Navigating the complexities of credit card debt can be an overwhelming experience, especially when trying to manage multiple credit cards with substantial outstanding balances, sometimes over $10,000. The burden of high credit card debts often leads to sleepless nights and constant worry about financial stability.

But despite the challenges, credit card usage remains an integral part of our daily lives, making it crucial to find effective debt relief solutions, particularly in the realm of credit card debt consolidation.

The recent surge in credit card balances, as indicated by the data, further emphasizes the need for practical strategies to regain control over our financial well-being. With the average credit card balance reaching $5,910 in 2022, many individuals find themselves struggling to make headway in paying off their debts. These staggering numbers highlight the pressing urgency to address credit card debt with viable and efficient solutions.

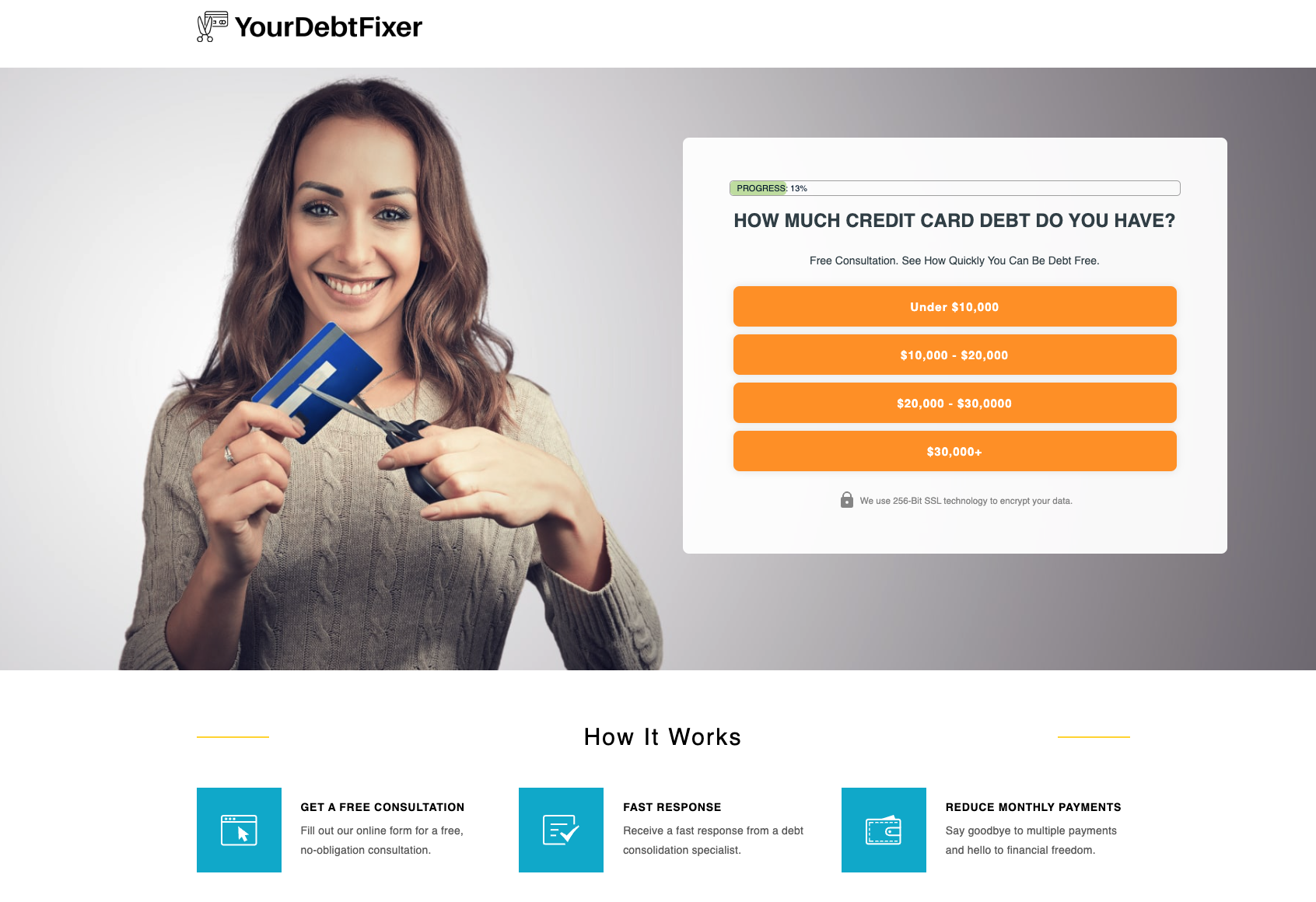

Luckily, amidst these daunting financial realities, platforms like Your Debt Fixer have emerged as beacons of hope for individuals seeking credit card debt consolidation solutions. By offering free consultations and personalized debt relief options, including credit card debt consolidation and debt settlement, Your Debt Fixer aims to empower individuals on their journey toward financial freedom.

