Looking to get your first car or just a new car but need the funds? We have found some of the best lenders for you. These lenders are the best subprime auto lenders, with SuperMoney being number one for its understanding of fast offers. See below for more lenders which offer similar things.

| Brand | Summary | Score |

| SuperMoney | Fast Offers | 10/10 |

| LendingTree Auto | Best deals for cars | 9/10 |

| First Choice Autoloan | Good for APR | 9/10 |

| Caribou | Easy Refinance | 8/10 |

| Auto Loan Zoom | No Credit History Needed | 8/10 |

| Best Auto Lenders | Easy Application | 8/10 |

A less than perfect credit score is often a barrier to getting favorable financing options from the traditional financial systems, especially when it involves auto purchases. Fortunately, you still have plenty of car loan options that are at your disposal even with bad credit.

In this article, we’ll help you compare a dozen lenders based on their affordability, repayment terms, types of loans offered and customer satisfaction.

Here are the best subprime auto lenders that will give you access to a loan even with bad or no credit history.

Top Subprime Auto Lenders 2024

- Supermoney: Provides offers within minutes

- LendingTree Auto: Best car financing deals

- First Choice Autoloan: Best overall lender

- Caribou: Fast easy auto refinance

- Auto Loan Zoom: No credit history required

- Best Auto Lenders: Fastest disbursement

Once approved, the funds are deposited into your account quickly, allowing you to hit the dealership in less than 24 hours.

For a more detailed look at each lender, check out our comprehensive reviews below.

1. LendingTree Auto: Best Auto Loan Financing Deals

Lending tree allows borrowers to apply for car loans through the manufacturer or other lenders making it among the best subprime auto lenders in the US In 2024. Furthermore, the right timing and taking advantage of rebates could greatly reduce the interest on the car loan making repayment easier.

The following are reasons to choose Lending Tree Auto as part of your go-to subprime auto loan lender in 2024:

- Offers best deals to borrower

- Allows borrower to apply through manufacturer

- Has rebates that reduce amount of interest on loan

- Flexible repayment terms

- Offers loans to borrowers despite their credit status

Even with a bad credit history, Lending Tree will help you purchase that car you need so much at a friendly interest rate and payment schedule.

2. First Choice Autoloan: Quick and Easy Application

Renowned as one of the top subprime auto lenders in the US for 2024, they offer a seamless application and funding process that ensures quick results. Whether you prefer a direct connection to a lender or a direct link to a dealer, First Choice Auto Loan caters to your specific needs.

Here's why First Choice Auto Loan stands out as the ideal subprime auto lender for you in 2024:

- Accepts extremely low credit

- Well connected with lenders and car dealerships

- Top rates auto loan lender

- Has competitive interest rates

- Loan repayment flexibility

First Choice Auto Loan provides you with multiple options to find the best fit for your subprime auto loan.

3. Caribou: Fast Auto Loan Finance

Caribou understands the importance of saving while financing a car. They offer borrower-friendly options that help you save money as you secure the loan to get behind the wheel. With a track record of happy customers, Caribou is committed to providing a smooth and satisfying borrowing experience. Their dedication to client satisfaction sets them apart in the subprime auto lending industry.

Here are some of the benefits of choosing Caribou as your best subprime auto lender in 2024:

- Highly rated by other consumers

- Great reviews on Forbes, The New York Timer etc

- No hidden fees or charges

- No impact on your credit score

- No SSN required

- No credit check to get loan approval

Caribou allows you to take control of your car payments, and also allows you to save hundreds of dollars each month on the car loan.

4. Supermoney: Provides offers within minutes

If you are looking for a smart way to finance your car, Supermoney is the best subprime auto lender to consider. The company offers an opportunity for a single form with multiple personalized auto loan offers, which is why it is part of our recommendation.

The following are some reasons to choose Supermoney as one of your best subprime auto lender:

- Quick access to auto loans

- Checking rates won’t affect credit score

- Rates as low as 2.94%

- Offers loans up to $100k

- Offers loans to borrowers with bad credit

With Supermoney, you are assured of getting the lowest interest rates on auto loans, no matter how bad your credit history may be.

5. Auto Loan Zoom: No Credit History Required

Do you feel you deserve a good car loan that is stress free? Auto Loan Zoom is one of the best subprime auto lenders to consider. The company offers all types of credit and is safe and secure. The entire online process on their website makes it the easiest to get a loan after completing your application in less than five minutes.

