Have you been rejected by ZocaLoans or you feel like this lender is not the right choice for you? Then you’ve arrived at the right page because we are going to share with you the best loans like ZocaLoans in 2024, so you can choose the right alternative for your case.

Be it that you are looking for a lower interest rate, faster disbursement, a higher approval rate for bad credit borrowers or a more efficient customer support service - our recommended ZocaLoans alternatives will be able to help you. Just check our ranking below to get started.

Top 7 Loans Like ZocaLoans You Can Apply For Today: Get Money Quickly Now

Here you have our ranking with the 7 best ZocaLoans alternatives, so you can apply for your loan right now and get the money you need today:

- ZippyLoan: Best ZocaLoan Alternative

- Viva Loans: Faster Disbursement

- HonestLoans.net: Cheaper Loans

- CreditClock: Better for Emergencies

- Big Buck Loans: Higher Approval Rate for Bad Credit

- Low Credit Finance: Higher Approval Rate for Unemployed

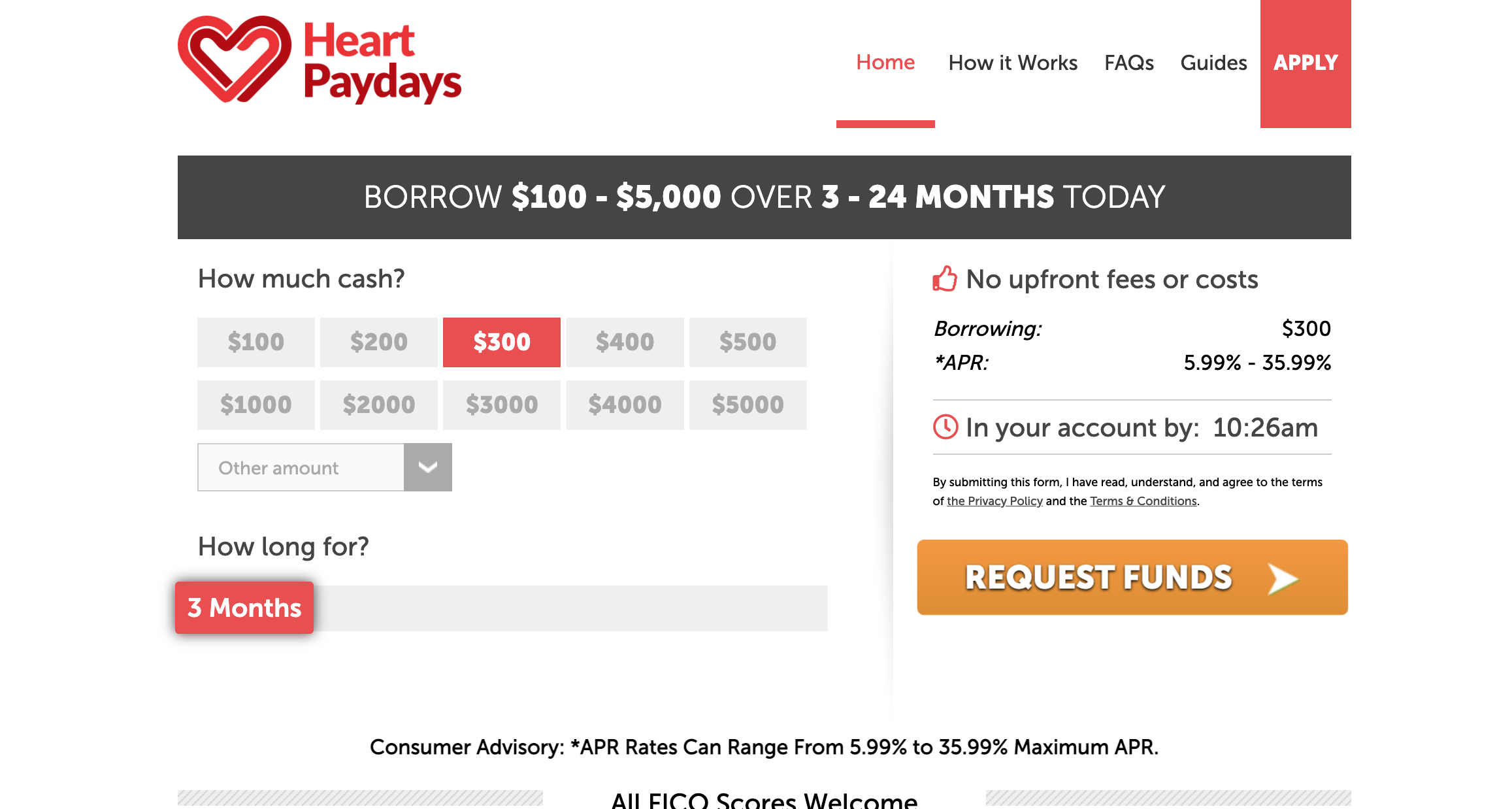

- Heart Paydays: Better Customer Support

If you want to explore more about each alternative and how well they compare against ZocaLoans, then come with us to check more information about them.

1. ZippyLoan: Best ZocaLoans Alternative

ZippyLoan is a much better company than ZocaLoans because they offer lower fees and interest rate, they have a higher approval rate for bad credit, unemployed and low income customers, their application and disbursement process is much quicker and you can borrow as much as $15,000 USD. As you can see, it’s a better alternative in all senses.

2. Viva Loans: Faster Disbursement

If you are looking for a faster, cheaper and bigger loan than what ZocaLoans can offer you, then Viva Loans is the right choice for you. With an approval and disbursement speed of only 1-2 hours, minimal eligibility requirements and a fair interest rate, it’s a solid alternative at your disposal.