Your Debt Fixer: For the Best Credit Card Debt Consolidation

If you have credit card debt worth $10,000 and above and are seeking debt relief options, Your Debt Fixer should be your first go-to lender. With a dedication to connecting consumers like you with reputable debt settlement or credit card debt consolidation partners, Your Debt Fixer streamlines the process and makes it easy to find the best solutions for your debt issues.

More importantly, Your Debt Fixer understands how challenging it is to find suitable credit card debt consolidation options among the plethora of choices available, especially during this era of advanced technology. As such, this broker has done the leg work by establishing a vast network of third-party debt specialists, lenders, and non-lenders. Anyone can access the services of these credit card debt specialists by just filling out one form, which takes less than 5 minutes.

Additionally, by having an online presence, Your Debt Fixer eliminates the need to visit physical offices, queue, and deal with a lot of paperwork. This enables you to connect with a credit card debt consolidation service provider effortlessly, whether you're at home, in the office, or on the move with your mobile device. This demonstrates just how convenient Your Debt Fixer is when it comes to getting that credit card debt consolidation for your debt.

Also, in the rare chance that Your Debt Fixer is unable to find a suitable credit card debt consolidation service provider for you, it presents you with alternative offers that could still be beneficial. Even better, you are under no obligation to accept any of these offers, and you can simply decline them if they don't align with your interests.

As for data integrity, Your Debt Fixer employs bank-level encryption for data security. This is necessary because you may be required to submit personal information through their network, making it necessary to protect the data from any malicious actors.

In summary, Your Debt Fixer prioritizes helping individuals seeking debt relief by finding tailored solutions and partners that suit their unique circumstances. All of this is also done online. Once all the background checks are completed, you are connected with a credit card debt consolidation service provider who will then proceed to give you a no-obligation free consultation on your customized credit card debt consolidation plan.

How Does Your Debt Fixer Work?

- Easy online form submission

To get started with Your Debt Fixer, you fill out one easy online form. In it, you will include details about your financial situation and debt-related concerns. Once completed, your inquiry will be submitted to the extensive network of credit card debt consolidation specialists.

- Personalized match and free consultation

After submitting the online request form, Your Debt Fixer diligently works to find a service provider that can assist you with your specific financial situation. After successfully identifying a match, you will be notified and presented with the next steps to schedule a free initial consultation. During this consultation, the debt specialist handling your case will review your financial details and provide a personalized plan tailored to your circumstances.

- Embrace financial freedom

If you decide to proceed with the debt specialist's recommended plan, you will be on your way to saying goodbye to credit card debt, regaining control of your finances, and paving your way to financial freedom from credit card debt.

Why Choose Your Debt Fixer?

-

It offers convenience – Your Debt Fixer offers a user-friendly and straightforward online platform that saves time and effort by connecting users with a large network of credit card debt specialists.

-

Wide range of services – By partnering with different service providers, who offer you a diverse array of options to address your unique debt situations, Your Debt Fixer caters to various credit card debt relief needs.

-

Free consultation – As a user of Your Debt Fixer, you stand to benefit from a no-obligation free consultation with a debt specialist if a suitable match is found. This personalized consultation allows you to receive expert advice and a tailored debt relief plan free of charge.

-

Potential for financial relief – If you are burdened by credit card debt and seeking effective solutions, Your Debt Fixer presents an opportunity to get rid of it over time by connecting you with debt specialists on the platform.

With Your Debt Fixer, getting debt-free through options such as credit card debt consolidation is a straightforward and efficient process that will expedite your journey to becoming debt free.

Understanding Credit Card Debt Consolidation

Credit card debt consolidation is a financial strategy that involves combining multiple credit card debts into a single, more manageable payment plan. This approach aims to simplify debt repayment, reduce interest rates, and help individuals regain control of their financial situation.