Auto Loan Zoom features among the best subprime auto lenders in the US in 2024 due to the following reasons:

- Safe and secure

- All types of credit scores accepted

- Quick application

- Affordable interest rates

- High approval rates for customers with poor credit

Securing an auto loan from Auto Loan Zoom is a breeze, thanks to their high approval rates. Even individuals with poor credit scores or no credit history can easily acquire a loan, making the process hassle-free.

6. Best Auto Lenders: Fastest Disbursement

Best Auto Lenders fall under the category of the best subprime auto lenders in the US in 2024 as they approve loans fairly quick and also extend their loans to all individuals regardless of their credit status. If you are looking for a lender with the fastest disbursement, Best Auto Lenders should be one of the best bets.

Here is why the company ranks among the best subprime auto lenders in the US in 2024:

- Competitive APRs

- Borrower chooses the vehicle they want

- All credit types are accepted

- Absolutely no obligation

- Easy application process

This is one of the best car financing options. It is however paramount to know that borrowers with better credit scores are given priority over those with extremely low credit scores.

Bad Credit Auto Loan

A bad credit for an auto loan is considered by most lenders as a credit score that is in the mid-600s or below. The FICO score and the Vantage scores are the most common scoring models that are used by many of the best subprime auto lenders in the US.

When deciding on approval of a borrower, best subprime auto lenders consider factors such as steady income, repayment history on previous loans, amount of debt and length of employment in addition to credit score. When your credit score falls below to the lower tier (badcredit) or when you have no credit history, the lenders will still approve your loan as long as the other factors are in your favor.

Types of lenders that offer auto loans for bad credit

It is important to apply for a loan from more than one lender when you have bad credit. Many lenders offer subprime auto loans but their requirements vary. Each of the lenders suggested has their requirements that fit your auto needs in different capacities. Applying for the auto loans through multiple lenders increases the chances of getting the best offer as you can take the lowest rate on your auto loan in the market.

The following are the types of lenders that would normally extend credit to borrowers to buy a vehicle:

Online marketplaces

The internet has made it possible for lenders to offer their services without the borrower having to go to the physical offices of the lender. Online lenders provide convenience as you can get a loan in the least time possible and at the comfort of your home. IT is also possible to apply for auto loans from multiple lenders simultaneously.

Banks and credit unions

Alternatively known as direct lenders they offer auto loans for individuals that have accounts with them. Their approval of loans is however based on factors such as the credit score of the borrower. With a poor credit score it might be close to impossible to get an auto financing loan from banks and credit unions.

Online vehicle retailers

Car retailers such as Carvana have their own ways of financing individuals that want to purchase a vehicle but have no money and have a poor credit history. In most cases the online retailers offer their financing to the purchaser and charge an interest for the agreed repayment period.

Requirements to Qualify For an auto loan for bad credit

The requirements for getting a loan from the best subprime auto lenders is similar to getting financing from other financial institutions in the US. Here is a list of the eligibility requirements to get approved for auto loan for bad credit:

- You have to be a US citizen or a permanent resident in the country

- Must have attained the age of the majority (18 years)

- You must have a source of income or a job

- Must be willing to provide requested utility bills

- You must have a valid driving license

- Where needed, you need to have a down payment

The requirements above come after the pre-approval from the internal review system after an online application. Once accepted you are required to provide the documentation to prove that you meet the identified criteria to qualify for the loan. If you already have a finance deal in place, you can re-finance using one of the lenders we have listed here

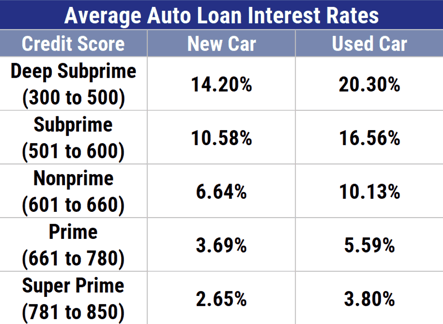

Interest charged on subprime loans

This is the only category where your credit score will affect your auto financing. For most lenders, the lower the credit score the higher the interest rates on auto loans and the vice versa applies.

A FICO score between 501 and 600 is likely to attract a car loan interest rate of 10.58% for a new car and 16.56% for a used car. If the score is as low as 350 to 500 then the subprime lenders are likely to offer higher interest rates between 14.2% for a new car and 20.3% for an older car.

