastest payday loan companies when it comes to approving your petition and releasing the funds.

Therefore, if you have plans for repaying the loan early because you know that you will have the necessary money to do it, then go ahead and apply for a payday loan at iCashLoans.

What Are the Requirements of a Payday Loan with Instant Approval in the UK?

If you want to know if you can apply for a payday loan from our recommended brokers, then here you have the list of the requirements you must meet:

- You must be a UK citizen or permanent resident

- You must be at least 18 years old

- You must have a bank account

- You must have a monthly income (verifiable source)

- You must have contact info such as an email and phone number.

As you can see, the initial requirements are minimal and it’s easy to apply, get a fast decision and even get approved instantly if you meet the lenders’ requirements. And since our recommended brokers work with direct lenders who have high approval rates, the odds will be in your favour.

Take into account that the monthly income and verifiable income source requirements will vary from lender to lender, and it will also depend on how much money you will be requesting. Most of them will only approve applications from customers that earn at least £800 to £1,000 per month.

How to Apply for a Payday Loan with Instant Approval

You can apply for your payday loan and get it approved instantly in only 5 steps:

- Choose a payday loan company from your ranking

- Fill out the online application

- Upload all the documents they request

- Submit your application

- Wait for the instant approval message.*

Since we’ve already done the hard work by filtering all the available brokers in the market, to only select the best of the best, all you have to do is to follow these 5 steps to get your money as soon as possible.

* Because our brokers work with direct lenders who can offer instant approval, you can receive your loan in as little as a couple of hours if you pass their underwriting assessment. However, keep in mind that in some cases, if you request it after business hours, then it can take up to 1 day for the company to deposit your loan.

Also, keep in mind that not all the applications will be approved. Even though our brokers work with direct lenders who have high approval rates, there is still the possibility of getting your loan application denied due to problems such as no verifiable source of income or not meeting the minimal requirements such as being at least 18 years old or a UK citizen or permanent resident.

How Do Payday Loans UK with Instant Approval Work?

For you to understand how these loans work, we will explain the different factors that compose them. Let’s start by defining the payday loan concept.

A payday loan is a loan that you can pay the next day after receiving your paycheck. This is why they request a verifiable source of income, to make sure that you are getting a paycheck that will bring the lender confidence that you will pay back on time.

The instant approval means that these brokers have an advanced system in place that will automatically review your application to make

sure that all the minimum eligibility requirements are met and pass these onto the direct lenders. Once your application has been analysed, the lender will instantly let you know if you’ve been approved or not.

If you’ve been approved, then they will proceed to deposit the money into your bank account. For example, some lenders can deposit the sum of your payday loan in your bank account in as little as 90 seconds.