When facing credit card debt from multiple sources, it can be challenging to keep track of various due dates, interest rates, and payment amounts. Credit card debt consolidation seeks to alleviate this burden by merging all outstanding balances into one loan or credit card with more favorable terms. By doing so, individuals have only one payment to make each month, making it easier to stay on top of their financial obligations.

One of the primary benefits of credit card debt consolidation is the potential to secure a lower interest rate on the consolidated debt. Credit cards often come with high-interest rates, which can lead to a never-ending cycle of accumulating interest charges. By consolidating debt into a single loan or credit card with a lower interest rate, borrowers may save money on interest over time, enabling them to pay off their debts more efficiently.

There are several methods of credit card debt consolidation, each with its unique approach. One common approach is obtaining a personal loan to pay off all credit card balances, leaving only the loan to repay. This option can be beneficial for those with good credit scores, as they may qualify for lower interest rates on the personal loan.

Another option is to transfer all credit card balances to a new credit card with a low or 0% introductory APR. This balance transfer card allows individuals to consolidate their debts while enjoying a promotional period of no interest charges. However, it's essential to be aware of any balance transfer fees and the duration of the promotional period to avoid potential pitfalls.

For individuals who own a home, a home equity loan or a home equity line of credit (HELOC) can also be used for credit card debt consolidation. These options allow borrowers to tap into the equity of their homes to pay off credit card debts. However, it's crucial to be cautious with this approach, as defaulting on a home equity loan or HELOC could lead to the loss of one's home.

Factors that Contribute to Credit Card Debt

Credit card debt gradually accumulates due to various factors that influence individual spending habits and financial circumstances. And, by understanding these contributing factors, you will be in a position to address the root causes of credit card debt and implement proactive measures to prevent its escalation. These factors include:

Impulse spending

Credit cards tag convenience with them. This convenience, coupled with the need for instant gratification, often leads to impulsive purchases. Often, consumers succumb to temptations and buy items they don't necessarily need as they rely on credit cards as a source of funding. These seemingly small and frequent purchases add up, resulting in a higher credit card balance over time.

Emergencies and unexpected expenses

Emergencies and unforeseen expenses more often than not catch individuals off guard, leaving them with limited options to cover the costs. In such situations, credit cards offer a quick and accessible solution, especially when immediate cash isn't readily available.

Living beyond means

Some individuals maintain a lifestyle that exceeds their financial capacity. This quickly leads to credit card debt. Some individuals as well, habitually spend beyond what they earn, making them turn to using credit cards to bridge the gap between their income and expenses. This constant reliance on the credit card then creates a cycle of debt.

Inadequate savings

People who don't have emergency funds or a safety net are more susceptible to unforeseen financial difficulties. When things are hard financially, people who don't have enough funds for emergencies use credit cards as a short-term solution, which leads to them accruing debt.

Reduced income

A person's financial stability is greatly impacted by an abrupt job loss that results in a drop in income. Due of this, many who are unemployed or have lower incomes turn to credit cards in order to pay for necessities until they are able to secure stable job again.

Enticing rewards and offers

Credit card companies often offer reward programs and promotional offers to attract consumers. While these perks are advantageous when used responsibly, they also tempt individuals to overspend in pursuit of rewards, leading to unknowingly accumulating debt.

Minimum payment trap

Paying only the minimum amount due on credit cards is enticing as it provides temporary relief from larger payments. However, consistently paying only the minimum prolongs the debt repayment period, increasing the total interest paid, and eventually a long-term struggle with credit card debt.

Credit Card Debt Repayment Strategies

Managing credit card debt can be difficult, but people can take back control of their financial situation by using smart debt repayment techniques. We will examine the different ways to pay off debt that can lead to financial freedom because managing debt is essential to avoiding the traps of growing credit card debt and exorbitant interest rates. Among them are:

Debt snowball

This strategy involves prioritizing debt repayment based on the balance left to clear. It however disregards the interest rates charged on the debts. What happens is, you start by paying off the credit card with the smallest balance while making minimum payments on others. Once the first card is paid off, move on to the next smallest balance, and so on.

Debt avalanche

In the debt avalanche method, a borrower focuses on paying off debts with the highest interest rates first. By targeting high-interest debts, you are in a better position to save money on interest over time. as such, it involves making minimum payments on all cards and allocating extra funds to the card with the highest interest rate. Once that is paid off, move to the next highest interest rate.