Here is a schedule that could help you determine the amount of interest to pay on your auto loan from the best subprime auto lenders.

An interest rate charged at 20% is favorable to most borrowers seeking auto financing from online lenders. The rate is lower than any rate you will find from other forms of finance such as payday loans that have the tendency of having APRs that are triple or quadruple the interest charged on auto loans.

What to consider when taking a Subprime Auto Loan

The interest rates

It is important to consider the amounts of interest that you will be on the loan that you receive to finance getting a car. The higher the interest rates the higher the costs of the loan and thus the higher the repayment amounts. Different lenders have different interest rates. Always compare lenders and their interests on car loans before making the decision to apply for such loans.

Repayment terms

The repayment terms determine the amount to be repaid on the loan each month and also the penalties that are associated with late payments. As a borrower, it is advisable to choose a loan with the repayment terms that best synchronize with your financial conditions. Paying more per month than you have could lead to deeper financial struggles as you may be forced to take payday loans to make payments on the car loan.

The need

If you are not in an urgent need of a car and other methods could work such as hiring for short term use, it is advisable to wait out the subprime auto car loan. Unless having a vehicle is urgent, avoiding the auto loan with bad credit could help reduce the financial obligations related to loan repayments in future.

The lender

You should always take out loans from lenders that are registered according to the laws of their jurisdiction of operation. Lenders without licenses participate in illegal financial practices which could end up increasing your financial burdens. Going with trusted lenders saves on losses that are preventable and stress that could be avoided. Our list of the best subprime auto lenders includes only licensed lenders that will legally help you with your financial needs.

Factors that influence auto loans interest rates in the USA

Credit score

The credit score influences the terms of your car loan as identified in the APR schedule above. A higher credit score leads to a lower interest on the car loan and the vice versa applies. If you feel that you have bad credit, you can see our choice of Bad Credit Auto Loans

Debt to income ratio

Higher ratios show a likelihood of defaulting on payables and therefore lenders tend to offer higher interest rates to individuals with a high debt to income ratio. The vice versa applies.

Car

The type of car also determines the interest charged on the loan. Older cars for instance attract a higher interest rate on the auto loan while newer cars attract a much smaller interest on the loan.

Get your Auto Loan Today

If you are in dire need of a car and have poor credit or no credit history, an auto loan with subprime terms might be the best option to get you behind the wheel. It is however important to understand the concept of such loans and the different lenders that are in the market. For the lenders, we have provided an in-depth recommendation of the best subprime auto loan lenders in the US market in 2024. You should however understand that subprime loans come at a cost such as higher fees and higher interest rates making the car loan more costly over time.

If you can wait it out, take time to improve on your credit score and that could improve the terms of the auto loan you take. You can also manage to finance the subprime auto loan in a better way once you improve your credit score.

FAQs

How do you receive instant car loan approval with bad credit?

In most cases, lenders require borrowers to fill in online forms with information that allows the lenders to determine loan approval or denial. You fill in a series of questions and answers based on your initial judgment.

What credit score do I need to get an auto loan?

Unlike the conventional lenders, subprime auto lenders do not have a minimum credit score they check to extend loans to customers. All you need as a borrower is proof that you will afford the monthly repayments. Credit scores only determine the type of interest rates that you can on your loan.

Can I get a car loan with bad credit?

Yes. The reviewed lenders offer loans to all individuals even those with poor credit scores or no credit history. IT is however in your best interest that you make a downpayment on the vehicle to reduce the burden of the repayment terms on the loan.

What rate will be charged on my loan?

The amount of interest varies depending on factors such as your FICO score. Those with a higher score will have an interest rate on their loans that is lower than those with poor or no credit scores. In the subprime category, the interest rates are between 10.58% for new cars and 16.56% for older cars.

Do I need collateral to take the loan?

No. You do not require collateral when taking out a subprime auto loan. The rationale is that the car acts as the collateral for the loan and if the borrower cannot make monthly payments, the lender has legal authority to repo the vehicle or sue the borrower for further liabilities on damaged vehicles.

What is the best time of the year to get a car loan?

The best times for getting a subprime auto loan are in November and December since many car dealerships frequently provide discounts and other incentives on their vehicle inventory.

Related posts Personal Loans with No Credit Check