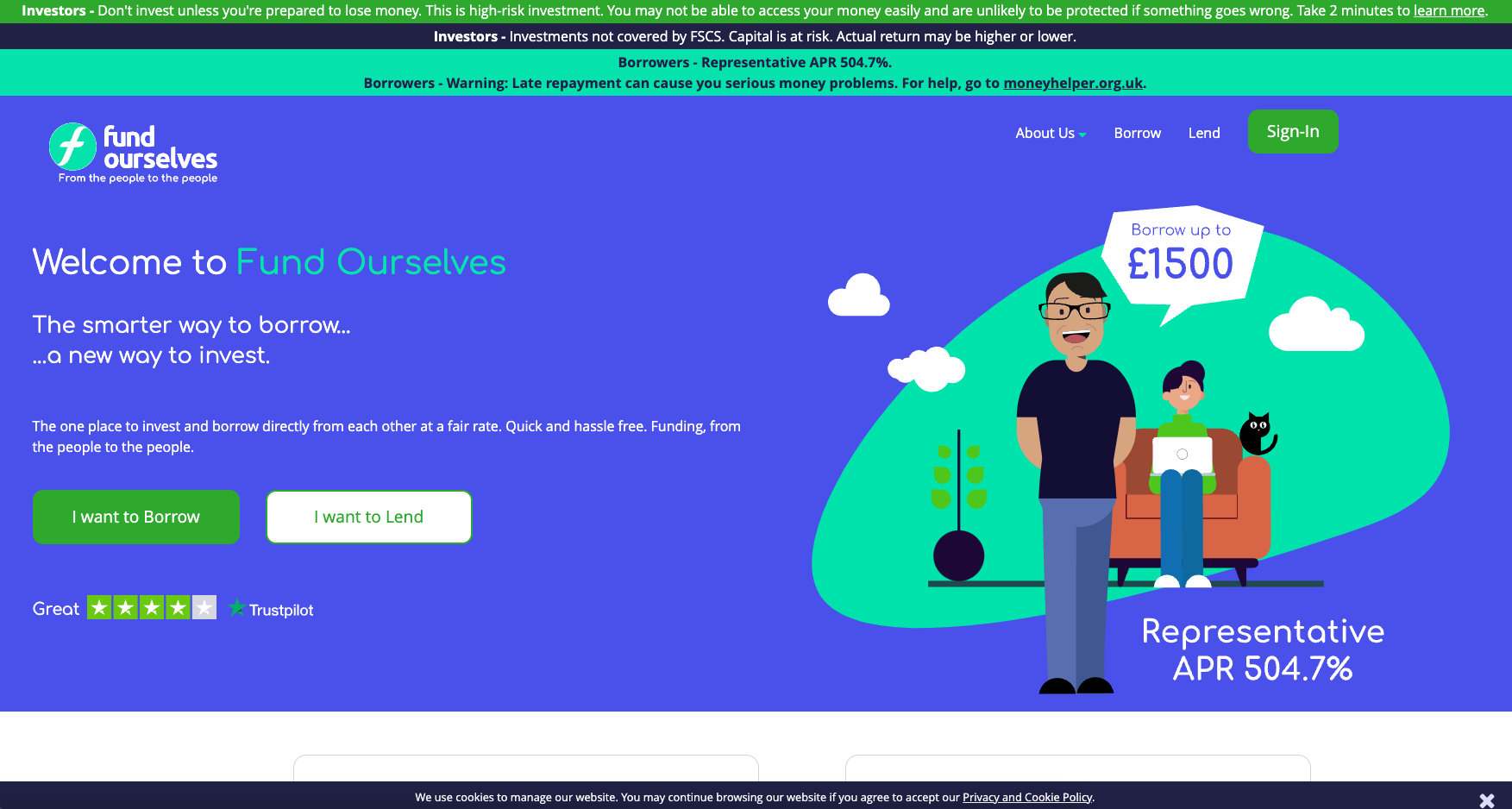

You can pay these loans in instalments that can range from 1 to 6 months on average. For example, Fund Ourselves brings you advantage for repaying early, which will allow you to reduce the cost of the loan.

All you have to do to receive your payday loan is to fill the application on any of our recommended brokers and their system will take care of the rest. If you meet all the lenders’ requirements, you will get approved instantly and you will receive the money you need as soon as possible.

Our Methodology for Choosing the 5 Best Payday Loans UK with Instant Approval

Here you will find the exact steps we followed to build this ranking, in order to only recommend to you the best payday loans available right in the UK that offer instant approval, even with a bad credit score.

Company History and Reputation

The first step is to make sure that the broker is legit, and hence, allowed to operate legally in the UK. After verifying that the company that offers payday loans with instant approval has been authorised by the FCA, we go ahead and check their history and online reputation.

The FCA will make sure that the lender is well-regulated in order to protect the UK customers from predatory interest rates, unfair clauses and other tactics that might put you at financial risk.

Since we analyse their entire history and online reputation, we make sure that the broker has more positive comments and ratings than negative reviews and complaints. We also analyse the complaints to find out if the company has been involved in scandals.

If everything looks transparent, good and legit, then we proceed to check the other aspects of their payday loans offers.

Eligibility Requirements

For a payday loan company to offer instant approval, it’s essential to make it easy for you to meet the eligibility requirements. We make sure that they are minimal such as being a UK citizen or permanent resident, small monthly income requirement, being at least 18 years old, having an active bank account and simple contact info such as an email and phone number.