Balance transfer

If you have a credit card with a high-interest rate, consider transferring the balance to a card with a lower or 0% introductory APR. This can provide temporary relief from interest charges, allowing you to focus on paying off the principal balance more quickly. Be mindful of any balance transfer fees and the duration of the promotional rate.

Consolidation

If you have multiple credit card debts, you can consider consolidating them with the use of maybe a personal loan or any other type of consolidation loan. These loans often have lower interest rates than credit cards, which in the end reduce the overall interest paid on the credit card debt.

Debt management program

By enrolling in a debt management program through a reputable credit counseling agency, you get into a better position to manage your challenging credit card debt. Also, with such an agency, you have the advantage of having an agency to negotiate with creditors on your behalf to lower interest rates and create a structured repayment plan.

Negotiation

You have the choice to get in touch with your creditors if you're having trouble making your credit card payments. You may then explain your financial circumstances to them and look into options for short-term relief, like decreasing interest rates or making a payment plan.

Alternatives to Credit Card Debt

Credit cards come with a risk of debt accumulation and high interest rates, even while they provide ease and purchasing power. Therefore, it's critical to evaluate the alternatives to credit card debt that people may choose. They are as follows:

-

Debit cards – As debit cards are linked directly to a checking or savings account, they enable users to make purchases using only available funds. As no credit is involved, there is no risk of accumulating debt or paying interest. Even better, they allow you to only spend within your limits.

-

Cash payments – Paying with cash provides a tangible connection between spending and available funds, and as a result, makes it easier to stay within budget and resist impulse purchases. Cash payments also help individuals to become more conscious of their spending habits.

-

Budgeting – By creating a comprehensive budget, you will be able to analyze your income and expenses and allocate funds wisely. By budgeting, you can set limits for different categories of spending and track financial activity, and as such prioritize essential needs, savings goals, and discretionary expenses.

-

Emergency funds – Having emergency funds for about three to six months’ worth of living expenses in reserve provides a safety net that will enable you to handle unforeseen expenses without turning to credit cards.

-

Savings accounts – For planned expenses, or even larger purchases, saving up in a designated savings account proves to be a prudent alternative to credit cards. Savings accounts also offer the potential to earn interest on saved funds, promoting financial growth.

Conclusion

In summary, credit card debt consolidation is an essential remedy for people who are struggling with several credit card debts and high sums that need to be paid off. While credit card convenience might occasionally result in impulsive spending and financial strain, credit card debt consolidation can make repayment easier and lower interest rates, which can help pave the road for financial stability.

But while credit card debt consolidation can provide significant benefits, understanding the contributing factors to credit card debt and adopting responsible financial habits are crucial steps towards a debt-free future. By implementing effective debt repayment strategies, exploring alternative payment methods, and building emergency funds, individuals can achieve financial freedom and regain control of their financial well-being.

With the right approach and support from platforms like Your Debt Fixer, individuals can pave the way to a brighter financial future and achieve lasting success in managing credit card debt.

Frequently Asked Questions

How does credit card debt consolidation work?

Credit card debt consolidation typically involves obtaining a new loan or credit card with a lower interest rate in order to pay off existing credit card debt. With just one monthly payment and often a cheaper interest rate, this simplifies loan management and allows for a longer payback period.

What are the benefits of credit card debt consolidation?

The ability to totally eliminate debt, more flexible payment options, and lower interest rates are just a few benefits of credit card debt consolidation. It could raise your credit score by proving that you manage your debt responsibly.

Should I close my credit card accounts once I pay off the debt?

Because it might shorten the duration of your credit history and limit the amount of credit you can utilize, closing credit card accounts can have an impact on your credit score. You might wish to think about keeping the accounts open if you make all monthly payments and utilize them appropriately.

Can credit card debt consolidation hurt my credit score?

Your credit score is not adversely affected by credit card debt consolidation on its own. However, because of the inquiry and new account, applying for new credit to consolidate debt can cause a brief decline in your credit score. Nonetheless, if you pay off all of your debt on time, your credit score will progressively increase.

How do credit card debt settlement companies work?

Credit card debt settlement services help customers pay off credit card debt by negotiating reduced payments from creditors. Nevertheless, there are certain risks associated with using these services, such as the potential for credit score loss and settlement business costs.