3. HonestLoans.net: Cheaper Loans

If all you want is a loan cheaper than what ZocaLoans is willing to bring you, then welcome HonestLoans.net. Featuring a lower interest rate, flexible terms and conditions, and a fast approval process, you can rely on this company to obtain what ZocaLoans simply cannot bring you.

4. CreditClock: Better for Emergencies

You won’t be able to rely on ZocaLoans if you need a loan at 3 AM because it is outside of their working hours, but on the other hand, CreditClock is available 24/7 - making it a much better choice in this case. In addition, they feature a lower interest rate and a higher approval rate for bad credit borrowers.

5. Big Buck Loans: Higher Approval Rate for Bad Credit

Bad credit can be a barrier between you and the loan you want, especially if you apply for it at ZocaLoans. However, Big Buck Loans is here to take it down and allow you to get the loan you need even with extremely bad credit under fair conditions.

6. Low Credit Finance: Higher Approval Rate for Unemployed

If you are unemployed then you will have a hard time getting approved by ZocaLoans, and that’s why we suggest you to apply for it at Low Credit Finance instead. With a higher approval rate for unemployed and low income borrowers, now you can easily get the money you need even with a limited credit history.

7. Heart Paydays: Better Customer Support

If you want a company that will be there for you at any stage of the process with fast answers and solutions, then Heart Payday is the ideal choice. Along with their low interest rate and high approval rate for bad credit borrowers, it’s an excellent alternative to ZocaLoans in 2024.

How to Apply for Loans Like ZocaLoans Easily

Here’s how you can apply for your loan right now to get the money you need as soon as possible:

- Choose a ZocaLoans alternative from our ranking

- Visit their website

- Fill out the application form

- Wait for approval

- Receive the money in your bank account

No rocket science here - our recommended alternatives have simplified the application process as much as possible, so you can get approved and receive the money you need as soon as possible.

The Main Problems of ZocaLoans

Thousands of people like you are searching for alternatives to ZocaLoans because this lender, although beneficial in some cases, suffers from critical problems that affect a big group of borrowers. Here we will discuss them:

- A High Interest Rate: When compared against other similar lenders, it usually charges a very high interest rate, making it more expensive to get a loan from them

- Strict Limits: You can only borrow a maximum of $1500 USD and if you have bad credit then they will reduce it even more

- Approval Rate for High Risk Customers: They don’t approve as many bad credit, limited credit history or unemployed customers as most people believe

- Deficient Customer Support Service: Their customer support department is OK at best, because they take a long time to get back to you and they don’t usually bring the right answers or solutions right off the bat.

Why Are Our Recommended Loans Like ZocaLoans a Better Choice?

Now that you know about the main problems of ZocaLoans, here you will see why our recommended alternatives can be a better choice in a wide variety of cases.

Lower Interest Rate and Fees

Our lenders, especially HonestLoans.net, will bring you a lower interest rate in the majority of cases, even if you have bad credit. Therefore, our alternatives are the best way to help you save money.

Higher Approval Rate for Bad Credit

Zocaloans tends to reject customers with a very low credit score, but our recommended alternatives such as ZippyLoan, Big Buck Loans and Low Credit Finance will be more than happy to approve your application.

Higher Approval Rate for Unemployed Borrowers

If you are currently unemployed then it will be hard for you to get approved by ZocaLoans, but our recommended alternatives like Low Credit Finance will be ready to approve your application and bring you the money you need.

You Can Borrow More Money

ZocaLoans will only lend you a maximum of $1500, and if you have bad credit, then the limit will be even lower. On the other hand, our recommended alternatives can lend you up to $15,000 USD without problems.

Read here for the best bad credit loans for $5000

Quicker Application Process and Faster Approval

The lenders we recommend have managed to make the application and approval process much faster than at ZocaLoans. Therefore, you can get your loan approved and disbursed at a faster rate, even if you apply for it outside of business hours because brands like CreditClock can handle it at any time of the day.

F.A.Q

If you want to learn more about loans like ZocaLoans, then here you will find the answers to the most frequently asked questions.

Who are ZocaLoans competitors?

The main competitors of Zocaloans are ZippyLoan, Viva Payday Loans, HonestLoans.net, Big Buck Loans, Low Credit Finance, CreditClock and Heart Paydays because they target the same market, but these companies have improved on the areas where Zocaloans is lacking. From lower interest rates to faster disbursement, these alternatives have become a better choice than Zocaloans in different scenarios. Another company that are similar to ZocoLoans is Speedycash, we have written another article about Speedycash to give you a full review.

What is a better company than ZocaLoans?

Overall, ZippyLoan is a better company than ZocaLoans because it offers a lower interest rate, it has a higher max loan amount, a higher approval rate for bad credit customers, accepts unemployed customers and offers a better customer support service. In all the areas that matter, ZippyLoan is a better lender than ZocaLoans.

Are loans like ZocaLoans legit?

Yes, we’ve personally reviewed each one of the lenders we recommend here, because we want to protect you. Therefore, all the ZocaLoans alternatives we’ve listed here are legal and regulated, and they offer clear and fair terms and conditions to all of their clients.

Can you borrow more money from loans like ZocaLoans?

Yes, all of our recommended loans like ZocaLoans will allow you to borrow more money than ZocaLoans because this company has a maximum loan amount limit of $1500 USD. And it can get even lower if you have bad credit, making it a bad choice if you have a low credit score or limited credit history.