It’s also important to talk about the credit score. This requirement will change depending on the lender, but for the most part, our recommended companies allow you to get a loan even with bad credit. Because the most important factor will always be your source of income and how much you make per month.

Software and Processing System

The broker needs to have a cutting-edge software and processing system in order to source you a lender with instant approval. Because, even if the requirements are easy to meet, a deficient system would make it impossible to bring instant approval to the applicants.

That’s why we make sure that the brokers we recommend have a working system supported by the latest technology, to ensure that the lenders they work with approve your application instantly if you meet the eligibility requirements and pass their underwriting assessment.

For example, Loan.co.uk have the most efficient approval systems from this ranking, because they truly approve the loans instantly, making it possible for you to receive the sum of the loan the same day.

Approval Rate

Our recommended brokers have the highest approval rate from the entire industry, to increase your chances of getting the money you need right now. As long as you meet the minimal eligibility

Requirements and their underwriting assessment, they may approve your application and deposit the money as soon as possible.

The approval rate will change from company to company, but if you want to increase the chances of getting your application approved, then you should go ahead and request it from Responseloans.co.uk or FancyaPayday.co.uk; this second is especially good for bad credit.

Cost of the Loan

Let’s be honest here, payday loans are more expensive than other types of loans, but that’s the price one has to pay for getting a loan over a shorter term with the potential of instant approval. However, this is not an excuse for a company to bill you excessive fees or an abnormally high interest rate (APR).

Since our recommended brokers are approved and regulated by the FCA, you can rest assured that the fees and interest rates will be within the industry standards. Also, since we have selected the companies that offer the cheapest payday loans with instant approval

in the UK, the total cost of the loan will stay as low as possible.

Loan Limits

Payday loans won’t let you request high sums of money, because there are other types of loans for these needs. However, our

recommended payday loans will offer you the highest limits in the industry in 2023.

Be it just £50, £500, £1,000 or even £2,500 - our recommender brokers bring you the ideal sums of money for attending the majority of emergencies and unexpected expenses.

Repayment Terms

The repayment terms need to be fair, precise and transparent. The direct lenders need to let you know what payment schedules you can make use of, the exact sum of the payments, the total cost of the loan and if you can repay the loan early, in order to reduce the total cost of

the loan.

For example, our recommended broker, Responseloans.co.uk, is the best choice as they make the process smooth and easy. There are no hidden costs or fees, making it an even better deal for you.

All in all, our recommended brokers will bring you lenders with favourable repayment terms that will make the instalments affordable, allow you to repay the loan early and even get a solution if you cannot repay the loan on time.

Customer Support

For an optimal experience, it’s key for the broker to offer excellent customer support service that can answer your questions and solve any problem right on the spot. This is exactly what our recommended brokers can offer you.

First, we make sure that they have several channels such as live chat, email and phone. Then, we verify that they can handle requests 24/7, and that the response time is fast, especially for live chat. Finally, we test the different customer support channels with different questions and issues.

If everything is satisfactory, in addition to the previous factors we have talked about, then we proceed to include it in our ranking. So far now, only 5 companies have made it to our ranking.

The Pros and Cons of Payday Loans UK

In order to help you make the best decision, let’s explore the pros and cons of these loans. We will bring you an unbiased analysis that will let you know more about our recommended lenders.

The Pros of Payday Loans

Our recommended payday loans with instant approval offer you plenty of advantages:

- Solve any type of emergency or last-minute expense thanks to the instant approval of our recommended payday loans

- Get access to funding even if you have a bad credit score or fresh credit history

- You can use the money of the payday loan as you please

- Minimal requirements

All in all, if you need a quick loan to solve any type of emergency, then our recommended lenders can bring you exactly what you need right now.

The Cons of Payday Loans UK

Even though the benefits are impressive - especially when you need money urgently - you also need to consider the cons:

- They have a higher interest rate when compared to other types of loans

- You can request only small amounts up to £1,000 in most cases

- Severe penalties when you don’t pay on time

The pros massively compensate for the few cons, especially when you can handle them by paying your loan early, and only using it for specific emergencies or situations. Because this will allow you to keep the cost of the loan low and avoid the potential penalties of not paying back on time because you requested more than you could afford to pay back.

Verdict: Should You Request a Payday Loan with Instant Approval?

Yes, if you need money right now and you want to pay as soon as possible, more precisely the day after you get your paycheck, then a payday loan with instant approval will be the ideal solution for you. Even more if you have a fresh credit history or issues with your credit score.

Now that you know what the top 5 payday loans are, you will have much better experience because you will obtain the funding you need from a reputable, trustworthy and transparent lender.

What Can I Do If My Payday Loan Request Was Rejected?

If this is the case, then you need to follow these steps:

- Get a verifiable source of income: The main reason why payday loans get denied is because the lender could not identify the source of your income. The next time you need to be more detailed and bring any type of proof that certifies that you have a regular monthly income

- Select the right lender: If you have bad credit, then your only option would be QuidMarket because they accept customers with a bad credit score. If you go ahead and request the max amount from BeeLoan with a bad credit score and no verifiable source of income, then it’s highly likely they will reject you

- Improve your credit score: This one will take you at least 4-6 months, but if you manage to improve it, then you will not only get access to payday loans, but also to other types of loans with better conditions, higher limits and a lower interest rate

- Reach out to the lender: It’s always good to contact the lender via live chat, email or even phone to learn about the exact reasons why your request was denied. This will let you know what you can do better the next time, in order to get your payday loan approved

- Don’t request too much money: Sometimes your petition might be denied because you requested more money than the lender was willing to bring you. Therefore, if your credit score is not bad and you have a verifiable source of income, then request less money and you are more likely to get the payday loan approved.

If you follow these tips, then you will have more chances of getting your loan approved the next time you apply. If the problem has been your credit score rating, then you should head over to LoansCashNow, because our recommended payday loans company with instant approval that accepts customers with bad credit.

F.A.Q

If you want to know more about our ranking of the best payday loans UK with instant approval, then here you have the answers to the most frequently asked questions.

When should you apply for a payday loan with instant approval?

When you need money for a last-minute emergency or when other types of funding are not available to you due to fresh credit history or issues with your credit score. In these scenarios, a payday loan can bring you the relief you need right now.

Do payday loans in the UK with instant approval require a credit check?

Yes, our recommended brokers are likely to perform a credit check when evaluating your application. However, it is not a decisive factor, because the most important aspect is proving that you have a verifiable source of income. That’s why our recommended options like Response Loans are willing to bring you a payday loan even if you have bad credit.. See here full list of brokers for bad credit.

Can you get a payday loan UK with instant approval with bad credit?

Yes, our recommended company Monarch Loans is ready to bring you a payday loan with instant approval even if you have a bad credit score rating. Our companies take into account your monthly income, possible assets and employment/education, and not only your credit score, making it easier for you to get a loan approved, even if you have bad credit as of now.

Can you get a better payday loan with a good credit score?

Of course, the better your credit score is, the better the conditions will be. For example, if your credit score is good enough, then the lender will bring you access to a better APR and massively increase your chances of getting your application approved. Furthermore, they might even offer you other products with higher limits, better repayment terms and additional benefits.

Can you repay a payday loan early?

Yes, our recommended brokers allow you to repay your payday loan early without penalties or extra fees. However, make sure to read your contract in order to be aware of all the details in regards to paying back the payday loan early.

What happens if you don’t pay back a payday loan?

If you don’t pay the payday loan on time, then you will have to face severe penalties such as late payment fees, and this will also decrease your credit score rating. Therefore, before requesting this loan, make sure that you can actually pay it back in order to avoid problems that will only affect your finances negatively.

Please take loans responsibly, you must be at least 18 years of age to apply for a loan:

https://www.stepchange.org/debt-info/types-of-debt/payday-loan-debt.aspx